While mobile phones can be extremely expensive to repair or replace if damaged or lost, several credit card providers offer mobile device insurance as a perk. Our top 8 cards offer $500 to $1,500 in coverage – and we’ll dive into what’s covered, what isn’t, and how you can rely on it to save you money.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is mobile phone insurance?

Mobile phone insurance might seem self-explanatory, but credit card insurance usually comes with quite a bit of fine print. Let’s look at the key terms and conditions to pay attention to.

Coverage start date

If your credit card offers mobile insurance, there’s typically a waiting period before coverage starts. In the case of the

What it means: You're not eligible for coverage if something happens to your device within the waiting period.

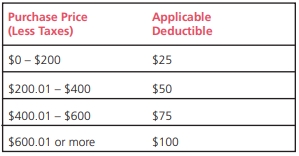

Deductible

A deductible is the amount of money that you have to pay before the insurance provider will kick in to cover your claim.

For the

If you paid $800 for your phone before taxes, you’ll need to cover $100 before the insurer will step in to cover the remainder of the claim.

Depreciation

Unfortunately, your mobile phone loses value over time – just like a new car when you drive it off the lot. Insurance providers don’t want to pay you the equivalent of a new phone for a mobile device that’s no longer new.

This is where depreciation comes in. Most insurance providers that work with credit card companies set a phone’s depreciation rate (i.e., how much your item loses value) at about 2% per year.

Here’s what that looks like in our hypothetical scenario of an $800 phone damaged 6 months after your purchase:

$800 x 2% = $16 in annual loss

$16 x 0.5 years (since you purchased the phone 6 months ago) = $8 depreciation

To figure out how much you’ll get back from your insurance claim, subtract the depreciation from the purchase price. Don’t forget to subtract your deductible!

$800 - $8 = $792

$792 - $100 deductible = $692

In this scenario, your maximum reimbursement would be $692 – even if your coverage is up to $1,000.

Credit cards with mobile device insurance

Here's an overview of some of the best Canadian credit cards with mobile device insurance:

| Credit card | Annual fee | Coverage amount | Coverage start date | Depreciation % | Learn more |

|---|---|---|---|---|---|

| American Express Cobalt | $191.88 | $1,000 | Upon purchase of the phone, or 91 days from the purchase | 2% | Learn more |

| BMO eclipse Visa Infinite | $120 | $1,000 | 91 days from the date of purchase of your mobile device or the date the first monthly bill payment is charged to your account | 2% | Learn more |

| Tangerine World Mastercard | $0 | $1,000 | 30 days from the date of purchase of your mobile device or the date the first monthly bill payment is charged to your account | 2% | Learn more |

| Scotia Momentum Visa Infinite | $120, waived for first year | $1,000 | 30 days from the date of purchase of your mobile device and the date the first monthly bill payment is charged to your account | 2% | Learn more |

| RBC Avion Visa Infinite | $120 | $1,500 | 91 days from the date of purchase of your mobile device or the date the first monthly bill payment is charged to your account | 2% | Learn more |

| National Bank World Elite Mastercard | $150 | $1,000 | The 60th day following the date of purchase of your mobile device or the date on which the second consecutive monthly payment under your plan is charged to your Mastercard account | 3% | Learn more |

| Scotiabank American Express | $0 | $500 | 30 days from the date of purchase of your mobile device or the date the first monthly bill payment is charged to your account | 2% | Learn more |

| BMO eclipse Rise Visa | $0 | $1,000 | 91 days from the date of purchase of your mobile Device or the date the first monthly bill payment is charged to your account | 2% | Learn more |

American Express Cobalt Card

Certificate of insurance: American Express Cobalt

The best credit card that includes mobile device insurance is the

This Amex card offers the standard $1,000 in mobile device coverage – but it really stands out when it comes to rewards. You’ll earn American Express Membership Rewards at these earn rates:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

And with each point worth up to 2 cents each, you can get a return of up to 10% on your purchases.

BMO eclipse Visa Infinite Card

Certificate of insurance: BMO eclipse Visa Infinite

The

You’ll also enjoy these high earn rates:

- 5 BMO Rewards points for every $1 spent on dining ($6,000 per year), groceries ($6,000 per year), gas, and transit

- 1 point per $1 spent on all other purchases

These BMO Rewards points can be used towards any travel booking for a return of up to 3.35% on your purchases. The card offers a $50 lifestyle credit and will earn 10% more points when you add an authorized user to the account.

Tangerine Money-Back World Mastercard

Certificate of insurance: Tangerine World Mastercard

No annual fee cards with mobile device insurance are very rare, and one of the best is the

Earn 2% cash back on up to 3 categories of your choice, and 0.5% cash back on all other purchases.

