Got the winter blues? Warm up with some hot credit card offers! We've got an amazing list of credit card offers, including bonus cash back and piles of rewards points. And if your goal is saving on credit card interest while you pay off your debt, there are some excellent balance transfer offers to consider.

To top things off, we're offering up to $

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

The best credit card deals in Canada

Here's our summary of the best credit card deals in Canada right now.

| Credit Card | Credit Card Offer | Annual Fee | Income Requirements | Apply Now |

|---|---|---|---|---|

| BMO Ascend World Elite Mastercard |

*  $150 GeniusCash $150 GeniusCash* Up to 100,000 115,000 bonus points (terms) |

$150, first year free | $80K personal/$150K household | Apply Now |

| MBNA True Line Mastercard |

*  $20 GeniusCash $20 GeniusCash* 0% interest for 12 months (3% fee) – one of the best balance transfer offers in Canada (terms) |

$0 | None | Apply Now |

| TD First Class Travel Visa Infinite |

*  $20 GeniusCash $20 GeniusCash* Up to 165,000 bonus points (terms) |

$139, annual fee rebate for the first year | $60K personal/$100K household | Apply Now |

| Tangerine World Mastercard |

*  $120 GeniusCash $120 GeniusCash* earn $120 bonus cash back when you spend $1,500 in the first 3 months (terms) |

$0 | $50K personal/$80K household | Apply Now |

| Scotiabank Passport Visa Infinite |

*  $150 GeniusCash $150 GeniusCash* Up to 50,000 bonus points (terms) |

$150 | $60K personal/$100K household | Apply Now |

| BMO eclipse Visa Infinite |

*  $150 GeniusCash $150 GeniusCash* Up to 80,000 bonus points (terms) |

$120, first year free | $60K personal/$100K household | Apply Now |

| Neo Secured Mastercard |

*  $50 GeniusCash $50 GeniusCash |

$95.88 | None | Apply Now |

| Scotiabank Gold American Express |

*  $100 GeniusCash $100 GeniusCash* Up to 45,000 bonus points (terms) |

$120 | $12K personal | Apply Now |

| MBNA Rewards World Elite Mastercard |

*  $20 GeniusCash $20 GeniusCash* Up to 30,000 bonus points (terms) |

$120 | $80K personal/$150K household | Apply Now |

| American Express Cobalt |

*  $100 GeniusCash $100 GeniusCash* Up to 15,000 welcome bonus points (terms) |

$191.88, charged out as $15.99 per month | None | Apply Now |

| TD Aeroplan Visa Infinite | * Up to 40,000 welcome bonus points (terms) | $139 | $60K personal/$100K household | Apply Now |

| American Express Gold Rewards | * Up to 60,000 bonus points (terms) | $250 | None | Apply Now |

| RBC Avion Visa Infinite | * Up to 55,000 bonus points (terms) | $120 | $60K personal/$100K household | Apply Now |

| Marriott Bonvoy American Express | * Up to 110,000 bonus points (terms) | $120 | None | Apply Now |

| BMO CashBack World Elite Mastercard |

*  $125 GeniusCash $125 GeniusCash* up to $480 cash back in the first 12 months (terms) |

$120, first year free | $80K personal/$150K household | Apply Now |

If you’re in the market for a business credit card, here are some of the best deals.

| Credit Card | Credit Card Offer | Annual Fee | Income Requirements | Apply Now |

|---|---|---|---|---|

| Scotia Home Hardware PRO Visa Business Card | * 15,000 bonus points (terms) | $0 | None | Apply Now |

| Loop Visa |

*  $100 GeniusCash $100 GeniusCash |

$0 | None | Apply Now |

| Scotiabank Passport Visa Infinite Business Card | * 40,000 bonus points (terms) | $199 | None | Apply Now |

EXCLUSIVE OFFER: Get up to 100,000 115,000 bonus points and 4 free lounge passes + $150 GeniusCash

One of the best flexible rewards credit cards with free airport lounge access, the BMO Ascend World Elite Mastercard, has a top offer running right now: a welcome bonus of 100,000 115,000 points after spending $4,500 in the first 4 months, $10,000 in the first 6 months and $20,000 in the first year. Redeemed for travel through BMO Rewards, those 115,000 points are worth $770.5.

Here’s what you’ll earn on purchases:

- 5 points per $1 spent on travel

- 3 points per $1 spent on dining, entertainment, and recurring bills

- 1 point per $1 spent on all other purchases

It also has a couple of other sweet benefits:

This little package is for an annual fee of $150, which is currently waived for the first year.

