The lineup of World Elite Mastercards is full of premium options with VIP-worthy perks and stellar earn rates. Many of the best Mastercards in Canada are World Elite cards.

Because of these premium perks, earn rates, and other excellent benefits, World Elite cards have relatively high eligibility requirements and annual fees. Still, these exclusive features can far outweigh the costs for savvy card users.

This article reviews the World Elite Mastercard program – its pros and cons, top cards, and more.

Key Takeaways

- World Elite Mastercards are Mastercard’s exclusive collection of premium cards with premium perks.

- All World Elite Mastercards have high income requirements of $80,000 personal or $150,000 household.

- If you qualify for these cards, you can expect high earn rates and unique perks like concierge service and access to incredible experiences around the world.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

World Elite Mastercard benefits in Canada

With nearly all World Elite Mastercards, you'll get access to a collection of exclusive benefits, including:

Mastercard World Experiences

If you have a World or a World Elite Mastercard, you'll get preferred access to all sorts of valuable offers and complimentary upgrades through Mastercard World Experiences. You can take advantage of offers like upscale hotel benefits through Mastercard Access.

Mastercard World Elite Priceless Cities

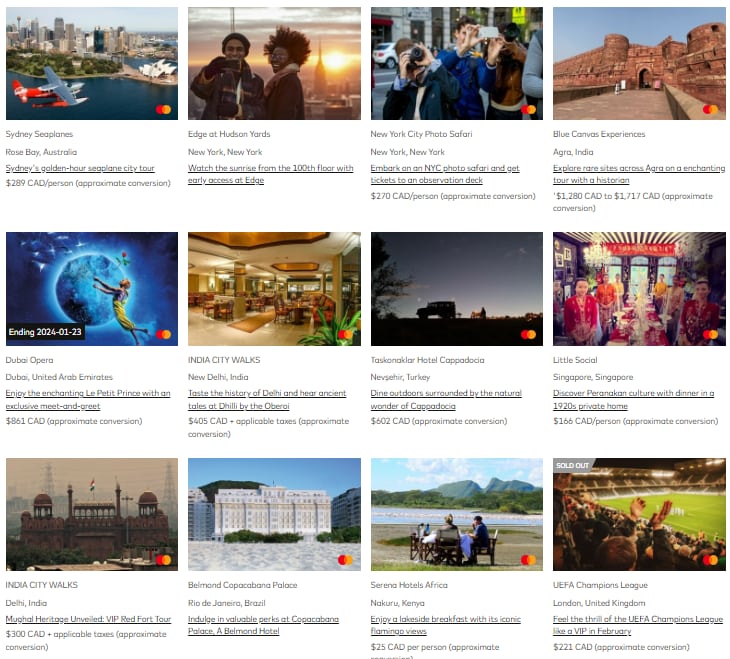

Mastercard Priceless Cities allows you to pick and choose from an array of inspirational experiences and once-in-a-lifetime opportunities from all over the world or closer to home.

Here are some examples of what's available:

Cardholders might also enjoy random rewards with Priceless Surprises. You may get free song downloads or instant event upgrades just for having a World Elite Mastercard.

Mastercard World Elite concierge service

Concierge service is perhaps one of the most underrated credit card perks that come with most premium credit card offerings. Among many other things, the concierge can help you:

- Make a restaurant reservation

- Book a hotel

- Order flowers

- Make business arrangements

- Arrange local travel

It's like having a personal assistant, but free.

Mastercard Travel Pass

All World Elite Mastercards include lounge access for all Mastercard Travel Pass lounges. While you won’t get free passes with most of them, the BMO Ascend World Elite Mastercard includes 4 free passes.

Provided by DragonPass, you can choose from over 1,400 lounges around the world, plus dining, spa, and retail experiences. You’ll find available airport lounges in major Canadian airports, including:

- Calgary International (YYC)

- Edmonton International (YEG)

- Montreal Pierre E.Trudeau International (YUL)

- Ottawa Macdonald Cartier International (YOW)

- Toronto Billy Bishop City (YTZ)

- Lester B. Pearson International (YYZ)

- Vancouver International (YVR)

- Winnipeg J.A.Richardson International (YWG)

Everyday offers

Along with travel and experience benefits, a World Elite Mastercard gets you access to some exclusive everyday offers.

Look forward to discounts on ride-sharing, food delivery, online shopping, and more. For example, earn cash back rewards when you shop or travel abroad. You could also get up to 7% off your next booking.com reservation, save up to 30% when you file your taxes with H&R Block, and get a discount on streaming services.

Downsides to World Elite Mastercards

World Elite Mastercards have high income requirements of $80,000 personal or $150,000 household, which makes them inaccessible to many Canadians. They also come with annual fees of up to $200 (though the average is $110), which may feel steep.

Best World Elite Mastercard offers

Interested in becoming part of the World Elite? Here are our top picks for the best World Elite Mastercards in Canada.

| World Elite Mastercard | Annual fee | Welcome Bonus | Apply now | |

|---|---|---|---|---|

| Best overall | BMO CashBack World Elite Mastercard | $120 | Up to $480 cash back in the first year, first year free (terms) | Apply now |

| Best for flexible rewards | MBNA Rewards World Elite Mastercard | $120 | 30,000 bonus points (terms) | Apply now |

| Best for earning Air Miles | BMO AIR MILES World Elite Mastercard | $120, first year free | Up to 7,000 bonus miles, first year free (terms) | Apply now |

| Best for no fee | Rogers Red World Elite Mastercard | $0 | None | Apply now |

| Best for travel credits | National Bank World Elite Mastercard | $150 | Up to 40,000 bonus points (terms) | Apply now |

| Best for business | BMO Ascend World Elite Business Mastercard | $149, first year free | Up to 70,000 100,000 bonus points (terms) | Apply now |

Best overall: BMO CashBack World Elite Mastercard

Giving you high earn rates on a variety of purchases, the

This card comes with a welcome bonus of up to $480 cash back in the first 12 months, plus an insurance package that's nothing to sneeze at – especially when compared to other cash back cards. You’ll earn up to 5% back on your purchases, and you can choose to redeem it whenever you’d like.

