Best Overall Credit Card in Canada for 2026

When you want the best of the best.

For the 8th year in a row, the American Express Cobalt® Card is the best overall credit card in Canada, offering cardholders a very long list of valuable benefits. The RBC Avion Visa Infinite Privilege and RBC Avion Visa Infinite are runners-up, providing solid non-Amex alternatives.

| Credit card | Annual fee | Average return | Welcome offer | Travel perks | |

|---|---|---|---|---|---|

| #1 | American Express Cobalt Card | $191.88 | 4.5% |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) | * 10 types of insurance * Earns American Express Membership Rewards, which can be transferred to other programs, redeemed for travel, or redeemed for several other valuable options * Up to $100 hotel credit, plus other perks, when booking hotels in The Hotel Collection from American Express Travel |

| #2 | RBC Avion Visa Infinite Privilege | $399 | 2.91% | Up to 70,000 bonus points (terms) | * 12 types of insurance * Earns Avion Rewards, which can be transferred to other programs, redeemed for travel, donated to charity, or redeemed in several other ways * Welcome offer is worth a mind-boggling $1,631, plus users get a one-time anniversary bonus of 20,000 points |

| #3 | RBC Avion Visa Infinite | $120 | 2.36% | 55,000 bonus points (terms) | * 12 types of insurance * Earns Avion Rewards, which can be transferred to other programs, redeemed for travel, donated to charity, or redeemed in several other ways * Huge welcome offer, worth $1,282, plus BOGO lift tickets at popular Canadian ski resorts via the Avion Collection |

Rewards and cash back are two of the most essential factors Canadians consider when choosing a credit card. This is why our Genius Rating system – an unbiased, data-driven algorithm – gives extra weight to these categories when comparing options and determining the top credit cards.

This article reviews the overall top three credit cards in depth, reviews the pros and cons of credit card use, and offers other helpful information to help you choose the best card for your needs.

Key Takeaways

- The best overall credit card in Canada is the American Express Cobalt Card.

- The RBC Avion Visa Infinite Privilege wins the silver award for best credit card, and the RBC Avion Visa Infinite earns bronze.

- When choosing a credit card, compare the rewards, fees, interest rates, insurance packages, and other important factors of the cards you're considering.

- Credit card benefits include earning valuable rewards and the opportunities to build your credit.

- Credit card cons include multiple fees and the risk of overspending.

The best overall credit cards in Canada

Our Gold award for the best overall credit card in Canada goes to the American Express Cobalt Card. This card’s astonishingly high average earn rate of 4.5% and its flexible rewards program play a significant role in its ranking so highly.

Our Silver award is awarded to the RBC Avion Visa Infinite Privilege, largely thanks to its extensive insurance package, and valuable travel perks – including access to the Visa Airport Companion Program. This card also boasts a sizeable welcome bonus

Our Bronze award goes to the RBC Avion Visa Infinite Privilege's close relative, the RBC Avion Visa Infinite. It also has a huge welcome offer and earns valuable Avion points. Plus, this card comes with Visa Infinite travel perks and RBC partner perks.

Canada’s best overall credit card: American Express Cobalt® Card

The American Express Cobalt Card has topped our charts once again. Its biggest asset? Incredible rewards. With eight ways to spend your American Express Membership Rewards, seven ways to earn them, and an average return of 4.5%, every Canadian is sure to find something they like about the Cobalt.

Everyone can appreciate the many benefits of Amex Offers, which include special discounts, rebates, and/or bonus points you can earn with specific retailers. Cobalt cardholders also have access to Amex's Front Of The Line program, which offers early ticket sales and reserved seating for various events.

This card comes with a long list of insurance protections, too, from purchase protection to emergency medical coverage. We estimate that the mobile device insurance alone adds about $53 to the Cobalt’s estimated insurance value – and that $53 is a significant chunk of the card's $191.88 annual fee (which is charged as $15.99 per month, by the way).

Really, the only major downside of this card is Amex's more limited acceptance. But even that isn't as bad as you may think, as most of Canada's top retailers accept American Express along with all other credit cards.

Best overall card silver winner: RBC Avion Visa Infinite Privilege

With an impressive list of premium perks – especially travel perks – the RBC Avion Visa Infinite Privilege solidifies itself as one of the best credit cards in Canada. The best perks are part of the Visa Airport Companion Program, including a free DragonPass membership (with up to six free lounge visits per year) and exclusive airport dining and retail offers.

The RBC Avion Visa Infinite Privilege has one of the largest welcome offers you'll ever see; you'll get 70,000 Avion rewards points after your account is approved, spend $5,000 in the first 3 months, and on your 1 year anniversary. That's a max value of $1,631, putting a big dent in the cost of that dream vacation.

