Best Low-Interest Credit Cards in Canada for 2026

A comparison of cards that let you pay off your balance faster.

With a low regular purchase rate and an incredible balance transfer welcome offer, the MBNA True Line Mastercard is the best low-interest credit card in Canada. Still, there are plenty of other valuable options for people looking to pay less interest on their cards, including the CIBC Select Visa Card and Desjardins Flexi Visa.

| Credit card | Interest rate | Current welcome offer | |

|---|---|---|---|

| #1 | MBNA True Line Mastercard | * 12.99% on purchases * 24.99% on cash advances * 17.99% on balance transfers |  $20 GeniusCash + 0% interest on balance transfers for 12 months (terms) $20 GeniusCash + 0% interest on balance transfers for 12 months (terms) |

| #2 | CIBC Select Visa Card | * 13.99% on purchases * 13.99% on cash advances * 13.99% on balance transfers | 0% interest on balance transfers for 10 months (terms) |

| #3 | Desjardins Flexi Visa | * 10.9% on purchases * 12.9% on cash advances * 12.9% on balance transfers | None |

A great low-interest credit card can save you money by keeping interest costs down, or by allowing you to pay down an existing balance at a reduced (or nonexistent) rate.

We've evaluated every single one of our best credit cards in Canada to help you find the best card with low interest rates, promotional welcome offers, low or no annual fee, and perks. We've listed the pros and cons of each of the best options below, so you can choose a card that best suits your needs and start paying down your interest.

Key Takeaways

- Average interest rates on normal credit cards are around 20%.

- You can save over 10% on interest by getting a low interest credit card.

- The best low interest credit card is the MBNA True Line Mastercard.

- Paying off your card in full is always preferable to carrying a balance, but a low interest card can help you reduce interest charges in emergencies.

The best low-interest credit cards in Canada

Our Gold award for the #1 low-interest card in Canada goes to the MBNA True Line® Mastercard®, thanks to its low 12.99% APR on purchases and 0% APR for 12 months on balance transfers.

Our Silver award goes to the CIBC Select Visa* Card for its 0% interest on balance transfers for 10 months (terms) and modest annual fee.

Finally, our Bronze award goes to the Desjardins Flexi Visa, thanks to its shockingly low 10.9% on purchases and no annual fee.

Canada's best low-interest credit card: MBNA True Line Mastercard

The MBNA True Line Mastercard is hands-down the best low-interest credit card in Canada with a low permanent interest rate of 12.99% on purchases. Plus, it has a balance transfer offer of 0% interest for 12 months, so you can focus on paying down your debt.

To save the most on interest with this card, consider using it for balance transfers. After paying off your balance, you'll continue to benefit from low interest rates on purchases, which will help you stay on top of your monthly payments.

For comparison purposes, here's how much you can save paying down a $5,000 purchase balance in 12 months with the MBNA True Line Mastercard instead of using a high-interest card at 24.99%:

| Credit card | Monthly Payment | Total Interest Paid |

|---|---|---|

| MBNA True Line Mastercard | $446.56 | $358.76 |

| 24.99% high-interest card | $475.18 | $702.36 |

You can use our credit card interest calculator to determine your own savings:

Credit Card Interest Calculator

Silver award low-interest credit card: CIBC Select Visa Card

When we say no frills, we mean it: the CIBC Select Visa Card is as stripped down as you can get. While you won't get any rewards or much for insurance coverage, you will get a fantastic 0% balance transfer offer and a low regular interest rate of just 13.99%.

The card does have a modest annual fee of $29, but it's currently being rebated for the first two years you have the card.

Bronze award low-interest credit card: Desjardins Flexi Visa

With the Desjardins Flexi Visa, you'll get a basic card with an excellent interest rate of 10.9% on purchases, the lowest base rate of our top three. It also includes decent insurance coverage, including mobile device insurance of up to $1,000 for any device purchased using the card.

While it's a pretty bare-bones card beyond this, the low interest rates and no annual fee make it a solid contender for a spot in your wallet.

Compare all top low-interest credit cards by Genius Rating

Our unbiased algorithm considers over 126 features for each of the

Here's how the best low-interest credit cards rank in order of Genius Rating:

The Genius Rating methodology

Since this card category is all about paying down debt, we keep our methodology simple. Interest rates and fees make up the vast majority of our rating to determine the best low-interest credit cards in Canada.

