Pros & cons

Pros

- Get up to 100,000 welcome bonus points.

- Earn up to 2 points per $1 spent on purchases.

- More perks than any other credit card in Canada.

- $400 in annual travel and dining credits.

- Unlimited airport lounge access at over 1,400 lounges.

- 4 ways to redeem points for high value.

- 11 types of insurance included.

Cons

- Lower acceptance as an American Express.

- High annual fee of $799.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 30,000 points which translates to an estimated $600.◊

For all welcome bonus details click here.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With American Express Platinum Card, here's how you earn rewards:

- 2 points per $1 spent on restaurants and travel

- 1 point per $1 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For American Express Platinum Card in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Transfer points to Aeroplan | $882 | |

| Fixed Points Travel Program | $772 | |

| Transfer points to Marriott Bonvoy | $512 | |

| Any travel | $441 | |

| Statement credits | $441 | |

| Charity donations | $441 | |

| Gift Cards | $340 | |

| Shopping at Amazon.ca | $309 | |

| Merchandise | $300 |

Calculating your annual rewards

$36,000 annual spending x 2.45% return on spending = $882 annual rewards

$882 annual rewards − $799.00 annual fee = $83 net annual rewards

Details and eligibility

- Estimated Credit Score

- 725 - 759

- Personal Income

- N/A

- Household Income

- N/A

- Annual Fee

- $799.00

- Extra Card Fee

- $250

- Card type

- N/a

- Purchase

- N/A

- Cash Advance

- N/A

- Balance Transfer

- N/A

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 120 days

- Travel Accident

- $500,000

- Emergency Medical Term

- 15 days

- Emergency Medical Maximum Coverage

- $5,000,000

- Trip Cancellation

- $2,500

- Trip Interruption

- $2,500

- Flight Delay

- $1,000

- Baggage Delay

- $1,000

- Lost or Stolen Baggage

- $1,000

- Hotel Burglary

- $1,000

- Rental Car Theft & Damage

- Yes

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

American Express Platinum Card's 4.3 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from American Express

American Express Platinum Card Review

For the complete red carpet treatment and an unsurpassed travel experience,

Now, as a rare metal credit card available in Canada with 50% more perks than its nearest competitor and more than double the number of perks of the typical travel credit card (we counted), it's easy to see why it is the #1 ranked perks card in Canada.

And while it has an annual fee of $799, you can deduct $400 from that thanks to its annual $200 travel and dining credits, leaving you with $399 to pay out of pocket. Still high, but worth it for the perks and VIP treatment you will receive as a frequent traveller.

Earning Membership Rewards with Amex Platinum

Starting off the list with a bang is its huge welcome bonus – sign up for this card and you'll get 100,000 Membership Rewards points after spending $10,000 in the first 3 months and making a purchase between months 15 to 17.

After that, you'll earn points at these brand new earn rates on all spending:

- 2 points per $1 spent on restaurants and travel

- 1 point per $1 spent on all other purchases

Redeeming Membership Rewards with Amex Platinum

The best value for your points is by transferring them to an airline program. There are 6 options to choose from, Aeroplan being one of the best, where you can transfer your points at a 1:1 ratio.

You have the option to transfer to these other airline programs as well:

