Get rewarded when you get a new credit card in our GeniusCash program

Looking for EXTRA cash back while applying for a new credit card? Then say hello to our GeniusCash program.

In addition to the impressive welcome bonuses and benefits that come with the card you choose, we reward you as well. When you're approved for select credit cards displaying the GeniusCash icon anywhere on creditcardGenius, we'll send you real cash (not gift cards or points) through Interac e-Transfer or PayPal.

You can see ALL our current GeniusCash offers and how it works here.

How do we get our Genius Rating?

We put a lot of effort into calculating Genius Ratings for all the credit cards in Canada.

With the

- rewards,

- welcome bonuses,

- annual fees,

- interest rates,

- perks and benefits,

- insurance,

- and much more.

Using our refined, math-based algorithm that we've been fine-tuning for almost a decade, we create a score out of 5 for each of the credit cards on our site. We then match it with whatever preferences you have to find the most rewarding credit cards for you.

Featured credit card offers

Here are some of our most recommended credit cards in Canada that we think you'll be able to get a lot out of.

Browse credit cards in Canada by category

Not all credit cards are alike. In fact, there is a vast array of different credit cards designed for different purposes.

Get cash back on every purchase and get rewarded the old fashioned way. It's the simplest type of rewards out there for savvy savers.

Why pay a steep annual fee when you don't have to? There are plenty of free credit cards out there that will still save you money and let you earn rewards.

Get a jump start on your next dream vacation with a travel credit card with high-end perks and comprehensive insurance for peace of mind.

Get travel rewards without paying an annual fee – perfect for budget-conscious travelers who still want to earn rewards.

Have some stubborn high interest credit card debt hanging around? A balance transfer credit card could cut those interest charges by up to 95%.

Find yourself travelling or buying online outside Canada and paying pesky 2.5% fees every time? Save big money by bringing those annoying foreign exchange fees to 0%.

Do you tend to carry a balance from month to month? You could save a huge amount on interest charges by getting a low interest credit card.

Groceries are one of the primary budget items for most Canadian households. The right grocery store credit cards could help you stretch your grocery budget even further.

With gas prices higher than the good ol' days, you can save on your commute with gas credit cards that earn you nice rewards or some sweet cash back.

Treat yourself to a nice meal that doesn't involve a side of fries and get supersized rewards with some of these top-tier restaurant credit cards.

For total peace of mind when travelling or making purchases, complimentary insurance coverage is a valuable asset to have with your credit card.

Get started on the right foot on your "adulting" journey with an A+ student credit card that will both reward you in the short term and help build your financial future in the long run.

Whether you're a snowbird who spends half the year in the U.S., or just someone who has U.S. income, one of our U.S. Dollar credit cards might be right for you.

If you're a loyal customer at a specific store, did you know how much more you could be getting in terms of points or cash back? Here are our top picks for the biggest stores in Canada.

Perks credit cards come with some of those luxe benefits that make life go from ashy to classy. From airport lounge access to 24/7 concierge service, and more.

There's a huge variety of different rewards programs available to Canadians, and rewards credit cards give you a way to earn more of the rewards you love.

Not all rewards programs are equal. Flexible rewards credit cards let you earn rewards for programs with a wide array of redemption options.

The best airline cards offer exclusive benefits when travelling with a specific airline, such as free checked bags and priority airport services.

Aeroplan credit cards let you boost your Aeroplan rewards earn rate and get you those free flights even faster.

Are you one of the many Canadians who collect Air Miles? One of our top Air Miles credit cards might be your ticket to boosted earnings.

Don't worry about overextending yourself and going into debt – prepaid credit cards are a safe and convenient way to pay for your everyday needs. Plus, some of these even have rewards!

Bad credit? Secured credit cards give you a way to get a credit card that will help you rebuild your credit score as you use it.

New to Canada and having trouble getting a credit card due to a low credit score? These credit cards are easier to be approved for so you can start your journey in Canada on the right foot.

Looking for something outside the major banks in Canada? These challenger banks offer unique products you won't find with the major credit card issuers.

Our math-based algorithm gives us objective ratings, but sometimes the people just want a voice. These are our readers' favourite credit cards, as voted on by people like you.

Savvy business owners all have a lot of expenses to take care of, so why not have one of these business credit cards that reward you for every dollar you spend?

When you're running a business, sometimes you want one less thing to think about. Getting cash back on your business purchases on a credit card is an easy, convenient solution.

Just starting your business and not wanting to pay Silicon Valley level annual fees? You can still get rewarded for your business expenses without coughing up money every year.

