Credit card insurance is one of the most valuable credit card benefits available, providing an average of $374 in additional value.

According to our research, emergency medical, rental car theft and damage, and extended warranty insurance add the most value to credit cards. Lost or stolen baggage, hotel burglary, and rental car personal effects coverage add the least.

Key Takeaways

- The most valuable type of credit card insurance is emergency medical coverage over 65 (worth an estimated $247), followed by rental car theft and damage ($140).

- Averaging $619 per credit card, Desjardins offers the most valuable credit card insurance packages on the market.

- Visa Infinite Privilege cards carry an average of $1,004 worth of coverage, roughly twice the amount found on Platinum Amex or World Elite Mastercard credit cards.

- With a total value of $1,048, the most valuable credit card insurance package belongs to the Desjardins Odyssey Visa Infinite Privilege.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

How much is credit card insurance worth?

Insurance is one of the most valuable credit card benefits available, but between legal jargon and coverage limits, it can be hard to determine its true worth.

In an effort to demystify the value of insurance coverage, we examined 116 credit cards with at least $9 worth of insurance for a total of 3,700+ data points. We found the value of 17 types of coverage ranges from $2 – $247.

| Rank | Insurance | Average value | Common coverage limit | Percent of cards with insurance |

|---|---|---|---|---|

| 1 | Emergency medical over 65 | $247 | 3 days | 23.3% |

| 2 | Rental car theft and damage | $140 | 48 days | 60.3% |

| 3 | Emergency medical | $128 | 15 days | 35.3% |

| 4 | Extended warranty | $81 | 1 year | 92.4% |

| 5 | Price protection | $72 | 90 days | 6.0% |

| 6 | Mobile device | $63 | $1,000 | 19.0% |

| 7 | Trip cancellation | $42 | $2,500 | 31.0% |

| 8 | Purchase protection | $39 | 90 days | 94.8% |

| 9 | Trip interruption | $27 | $5,000 | 39.7% |

| 10 | Personal effects | $23 | $750 | 1.7% |

| 11 | Rental car accident | $19 | $200,000 | 6.9% |

| 12 | Travel accident | $10 | $500,000 | 62.9% |

| 13 | Baggage delay | $9 | $500 | 44.8% |

| 14 | Event ticket cancellation | $8 | $1,000 | 1.7% |

| 15 | Flight delay | $6 | $500 | 38.8% |

| 16 | Lost or stolen baggage | $2 | $1,000 | 44.0% |

| 17 | Hotel burglary | $2 | $2,500 | 27.6% |

| 18 | Rental car personal effects | $2 | $1,000 | 10.3% |

The most valuable types of coverage kick in when things go catastrophically wrong – think medical emergencies or car accidents – but they also prevent you from being upsold on pricey protection plans. The next most valuable type of coverage applies to your most recent shopping and purchases.

While worrying, all other types of coverage – interrupted travel plans, stolen personal effects, flight delays, lost baggage, etc. – are comparatively cheap. If you’re in the market for a new credit card, focus on cards with coverage from the top of this list, not the bottom.

You can find out how much insurance your credit card has, the applicable terms, and how to make a claim by reading the certificate of insurance in your credit card package.

The 3 most valuable types of credit card insurance

The 3 most valuable types of credit card insurance cover big accidents, providing peace of mind and big savings. The annual fee for a single travel insurance credit card is usually much cheaper than a comparable insurance plan that covers multiple trips.

As an added benefit, most cards with this coverage include access to emergency travel assistance. You can get help finding an ATM, a bank, a doctor, a lawyer, and more by calling the 24/7 hotline.

Note: The inclusions and exclusions listed below serve only as examples and may not apply to every credit card. Always refer to the certificate of insurance for the terms of coverage.