This card doesn't skimp on insurance either, offering 12 different types. This includes emergency medical coverage for seniors ages 65+ for 7 days, along with several other valuable travel insurance options. This is why the RBC Avion Visa Infinite Privilege is also one of the top-rated travel cards for seniors.

Unfortunately, this card does have a very high annual fee of $399. While that fee is easily counteracted by the value of the card's many, many perks, it can still be a tough pill to swallow.

Best overall card bronze winner: RBC Avion Visa Infinite

Essentially the RBC Avion Visa Infinite Privilege's little sister, the RBC Avion Visa Infinite still has an amazing welcome offer – worth $1,631 – and earns Avion rewards points. Users earn up to 1.25 points per $1 spent on travel and 1 point per $1 spent everywhere else, and points can be redeemed for travel, merchandise, charitable donations, and more. You can also transfer those points to 4 different airline programs, which makes planning your next rewards trip a cinch.

It should be noted, though, that while Avion points are quite valuable when redeemed for travel, other redemption options aren't quite as good. These alternatives offer about a 1% return, so this might not be the card for you if you aren't interested in travel.

As part of the Visa Infinite program, the RBC Avion Visa Infinite comes with some pretty sweet perks. In exchange for income requirements of $60K personal or $100K household and an annual fee of $120, the program gets you access to Visa’s luxury hotel collection, dining series, and complimentary concierge service.

Despite its lower annual fee ($120 vs. $399), this card comes with the same comprehensive insurance as the RBC Avion Visa Infinite Privilege. While most of its coverage is travel-focused, the extended warranty, purchase protection, and mobile device insurance provide top value even for homebodies.

Compare all top credit cards in Canada by Genius Rating

The overall best credit cards are chosen based on our Genius Rating system, which uses a refined, math-based algorithm to rank each card on a scale of 1 to 5.

Explore the top 10 credit cards in Canada:

The Genius Rating methodology

Our Genius Rating system considers more than

- Rewards (31%)

- Fees (20%)

- Approval (5%)

- Perks (16%)

- Insurance (16%)

- Interest (7%)

- Acceptance (5%)

Learn more about the Genius Rating methodology

How to choose the best credit card for your needs

To find the best card for your financial situation, consider the same factors that determine a card’s Genius Rating: rewards, fees, approval, perks, insurance, interest, and acceptance. Of course, be sure to factor in your unique lifestyle and preferences.

Even though we love the American Express Cobalt Card, it might not be right for everyone, so take time to examine and weigh the following details:

Rewards

Rewards can look different between cards – some offer straight-up cash back, some offer points, etc. You'll want to choose a card that provides the type of rewards that best suit your needs. For example, you probably shouldn't choose a card that offers hotel points if you rarely leave home.

It helps to study your spending habits to determine which purchase categories (gas, groceries, travel, etc.) you spend the most on. When you weigh your spending habits with the rewards you want to receive, such as travel or cash back, it’ll be much easier to find a credit card you like.

Spoiler alert: the American Express Cobalt Card has the best earn rate by a long shot.

But here’s a chart that showcases the average earn rates of the top three credit cards to give you a better idea of how these cards stack up:

Tip: No matter what credit card you use, you could be earning bonus cash back on top of your card's rewards. Input your monthly spend in the GeniusCash app, and level up to earn real cash.

Fees

Paying hefty annual fees isn't ideal, but there are times when a card's perks and benefits can outweigh this cost. The RBC Avion Visa Infinite Privilege, for example, has a significantly large annual price tag of $399, but its insurance package alone is worth about $971 each year.

Of course, the biggest fee to consider is the annual fee, but several other types of fees should be factored in as well. Depending on the type of card you're looking at, compare foreign transaction fees, supplemental card fees, balance transfer fees, and other similar costs.

But since annual fees are usually top of mind, here's how the top credit cards compare:

Note that the American Express Cobalt Card charges its fee monthly in all provinces except Quebec, which has an annual fee. We’ve used the annual sum of all monthly fees for comparison.

Approval

Every credit card has specific eligibility requirements, usually involving income and credit score. All the other credit card details and features won't benefit you if you don't meet these requirements.

Many credit cards have no minimum income requirements, including several American Express cards, like the American Express Cobalt Card. However, premium-tier cards typically require higher earnings to qualify. You either need to meet the person or household minimum.