An all-expenses-paid work trip and top-flight insurance on a credit card is another excellent option for your business. Take advantage of first-class perks with these solid credit cards.

In the end, there can be only one. Every year, one credit card emerges as our #1 overall credit card in Canada.

Who are the major credit card networks in Canada?

There are 3 major credit card networks in Canada: Mastercard, Visa, and Amex. Each has their own lineup of cards and perks, and the acceptance rate of these cards varies where you go.

American Express cards often come with top notch rewards and some of the most VIP perks packages available. It's also home to our #1 ranked credit card in Canada.

Mastercards are known for having a great acceptance rate, top-of-the-line complimentary insurance coverage, and the rewarding Air Miles rewards cards.

Looking for a solid cash back credit card? Or prefer to boost your Aeroplan points? Visa might be just the ticket.

Browse credit cards by bank

These Canadian banks issue credit cards nationwide, offering a diverse selection of credit cards – each collection with their own flavour.

BMO offers some of the best Air Miles and student credit cards available – plus a handful of cards for BMO Rewards and cash back.

CIBC has a portfolio of Visa cards for collecting Aeroplan points, CIBC's own Aventura Rewards, or plain old cash back.

Home Trust has 3 Visa credit cards, including a no fee cash back card, and secured credit cards that can help you rebuild your credit rating.

KOHO is an alternative to the big banks. They don't issue credit cards, but rather offer a pair of prepaid cards. They also offer a selection of unique financial products when you get a prepaid card.

MBNA offers a variety of Mastercards, with cash back, flexible rewards, airline miles, and low interest options available.

Neo Financial offers a unique credit card product with the Neo Credit Card. These cards have very high bonus rewards at select retail partners.

Perfect for WestJet fliers or anyone looking for flexible rewards, RBC offers a significant collection of credit cards for Canadians, including both Visas and Mastercards.

Scotiabank has something to suit almost everyone's wallet, whether you're looking for cash back, travel perks, or the very rewarding Scene+ points program.

Simplii Financial is an online bank featuring an excellent cash back credit card and full-service banking all for no monthly or annual fees.

Tangerine is an online bank that offers 2 unique cash back credit cards. Both no fee, you get to choose your own bonus categories.

Brim Financial offers a trio of cash back Mastercards with no foreign exchange fees, one of which took home the distinction of being the #1 card from a challenger bank.

Canadian Tire issues its own credit cards – with them, you can save on gas or boost your Triangle Rewards earn rate.

Desjardins offers both Visas and Mastercards, including low interest and flexible rewards options.

The National Bank of Canada has a diverse portfolio of credit cards, some of which include unique perks you don't see very often.

With 3 credit cards in its portfolio, Rogers doesn't offer a huge amount of choice, but if you're looking for no fee cash back, you might want to take a look.

As one of Canada's largest retailers, Walmart offers credit cards to earn extra rewards at its stores, both online and in person.

More Special Credit Card Offers

How To Choose A Credit Card – 7 Factors to Think About

Getting a new credit card may seem like a daunting task. We have

So how do you choose? Well, we came up with 7 questions to answer to help narrow down what you need. Once answered, we have a special tool that will show you the top credit cards for you.

Here's our guide on how to choose a credit card in Canada.

How to choose a credit card

How do you choose a credit card? We've got 7 basic questions to answer. Once done, you'll come up with a combination of things you want in a credit card.

They are:

- 1. What is your credit score?

- 2. Do you tend to carry a balance?

- 3. What are your travel insurance needs?

- 4. Do you want perks?

- 5. Should you pay an annual fee?

- 6. Choose your rewards

- 7. Acceptance & income

Here are the details on each one.

1. What is your credit score?

Let's start by reviewing what your credit score is. You may not know your credit score, but you probably have a rough idea if it's good enough for a credit card.

Answer these few questions:

- Have you ever missed any payments, and if so, are there more than 1 or 2, and were they for less than 30 days?

- Or, have you never had credit before?

If you answered no to any of these, you can move on to the next section, there really shouldn't be any issue with your credit score.

If you answered yes to them, you should still be fine when it comes to getting a credit card. For the 2nd, you likely don't need to turn to secured credit, but you'll have to be careful what you apply for – we suggest staying away from premium credit cards as they may require high credit scores.

Now, in the last 6 years, if you've been late on multiple payments, have a consumer proposal, or worse, been in bankruptcy, your credit score may be in the poor range. It's definitely best to find out what it is (you can learn more about checking your credit score here). If it's less than 600, you're likely going to need a secured credit card, and your quest to find the best credit card for you ends here at step 1.