1. Emergency medical over 65

Average value: $247

What it covers: Emergency medical, dental, and in-hospital treatment for the cardholder and spouse (and sometimes children and grandchildren) if illness or injury occurs while travelling

What it doesn’t cover: Treatment for pre-existing conditions, trips within your home province, and complications from pre-existing conditions

Travel insurance for seniors over the age of 65 is roughly 3 times more expensive than for travellers in their 20s and 30s. Senior travellers are more likely to be injured and suffer complications, while pre-existing conditions such as diabetes tend to worsen.

That’s also why credit card travel insurance for seniors lasts a mere 3 – 15 days and contains many exclusions. We recommend reading your certificate of insurance with care; if you qualify for coverage, it could save you a bundle.

Best card: The Desjardins Odyssey World Elite Mastercard provides up to 15 days of coverage for travellers between 65 and 75 years old, 31 days for those between the ages of 60 and 64, and 60 days for anyone 59 and under.

2. Rental car theft and damage

Average value: $140

What it covers: Fees, damages, and towing charges for 1 rental vehicle after a collision, fire, theft, or vandalism

What it doesn’t cover: Cargo vans, motorcycles, exotic vehicles, a car valued above the maximum MSRP covered (typically around $65,000), and any rental not paid for using the credit card in question

The next time you need a ride, you can confidently decline the rental car agency’s loss/collision damage waiver. Some 60% of credit cards will protect you from paying "loss of use" charges after an accident or theft, saving you up to $30 per day. Rent a car from AVIS using the Scotia Momentum Visa Infinite Card and you save up to 25% off with a car rental discount

Best card: The MBNA Rewards World Elite Mastercard is one of the few rewards credit cards to offer all 3 types of rental car insurance, including theft and damage.

Pro Tip: When you’re travelling, familiarize yourself with the rental car coverage you must have – and what you can skip. Rental agencies make money from upselling you on things like insurance coverage, so it pays (literally) to be informed.

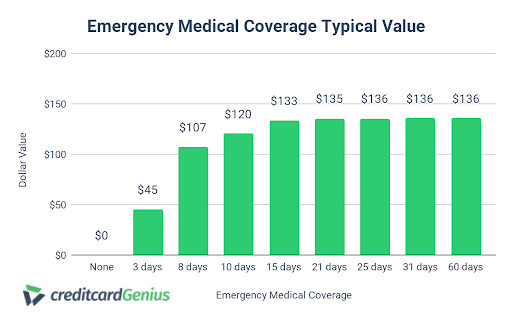

3. Emergency medical

Average value: $128

What it covers: Emergency medical, dental, and in-hospital treatment for the cardholder, spouse, and dependent children if illness or injury occurs while travelling

What it doesn’t cover: Travellers over the age of 65, trips within your home province, travel without the primary cardholder, and complications from pre-existing conditions

When it comes to pricing emergency medical insurance, what matters most is trip length – to a certain point. Assuming you keep the same coverage limit, the price of an annual insurance plan with unlimited trips maxes out at $135 for 21 – 60 days.

Why? Because you’re more likely to travel for 5 days or less and very unlikely to require emergency medical coverage for more than 15 days. Given these odds, about 40% of travel credit cards cover up to 15 days and a little over 10% cover up to 60.

Best card: The National Bank World Elite Mastercard provides up to 60 days of emergency medical coverage for travellers age 54 and under, plus subsistence allowances and travel expenses for travelling to a loved one’s bedside.

The 5 most useful types of credit card insurance

Ranging from $39 – $81 in value, shopping insurance can help protect your newest purchases and possessions from accidents, damage, fire, and theft. Although it may not provide as much compensation as travel insurance, you’re more likely to use it, making it quite valuable.

Note: The inclusions and exclusions listed below serve only as examples and may not apply to every credit card. Always refer to the certificate of insurance for the terms of coverage.

4. Extended warranty

Average value: $81

What it covers: The cost of repairs, services, or a replacement, following the terms of the original manufacturer’s warranty

What it doesn’t cover: Vehicles, used items, custom orders, business purchases; heating and cooling appliances; and normal wear and tear

Depending on the item, you could get a 1 - 2-year extension of the original manufacturer’s worth an estimated $72 – $144. All you have to do is pay with your credit card and keep your receipt somewhere safe.