- Interest 50%

- Fees 50%

Learn more about our Genius Rating methodology

How to choose the right low-interest credit card

You've probably heard it a million times: you should pay off your credit card in full every month. However, we know even the best intentions don't always work out. You may need the help of a low-interest credit card from time to time.

A low-interest card can also make sense if you're consolidating or paying down existing debt. For instance, if you have three credit cards with 24.99% interest rates, you can transfer all three of their balances to a low-interest card so you're only making one payment (and paying a lot less in interest).

Since these cards have low interest rates, they don't typically offer substantial rewards. That said, if you want to have a stable interest rate that won't jump up after a promo period ends, a low-interest credit card might be right for you.

Interest rates

Low-interest cards offer just that: a low interest rate on purchases and balance transfers. Because these cards are stripped down in terms of insurance, rewards, and perks, they're heavily focused on a great everyday rate.

As you can see in the chart above, our top card, the MBNA True Line Mastercard, doesn't have the lowest interest rates across the board. In fact, it doesn't have the lowest rates in any of the three interest categories. What it does have is an incredible promotional rate for balance transfers.

Here's how the promotional balance transfer offers compare for our top three cards:

| Card | Balance transfer promo rate | Balance transfer promo length | Balance transfer fees |

|---|---|---|---|

| MBNA True Line Mastercard | 0% | 12 | 3% |

| CIBC Select Visa Card | 0% | 10 | 1% |

| Desjardins Flexi Visa | N/A | N/A | N/A |

Fees

Low-rate credit cards are hyper-focused on reducing costs. As such, they tend to have no fee or very low fees. Here’s how the annual fees of the top 3 cards compare:

The Desjardins Flexi Visa and MBNA True Line Mastercard charge no fee, while the CIBC Select Visa Card charges a modest $29 annual fee.

Cards also sometimes charge fees on top of balance transfer and cash advance rates:

- Balance transfer fees: Most banks charge a balance transfer fee of between 1% and 3% of the transfer; however, some provide promotional offers, including a reduced (or eliminated) transfer fee during a promotional period. The CIBC Select Visa Card, for instance, offers a promotional 1% fee on transfers for the first few months after account opening.

- Cash-advance fee: If you make a cash advance, expect a fee of around $5 per transaction.

Rewards

Low-interest credit cards typically don't offer rewards. Instead, these cards prioritize a great low rate every day.

An example of an exception, however, is the BMO eclipse rise Visa* Card. This card offers 0.99% on balance transfers for the first 9 months, plus generous rewards. Starting with a welcome bonus of

You can use our convenient BMO Rewards calculator to determine the value of your BMO Rewards points:

| Redemption Option | Point Value | Total Value |

|---|---|---|

| Travel | 0.67 cents | $7 |

| Investments | 0.67 cents | $7 |

| Experiences | 0.65 cents | $7 |

| Gift Cards | 0.56 cents | $6 |

| Merchandise | 0.54 cents | $5 |

The tradeoff is that this card reverts to a high regular interest rate of 21.99% once the balance transfer promo period ends.

Tip: No matter what credit card you use, you could be earning bonus cash back on top of your card's rewards. Input your monthly spend in the GeniusCash app, and level up to earn real cash.