| Top Canadian credit card | Personal income requirement | Household income requirement |

|---|---|---|

| American Express Cobalt Card | $0 | $0 |

| RBC Avion Visa Infinite Privilege | $200,000 | $200,000 |

| RBC Avion Visa Infinite | $60,000 | $100,000 |

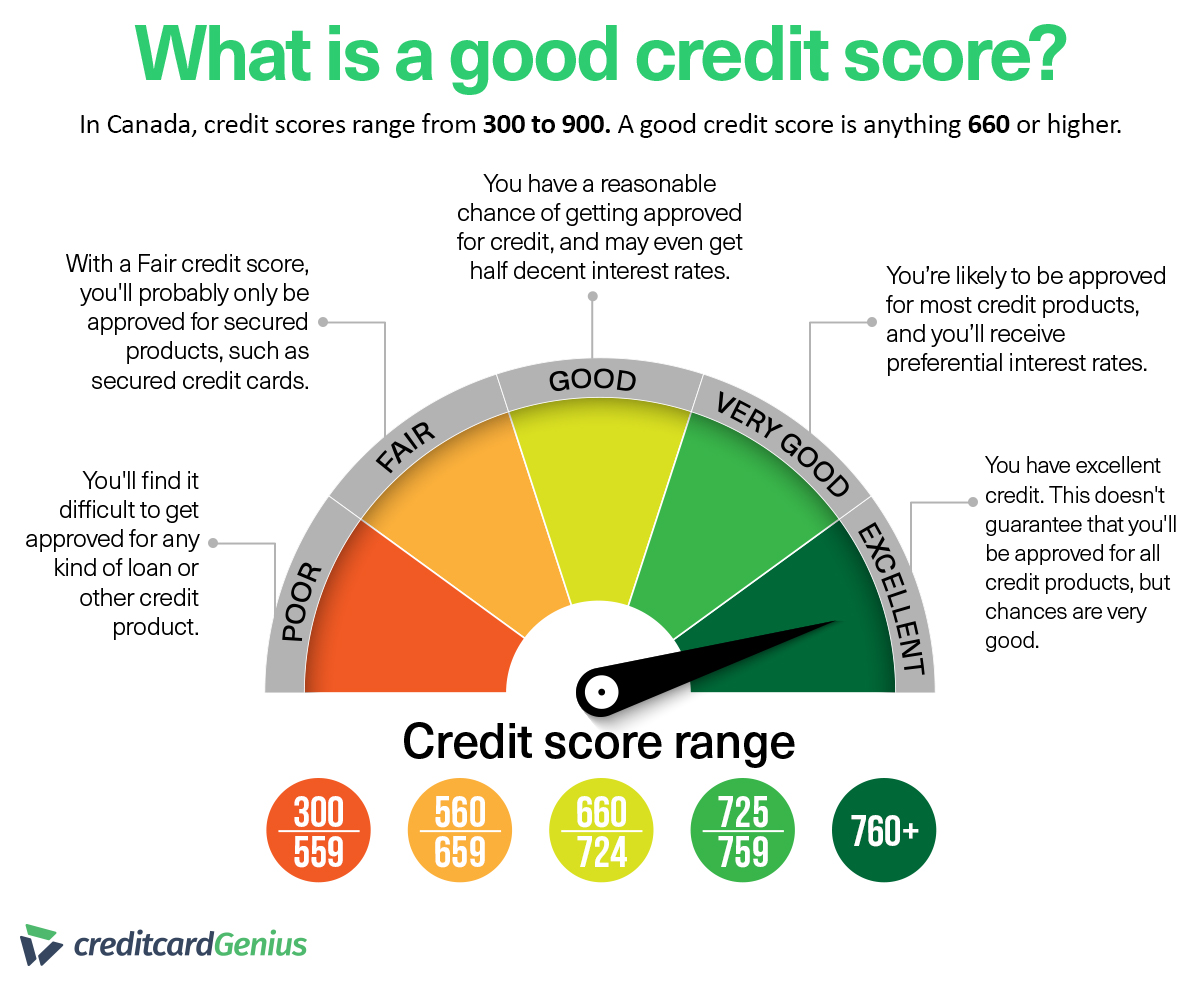

Premium-tier cards typically require higher credit scores too, but there are many excellent credit card options available for those with lower scores too. Either way, it's important to know where your credit stands before applying.

Perks

A credit card's perks are often its most valuable features. Not all perks will benefit all people, but paying attention to which ones are available with which cards can help you narrow down your choices.

Here are a few examples of perks available with various Canadian credit cards:

- Welcome bonuses: These bonuses can take the form of points, cash, extended benefits, and other deals. One of the cards on our best overall list, the RBC Avion Visa Infinite Privilege has one of the biggest and most valuable welcome offers in Canada: Up to 70,000 bonus points (terms).

- First-year fee waiver: A particularly common perk, some credit cards offer to waive the first year's annual fee. This gives users the opportunity to try out a card for a year to see if they make enough use of it to justify paying its fee each year.

- Free roadside assistance: Yes, some credit cards even provide roadside assistance at no extra cost. Your card may just have your back if you find yourself locked out of your vehicle, on the side of the highway with a flat tire, or experiencing any other type of car trouble.