Best card: The National Bank World Elite Mastercard provides up to $60,000 of coverage for extended warranty claims, but you must call to register any item with a warranty longer than 5 years.

5. Price protection

Average value: $72

What it covers: The difference between an item’s original purchase price and a later sale price

What it doesn’t cover: Price differences of less than $10, animals, living plants, perishables, computers, cell phones, vehicles, custom orders, business purchases, services, and used items

If you’re kicking yourself because you just missed a sale, grab your credit card’s certificate of insurance instead. With price protection insurance, you can get the difference refunded. This rare coverage is only available on 6% of the credit cards we studied, 7 of which include coverage for up to 180 days.

Best card: The MBNA Rewards World Elite Mastercard offers up to 60 days of price protection coverage.

6. Mobile device

Average value: $63

What it covers: The cost of a repair and/or replacement of your mobile device following accidental damage, loss, theft, or mechanical failure

What it doesn’t cover: Damaged, defective, lost, or stolen phone accessories or batteries; cosmetic damages; and damages resulting from lack of care, natural disasters, or power surges

Cell phone insurance enables you to save 5 – 10% of the purchase price of your phone, or about $9 per month. Some plans might even cover accidental drops, cracks, and spills!

Unfortunately, it’s only available on just under 20% of credit cards studied and it usually carries a deductible. The standard formula assumes a 2% depreciation in price for every month past your device’s original purchase date.

Best card: The RBC Avion Visa Infinite is the only phone with a 2-year, $1,500 mobile device protection plan, a $120 annual fee, and moderate income requirements.

7. Trip cancellation

Average value: $42

What it covers: The non-refundable cost or fee of cancelling and/or rescheduling a trip due to a family emergency, sudden illness, or natural disaster

What it doesn’t cover: Cancellations due to medical emergencies arising from pre-existing conditions or circumstances that were known at the time of booking

Trip cancellation insurance saves you the cost of cancelling or rescheduling airplane tickets, vacation packages, cruise deposits, and more. For example, to change a flight with Air Canada, travellers must pay $100 per ticket (plus any fare difference). With the right credit card, you can submit a claim, get your money back, and put it toward your new vacation date.

Trip cancellation coverage is especially useful for booking cheap, non-refundable plane tickets. Just know that you can’t cancel a flight based on last night’s fortune cookie; your "emergency" must be substantiated with a doctor’s note, police report, or other official document.

Best card: The Scotiabank American Express Platinum Card provides up to $2,500 of trip cancellation coverage and tons of travel perks, including airport lounge access.

8. Purchase protection

Average value: $39

What it covers: The cost of repair or replacement a new purchase after theft, loss, or damage

What it doesn’t: Animals, live plants, perishables, electronics, computers, drones, vehicles; heating and cooling appliances; and normal wear and tear

If you charge an item to a credit card with purchase protection, you can rest easy knowing it’s protected for up to 180 days. Theft, fire, and foreign purchases are usually covered; misuse, confiscation, and "mysterious disappearances" are not.

Best card: The National Bank World Elite Mastercard provides up to 180 days of purchase protection, to a maximum of $60,000.

The 9 least valuable types of credit card insurance

Every other remaining type of credit card insurance is worth less than $30, either because it’s cheap or you probably won’t use it. In certain circumstances, it may be worthwhile to have:

- Trip interruption coverage ($27). Many emergency medical insurance plans include the cost of a return flight home if your trip is interrupted by injury or sickness. For those that don’t, slightly less than 40% of cards studied provide $1,000 – $5,000+ of coverage.

- Personal effects insurance ($23). BMO credit cards include up to $750 of coverage for items lost, stolen, or damaged at any point during travel.

However, the rest of the insurance plans on our list are worth less than $20 each and shouldn’t persuade you to sign up for a card.

- Rental car accident insurance is included in most regular car insurance policies.