We're also offering $150 in GeniusCash when you open a new account.

0% interest for 12 months – one of the best balance transfer offers in Canada + $20 GeniusCash

If you have some sticky debt hanging around, one of the best balance transfer offers in Canada is here to save the day (and your credit score).

The MBNA True Line Mastercard is offering a 0% balance transfer promo rate for an incredible 12 months with a 3% transfer fee.

And unlike many balance transfer offers, once the promotional period is over, you can still take advantage of a permanently low 12.99% purchase interest rate. With other cards, the interest rate will shoot back up to 19.99% or more.

Apply and get approved for the card through creditcardGenius and we'll give you $20 in GeniusCash.

Up to 165,000 bonus points, an annual $100 travel credit, and $20 GeniusCash

The TD First Class Travel Visa Infinite Card offers plenty of rewards and some unique perks.

First, the welcome bonus is stellar: 165,000 TD points after spending $5,000 in the first 180 days. Those 165,000 points are worth $825 when redeemed for travel through Expedia For TD.

Here’s what you’ll earn in regular rewards:

- 8 points per $1 spent on travel booked online through Expedia For TD

- 6 points per $1 spent on groceries, restaurants, and public transit

- 4 points per $1 spent on recurring bill payments, streaming, digital gaming, and media

- 2 points per $1 spent on all other purchases

But of course, there's more:

- Once per year, on your anniversary, get 10% bonus points based on what you earned (up to a maximum of 10,000 points)

- Visa Airport Companion membership and 4 free passes

- An annual $100 travel credit to use at Expedia for TD

- $20 GeniusCash when you get approved using our offers page

The annual fee is just $139, which is rebated with the first-year-free offer.

Extra $120 cash back, no annual fee, and a $120 GeniusCash bonus

For a limited time, the Tangerine Money-Back World Mastercard is offering an extra $120 cash back.

To make this offer even sweeter, we're adding $120 in GeniusCash when you apply and get approved for the card through creditcardGenius.

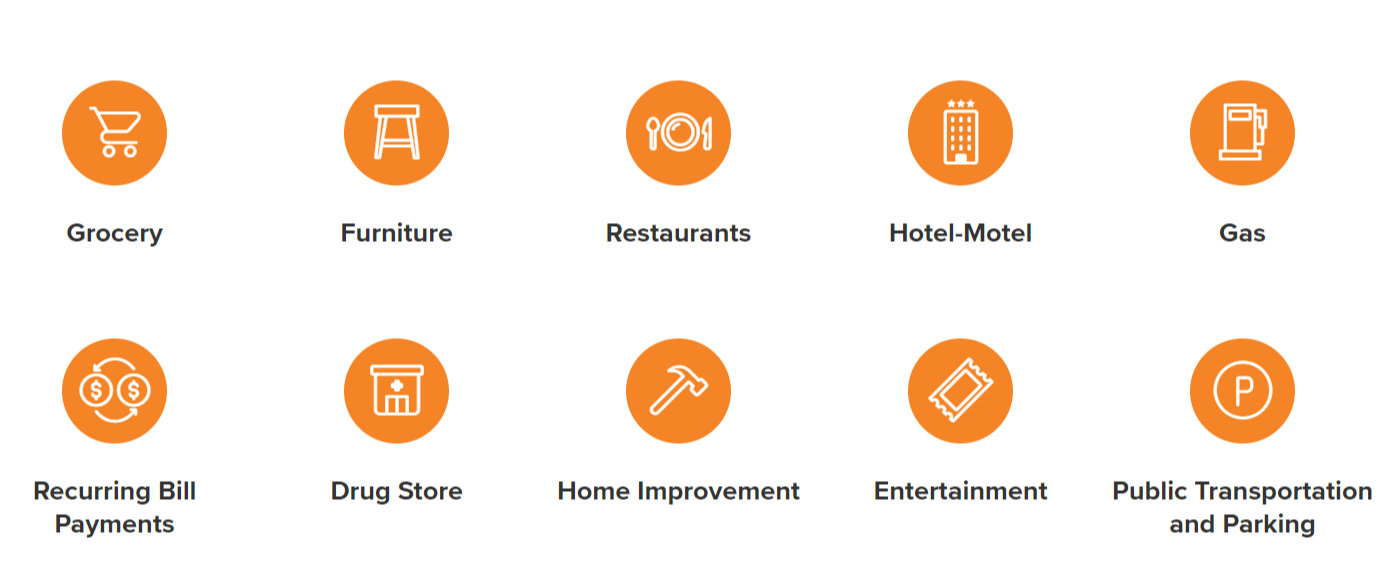

As for your rewards, you get to choose which categories earn you 2% cash back – two categories if your cash back is applied as a statement credit and three if you deposit your rewards into a Tangerine savings account.