| Airline Rewards Program | Transfer Ratio |

|---|---|

| Air Canada Aeroplan | 1:1 |

| British Airways Avios | 1:1 |

| Delta SkyMiles | 4:3 |

| Cathay Pacific Asia Miles | 4:3 |

| Etihad Guest | 4:3 |

| Air France/KLM Flying Blue | 4:3 |

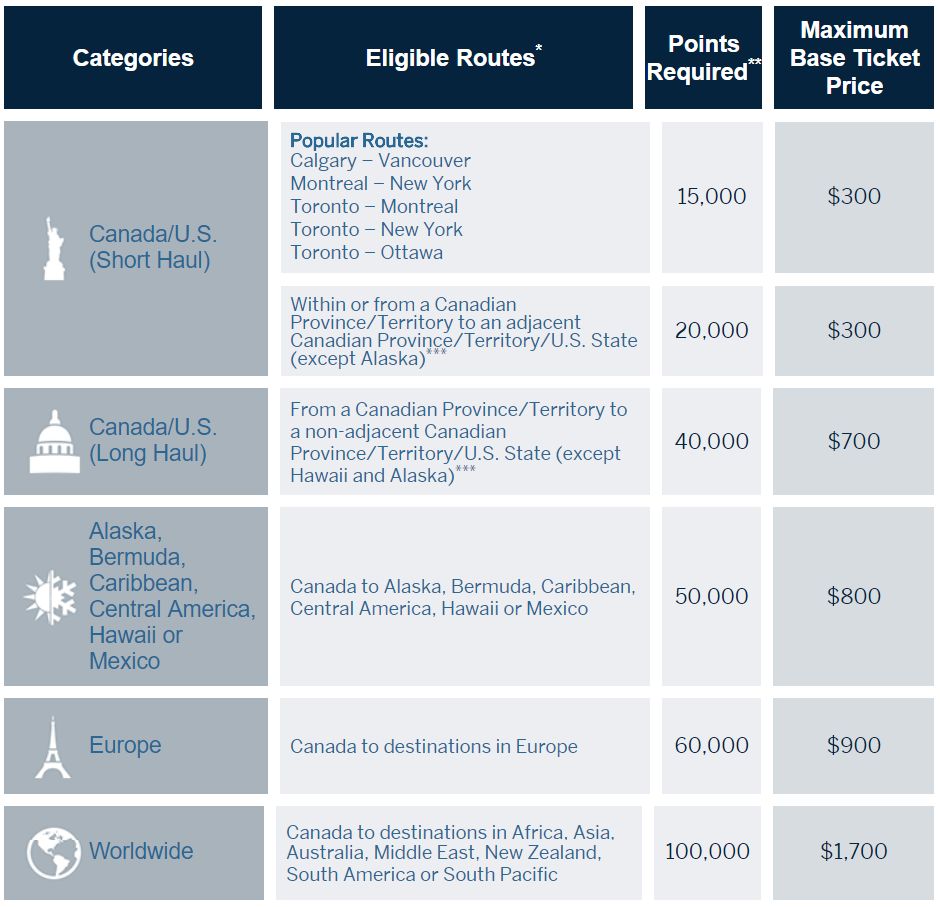

The next best way to use your points is by using the American Express Fixed Points Chart. This chart will let you use a set amount of points to fly to a set region of the world.

Here is what the chart looks like for economy class redemptions:

You'll have to pay the taxes and fees, but despite that, maximizing this chart will get you a value of 2 cents per point. That's twice as much as the usual 1 cent per point most travel cards offer.

But that's only for select flights. For most people, the best value will be long haul Canada/U.S. flights, which carry a value of 1.75 cents

Depending on your travel plans, the fixed points chart may be a better option for economy class tickets as opposed to transferring to airline partners. You'll get increased flexibility and get a similar point value.

The business class chart doesn't provide any better value than economy. The maximum point value you can obtain is 1.8 cents.

If you want to redeem for business class seats, you would be better off transferring to an airline partner. It's relatively easy to get a value of 3.5 cents per point, and redemption options of up to 6 cents per point are not unheard of.

There are also plenty of other ways to redeem your membership rewards as well:

| Redeem Points For | Point Value (Cents Per Point) | Welcome Bonus Value |

|---|---|---|

| Transfer to airline partners | 2.5 CPP | $2,000 |

| Fixed Point Travel program | 1.75 CPP | $1,750 |

| Transfer to hotel partners | 1.2 CPP | $1,200 |

| Travel purchase statement credit | 1.0 CPP | $1,000 |

| Ticketmaster purchases | 1.0 CPP | $1,000 |

| Charity donations | 1.0 CPP | $1,000 |

| ANY purchase statement credit | 1.0 CPP | $1,000 |

| Gift cards | 0.82 CPP | $820 |

| Amazon.ca purchases | 0.70 CPP | $700 |

| Merchandise | 0.68 CPP | $680 |

Learn more about the Membership Rewards program with our complete guide, including additional ways you can get maximum value from your points.

American Express Platinum benefits and perks

Now, the moment you have been waiting for. Drumroll, please.

Earning rewards on your purchases is great, but the real reason you want this card is for the perks.

No card in Canada has a list of perks as long as The Platinum Card. It's the reason we crowned it as Best Perks Credit Card In Canada for 5 years in a row.

Buckle up and get ready for the not-so-skinny on all these fat perks and benefits.

Annual $200 travel credit

The easiest $200 you'll ever save – with this card, once per year, you'll get access to a $200 annual travel credit.

Simply book any single travel booking worth more than $200 at either The Platinum Card Travel Service or American Express Travel Online, and get $200 off your purchase. This credit can be applied towards any flight, hotel or car rental. The only restriction is just to book something that costs more than $200.

Note: American Express Travel only price matches hotels.