There aren't many to choose from. The best of the best is the Neo Secured Mastercard. And it's for these 3 reasons:

- has no annual fee,

- only requires a security deposit of $50, and

- offers rewards on purchases.

It's a trifecta that other secured cards can't match.

2. Do you tend to carry a balance?

One of our biggest rules when it comes to responsibly using credit cards is you have to pay your balance in full, every month. Typical credit card interest is in the range of 20% and can be a killer on finances.

But, we know that things can happen. And if you do carry a balance, even from time to time, you're going to be better off with a low interest credit card. Instead of paying the typical 20% interest on your balance, you can get a rate of 10% or better.

These cards come at a cost. They're usually pretty basic, only a few offer rewards (and they're not that good), and come with an annual fee. But you may offset all this with a lower interest rate.

You can review all your low interest credit card options here. One to take a closer look at is the MBNA True Line Gold Mastercard. It has a low rate of 10.99% on purchases and balance transfers, for a $39 annual fee.

3. What are your travel insurance needs?

If you haven't gotten off the highway yet, you'll need to answer all of our remaining questions.

Let's start with credit card insurance. Most no fee credit cards include basic insurance – extended warranty and price protection. Some even include mobile device insurance.

But what about travel insurance? You'll need a credit card with an annual fee to get some decent coverage.

Nobody wants travel plans interrupted, but it happens. And having a credit card with travel insurance can get you your money back if you have to cancel, covers expenses if you're delayed, or saves you the cost of having to get rental car insurance.

As to how helpful it can be? Here are 2 different travel insurance claims you can take a look at.

4. Do you want perks?

For many, all they want in a credit card is rewards and none of the extra stuff. But that extra stuff has value.

What are some credit card perks you can get? Here's a listing of some of the most popular ones:

- airline companion vouchers,

- priority airport services,

- free checked bags,

- airport lounge access, and

- annual travel credits.

Credit card perks are largely the domain of travel credit cards, and you'll need a credit card with an annual fee to pay for them.

5. Should you pay an annual fee?

If you answered yes to either of the previous 2 questions, you already know an annual fee is in your future, and you can skip to the next step.

But if not, then it comes to how much you will earn in rewards.

And if this is the case, you'll want to earn enough rewards to offset the annual fee. What's our guideline? Glad you asked.

We'll consider you're looking at a credit card with an annual fee of $120. We'll also assume your average rewards are 2% on all purchases with said credit card.

Compared to a no annual fee average return of 1%, we'll use this formula to come up with the monthly spending you'll need to meet to offset your annual fee.

Monthly spending requirement = (Difference in annual fee) / (Difference in earn rate) / 12

Taking our numbers above, and we get:

(120) / (0.01) / 12 = $1,000

That would be our rough guideline as to whether or not an annual fee is worth it. Spend less, and go no fee. Spend more, and at the very least, consider it.

6. Choose your rewards

Now for the last step – what do you want to earn for rewards?

There are 3 types of rewards you can earn:

- cash back,

- flexible, and

- travel.

Some flexible credit cards can also be considered travel cards (but not vice versa). Here is a quick overview of each.

Cash back

Cash back is the simplest form of rewards. For every purchase you make, you earn a set percentage back in the form of cash.

Most credit cards pay out cash back as a statement credit but a few offer direct deposits to bank accounts.

Flexible

Flexible credit cards earn points that offer guaranteed value for your points. Whether it's for travel or in-store discounts, you'll get the same value for your points.

Now, many programs offer many ways to redeem your points, including cash. But there's usually 1 way to use your points for best value.

If the best redemption option is for booking any travel (and that's many of them), you could also consider them to be travel credit cards.

Travel

Now we have pure travel rewards. They differ from flexible travel rewards for one reason – your value is not guaranteed. And depending on the program you're earning points in, you may also be limited as to who you can use them with.

Aeroplan is an excellent example. We carry an average value of 2 cents per point on flight redemptions, but the value you actually can get can vary. And, you're also limited to just getting that on Air Canada and Star Alliance flights.

We also consider rewards programs that have flight charts. The Avion Rewards program for instance, can give you up to 2.33 cents per point when redeeming for flight. But again, it's not guaranteed.

Some cards offer both travel and flexible rewards points. Amex Membership Rewards for instance, has these pure travel reward options:

- transfer points to 6 airline programs,

- transfer points to 2 hotel programs, and

- Fixed Points Travel program.

