Best Koho Mastercards in Canada for 2026

There are only 3 to choose from, but the best KOHO Mastercard in Canada is the KOHO Everything Mastercard. It's a metal card that earns 3.5% interest on the account balance, up to 2% cash back, and a list of other valuable benefits.

KOHO issues some of the best prepaid credit cards, but they work a little differently from standard prepaid cards. Instead of applying for separate cards, you select a membership plan – Essential, Extra, or Everything – and receive the corresponding card. The higher the membership tier, the better the perks.

Whether you're strictly trying to build credit or you need a reliable prepaid card that earns interest, this guide can help you choose between KOHO credit cards.

Key Takeaways

- The KOHO Everything Mastercard card is the best KOHO credit card, offering the best rewards and highest interest rate.

- The KOHO Essential Mastercard is KOHO's basic credit card, which has the potential to be a no-fee card.

- To improve your credit score with a KOHO card, you must enroll in KOHO Credit Building.

Best KOHO credit cards

| Category | Credit card | Annual fee | Rewards | Average earn rate | Welcome bonus |

|---|---|---|---|---|---|

| Best basic prepaid card | KOHO Essential Mastercard | $48 |

| 0.5% |  $80 GeniusCash + $20 after the first purchase $80 GeniusCash + $20 after the first purchase |

| Best low-fee card | KOHO Extra Mastercard | $144 |

| 0.8% |  $80 GeniusCash + $20 after the first purchase $80 GeniusCash + $20 after the first purchase |

| Best premium card | KOHO Everything Mastercard | $177 |

| 1.1% |  $80 GeniusCash + $20 after the first purchase $80 GeniusCash + $20 after the first purchase |

1. Best basic prepaid card

Rewards:

- 1% cash back on groceries, restaurants, and transportation

It might be the most basic of the options, but the KOHO Essential Mastercard is available for no fee – it simply requires that you set up a recurring direct deposit into your KOHO account. You won't earn as much cash back as the mid-range or premium prepaid cards, but even without the direct deposit, you'll still pay a much lower annual fee of $48.

If you're undecided about these cards, consider how much you're willing to pay for the privilege of keeping the card in your wallet.

Pros:

- Low $48 annual fee

- $0 annual fee with recurring direct deposit

- No credit check required

- Earn up to 2% interest

- Low 1.5% foreign exchange fee

Cons:

- Only earns 1% cash back on 3 categories

- No insurance included

2. Best low-fee card

Rewards:

- 1.5% cash back on groceries, restaurants, and transportation

- 0.25% cash back on all other purchases

If you're looking for more from your prepaid card, consider the KOHO Extra Mastercard. This card stands out for its lack of foreign transaction fees, a free monthly international ATM withdrawal, and a 30% discount on KOHO's Credit Building service. Of course, there's a cost of these extras: an annual fee of $144, or $12 per month.

If you decide it's not for you, you can downgrade to the no-fee version of the card at any time.

Pros:

- Up to 1.5% cash back on purchases

- Earn up to 2.5% interest

- No foreign exchange fees

- 1 free monthly international ATM withdrawal

- Discounted Credit Building service

Cons:

- No insurance included

- No cash back on rent payments

3. Best premium prepaid card

Rewards:

- 2% cash back on groceries, restaurants, and transportation

- 0.5% cash back on all other purchases

If you want the best of the best from KOHO, the KOHO Everything Mastercard is a unique package. You'll get a solid 1.1% earn rate, plus enjoy earning 3.5% interest on the money deposited in your account. Advanced phone support, half-priced access to the Credit Building service, and cash back on rent payments are more bonus features available with this card vs. the lower tiers.

This product is one of the few available as a sleek metal credit card, though new clients may have to join a waitlist and first receive a typical plastic card.

Pros:

- Up to 2% cash back

- Earn up to 3.5% interest

- No foreign exchange fees

- Half-priced Credit Building service

- Free credit reports

Cons:

- Higher annual $177fee

- Low base earn rate

What is KOHO and how does it work?

KOHO is an online-only bank that was founded in 2014, when it began issuing Visa credit cards. Now, it only issues Mastercards. As a challenger fintech, it's well known for its prepaid credit cards and credit-building program, KOHO Credit Building.

This online institution mostly designs its services and opportunities for people who may not qualify for credit products from big banks. For instance, KOHO offers a no-fee hybrid chequing/savings account with one of the highest interest yields in the country.

Similar to traditional banks and unlike credit unions, you aren't required to become a KOHO member. If you're interested in a product, simply head to the KOHO site or open the mobile app to complete an application.

Pros and cons of KOHO prepaid credit cards

Among other benefits, KOHO credit card applicants don't undergo a credit check, and the cards offer low FX fees and high interest on savings. However, they also have low base cash back rates and don't provide any insurance.

