If you're wondering where American Express is accepted in Canada, you'll be happy to know that most well-known cross-country stores and services accept Amex. Yet, some merchants still refuse to accept these valuable payment options from customers.

The best American Express cards offer features and benefits that match or outdo the top cards from other networks, making them excellent cards for Canadian shoppers. However, Amex charges significant processing fees for merchants, causing many small businesses (and a few larger ones) to decline accepting them.

While we can't list every small business in the country, the following guide outlines which major Canadian merchants accept Amex as payment and which don't.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Where is American Express accepted in Canada?

There's no shortage of retailers, gas stations, restaurants, and entertainment providers you'll be able to use your Amex card with.

Sure, there will be the odd one here and there, but by and large, you shouldn't have much of a problem using your card.

| Category | Examples of brands |

|---|---|

| Grocery stores | * Safeway * Sobeys * Metro and Metro Plus * Longos * Whole Foods Market * 7-Eleven * Circle K * Super C * Marché Richelieu * IGA * FreshCo |

| Major retailers | * Walmart * Canadian Tire * Best Buy * Shoppers Drug Mart * Home Depot * Staples |

| Gas stations | * Esso * Petro Canada * Shell * Husky * Irving * Ultramar |

| Entertainment chains | * Cineplex * Ticketmaster * StubHub |

| Restaurants | * Tim Hortons * McDonalds * Starbucks * Boston Pizza * Recipe Unlimited restaurants (includes Harvey’s, Swiss Chalet, Kelsey's, and Montana's) |

According to American Express, over 110,000 places started accepting American Express Cards in 2023.

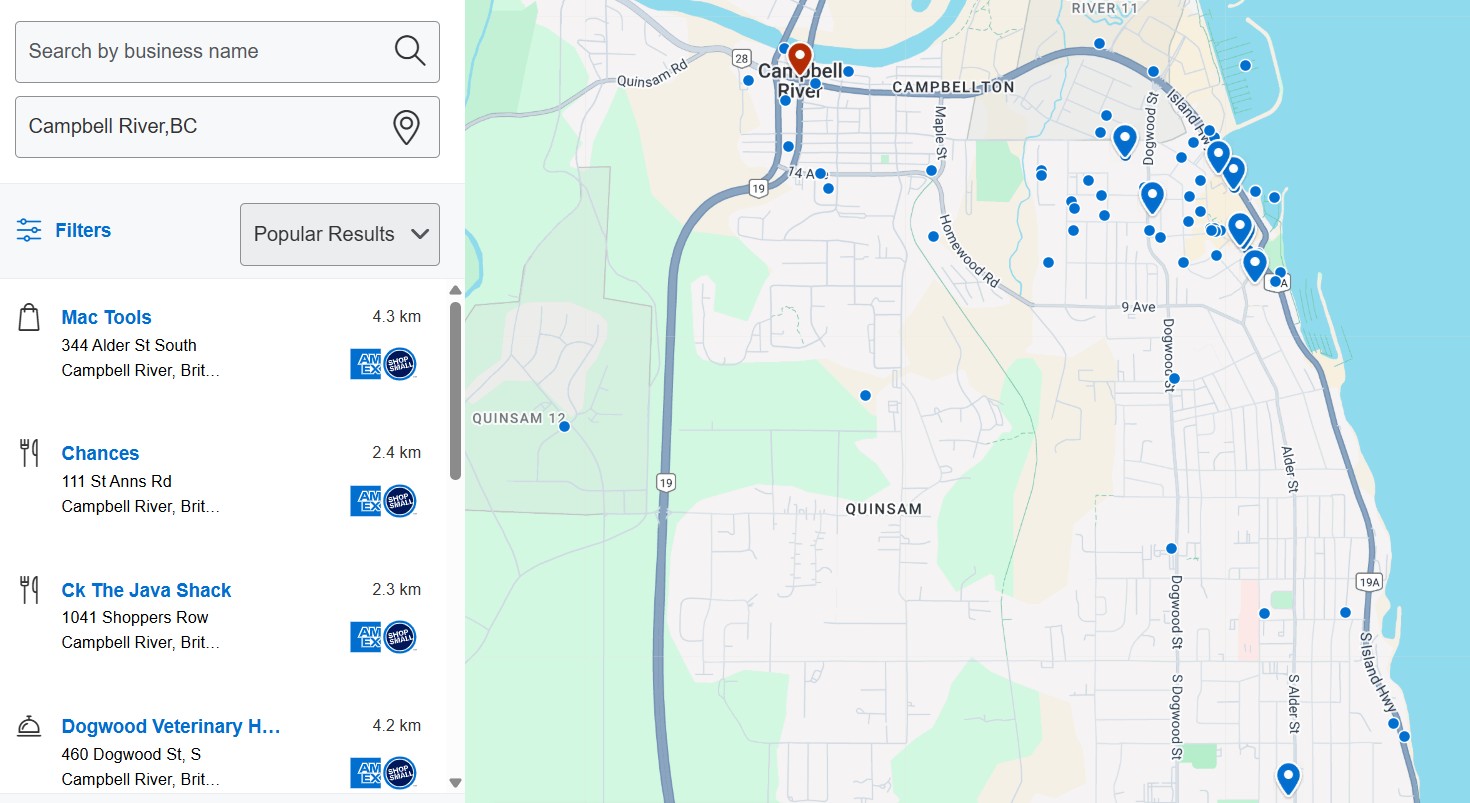

Want to see where your Amex card could be accepted? This map, created by American Express, shows you what merchants in your area – large and small – accept Amex cards. That way, you can stop at Sobeys or Canadian Tire and grab a Tim Horton’s coffee on the way home.