Here are the categories you can choose from:

The card has no annual fee and delivers 0.5% cash back on all other purchases. It also offers a low promotional balance transfer interest rate of 1.95% for 6 months, accompanied by a 1% balance transfer fee.

50,000 bonus points, no foreign exchange fees, and $80 GeniusCash

For a card that offers sublime perks, the Scotiabank Passport Visa Infinite Card will give you flexible travel rewards and much more.

You can earn a welcome bonus of 50,000 points after spending $2,000 in the first 3 months and $10,000 in the first 6 months, which is worth $500 when redeemed for travel through Scene+. And on top of that, you’ll earn points on your everyday purchases:

- 3 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 2 Scene+ points per $1 spent on groceries, restaurants, entertainment, and daily transit

- 1 Scene+ point per $1 on all other purchases

Where this card really shines in rewards is the annual bonus: spend $40K per year on this card and you'll get a 10,000 point bonus. For every $10K you spend above that, you’ll receive another 2,000 bonus points.

But its best feature? No foreign transaction fee. Save yourself the usual 2.5% fee on purchases made in currencies other than CAD.

Throw in comprehensive insurance – including travel insurance coverage for anyone over 65 – and a Visa Airport Companion membership with 6 free visits, and you'll be able to relax and put your mind at ease while you're travelling.

Oh, and by the way, we're offering $80 GeniusCash when you get approved.

Get up to 80,000 bonus points + up to 5x the points on purchases + $150 GeniusCash

One of the best flexible rewards credit cards has a top offer running right now (which includes a little extra bonus cash when you apply through creditcardGenius): the BMO eclipse Visa Infinite Card.

You'll earn 80,000 after spending $4,000 in the first 110 days, $7,000 in the first 6 months, and $12,000 in the first year Redeemed for travel through BMO Rewards, those 80,000 points are worth $536.

The earn rates are also stellar:

- 5 BMO Rewards points for every $1 spent on dining ($6,000 per year), groceries ($6,000 per year), gas, and transit

- 1 point per $1 spent on all other purchases

Plus, it has 2 unique perks:

- Annual $50 lifestyle credit. Every year after your card's anniversary, you'll save $50 on your first purchase greater than $50.

- 10% bonus points. Earn these bonus points when you add an authorized user to the account.

The entire package can be yours for an annual fee of $120, which is currently waived for the first year. We're also tossing in $150 in GeniusCash on approval.

A secured credit card that offers rewards + $50 GeniusCash

If you're in need to improve your credit, a secured credit card with guaranteed approval is one way to improve it. But the choices can be lacklustre – no rewards or perks to speak of. But Neo is changing that. The Neo Secured Mastercard is one of a few secured credit cards offered by Neo.

The rewards aren't anything to brag about, but it's better than most secured cards.

- Average of 5% cash back at partner retailers

- 1% cash back on gas and EV charging, up to $500 spent monthly

- 1% cash back on groceries, up to $500 spent monthly

The security deposit you need to provide is quite small – you'll only need $50 to open a secured account. Just keep in mind that the security deposit you provide equals your credit limit.

There is a monthly fee of $7.99 with this card but it can be waived by maintaining $5,000 in deposits with Neo.

You can also earn $50 GeniusCash from us when you get approved for a new account.

Up to 45,000 bonus points, first year free, and $100 GeniusCash

The Scotiabank Gold American Express Card is one of the best flexible rewards credit cards and it’s running a deal you won't want to miss.

The welcome bonus of up to 45,000 points after spending $2,000 in the first 3 months and $7,500 in the first year is worth $450 when redeemed for travel through Scene+. We're also offering $100 GeniusCash when you open a new account.

As for your regular purchases, you'll get:

- 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 5 Scene+ points per $1 spent on groceries, dining, and entertainment

- 3 Scene+ points per $1 spent on gas, select streaming services, and transit

- 1 Scene+ point per $1 spent on foreign currency purchases

- 1 Scene+ point per $1 spent on all other purchases

There's one more big positive to this card: no foreign transaction fees. You'll save 2.5% when making any purchase that isn't in Canadian dollars.

It's all for an annual fee of $120 and a low personal income requirement of $12,000. You can also get $60 in GeniusCash when you get approved through us.