All of these options have varying value, up to 2 cents per point. But if you so choose, you can also use your points to help pay the cost of any purchase, at a set value of 1 cent.

Which is best is up for you to decide.

However, if you said yes to step 4 on wanting perks, you'll almost certainly be looking at a travel or flexible credit card.

If you said yes to step 3, you're probably going to end up with a flexible or travel credit card. Travel insurance packages aren't always the best on cash back credit cards, only a few offer decent insurance coverage.

7. Acceptance & income

Finally, you'll need to consider where you shop and what your income is.

Acceptance largely applies to American Express credit cards. Acceptance is quite good as you can see here, but it's not quite on par with Visa or Mastercard, holding these 2 major blind spots:

- Loblaws, and

- Costco.

Of course, if you are a heavy duty Costco shopper, you'll want to make sure you have a Mastercard, as it's the only credit card they accept.

Amex cards have 1 key advantage though – they have no income requirements to worry about. Premium Visa and Mastercards have the following income requirements.

| Card Type | Personal Income | Household Income |

|---|---|---|

| World Mastercard | $60,000 | $100,000 |

| World Elite Mastercard | $80,000 | $150,000 |

| Visa Infinite | $60,000 | $100,000 |

| Visa Infinite Privilege | $150,000 | $200,000 |

Keep this in mind when looking at credit cards. Even basic Mastercard and Visa cards can have a personal income requirement of $15,000.

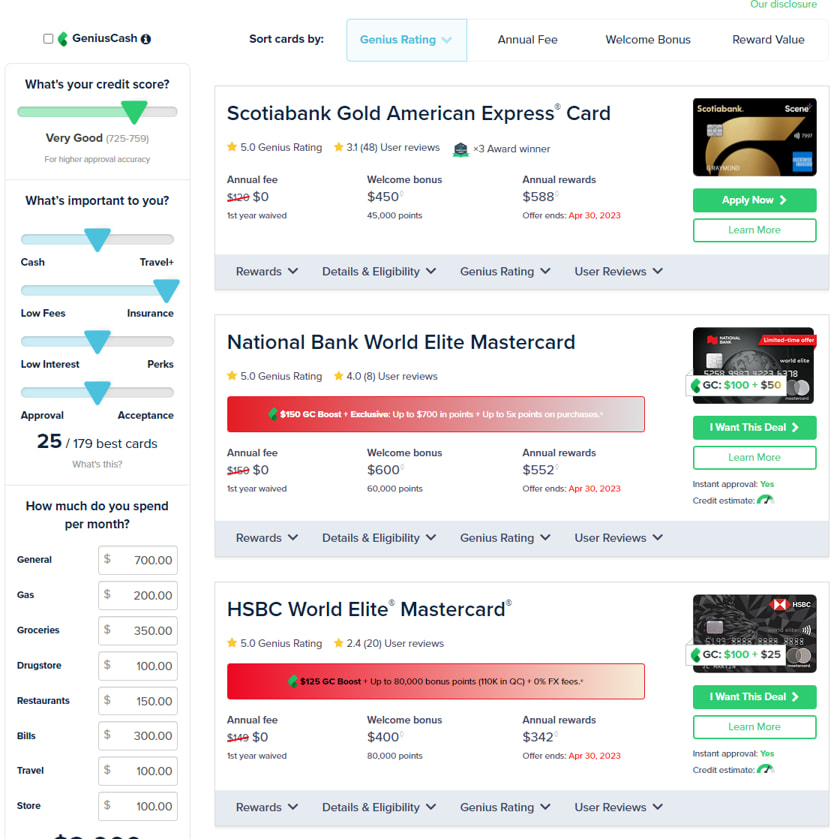

An unbiased credit card chooser – our compare credit cards page

You've chosen what features you want in a credit card – how can you decide which one to get? Or at least narrow yourself to a few choices?

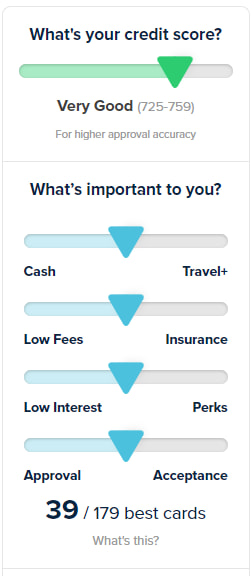

Let's introduce you to our compare credit cards page. On it are 4 sliders you can set to customize what you are looking for in a credit card.

These sliders match up with the questions posed above. Simply adjust them to what you want in a credit card to see cards best suited for you.