Annual $200 dining credit

You'll also get a similar credit on dining. At select restaurants around the world (with many in Canada), you can save $200 on your meal. All you have to do is make sure your meal is more than $200, charge your meal to your card, and you'll save $200 on it.

Here is the listing of restaurants you can use your credit at.

American Express Platinum Lounge access

To really make you feel like a VIP, this card will get you unlimited free access for yourself and one guest to over 1,400 airport lounges as part of the American Express Global Lounge Collection. This collection includes all Priority Pass lounges.

The collection includes American Express branded "Centurion" lounges which are some of the most prestigious airline lounges currently available. There's a limited number, the majority of which are located in the United States. These lounges generally provide the most luxury, comfort and amenities of all airport lounges.

In fact, it's the only credit card in Canada (along with its business counterpart) to offer unlimited lounge visits for both you and a guest.

Imagine reclining in a lounge like this while you're waiting for your flight to leave (not bad, eh?):

Photo by Yimu H.

Why do you want access to an airport lounge? For comfort and relaxation...Sit in a nice, comfortable chair. Get yourself something to eat (usually hot) and enjoy alcoholic and non-alcoholic drinks for free. Premium brands are often available.

Want to get some work done? Most lounges have work stations, computers and printers if you need them.

Some lounges even have showers if you want to freshen up before flying. Plus, you won't have to hear constant flight announcements. You'll be able to relax and enjoy your time while waiting for your flight.

VIP Toronto airport benefits

If you travel frequently from Toronto Pearson airport, you'll get even more awesome travel benefits to improve your airport experience, including complimentary valet parking, parking discounts and priority security screening.

First, get free valet parking. Simply show your American Express Platinum Card, and the $25 fee will be waived.

Prefer to park yourself? Get a 15% discount on parking as a statement credit when you charge the cost to your card.

Once inside, breeze through security with priority security lanes.

Save yourself some money and time every time you fly from the airport with your Amex Platinum Card.

International Airline Program

For even more flight discounts, you'll be able to take advantage of the International Airline Program, which will give you discounted base fares for you and 7 – yes, 7 – additional passengers when you book tickets in first, business or premium economy.

There are a couple of restrictions. Travel must originate and return to select Canadian gateways, and savings may not extend to codeshare flights operated by partner airlines. The discount also only applies to the base airfare of the ticket. You are still responsible for any taxes and fees.

To find out what a ticket will cost, you have to call the Platinum Travel Service and discuss some itineraries. You also have the option just to receive your quote, and have 48 hours to decide if you want to purchase the flight.

These are the current airlines participating in the program:

Fine Hotels & Resorts

To sweeten this deal even further, you'll get some great complimentary benefits while staying at hotels with the Fine Hotels & Resorts Collection.

These benefits are worth an average of $550 USD at over 1,600 properties worldwide. To get these benefits, your stay must be booked with American Express Travel through the Fine Hotels and Resorts Collection portal.

What are some of these benefits, you ask?

- early check-in,

- free room upgrade on arrival (if available),

- daily breakfast for 2,

- late checkout,

- free wifi, and

- $100 in property benefits (benefits vary).

The Hotel Collection from American Express

Not to outdo itself, American Express also offers The Hotel Collection. Receive up to $100 USD in hotel credits that can be used on amenities at over 600 hotels and resorts in 30 countries. Similar to Fine Hotels And Resorts, your stay has to be booked with American Express Travel in The Hotel Collection page.

Use your credit for things like dining, spa, golf or hotel facilities.

Plus, get a complimentary room upgrade at check in when available.

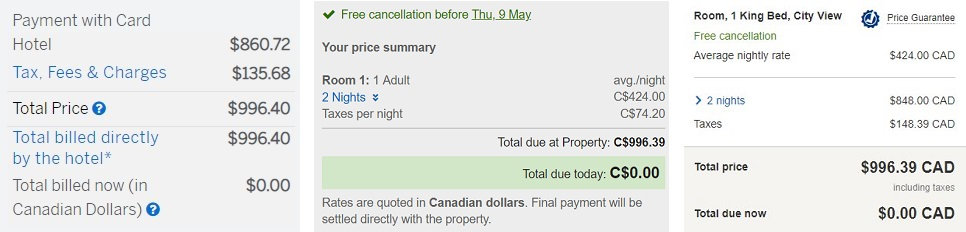

Hotel prices booked through Amex Travel

So, all these hotel benefits are great. But how do the prices of these hotels compare to others? We test booked a couple of options through the Hotel Collection, and compared them to both Expedia and hotels.com. We booked a 2 night stay for both properties.