With KOHO credit cards, you can look forward to benefits like these:

- No credit checks: KOHO only offers prepaid cards, and since these aren't credit products, you won't need to undergo a credit check. All you have to do is load the card and spend what you put on it.

- Switch cards at any time: If you start with the no-fee card and want more, go ahead and make the switch. Of course, the inverse is also true– if you start with a premium card and decide the fee isn't worth it, it's easy to downgrade to the no-fee card instead.

- Low foreign transaction fees: Most credit cards charge 2.5% on purchases not made in Canadian dollars. But the KOHO Essential Mastercard charges a low fee of 1.5% while the KOHO Extra Mastercard and KOHO Everything Mastercard don't charge any at all. Even at 1.5%, this can save travellers quite a bit of money.

- The KOHO app: The KOHO app makes it easy to manage your money with budgeting tools and spending analysis. The app is available for both iOS and Android.

But you'll also need to contend with these downsides:

- Low base earn rates: The base earn rate for these cards is quite poor compared to standard credit cards. The Essential only gets you 1% back on groceries, transportation, and restaurant purchases. The Everything earns you 2% on those same categories, while the Extra splits the difference at 1.5%. Outside of these categories, you're looking at nothing to 0.5% in earnings.

- No bearing on your credit score: Since they're prepaid cards, KOHO credit cards won't help your credit score. That said, KOHO has an add-on you can purchase to support your credit-building initiatives (more on that below).

- Lack of insurance: If you're hoping for insurance coverage, you're out of luck. None of the KOHO cards come with insurance, though the premium card includes price protection.

Earning rewards with KOHO credit cards

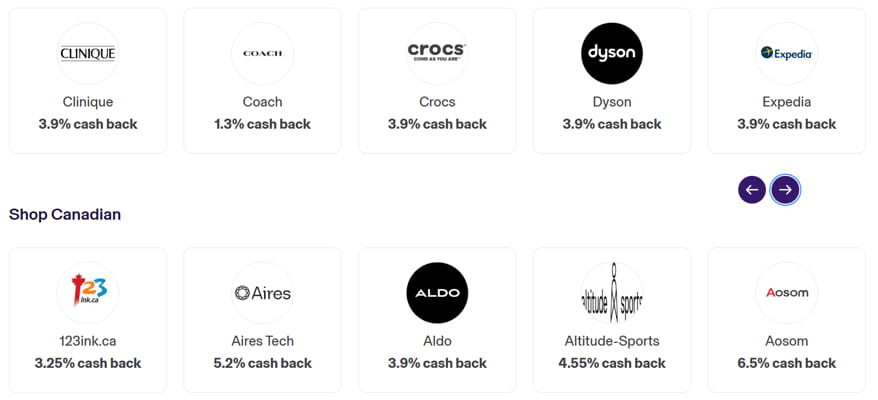

If you want to level up your rewards, you need to shop with KOHO's partners. This sample shows a few of its partner retailers:

Earnings depend on the partner, but you can enjoy as much as 6.5% back. And this is bonus cash back – you'll earn at your card's regular rate, too.

Features of KOHO Mastercards

Once you have a KOHO prepaid card, you'll be able to access other KOHO products, services, and benefits. Here's what's available:

1. KOHO Credit Building

KOHO only offers prepaid cards, so they won't impact your credit score – good or bad. But with KOHO Credit Building, you can pay to have KOHO report your on-time payments to 1 major credit bureau. You'll get access to your score and should see an improvement in 4 months.

The service costs $10 per month, but you get significant discounts if you also have a KOHO credit card. The Extra tier offers a 30% discount, and the Everything tier a 50% on these credit services.

Remember: If you choose to pay for this service monthly, ensure you always have $10 on your prepaid balance. If you have insufficient funds to pay the monthly fee, KOHO will report the missed payment (yes, it works both ways).

2. KOHO Earn Interest

If you keep enough cash on your prepaid card, you can earn interest on it with KOHO Earn Interest. How much you earn depends on your card:

- Essential: 2%

- Everything: 3.5%

- Extra: 2.5%

You need to set up a direct deposit on your account to enable KOHO Earn Interest. Without it, you won't earn anything.

3. KOHO International Money Transfer

KOHO makes it easy to send money to people in over 190 countries using money from your prepaid balance. KOHO International Money Transfer offers competitive exchange rates and is upfront about the fees you'll pay. We looked at a variety of transfers and found that it costs roughly $4 in fees to send $1,000 abroad (which varies by currency).