30,000 bonus points and $20 GeniusCash

The MBNA Rewards World Elite Mastercard is one of the best flexible rewards credit cards in Canada – and it's largely because of the rewards. You can earn 30,000 bonus points after spending $2,000 in the first 90 days and signing up for paperless e-statements, plus MBNA Rewards points at these high regular rates:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

The card also comes with a birthday bonus of 10% of what you earned over the last year, up to a maximum bonus of 15,000.

You can use your MBNA Rewards for a host of redemptions, including travel, merchandise, gift cards, and statement credits.

To top it all off, we're offering $20 in GeniusCash when you get approved.

Best credit card in Canada – up to 15,000 bonus points

The American Express Cobalt Card is our #1 ranked credit card in Canada – and has been for 5 years running.

Here’s why: You can earn tons of points, and each one is super valuable.

The card offers a generous welcome bonus of 1,250 bonus points every month you spend $750 in the first year. That's a total of 15,000 points – worth up to $300.

On top of that, you'll get:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

And it's all for a manageable $15.99 monthly fee instead of an annual $191.88 payment.

Here’s what those points are worth:

- Aeroplan travel: To get the best value for American Express Membership Rewards, transfer your points to Aeroplan and use them on flights. Points are worth up to 2 cents each this way.

- Fixed points travel program: Here, you can use a set amount of points to fly between zones. Each point is worth up to 1.75 cents.

- Marriott Bonvoy: Amex points transfer at a ratio of 5:6, effectively giving you a 20% bonus. With a Marriott Bonvoy point worth 0.97 cents when redeemed for hotel stays, an Amex point is worth 1.16 cents when transferred over.

- All purchases: You can also redeem points for any purchase, including travel. Each point is worth 1 cent when used this way.

The numerous options make this a truly flexible credit card.

Up to 40,000 welcome bonus points plus Air Canada perks

If you’re looking for a nice welcome bonus, a suite of Air Canada perks, and an advanced earn rate, consider the TD Aeroplan Visa Infinite Card.

TD is currently running an excellent offer with this card. You’ll start off with up to 40,000 welcome bonus points, earned as follows:

- 10,000 points after your first purchase

- 15,000 points after spending $7,500 in the first 180 days

- 20,000 points after spending $12,000 in the first 12 months

For earn rates, you’ll get a standard 1 Aeroplan point per dollar spent on the card, plus 1.5 points for every dollar spent in three bonus categories:

- Gas

- Groceries

- EV charging

- Air Canada purchases

To top it off, the card has a reasonable annual fee of $139 and gives you access to great Air Canada perks, like one complimentary checked bag, preferred pricing on reward flights, and 1,000 Elite Status Miles for every $10,000 spent annually.

Up to 60,000 bonus points + annual $100 travel credit

The American Express Gold Rewards Card is running a hot offer right now, one of the best it's ever had.

You can earn up to 60,000 bonus points - 5,000 bonus points every month you spend $1,000 in the first year.

And those 60,000 points are worth a lot! Here's their value when redeemed for various travel redemptions through the Amex Membership Rewards program:

- Transfer to Aeroplan: $1,200

- Fixed Points Travel Program: $1,050

- Transfer to Marriott: $696

- Redeemed for any purchase (including travel): $600

Here's what you'll earn on your daily purchases:

- 2 points for every $1 spent on gas, groceries, drugstores, and travel

- 1 point for every $1 spent on all other purchases

To top it off, the card has premium-level perks:

- $100 annual travel credit

- Priority Pass membership (no fee passes)

- 4 annual passes to Plaza Premium Lounges in Canada

- A metal credit card available in your choice of colour

Note the annual fee is a bit higher than standard at $250. This is balanced out, though, by the fact that this card doesn't have any income requirements.

Get up to 55,000 bonus points worth up to $1,282

The hottest of hot offers is currently being run by the RBC Avion Visa Infinite: earn 55,000 Avion points after your account is approved and you spend $5,000 in the first 6 months.

You get a few options when redeeming your Avion points. Here's a quick summary of your travel options and what those 55,000 points are worth.

| Travel redemption | Value of 1 point | Welcome bonus value |

|---|---|---|

| Air Travel Redemption Chart | Up to 2.33 cents | $1,281.5 |

| Transfer to British Airways or Cathay Pacific 1:1 | Up to 1.75 cents | $962.5 |

| Transfer points To American Airlines 10:7 | Up to 1.23 cents | $676.5 |

| Transfer points to WestJet 100:1 | 1 cent | $550 |

| Redeem for any travel through Avion Rewards | 1 cent | $550 |

On regular purchases, you'll earn 1 point per $1 spent (25% more on travel), and get 12 types of insurance for a $120 annual fee.

Get up to 110,000 points + annual free night

The Marriott Bonvoy American Express Card is an excellent credit card to earn free hotel stays. The welcome offer is 110,000 after spending $6,000 in the first 6 months and making a purcahse in month 15..

While making purchases to earn it, here's what you'll earn:

- 5 points per $1 spent at Marriott properties

- 2 points per $1 spent on all other purchases

And, it has these excellent Marriott perks.

- Annual free night certificate: after your first year, you'll get an annual free night certificate worth up to 35,000 points. Find any hotel night for that amount or less and it's yours.

- Automatic Silver Elite status: Just by having the card, you'll get Silver Elite status, which gets you things like bonus points on stays, room upgrades, and better WiFi. YOu can get upgraded to Gold Elite by spending $30,000 per year on your credit card.

- 15 Elite night credits: Think of it as an easier path to Gold state. Stay 10 nights at a Marriott hotel in a year and you'll be upgraded (it normally takes 25 paid nights).

The annual fee for this? An entirely reasonable $120 – the annual free night more than covers it.

up to $480 cash back in the first 12 months + first year free + $150 GeniusCash

GC: $125

GC: $125

$120.00

$0

1st year waived

Credit estimate: (560 - 659)Instant approval: Yes

The BMO CashBack World Elite Mastercard is running a hot deal for a cash back credit card.

You'll get up to $480 cash back in the first 12 months. On top of that, we're giving new cardholders $150 in GeniusCash.

In terms of rewards on purchases, you'll get:

- 5% cash back on groceries, up to $500 in monthly spend

- 4% cash back on transit, up to $300 in monthly spend

- 3% cash back on gas, up to $300 in monthly spend

- 2% cash back on recurring bills, up to $500 in monthly spend

- 1% cash back on all other purchases

And it comes with some premium perks, too:

- Free roadside assistance

- 13 (out of

17 ) types of insurance - World Elite Mastercard benefits

To top it off, the first year is currently free. This is a limited-time offer that you don't want to miss.

Bonus credit card offers – up to $250 in GeniusCash

We have plenty more GeniusCash offers available right now.

Here is where you can view all of our offers.

Best business credit card deals

If you're in the market for a business credit card, here are a few top deals to take a look at.

Earn 15,000 bonus points + no annual fee

Contractor who buys a lot of building supplies? The Scotia Home Hardware PRO Visa Business Card is perfect for those who get their supplies at Home Hardware stores. This card will earn you 1 Scene+ point per $1 spent on all your purchases at Home Hardware.

There's also a welcome bonus. You'll earn Scotia Home Hardware PRO Visa Business Card bonus points after spending $1,500 at Home Hardware stores.

This card has no annual fee and will get you extra savings with the Visa SavingsEdge program.

A business card with no foreign exchange fees on common currencies and no annual fee + $100 GeniusCash

If you often do business in Canadian or U.S. Dollars, Euros, or British Pounds, the Loop Card might be a great choice for your small business.

You’ll pay no foreign exchange fees on those currencies plus earn 1 point per $1 spent on all purchases. Each point is worth 0.5 cents and you can redeem those points for gift cards.

On top of this, Loop provides a 55-day grace period for payments, doesn’t have any annual fee, and has a sweet Genius Cash offer of $100.

Earn 40,000 bonus points + pay no foreign exchange fees

The Scotiabank Passport Visa Infinite Business Card is a top business credit card in Canada. Earning Scene+ points, you'll earn 1.5 points per $1 spent.

It also has a very large welcome bonus, earning you 40,000 points after spending $5,000 in the first 3 months and 60,000 in the first year.

And the perks don't stop there, this card also offers:

- No foreign exchange fees

- Visa Airport Companion membership with 6 free passes

- Complimentary Avis Preferred Plus membership

What credit card offers are you looking at?

What credit card offer will you take advantage of this month? Is there one we haven’t mentioned?

Let us know in the comments below!

FAQ

What is the best credit card in Canada?

The best credit card in Canada is the American Express Cobalt. You'll earn up to 5 points per $1 spent. With points being worth up to 2 cents each, this card has a fantastic return of up to 10% back on purchases.

What is the best cash back credit card offer right now?

The best cash back credit card offer is with the BMO CashBack World Elite Mastercard. You'll earn up to $480 in bonus cash back over the first year.

I want to save on credit card interest – what's the best credit card deal for me?

If you need to save on credit card interest, the MBNA True Line Mastercard has a fantastic balance transfer offer. This card comes with a promotional rate of 0% for 12 months on balance transfers, an excellent way to avoid paying credit card interest for a whole year.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 26 comments