Scotia Momentum Visa Infinite Card

Certificate of insurance: Scotia Momentum Visa Infinite

If you’re looking for a cash back credit card with mobile device insurance, look no further than the

Packed with high earn rates and $1,000 in mobile device coverage and 11 types of insurance, the Scotiabank Momentum Visa Infinite will earn you:

- 4% cash back on groceries and recurring bill payments

- 2% cash back on gas, transit, and food delivery

- 1% cash back on all other purchases

The annual fee of $120 is waived for the first year.

RBC Avion Visa Infinite

Certificate of insurance: RBC Avion Visa Infinite

It probably doesn’t come as a surprise that RBC also offers mobile device insurance through the

With this card, you'll also earn 1 RBC Rewards point for every $1 spent (25% more on travel purchases).

This credit card has a standard annual fee of $120, and income requirements of either $60,000 personal or $100,000 household.

National Bank World Elite Mastercard

Certificate of insurance: National Bank World Elite Mastercard

The

Here’s how you earn points:

- 5 points per $1 spent on groceries and restaurants, up to $2,500 in total spend per month (2 points after)

- 2 points per $1 spent on gas, electric vehicle charging, recurring bills, and travel booked through À La Carte Rewards

- 1 point per $1 spent on all other purchases

With your points you can redeem a $150 annual travel credit, National Bank investments, gift cards, merchandise, and cash back.

Scotiabank American Express Card

Certificate of insurance: Scotiabank American Express

For no annual fee with mobile device insurance, you can’t do better than the

You'll get $1,000 in coverage, and you'll earn Scene+ points at these rates:

- 3 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 2 Scene+ points per $1 spent on grocery, dining and entertainment, gas, daily transit, and select streaming services

- 1 Scene+ point per $1 spent on all other purchases

You can use your points towards a multitude of things, including travel, movies, and merchandise.

BMO eclipse rise Visa Card

Certificate of insurance: BMO eclipse Rise Visa

There's one more no fee credit card that offers mobile device coverage: the

It offers $1,000 in coverage and rewards at the following rates:

- 5 BMO Rewards points for every $2 spent on dining, groceries, and reccurring bills

- 1 point per $2 spent on all other purchases

You can use your BMO Rewards points for travel bookings or many other redemption options.

What your cell phone insurance covers

As you read through the insurance policy’s fine print, it’s important to know what’s covered and what’s not so that you don’t spend time and energy submitting a claim that won’t be approved.

Most policies cover accidental damage, loss, and theft of your phone. We should stress that it’s always a good idea to read your insurance certificate closely to find out the exact coverage details.

You’re probably not shocked to learn that more things are excluded than included. For instance, these parts aren’t commonly covered:

- Accessories

- Batteries

- Used mobile devices

- Devices purchased for resale

- Modified devices

- Cosmetic damage that doesn’t affect functionality

- Normal wear and tear

How to make a mobile device insurance claim

Before you try to fix your phone, submit a claim with your credit card company. If you want to be reimbursed for the repairs, you need to get approval first.

That said, if your phone was stolen, immediately file a police report – and don’t forget to cancel all services to your device.

Gather all related documents

To streamline the application process locate the following:

- Original sales receipt of your device

- Date and time you notified your provider of loss or theft

- Copy of your original manufacturer's warranty

- A copy of the written repair estimate, in case of mechanical failure and accidental damage

- An account statement showing the full purchase price of your device

- A police, fire, insurance claim, or loss report in case of theft

File a claim on the phone

You can file a claim over the phone, though some credit card issuers will allow you to do it online. Here’s easy reference to their contact information:

| Issuer | Telephone number |

|---|---|

| American Express | 1-800-243-0198 |

| BMO | 1 833 324-5947 |

| Scotiabank | 1-800-263-0997 |

| RBC | 1-800-533-2778 |

| Tangerine | 1-855-255-6050 |

| National Bank | 1-888-235-2645 |

When you call, a customer service representative will take your information and tell you about the next steps. You might have to submit photo documentation, for instance. They’ll also provide a timeline of when you might expect a claims decision and reimbursement.

Learn more: How to make a successful mobile device claim

FAQ

What is credit card mobile phone insurance?

Credit card mobile phone insurance covers a mobile device in case of accidental damage, theft, or loss. For the insurance to take effect, you must either charge the full cost of the phone or the mobile phone bill to your credit card.

What is the typical coverage provided with credit card mobile device insurance?

Most credit cards come with $1,000 in coverage but this can change based on the card. The maximum amount you can receive will generally be less than that, as depreciation and a deductible can lower the maximum amount that can be claimed.

What is the best credit card that features mobile device insurance?

The best credit card that includes mobile device insurance is the American Express Cobalt, which includes $1,000 in coverage, and offers up to 5 points per $1 spent on purchases.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 9 comments