For rewards, you may have noticed that "flexible" is not in the rewards slider at the top – it's simply the middle setting.

For the others, if you have no preference, simply leave it in the middle.

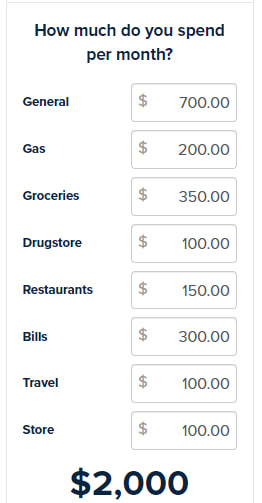

You can also adjust your monthly spending in 8 different categories.

What you see here is our default spending – feel free to change it as you like.

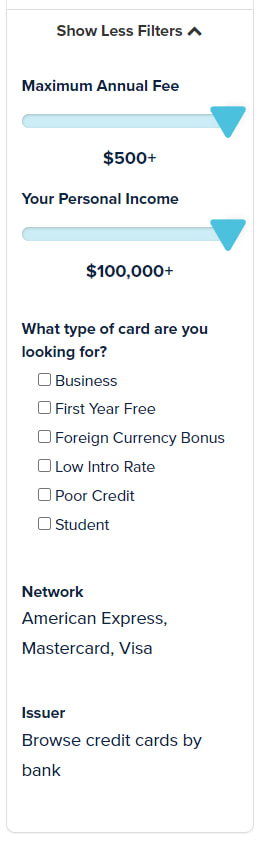

There are other filters you can also apply.

As you make changes, the results you see are updated in real time.

Do that, and you'll see a list of top credit cards for you. Here's an example.

We want a flexible rewards credit card with top notch insurance. So, we'll simply change the 2nd slider to insurance, and here are our top 3 results.

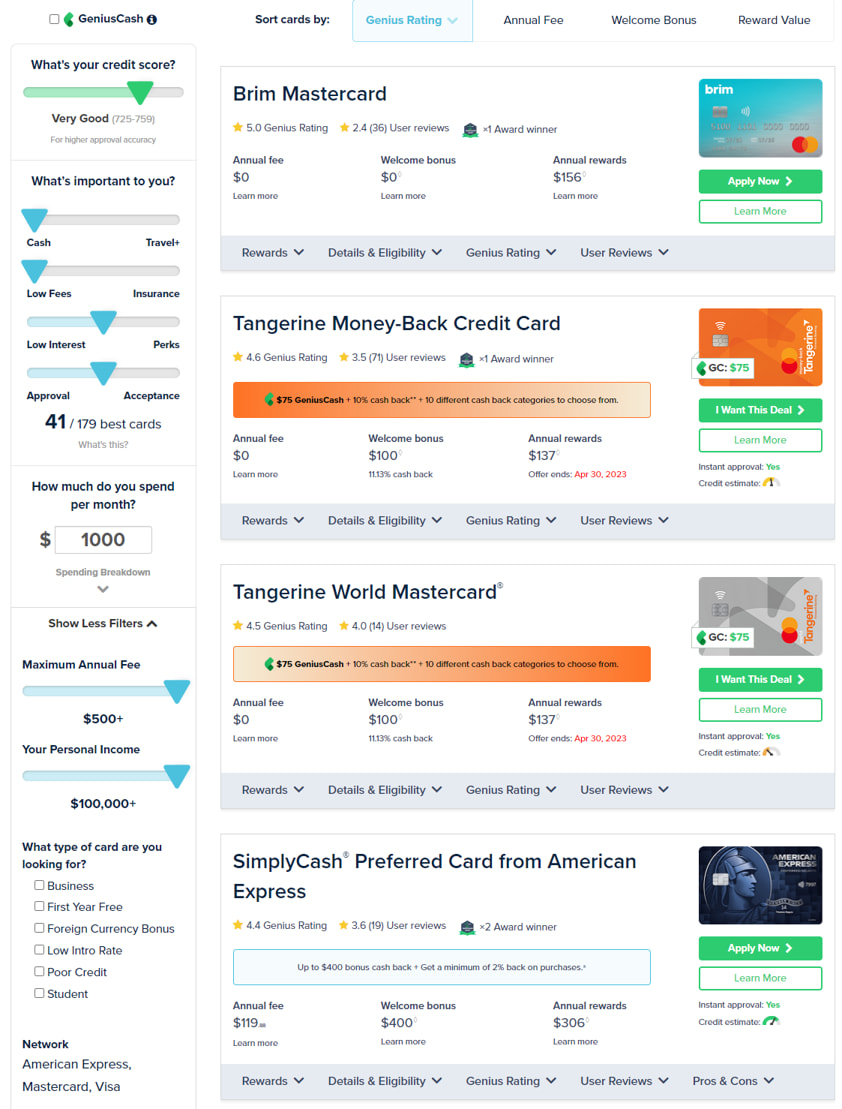

Or perhaps we just want a no fee cash back card. We'll change the top 2 sliders and get these results.