Approval

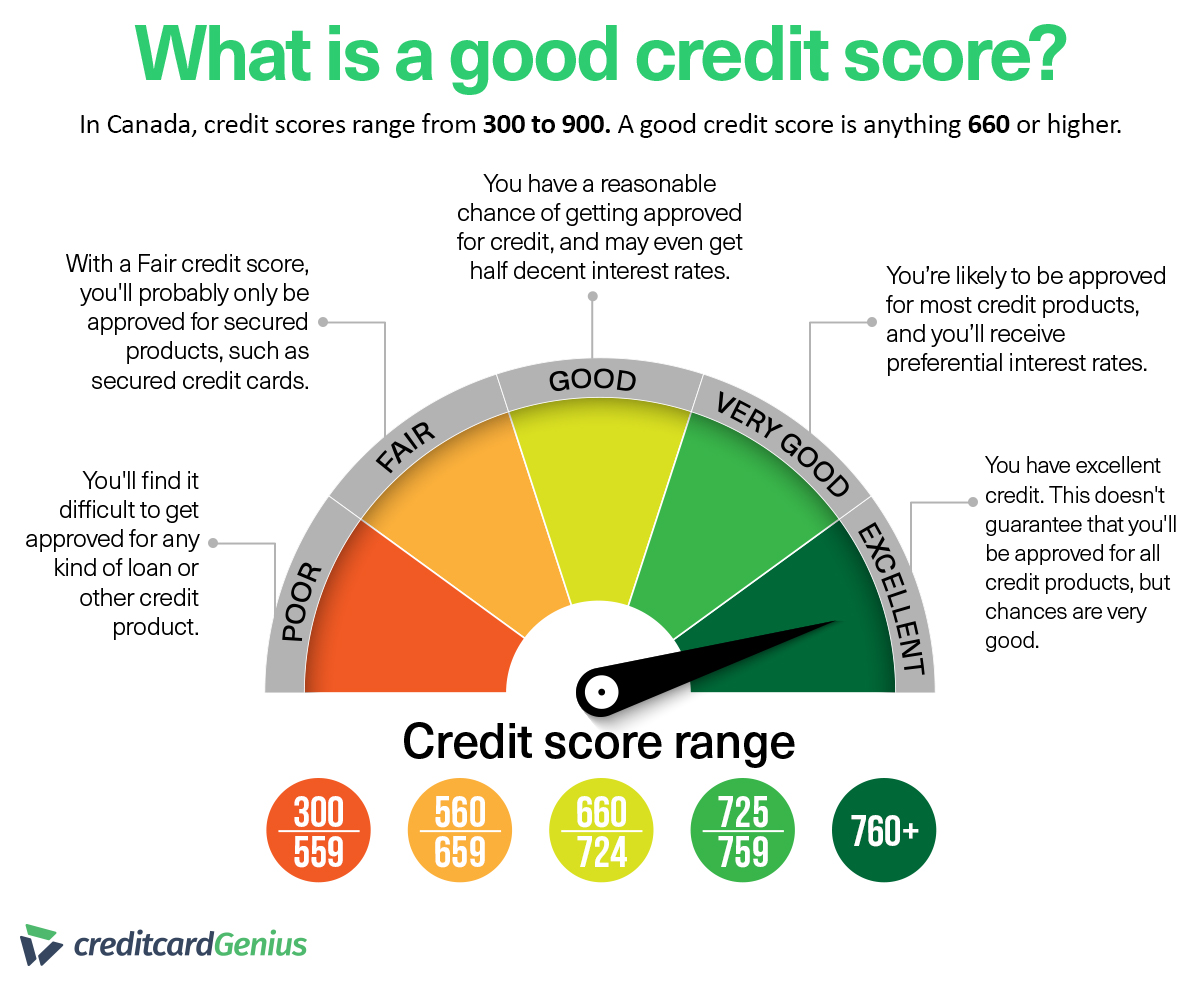

Low‑interest credit cards are typically marketed to Canadians with good scores. They also tend to have lower – or sometimes zero – income requirements, making them an accessible choice for borrowers who want affordable financing without the added fluff of a rewards card.

All three of the top low-interest credit cards have no personal income requirements, but the Desjardins Flexi Visa does require a household income of at least $0.

The estimated credit score requirements vary considerably, however, as shown here:

| Card | Estimated credit score requirements |

|---|---|

| MBNA True Line Mastercard | 660 - 724 |

| CIBC Select Visa Card | 560 - 659 |

| Desjardins Flexi Visa | 760 - 900 |

As mentioned, our top low-interest credit cards require scores in the "good" range. Here's a visual to help you understand what this range looks like and how it compares with others:

Perks

Low-interest credit cards typically lack any valuable perks. Some cards, like the MBNA True Line Mastercard, offer small perks like fuel discounts at select gas stations.

Insurance

Low-interest credit cards typically offer very low or no insurance coverage. As such, the most you can usually expect is an extended warranty and purchase protection.

The Desjardins Flexi Visa is the only one of our top low-interest credit cards with an insurance package worth mentioning. Here's what it has to offer:

Desjardins Flexi Visa

| Extended Warranty | 1 year |

| Purchase Protection | 90 days |

| Mobile Device | $1,000 |

| Emergency Medical Term | 3 days |

| Emergency Medical Maximum Coverage | $5,000,000 |

| Emergency Medical over 65 | 3 days |

| Trip Cancellation | $500 |

| Trip Interruption | $1,000 |

| Baggage Delay | $500 |

| Lost or Stolen Baggage | $500 |

Please review your insurance certificate for details, exclusions and limitations of your coverage.