The final kicker is a very rare credit card perk: roadside assistance. You'll get complimentary roadside assistance just by keeping this card around. And even though it's a cash back card, you'll enjoy some travel benefits like airport lounge access.

Pros:

- up to $480 cash back in the first 12 months

- Up to 5% cash back on purchases

- 13 types of insurance included

- Roadside assistance included

- Save up to 7 cents per litre at Shell

Cons:

- Income requirement of $80,000 personal or $150,000 household

- Low monthly spend caps on bonus categories

Best flexible rewards: MBNA Rewards World Elite Mastercard

The

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

You'll also get 10% bonus points every year on your birthday – up to a maximum of 15,000 points – and you'll be covered by 12 types of purchase and travel insurance.

Pros:

- Up to 30,000 bonus points

- Up to 5 points per $1 spent on purchases

- 10% bonus points every year on your birthday

- Includes 12 types of insurance

Cons:

- $120 annual fee

- Income requirements of $80,000 personal or $150,000 household

Best for earning Air Miles: BMO AIR MILES World Elite Mastercard

If you want to earn Air Miles on all your purchases, look no further than the

You'll earn 3 Air Miles per $12 spent at Air Miles reward partners, 2 Air Miles per $12 spent on groceries and wholesale clubs, and 1 mile for every $1 spent everywhere else. You’ll also enjoy one of the most comprehensive insurance packages available, with 14 types of coverage in total.

Pros:

- Up to 7,000 welcome bonus Air Miles

- Up to 3 Miles per $12 spent on purchases

- Annual 25% discount on 1 Air Miles reward flight booking

- Automatic Air Miles Onyx status

- Includes 14 types of insurance

- Save up to 7 cents per litre at Shell

Cons:

- Low rewards compared to other premium cards

- Income requirements of $80,000 personal or $150,000 household

Best for no fee: Rogers Red World Elite Mastercard

Most World Elite Mastercards charge an annual fee, but not the

This card won’t deliver an extensive insurance package like some of the other World Elite Mastercards, but if you’re a Rogers customer, getting the Red card makes a lot of financial sense.

Pros:

- 3% cash back on USD purchases

- 1.5% cash back on all purchases – increases to 2% if you have a Rogers service

- Includes 6 types of insurance coverage.

- 50% bonus when you use your cash back to pay for Rogers services

Cons:

- Must spend $15,000 annually or risk being downgraded

- Income requirements of $80,000 personal or $150,000 household

Best for travel credits: National Bank World Elite Mastercard

Seasoned travellers usually look for specific credit card benefits: a great insurance package, lounge access, travel fee reimbursements, and a great earn rate on purchases with extended protection. Fortunately, the

In addition to the extensive travel insurance you get, you’ll also enjoy unlimited free access to the National Bank Lounge at Montréal-Trudeau Airport (that’s in addition to the standard airport lounge access you get through Mastercard).

Pros:

- Up to 5 points per $1 spent on purchases

- Includes 10 types of insurance

- $150 annual travel fee reimbursements

Cons:

- $150 annual fee

- Income requirements of $80,000 personal or $150,000 household

- No welcome bonus

Best for business: BMO Ascend World Elite Business Mastercard

Businesses can also use World Elite Mastercards! Our top pick, the

- 4 points per $1 on gas, office supplies, and cell phone/internet bills

- 1.5 points per $1 spent on all other purchases

The card was the winner of our 2024 Best Cash Back Business Card in Canada award. We like that you can redeem your points for cash back or BMO investments. The low interest rates on the card and access to Maple on-demand healthcare make it a valuable card to have in your pocket.

Pros:

- Up to 70,000 100,000 bonus points

- Up to 4 points per $1 spent on purchases

- Mastercard Travel Pass with 2 free lounge passes annually

- 13 types of insurance included

- Save up to 7 cents per litre at Shell

Cons:

- $149 annual fee (waived for the first year)

- Low point value of 0.67 cents

- Income requirements of $80,000 personal or $150,000 household

FAQ

Does Mastercard World Elite give lounge access?

Most World Elite cards give you (and potentially a guest) access to airport lounges. That said, the details of your specific card will dictate which lounges you can access and whether you have to pay an entry fee.

How hard is it to get a World Elite Mastercard?

It can be difficult to qualify for a World Elite Mastercard since you’ll need a strong credit score and at least $80,000 in personal income or $150,000 in household income. Plus, annual fees average about $110 per year.

What is the annual fee for the World Elite Mastercard?

The annual fee for a World Elite Mastercard varies by card, though the average fee is $110. The exception is the Rogers Red World Elite Mastercard, which has no annual fee.

How do I know if my Mastercard has access to a lounge?

To see if you have lounge access, call the customer service number on the back of your card to ask a customer service representative, check your card’s benefit booklet, or use a lounge locator app.

What is the minimum income for a World Elite Mastercard?

The income requirements for all World Elite Mastercards are $80,000 annual personal income or $150,000 annual household income.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 8 comments