In this case, card #4 does have an annual fee – it's so good in other areas it still rates really well, even when you don't want fees.

In this case, simply set your max annual fee slider to $0 to remove cards that have one.

So, happy sliding, and finding the best credit card for you.

The best credit cards in Canada

What are some of the best credit cards in Canada? Here's a summary for the best among a few different categories.

| Credit Card | Welcome Bonus | Rewards | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| American Express Cobalt Card |

$100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms)

|

* 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

* $191.88 * None |

Apply Now |

| SimplyCash Preferred Card from American Express | 10% cash back for the first 3 months + $50 (terms) |

* 4% cash back on gas and groceries * 2% cash back on all other purchases |

* $119.88 * None |

Apply Now |

| American Express Green Card | 10,000 bonus points (terms) |

* 1 point per $1 spent on all purchases |

* $0 * None |

Apply Now |

1. Best credit card in Canada

The American Express Cobalt Card is the best credit card in Canada. And it's largely because of the rewards.

Here's what you'll earn for purchases:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

Combined with each point being worth up to 2 cents each, you're looking at annual rewards of $1,620. It also includes 10 types of insurance.

All those rewards are for a $191.88 annual fee.

Other best credit cards

2. Best cash back credit card

If you prefer cash back rewards, the SimplyCash Preferred Card from American Express offers more cash back than any other credit card.

Here's what you'll earn for cash on every purchase:

- 4% cash back on gas and groceries

- 2% cash back on all other purchases

It's also a rare cash back card with good travel insurance, including a total of 10 types, for a $119.88 annual fee.

Other cash back credit cards

3. Best no fee credit card

If you just want a credit card with no annual fees, the American Express Green Card will give you the most rewards you can get.

It earns a simple 1 point per $1 spent on all purchases. But, with each point being with up to 2 cents each, you're looking at an amazing return of up to 2%.

Like most no fee cards, there isn't much here in the insurance department, with just 2 types included.

Other top no fee credit cards

What is your favourite credit card?

It can be a daunting task choosing a credit card. Hopefully we've created a process to help you find your next one.

What is your favourite credit card?

Feel free to share with everyone below.

FAQ

What are some steps to follow in choosing a credit card for you?

There are few things to decide on in helping choose a credit card. They include:

- what kinds of rewards do you want,

- whether you'll need travel insurance, and

- whether you're alright paying an annual fee.

Where can I find a listing of the best credit cards in Canada?

We have a listing of all the best credit cards in Canada across 31 different categories. You can view our best credit card rankings here.

What type of credit card do I need?

The type of credit card you need depends on what you want. Do you want to earn cash back or travel rewards? Do you like having travel insurance? Are you ok with paying an annual fee? The best credit card for you is all about personal preferences.

Can I have multiple credit cards at the same time?

There's no limit as to how many credit cards you have at any 1 time. As long as you have a strong credit score, a few extra applications and approvals won't harm anything.

How to apply for a credit card in Canada

Applying for a credit card is a straightforward process, but because this has to do with your money, it's important to make sure you follow the right steps. Here is a step-by-step guide on the steps you'll need to follow to apply for a credit card, as well as some contingency plans in case you're denied.

1. Make sure you're eligible for the credit cards you want

Most credit cards have eligibility requirements that you'll have to meet in order to get them. These include:

- your age and residential status,

- your personal annual income, or your household's combined annual income, and

- your credit rating.

In terms of age, you will need to be the age of majority in your province or territory. In addition to this, you'll need to be a resident of Canada to get a credit card.

Income-wise, it's dependent on the card you're going for, but the basic rule of thumb is that the better the perks, benefits, and earn rates that come with it, the higher the income requirements are.

There are 3 tiers of credit cards that generally offer similar benefits across all of the issuers, and if the credit card you're eyeing is within one of these tiers, these are the minimum income requirements you'll need to have:

| Personal | Household | |

|---|---|---|

| Visa Infinite | $60,000 | $100,000 |

| World Elite Mastercard | $80,000 | $150,000 |

| Visa Infinite Privilege | $150,000 | $200,000 |

If you meet at least one of the two, you're good to go.