- Travel perks: There are many different types of travel perks, making travel-specific credit cards very attractive. Access to airport lounges, discounted companion flight vouchers, and exclusive hotel upgrades are just a few associated benefits and sweet treats that travelling cardholders can enjoy.

Insurance

Another often overlooked but incredibly significant credit card feature is the insurance coverage it provides. Not all cards offer insurance, but many offer at least one or two types, providing financial value as well as peace of mind.

All three entries on our list of best overall credit cards have solid insurance packages, but the RBC Avion Visa Infinite Privilege and RBC Avion Visa Infinite offer slightly more than the American Express Cobalt Card. They offer a few types of travel insurance that the Cobalt doesn't, like emergency medical coverage for those over the age of 65.

Interest rates

Ensuring you’re aware of and comfortable with a credit card’s interest rates and fees is essential, even before you apply for the card. It's particularly important if you tend to carry a balance, so that you can focus on cards with lower interest rates.

Take a look at this chart, and you'll see how the interest rates for the top three overall credit cards in Canada compare (note that the Cobalt doesn't have a balance transfer rate at all):

Acceptance

To avoid frustration at checkout, you'll want to choose a credit card that you know is accepted at the retailers you frequent the most. Knowing ahead of time where you can use your chosen card helps to avoid complications.

Keep in mind that while they're accepted far more often than many people realize, American Express cards do have lower acceptance than Visas or Mastercards. Also, there's no point in getting a Visa card if you plan to use it mostly at Costco – a place that only accepts Mastercards.

Pros and cons of credit cards

Credit cards have both pros and cons – some earn you cash back at surprising rates, putting money back in your pocket, but the risk of overspending and falling into debt is still there.

Put simply, credit cards can be a powerful financial tool or a source of financial stress, depending on how you use them.

Credit card benefits

- Rewards: Most cards offer a rewards program, typically points or cash back, and some are incredibly valuable. You certainly won't get benefits like these when paying with cash.

- Credit building: Used properly, credit cards can help build your credit history and boost your credit score. They're all but essential for newcomers to Canada and others looking to build credit.

- Perks: Many credit cards offer attractive features and incentives, such as generous welcome offers, luxury travel upgrades, retail partner discounts, and more.

- Insurance: From extended warranties to medical coverage while on vacation, credit card insurance packages can be comprehensive and valuable.

- Convenience and flexibility: Credit cards make online shopping much easier, provide easy-to-find transaction records, can be used while travelling, and save time by eliminating the need to stop at a bank or ATM.

- Security: Unlike cash, which is lost immediately if stolen, credit cards allow you to report fraud and recover your funds quickly through your card provider. All three major networks (Visa, Mastercard, and Amex) also provide Zero Liability Protection.

Credit card drawbacks

- Easy overspending: Because credit card purchases don't require immediate payment, it's easy to spend more than you intended and lose sight of your budget.

- High interest rates: Unfortunately, it's easy to fall into debt with credit cards. If you don't or aren't able to pay off your balance in full each month, interest charges will add up very quickly.

- Fees: Annual fees can be quite expensive, and people often forget about other credit card fees, such as those for cash advances, foreign exchange, supplemental cards, overlimits, and late payments

- Credit score risk: Just as responsible credit card spending can help build your credit, poor spending and handling can bring it down quite quickly and sharply.

FAQ

What's the best credit card to have in Canada?

The best overall credit card in Canada is the American Express Cobalt Card. It has high earn rates in multiple categories, including groceries and travel, provides comprehensive insurance, offers a competitive welcome bonus, and has many more benefits.

What is the most prestigious credit card in Canada?

The by-invitation-only American Express Centurion Card is probably the most prestigious, but the BMO eclipse Visa Infinite Privilege Card and American Express Platinum Card are top contenders. They offer high-end perks like lifestyle credits, airport lounge access, and more.

Can you get Amex Cobalt in Canada?

Yes, the American Express Cobalt Card is available in Canada. In fact, it's the best overall credit card Canadians can get, providing high returns, excellent rewards, lots of insurance, and many other perks for both everyday spending and travel.

How do I know which credit card is best?

To choose the best credit card for your needs, consider a card's earn rate, interest rates, rewards program, insurance coverage, and other such factors. Everyone's needs and wants are different, so there isn't a one-card-fits-all solution.

What are the 5 Cs of credit cards?

The five Cs are character, capacity, capital, collateral, and conditions. These apply to all types of credit, and lenders consider the five Cs of an applicant's financial situation to determine the level of risk they represent.

Editorial Disclaimer: The content here reflects the author's opinion alone. No bank, credit card issuer, rewards program, or other entity has reviewed, approved, or endorsed this content. For complete and updated product information please visit the product issuer's website. Our credit card scores and rankings are based on our Rating Methodology that takes into account 126+ features for each of 228 Canadian credit cards.

×9 Award winner

×9 Award winner