What is a low-interest credit card?

Any credit card can be considered low-interest if its purchase rate is below the national average, currently around 20%.

Some of the lowest interest rates we found were around 10% to 14%, which saves you between 6% and 10% on your credit card interest charges if you carry a credit card balance. Over time, this can add up to thousands of dollars in savings on interest payments alone.

Keep in mind that you can find cards with even lower promotional rates; some offer 0% interest. Read the terms of these cards carefully, as the interest rates often increase once the promotional period ends.

Benefits of low-interest credit cards

Really, the best benefit of getting a low-interest credit card is in the amount of money you could save, depending on your current interest rate and whether you carry a credit card balance.

We should point out that since these cards have low interest rates, they don't tend to offer much for rewards. That said, if you want to have a stable interest rate that won't jump up after a promo period ends, a low-interest credit card might be right for you.

Use our credit card interest calculator to see how much you're paying in interest – and how much you could save with a low-interest credit card.

Alternatives to low-interest credit cards

If you're looking to put a large balance somewhere temporarily or improve your credit score, consider these other credit card options:

The table below shows a side-by-side comparison of the best low-interest credit card (MBNA True Line Mastercard) with the best prepaid card (EQ Bank Card) and best secured card (Neo Secured World Elite Mastercard):

FAQ

What is the best credit card with low interest?

The MBNA True Line Mastercard is the best credit card with low interest, charging just 12.99% on all purchases and 0% on balance transfers for the first 12 months. It also has no annual fee, which makes it even more appealing.

Which bank credit card is best and has the lowest interest rate?

The Scotiabank American Express Platinum Card is the best card issued by a bank with the lowest interest rate. You'll only be charged 9.99% interest for purchases, balance transfers, and cash advances – along with other valuable perks. That said, it comes with a hefty $399 annual fee.

What is a good interest rate for a credit card?

Most credit cards charge between 19.99% and 22.99% for purchases, so rates below that are considered good. For example, low-interest rate cards often have interest rates ranging from 8.99% to 15.99%.

Which credit card has the longest 0% interest rate?

The MBNA True Line Mastercard comes with a zero interest promotional balance transfer rate for 12 months. You still have to consider balance transfer fees with the MBNA True Line Mastercard, but you won't have any annual fee to worry about.

How can I reduce credit card interest?

Steps you can take to reduce credit card interest include paying off your credit card in full each month (or as large a payment as you can afford), using a balance transfer credit card, consolidating your debt onto a low-interest credit card, setting up automatic payments, and even calling to negotiate your interest rate.

How do I lower my credit card interest rate?

If you've made significant improvements to your credit score, you can always try asking your credit card issuer to take a look at your account and lower your interest rate, or work with them to negotiate a payment schedule. Alternatively, you can apply for a low-interest credit card and transfer your balance to it.

Do balance transfers hurt your credit?

Transferring the balance from one card to another won't harm your credit, but your score might temporarily take a hit when you apply for a new card, since credit card issuers do hard credit checks when reviewing your application.

How is credit card interest calculated?

If you spend on credit and don't pay it off at the end of the billing cycle, the lender (that is, your credit card issuer) charges credit card interest – it's the cost of borrowing money. Most lenders offer a grace period of around 21 days after a purchase before interest begins to accrue. If you don't pay the balance in full, interest is calculated from the date of the purchase.

When does a low-interest credit card make sense?

A low-interest card can make sense if you're consolidating or paying down existing debt. If you have three credit cards with 24.99% interest rates, you could transfer their balances to a low-interest card and save money on interest over time.

What does fixed rate vs. variable rate interest mean?

Fixed-rate credit cards have interest rates that don't change – the rate is determined when you're issued the card, and it will stay the same. Variable-rate credit cards have interest rates that can change over time.

Editorial Disclaimer: The content here reflects the author's opinion alone. No bank, credit card issuer, rewards program, or other entity has reviewed, approved, or endorsed this content. For complete and updated product information please visit the product issuer's website. Our credit card scores and rankings are based on our Rating Methodology that takes into account 126+ features for each of 228 Canadian credit cards.

×2 Award winner

×2 Award winner