The last thing you'll need to worry about is your credit score. There is no set credit score that will get you access to certain cards, but as with the income requirements, the better the benefits, the higher the score required. Just keep making your payments on time and continue following best practices to build your credit score and you'll eventually work your way up to the higher tiers.

2. Shop around for the hottest deals on credit cards

It goes without saying that you shouldn't just take the first credit card that you find online or is recommended by a friend. Use the tool above to get an idea of what cards might suit your needs or take our credit card quiz to narrow it down even further.

It pays to do your homework so you can get the most rewards and perks for your lifestyle. The last thing you want is to find out how little you're earning in terms of cash back or finding out that you're actually losing money due to an annual fee you can't outearn.

3. Fill out the credit card application

Now that you've found your dream credit card, it's time to apply. Nowadays, you can do it online and find out pretty quickly if you've been approved. When you apply, be sure to have all the basic information on hand, including things like:

- your name, address, and phone number,

- your current rent or mortgage payment,

- your personal or household income, and

- your social insurance number.

4. Wait to be approved

As we said, instant approval is quite common nowadays, so your waiting period may be nearly instant (and you may even be issued a virtual credit card that you can start using for online purchases right away).

From here, you'll get your new credit card mailed to you – you'll have a few days to find a snug home in your wallet for it.

If you weren't instantly approved, you may have to wait a few weeks to get approved.

5. Did your credit card application get declined?

Now let's talk about the unfortunate alternate ending to the above story. It happens, but sometimes people aren't approved for their credit card of choice. If you failed to meet any of the requirements that we listed above (or some other bank requirements, like not having steady employment), you will have to go with a different credit card for the time being.

In the meantime, you can work on things like improving your credit score or finding a job that earns enough money to meet the income requirements.

In the off-chance that you applied before you were 18, moved to Canada, or happened to make a bunch of silly typos or incorrect information on your information (we're looking at you, McLovin), then you'll have to correct those as well or wait until you're all set to go.

Pros and cons of credit cards

As with all things, credit cards have both their upsides and their downsides.

5 benefits of credit cards

This might be surprising for some, but credit cards could help your finances if used the right way. (Also see our list of cons below.)

1. Establish your credit history and build your credit score

Credit cards are one of the easiest ways to establish your credit history if you're young, or if you're a newcomer to Canada. Your credit score takes the length of your credit history into account, so getting that started as soon as you can is a huge benefit.

And if you use your credit card responsibly – meaning only using it for things you can afford and paying it off in full every month – it is a very quick way to improve your credit score.

Credit card companies will report your activity to one or both of Canada's credit bureaus on a regular basis (usually monthly), and this will be reflected in your credit report and credit score shortly after.

2. Credit card insurance

One often overlooked feature of credit cards is that the majority include at least some complimentary insurance coverage, ranging from emergency medical coverage for travellers to simple purchase protection and extended warranties. Other, more rare insurance coverage may include travel insurance for seniors and mobile device insurance.

There are

And while the numbers are estimates, they give you a rough idea of just how valuable some of these insurance packages can be. Most Canadian banks offer insurance packages with an average value over $100.

3. Credit card perks

Credit card perks are those extra benefits that make life just a little bit more luxurious.

Whether it's having access to those comfy airport lounges while travelling, or being able to call a concierge service to make dinner reservations – these are the benefits that some of the premium travel credit cards lay on pretty thick.

But, for the most part, with generous perks come high annual fees. Do you really get what you pay for?

We did another study to determine the estimated value of credit card perks, and the results may come as a surprise, with some credit cards having hundreds of dollars worth of perks included.

4. Credit card rewards

Having a credit card unlocks rewards, which is one of the main reasons people get one. When you pay in cash, you don't get anything back, but with a credit card, people have been able to get around 1% back on their purchases, but sometimes see returns as high as 10% depending on how they redeem their rewards.

You can use the "Spending Breakdown" calculator on this page to compare how you'll get rewarded and see which cards are best for you in this case. Normally, we have a $2,000 monthly spend, but our algorithm can be fully customized to suit anyone's needs.

5. Convenience and simplicity

Using a credit card is a game-changer in terms of simplicity. Nowadays, you just need to tap your card at any payment terminal or enter your card number and CVV online to make a purchase. No more counting change or worrying about whether you have enough.

It's so easy, perhaps too easy, meaning that many people tend to overspend. But with good credit card habits and all the rewards and perks you'll get, it's never a bad thing to use a credit card when you can.