- Travel accident coverage is widely available and cheap because it applies to plane, train, and bus crashes, which are exceedingly rare.

- Baggage delays and lost or stolen baggage are already provided for by Canada’s airline delay compensation laws.

- Event ticket cancellation insurance is sold by Ticketmaster for just $8 per $1,000 of coverage and carried only by Brim Financial credit cards.

- Rental car personal effects coverage is an extremely cheap add-on and applies to a much narrower set of circumstances than personal effects insurance.

- Hotel burglary insurance is cheap, but because it covers few circumstances, it’s more worthwhile to get a card with personal effects insurance.

Most valuable insurance by credit card

Because it’s often expensive, the most extensive insurance packages belong to the most expensive premium credit cards. The 5 top-rated credit cards with the most valuable insurance packages all have fairly high annual fees:

| Credit card | Annual fee | Coverage types included | Insurance value | Income requirements |

|---|---|---|---|---|

| National Bank World Elite Mastercard | $150 | 10 | $1,065 | $80K personal or $150K household |

| CIBC Aventura Visa Infinite Privilege Card | $499 | 12 | $1,037 | 200K personal or 200K household |

| CIBC Aeroplan Visa Infinite Privilege Card | $599 | 12 | $1,037 | 200K personal or 200K household |

| Scotiabank American Express Platinum Card | $399 | 12 | $1,010 | $12K personal |

| RBC Avion Visa Infinite Privilege | $399 | 12 | $971 | 200K personal or 200K household |

The National Bank World Elite Mastercard does everything right, pairing a 2-year warranty extension, 180 days of purchase protection, and $1,500 of mobile phone coverage with the most valuable travel insurance on our list. The 2 CIBC credit cards also offer good shopping protection and a well-rounded travel insurance package.

Don’t be fooled by the Scotiabank American Express Platinum Card’s low income requirements – you still need a good credit score to qualify. Although not as valuable as the other cards, the RBC Avion Visa Infinite Privilege also happens to be one of the best lounge access credit cards in Canada.

If you prefer to spend and travel modestly, you still have plenty of great options. Our top 4 budget picks offer an above-average amount of insurance, low income requirements, and amazing rewards:

| Credit card | Annual fee | Coverage types included | Insurance value | Income requirements |

|---|---|---|---|---|

| CIBC Aventura Gold Visa Card | $139 | 10 | $461 | $15K personal |

| American Express Cobalt Card | $191.88 | 10 | $410 | N/A |

| SimplyCash Preferred Card from American Express | $119.88 | 10 | $410 | N/A |

| MBNA Rewards Platinum Plus Mastercard | $0 | 3 | $304 | N/A |

Most valuable credit card insurance by bank

Credit card insurance is usually provided by an underwriter contracted by the bank. Naturally, Canada’s Big 5 Banks can afford the best coverage… or can they?

| Issuer | Average insurance value | Average total coverage |

|---|---|---|

| Desjardins | $619 | $525,117 |

| Scotiabank | $546 | $349,188 |

| TD | $489 | $318,813 |

| Brim | $432 | $558,250 |

| National Bank | $431 | $31,750 |

| CIBC | $350 | $258,010 |

| American Express | $347 | $361,192 |

| RBC | $332 | $239,162 |

| MBNA | $255 | $809,286 |

| BMO | $247 | $204,200 |

| Tangerine | $179 | $500 |

Because they offer generous plans for travellers over 65, Desjardins credit cards pack a surprising amount of insurance coverage. And although Scotiabank credit cards rank last among the big 5 when it comes to valuable benefits, the bank ranks first for insurance value.

TD is the only bank to appear among the top 5 for most valuable insurance and benefits, making it an excellent choice for Canadians looking for lots of extra value. Meanwhile, Brim Financial is the only online bank to crack the top 5 thanks to the Brim World Elite Mastercard, which features extended warranty, purchase protection, mobile device, and travel insurance coverage.