4. Travel insurance

Walnut Insurance and TuGo Travel Insurance partner with KOHO to provide tenant and travel insurance. The tenant insurance is standard, with up to $1 million bodily injury liability and $100,000 in property damage liability. The travel insurance can be customized, or you can choose a full inclusive package with trip cancellation, emergency medical coverage, and more.

Users can apply for these insurance products quickly and easily through the KOHO mobile app.

Should you get a KOHO credit card?

If you're in the market for a prepaid credit card, KOHO is a solid choice. With no credit checks necessary, these cards are a good way for you to manage your finances without worrying about incurring debt. If you spend a lot of money at KOHO partner businesses, these cards may be worth it to you.

That said, prepaid cards like KOHO don't offer the best rewards or earn rates, and you won't get any insurance with your card. Additionally, KOHO cards won't help raise your credit score. It's important to weigh how the card will fit into your financial situation before you apply.

Take a look at the following types of spenders to see if a KOHO card is right for you:

- Budget-minded people: Using a KOHO prepaid card ensures you won't spend more than you have.

- People building credit: If you don't have credit or your score is poor, KOHO's credit-building program is an inexpensive way to establish or improve your credit score.

- Frequent online shoppers and travellers: KOHO doesn't charge foreign transaction fees on specific plans, making it a great option if you shop online or travel abroad regularly.

- Young adults and students: KOHO cards are fantastic starter cards for young people who benefit from the easy eligibility requirements and the site's budgeting tools.

- People who want high-interest savings: Depending on the plan, your balance could earn interest while sitting in your account.

How to apply for a KOHO Mastercard

As is the case with most credit cards, prepaid and otherwise, it's easy to apply for a KOHO Mastercard. With no income or credit requirements, all you need to be is a Canadian resident and the age of majority in your province or territory.

To apply, visit one of our offer pages and click either "Apply" or "I want This Deal". Alternatively, you can apply directly through the KOHO website or mobile app. Once you complete the secure online application, your card will be on its way!

Alternatives to KOHO cards

If you're looking for cards that are easy to qualify for and simple to use, check out these alternatives:

| Card | Pros | Cons | Learn more |

|---|---|---|---|

| Wealthsimple Prepaid Mastercard | * Earn up to 2.5% interest on your account balance * No foreign exchange fees | * No insurance included * No rewards on purchases | Learn more |

| EQ Bank Card | * No annual or foreign exchange fees * Acts as a hybrid bank account, with no charges for ATM withdrawals * Earn 2.75% interest on your balance | * Only earns 0.5% cash back on purchases * No insurance included | Learn more |

| Neo Everyday Account | * Earn an average of 5% back at Neo retail partners * Earn 0.1% interest on your balance | * Rewards from non-Neo partners aren't nearly as valuable * No insurance included | Learn more |

FAQ

Is KOHO a credit card?

While you can use KOHO cards like credit cards, they're technically prepaid cards. To use a KOHO card, you must first deposit money into your account, and later, when you use your card to make a purchase, the money is withdrawn from your account.

Does KOHO actually build credit?

KOHO prepaid cards don't build your credit as standard credit cards do, but KOHO Credit Building can help build your score. You'll pay a small fee to have KOHO report your on-time payments to one of the major credit bureaus – though the fee is significantly discounted for KOHO Extra Mastercard and KOHO Everything Mastercard cardholders.

Does a KOHO card work as a credit card?

KOHO cards are prepaid credit cards, so while you can spend with them as you would a typical credit card, your available credit amount is limited to what you deposited in your account. It functions like a debit card – you aren't extended any extra credit beyond what you yourself have contributed – but is accepted like a credit card.

Is KOHO a good first credit card?

Yes, KOHO cards are excellent options for your first credit card. They can help you stay within a spending limit and provide the convenience and flexibility of using a credit card to pay for things. And because they're not true credit products, they prevent you from falling into credit card debt.

What are the cons of KOHO?

Unfortunately, KOHO cards can't help build or improve your credit score, since they're not true credit products – though they do provide discounted access to a credit-building service. They don't provide the insurance coverage that many typical credit cards do, either, and the KOHO Everything Mastercard in particular has quite a high annual fee.

Can I withdraw money from a KOHO credit card?

Yes, you can withdraw money from your KOHO prepaid credit card. KOHO cards function like debit cards, allowing you to access funds you've already loaded into your account. However, since KOHO doesn't have its own machines or partner with any ATM networks, be wary of ATM fees.

Editorial Disclaimer: The content here reflects the author's opinion alone. No bank, credit card issuer, rewards program, or other entity has reviewed, approved, or endorsed this content. For complete and updated product information please visit the product issuer's website. Our credit card scores and rankings are based on our Rating Methodology that takes into account 126+ features for each of 228 Canadian credit cards.

×1 Award winner

×1 Award winner