3 drawbacks of credit cards

All that said, there are a couple of credit card features you'll want to watch out for.

1. High interest rates

If you don't pay off your balance, credit cards tack on interest, usually to the tune of around 20% in Canada.

Chances are you've heard at least one horror story of credit card debt that became extremely hard to pay off because of the high interest rates.

Here's a look at some examples of how much interest rates will impact you in a few different scenarios to really illustrate how punishing they can be.

| Credit type | Interest rate | Balance | Monthly payment | # of months to pay off | Total paid | Total interest paid |

|---|---|---|---|---|---|---|

| Balance transfer credit card | 1.99% | $2,500 | $280.09 | 9 | $2,520.81 | $20.81 |

| Line of credit | 8.7% | $2,500 | $287.94 | 9 | $2,591.46 | $91.46 |

| Typical credit card | 19.99% | $2,500 | $301.42 | 9 | $2,712.78 | $212.78 |

| Payday loan | 46.95% | $2,500 | $334.89 | 9 | $3,014.01 | $514.01 |

While the payday loan is the worst of the bunch, typical credit card debt is clearly very expensive.

If at all possible, you should pay off your credit card in full every month to avoid these high interest payments.

2. Credit card fraud

Credit card fraud is a major problem, with 24% of Canadians reporting that they have had their credit card defrauded by some sort of email or phishing scam. This is much higher than the olden days of credit card skimmers.

If you have a credit card, be sure to always think twice before making risky purchases online and be sure to keep an eye on your statements for anything out of the ordinary.

Fortunately, credit cards have measures in place to help reverse fraudulent transactions, but it's always good to avoid finding yourself in a sticky situation in the first place.

3. Credit card fees

Credit cards fees are always top of mind, and with a lot of cards, the most glaring one is the annual fee.

Even with all of the no annual fee credit card options out there, it's always worth considering ones with an annual fee since they almost always have better earn rates and perks. So long as you can earn more than the fee, you're clear to take advantage of one.

Some other fees include:

- balance transfers,

- cash advances,

- supplemental cards,

- overlimit fees, and

- foreign exchange fees.

You may not need to worry about some of these, but it's always good to review how much each fee is should you find yourself having to pay one.

Credit Card Award Winners

FAQ

What are the easiest credit cards to get approved for?

The easiest credit cards to get approved for are secured credit cards. These are credit cards generally designed for people who have poor credit, so they're pretty easy to get.

The idea is that you pay the credit card issuer a deposit, and they issue you a credit card with a credit limit equal to the amount of that deposit. Use and pay it like a regular credit card, and they report your payment activity to the credit bureaus, helping you rebuild your credit.

How do I get a credit card with bad credit?

If you have bad credit, you may find it difficult to get approved for a credit card.

There is a type of credit card designed for your situation, however, that is easier to get approved for, and that can help you rebuild your credit over time.

Secured credit cards are relatively easy to get, because you have to pay the credit card issuer a deposit before they'll give you a card. This is to give them some security (get it?) so they don't lose any money if you don't pay your bills.

What credit card should I get to build credit?

The top secured credit card in Canada is the

Use this secured credit card responsibly, and you'll start rebuilding your credit in no time.

What are the top 3 credit cards?

The perfect fit for you in terms of a credit card really depends on your preferences and your spending habits.

If you're a frequent traveller, you'll probably want a premium travel credit card with all the associated perks and benefits.

Are you a savvy saver with a keen eye for saving money? Chances are that you'll want a cash back credit card (or a no fee cash back card) that will give you the maximum return on your spending.

That said, however, you can find our #1 overall credit card right here, which comes out at the top pick in several of our #1 credit card categories.

In the end, however, the choice is up to you.

Which is the #1 credit card in Canada?

The best credit card in Canada is American Express Cobalt Card. This is because its stellar Amex Membership Rewards earn rates as well as its premium benefits are well worth the annual fee. If Amex cards or rewards credit cards aren't your thing, you can try out our credit card quiz to match you up with the card that's right for you.

What is GeniusCash and how do I earn it on my credit cards?

GeniusCash is a special offer on select credit cards in Canada provided by creditcardGenius. Essentially, it's bonus cash back that you get on top of a credit card's welcome bonus and perks. If you claim an offer from one of these GeniusCash-partnered credit cards, you can earn up to ${{maxOfferValue}} in actual cash on approval, sent straight to your bank via Interac e-Transfer or to your PayPal account.

×7 Award winner

×7 Award winner