Last is National Bank. Although it doesn’t offer as much coverage as the other 4, its insurance packages are comprehensive and well-chosen for maximizing value.

Most valuable credit card insurance by network

While the amount of insurance coverage largely depends on your bank, most issuers reserve premium insurance packages for premium cards. For example, Mastercard credit cards average $301 worth of insurance, Visa cards average $377, and Amex cards average $412.

But it’s a different story if choose a top-tier, super-premium credit card:

| Mastercard | American Express | Visa | |

|---|---|---|---|

| Average insurance value | $301 | $412 | $377 |

| Average total coverage value | $250,420 | $372,875 | $282,003 |

| Top-tier card program | World Elite Mastercard | Amex Platinum | Visa Infinite Privilege |

| Income requirements | $80K personal or $150K household | N/A | $200K personal or household |

| Top-tier cards’ average insurance value | $578 | $661 | $1,004 |

Although it ranks highly for benefits, American Express doesn’t offer as much insurance as you might think. Its top-ranking card, the Scotiabank American Express Platinum Card, features twice the coverage as the vaunted American Express Platinum Card ($1,010 versus just over $500). World Elite Mastercards also cover a wide range, providing $248 – $1,065 in insurance value.

Although Visa’s enormous credit card catalogue produces a low average value insurance value, the Visa Infinite Privilege program is a reliable choice for high-income cardholders. Insurance packages start at $650 and go all the way up to $1,048 with the Desjardins Odyssey Visa Infinite Privilege.

Methodology

There’s no such thing as average when it comes to insurance – premiums can change depending on your age, gender, health history, address, and more. We did our best to approximate insurance values by looking at the prices of comparable plans and estimating a reasonable frequency of use.

- Extended Warranty: Consumer plans usually cost 1 – 5% of the purchase price, so we based our estimate on 2% of $3,600 of eligible consumer goods per year.

- Purchase Protection: We subtracted other, more reliable insurance values from credit card annual fees and used Bayesian regression to draw a line through the results, yielding an average cost of 1%. We applied 1% to the same figure of $3,600 of consumer goods.

- Price Protection: Our estimate assumes a 20% savings on 10% of available purchases, but it’s possible to do much better if you track prices diligently.

- Mobile Device: We based our values on the typical $9 – $20 monthly fee charged by carriers.

- Event Ticket: TicketMaster sells a comparable insurance plan for $8 per $1,000 of coverage.

- Emergency Medical: Our estimate is based on the typical premium for an annual plan covering unlimited trips.

- Travel Accident, Trip Cancellation, Trip Interruption, Flight Delay, Baggage Delay; Lost and Stolen Baggage: Travel insurance is often lumped together and difficult to separate. We determined a base lumped value by examining credit card fees and package offerings, then divided it based on probability and severity.

- Rental car accident: We based our estimates on the price of packages offered by rental car companies and determined a rough proportion of value to coverage limit.

- Rental car theft and damage: We assumed the average Canadian rents a car for 7 days per year and pays $20 per day for a loss/collision damage waiver (a figure based on the typical cost of $10 – $30 per day).

FAQ

What insurance do I get with my credit card?

Most credit cards include, at minimum, some form of purchase protection or travel accident coverage. Check your card’s certificate of insurance to make sure.

How does credit card insurance work?

Credit card insurance is provided by a company contracted by the bank. To receive compensation, you must submit a claim and wait for an adjuster to approve or deny it.

Does using credit card insurance affect your credit score?

Credit card insurance claims are not reported to credit bureaus and will not affect your credit score.

How do I know if I have credit card insurance?

Every credit card package includes a certificate of insurance outlining the coverage included, any terms and conditions, and how to make a claim. Be sure to read the literature that comes with your new credit card to understand what types of coverage you have.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×7 Award winner

×7 Award winner  $20 GeniusCash + Up to 30,000 bonus points + birthday bonus worth up to 15k points.*

$20 GeniusCash + Up to 30,000 bonus points + birthday bonus worth up to 15k points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments