Best Neo Financial Credit Cards in Canada for 2026

While there are five excellent, highly-rated cards to choose from, the best Neo Financial credit card is the Neo World Elite Mastercard. For a reasonable annual fee, users can earn up to 5% cash back on all purchases while also enjoying World Elite perks.

As an online-only, Canadian-based fintech, Neo has lower overhead than many brick-and-mortar banks and can therefore offer better rates and inexpensive products. But it doesn't skimp on quality – all of Neo's credit cards are top-of-class, including excellent secured and prepaid cards.

Here, you'll find a detailed study of Neo Financial's credit cards so you can find the one that best fits your personal needs.

Key Takeaways

- The best card from Neo Financial is the Neo World Elite Mastercard.

- Neo is a relatively new fintech that started in Alberta in 2019.

- Neo issues a handful of Mastercards, including secured and prepaid card options.

- Neo's unsecured Mastercards have high income requirements, but premium rewards and benefits.

Best Neo Financial credit cards

To help you quickly find the right Neo card for you, take a look at the following table.

| Category | Credit card | Annual fee | Current offer |

|---|---|---|---|

| Best Neo Credit Card | Neo World Elite Mastercard | $125 | None |

| Best no-fee Neo card | Neo World Mastercard | $0 |  $50 GeniusCash + None $50 GeniusCash + None |

| Best secured Neo card | Neo Secured Mastercard | $95.88 |  $50 GeniusCash + None $50 GeniusCash + None |

| Best Neo travel card | Cathay World Elite Mastercard | $180 | Up to 60,000 bonus points (terms) |

| Best prepaid Neo card | Neo Everyday Account | $0 | None |

Best Neo credit card

The Neo World Elite Mastercard is the best that Neo has to offer. For a reasonable annual fee of $125, you'll get the most rewards and insurance – up to 5% cash back on all your purchases and an average return of 5% with Neo partners. You’ll also get World Elite Mastercard benefits and 12 types of insurance.

Pros:

- Up to 5% cash back on all purchases

- 5% average cash back at Neo retail partners

- 12 types of insurance

- World Elite Mastercard benefits

Cons:

- High income requirements

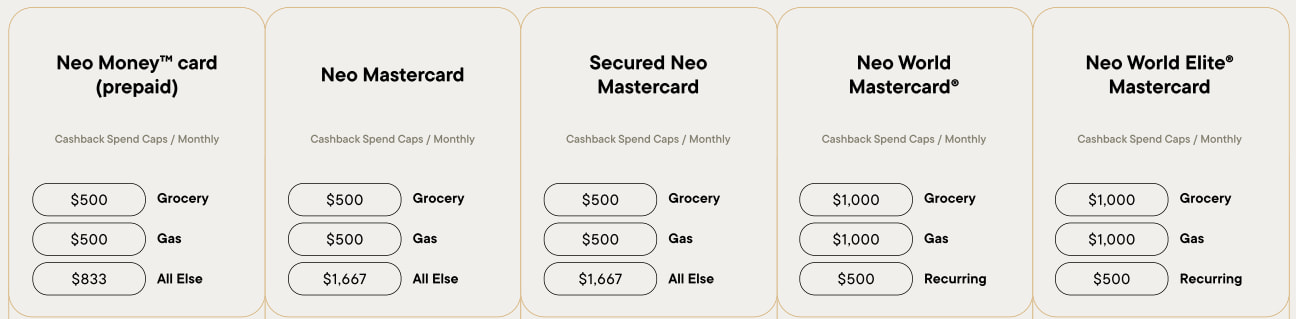

- Monthly caps on all bonus categories

Best no fee Neo credit card

If you’re looking for the best Neo card with no fee, the Neo World Mastercard is your best bet. There are few perks with this card, but you’ll still earn up to 5% cash back with Neo partners and up to 2% cash back on regular purchases. It's also a rare no fee World Mastercard in Canada.

Pros:

- Up to 5% cash back with Neo retail partners

- Up to 2% cash back on all purchases

- No annual fee

Cons:

- High income requirements

- Monthly caps on all bonus categories

Best secured Neo card

For those struggling with less-than-stellar credit, or anyone who's nervous as they start on their credit card journey, the Neo Secured Mastercard is a reliable, safe, and valuable option. You can earn cash back on your spending, and the highly rated Neo app can be a huge help for budgeting and tracking purposes.

All secured credit cards allow you to spend as you would with a typical credit card, but rather than extend your actual credit, they draw from your security deposit. While other secured cards can require minimum deposits of $500, Neo has a much more reasonable requirement of just $50.

Pros:

- Up to 5% cash back with Neo retail partners

- Guaranteed approval as a secured credit card

- Minimum security deposit of just $50

Cons:

- Limited rewards outside of Neo partners

- No insurance included

Best Neo travel card

The Cathay World Elite Mastercard is the only credit card in Canada that directly earns Asia Miles – plus it comes with some great travel benefits, including priority online check-in, extra free baggage allowance, and business lounge redemption access.

You’ll earn rewards at these rates:

- 4 miles per $1 spent on Cathay Pacific flights

- 2 miles per $1 spent on purchases made in foreign currency

- Avg 5 miles per $1 spent at Neo retail partners

- 1 mile per $1 spent on all other purchases

And finally, you’ll get 12 types of insurance and World Elite Mastercard benefits for an annual fee of $180.

Pros:

- Up to 60,000 bonus Asia Miles

- Up to 15 miles per $1 spent at Neo retail partners

- Cathay Pacific benefits

- 12 types of insurance

- Mastercard Travel Pass membership

Cons:

- Income requirements of $80,000 personal or $150,000 household

- Annual fee of $180

- Cannot redeem Asia Miles for flights within Canada

Best prepaid Neo card

Think of the Neo Everyday Account as a hybrid prepaid-savings card. You’ll deposit money and earn interest on it, then earn reward points for making purchases. You can earn up to 5% with Neo retail partners – one of the best rates for a prepaid card. And although this card won’t help you build credit, it’s easy to get approved for since there’s no hard credit check.

There's one other benefit to this card: you can upgrade the earn rates on all other Neo credit cards when you keep a certain balance in your account. More on that below

Pros:

- Up to 5% back at Neo retail partners

- Earn 0.001% interest on your balance

- No annual fee

- No credit checks required

Cons:

- No rewards outside of Neo retail partners

- Does not improve credit score

- No insurance included

Pros and cons of Neo Financial credit cards

Sometimes, a good old pros and cons list can help you determine if a card is right for you. Here are the benefits and drawbacks of Neo credit cards.

- High earn rates on purchases. The earn rates are very good on purchases at partner retailers with up to 5% back, and since Neo partners are scattered across a variety of categories, there's bound to be somewhere you like to shop.

- Redeem your cash back anytime. You get to decide when you want your rewards paid out with no minimum redemption amount. It's a welcome change from many cash back credit cards that only pay out your rewards once per year.

- Valuable, highly-rated mobile app: The Neo Financial app makes it easy to track your increased cash back earnings. Plus, it’s highly rated with a 4.3 rating on Google Play and a 4.8 rating on the App Store.

- Customizable perks and premium plans: While the World and World Elite Mastercards include a few basic types of insurance coverage, you can purchase a Premium plan for $9.99 per month. The plan boosts select earn rates, provides credit monitoring, adds insurance coverage, and includes priority customer support.

- No supplemental cards: If you share finances with someone and want extra cards on your account, you can't get them with Neo (but they're working on it).

- Income requirements for premium cards: The top-of-the-line World Elite Mastercard requires $80,000 in personal or $150,000 household income per year, while the World card requires $50,000 personal or $80,000 household income per year.

- Premium features come at a cost: Be prepared to spend $9.99 per month to access the best earn rates, enhanced insurance coverage, and better customer support. You can also add Travel, Mind and Body, Food and Drink, and Mobile and Personal Protection, but each perk is an additional fee.

- Low cash back caps: You'll also face strict monthly spending caps on the major cards, which will reduce your rewards potential.

How to earn cash back with Neo Financial credit cards

A cornerstone of earning cash back with a Neo credit card is using their retail partners.

Neo partners with over 10,000 retailers to offer bonus rewards when you use a Neo card. The earn rate is an average of 5% but you’ll have to forego your card’s regular earn rate to get this.

We should also note that if you purchase an additional perk plan, you could earn more cash back on specific categories:

- 2% cash back on foreign purchases and 1.5x back with travel partners on the Travel Plan ($7.99 per month)

- 1.25x back at gyms, fitness classes, yoga studios, recreational centres, vitamin & supplement suppliers, and wellness practitioners with the Mind and Body Plan ($9.99 per month)

- 1.25x cash back on food delivery and partner restaurants, cafes, and bars on the Food and Drink Plan ($1.99 per month)

Who should consider a Neo credit card?

Since Neo cards are such unique financial products, they’re not the best option for everyone. People willing to shell out a hefty annual fee in exchange for premium rewards will probably want to pass. However, a Neo card could be a good option for:

- Fans of cash back rewards: Neo cards have competitive rates, especially for retail partners. Because of this, a Neo card is great for someone who wants rewards on everyday purchases.

- People who are building credit: Whether you’re new to credit or are rebuilding yours, the Neo Secured Mastercard allows people to make a deposit, which becomes the credit limit. Neo reports responsible use to the credit bureaus, which can improve your credit score.

- Tech-savvy users: If a highly-rated mobile app and user-friendly website are musts, Neo has you covered. You can conveniently access your Neo account online or with your phone day or night.

How to apply for a Neo Financial credit card

To apply for a Neo Financial credit card, you must be a resident of Canada and of the age of majority in your province or territory. For the secured card, you'll also need to provide a deposit of at least $50.

If you meet those basics, use our secure links to start your application with Neo.

FAQ

Is Neo an actual credit card?

Yes, most Neo credit cards have standard credit score and income requirements, but the Neo Everyday Account is a prepaid card, so you must deposit money into the account to use the card. It isn’t a credit product.

What credit score do you need for a Neo credit card?

You should aim for a credit score of at least 600 to improve your odds of approval. But remember that the required credit score depends on the card – the more premium the product, the higher the required score typically is.

Does Neo offer Visa cards?

At this time, Neo only issues credit cards that are part of the Mastercard network. If you’re interested in Visa or American Express credit cards, you’ll need to look at a different card issuer, like TD or Scotiabank.

How do you cancel a Neo Financial credit card?

To cancel a card, confirm you don't have a balance on your account. Then, log into the app or website and select "Credit" under the Accounts tab. Choose the account you want to close, tap “Details,” and follow the prompts.

×3 Award winner

×3 Award winner