But Amex also gives you the opportunity to support your local businesses. The downtown boutiques, the small grocery stores with the employees that make you feel like family, and the hardware store that’s been there for longer than you or your parents have.

Where is American Express NOT accepted in Canada?

You might be surprised to learn that 2 major retailers do not accept Amex: Costco and Loblaws brands (except for Shoppers Drug Mart).

As for small businesses, it varies widely. Amex costs small businesses more in processing fees, so some owners don’t accept Amex cards. If you want to use your Amex card at a small business, just call and ask whether they accept it!

Are Amex credit cards worth it?

Amex is well known for offering some of the best perks and benefits of any credit card issuer. Here are some of the reasons you may want to reach for American Express:

- Amex Offers: Special access to limited-time offers through retail partners

- Front Of The Line: Pre-sale access or reserved seats to concerts, sporting events, dining experiences, and theatre performances

- Amex Travel: Special offers for flights, hotels, and car rentals

- Member extras: Unlock statement credits with specific partners

- Insurance: Most Amex cards come with several types of travel, mobile, and purchase insurance

- Lending options: Access to personal loans and installment payment plans through your card

Like other card issuers, American Express operates its own rewards program: American Express Membership Rewards. We found it to be one of the best loyalty rewards programs, giving some of the highest redemption values for travel.

Cardholders earn points for purchases that they can redeem for travel (flexible or fixed points), cash, gift cards, or merchandise. If none of those options work for you, Amex also gives you the ability to transfer Amex points to a partnering reward program like Aeroplan, Air France, or Hilton Honors.

Our best Amex credit cards

American Express cards are some of our top-ranking cards in our annual rankings, including the best credit card in Canada for 8 years running. Almost every one of our rankings lists has an Amex card in the top 5.

| Credit card | Welcome bonus | Earn rate | Annual fee | Apply |

|---|---|---|---|---|

| American Express Cobalt Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | $191.88, charged as $15.99 per month | Learn More |

| Scotiabank Gold American Express Card |  $60 GeniusCash + Up to 45,000 bonus points, first year free (terms) $60 GeniusCash + Up to 45,000 bonus points, first year free (terms) | * 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 5 Scene+ points per $1 spent on groceries, dining, and entertainment * 3 Scene+ points per $1 spent on gas, select streaming services, and transit * 1 Scene+ point per $1 spent on foreign currency purchases * 1 Scene+ point per $1 spent on all other purchases | $120 | Learn More |

| American Express Gold Rewards Card | Up to 60,000 bonus points (terms) | * 2 points for every $1 spent on gas, groceries, drugstores, and travel * 1 point for every $1 spent on all other purchases | $250 | Learn More |

| American Express Green Card | 10,000 bonus points (terms) | * 1 point per $1 spent on all purchases | $0 | Learn More |

American Express Cobalt

The

- 5 points per $1 spent on eligible restaurants, bars, cafés, and even food delivery

- 2 points per $1 spent on gas, transit, and eligible travel purchases

- 1 point per $1 spent on all other purchases

With a point worth up to 2 cents when transferred to Aeroplan or 1.75 cents when redeemed for flights using the Fixed Points Travel Program, you can get a substantial return on your spending.

Scotiabank Gold American Express

The

- 6 points per $1 spent at Sobeys, Safeway, Freshco, and more

- 5 points per $1 spent on groceries, dining, and entertainment

- 3 points per $1 spent on gas, select streaming services, and transit

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

We should point out that you earn Scene+ points, which is the currency for Scotiabank’s reward program. You can redeem points for discounts, gift cards, cash back, and travel.

The card also comes with extensive insurance coverage and no foreign exchange fee, saving you the standard 2.5% on non-CAD purchases. Although there is a modest annual fee, the income qualifications are low, making it a great card for someone who might not qualify for an elite Amex card.

American Express Gold Rewards

If you’re looking for an Amex card with the best travel benefits, look no further than the

While the earnings aren’t as impressive as others on our list, the travel benefits are excellent. You’ll get 2 points per $1 spent, 4 free passes to Plaza Premium lounges in Canada, and 11 types of insurance coverage. When you’re ready to redeem points, you’ll have 4 high-value options.

American Express Green Card

We wanted to include a fee-free Amex card, and the

The card doesn’t offer much in the way of insurance, but we see the Amex Green card as a useful starter card for newcomers or those who are building credit.

FAQ

Does Canadian Walmart take Amex?

Yes, you can use your American Express credit card at Walmart locations in Canada and on its website. However, unlike Mastercard, Amex doesn’t typically consider Walmart Supercentres to be grocery stores, so you won’t get grocery store earn rates at Walmart.

Can I use Amex at Tim Hortons?

Yes! You can pay for your next Timmies run with your Amex card. In fact, the

Will Costco accept Amex?

Unfortunately, Costco (and Loblaws brands) don’t take American Express. If you’re shopping in store, you’ll need to pay with cash, debit, or Mastercard, so the best Costco cards in Canada are all Mastercards. However, you can use Visa when shopping at Costco online.

What stores don't accept American Express?

Some small businesses don’t take Amex, and neither do Costco and Loblaws stores (with the exception of Shoppers Drug Mart). However, that could change in the future, so it doesn’t hurt to keep checking.

What is the downside of American Express?

If there’s one issue with Amex, it’s that sometimes, smaller merchants won’t accept the card network because it charges higher processing fees. However, most major retailers take Amex Express.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 3 comments