First, we test booked the Fairmont Royal York in Toronto:

The Hotel Collection actually had a cheaper rate of $772.10, compared to $855.54 found at both Expedia and hotels.com.

Then, we also test booked the Douglas Autograph Collection hotel in Vancouver.

Here we have a near identical price across the board.

So, it's definitely worth looking into what hotels you can book through these 2 options. Hotels seem to be well priced, you might even save money, and you'll get free benefits for doing so.

Upgraded hotel status

Some people spend their entire year working towards getting distinction status for their favourite hotel rewards program. And for good reason: distinction status comes with its own slew of perks and savings that everyone wants.

With The Platinum Card, you not only get distinction status with 1 reward program, but 4, automatically.

Enjoy complimentary:

- Hilton Honors Gold status, and

- Marriott Bonvoy Gold Elite status.

Here's a breakdown of what benefits are offered:

Insurance coverage

If all those perks weren't enough, this card also comes with a more unique coverage of StandbyMD Travel Medical concierge. This program can arrange telephone consultations, in house visits by physicians and hospital referrals depending on where you are travelling.

Plus, get 11 types of insurance coverages to protect you during your travels.

American Express Platinum® Card

| Extended Warranty | 1 year |

| Purchase Protection | 120 days |

| Travel Accident | $500,000 |

| Emergency Medical Term | 15 days |

| Emergency Medical Maximum Coverage | $5,000,000 |

| Trip Cancellation | $2,500 |

| Trip Interruption | $2,500 |

| Flight Delay | $1,000 |

| Baggage Delay | $1,000 |

| Lost or Stolen Baggage | $1,000 |

| Hotel Burglary | $1,000 |

| Rental Car Theft & Damage | Yes |

Please review your insurance certificate for details, exclusions and limitations of your coverage.

And there you have it

For an annual fee of $799, The American Express Platinum Card will let you get some serious red carpet treatment, on top of great discounts and complementary features that are not easy, or affordable, to get elsewhere.

Plus, as this card has no income requirements, it's available to anyone who has good credit.

If you seek great discounts and preferential treatment, this card will be worth your while.

It's certainly a card worth trying – even just for the huge welcome bonus and $400 in travel and dining credits.

Key benefits

User reviews

Reviewed by 16 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Expect to be declined for your application without a reason, even if you have good income, good credit score and low personal loan. They refused to let you know why you are rejected and simply asked that you reapply 3 months later.

For a card that you have to pay $799 a year, the level of customer service and response is totally unacceptable. We live in 2025, not 1925, I believe in good customer service when I do business with a company, WALK AWAY unless if you don't mind that they treat you as a commodity, rather than a customer

This card is terrible. I've ran millions through it over the past 5 years. Then started randomly cutting me off each month at lower and lower levels, despite never missing a payment. Amex tells me its 'due to a variety of risk factors' however I am a multi millionaire with excellent credit. Card doesn't work at a lot of locations that don't accept amex. Don't waste your time on a crappy card and a company with even worse customer service.

It's not a very good card. They messaged me and say oh we are lowering your credit limit and than started to threaten me about my credit limit saying they will lower it. I pay my card on time and really for 800$ fee they gave me a tiny limit on my platinum card which is lower than all my normal cards. So I am not going to renew next year, as I do not feel comfortable working with hem.

Don’t apply for this card if you are looking for access to the airport lounges. This is not guaranteed. The access to lounges is at the operator’s mercy. $800 cad a year is totally not worth it.

On paper there are better cards out there but the customer service, user interface, special offers, huge credit limits, may make it worthwhile.

it has 2% MR earn rate on travel - so does Amex gold. At 3x cheaper annual fees.

It has 2% MR earn rate on dining - so does Cobalt (5x up to $2500/mo). at 5x cheaper annual fees. The MBNA rewards card gives you 4.7% cash back if redeemed to gift cards. Way stronger than the Plat.

It has unlimited lounge aceess - but lots of cards can give you a few visits for free. Lounges are only good for relaxing and free alcohol, food is awful.

$200 dining credit - only to be used at designated restaurants. In certain cities there are none.

$200 travel credit - only to be redeemed via AMEX travel portal. Prices arent competitive, a hassle to redeem, not much benefits out of it.

Concierge - useless. One time I asked for Taylor swift tickets. They got none. Another time I asked for a VIP ticket to a circ show and they sent me a weblink for me to research.

The only thing worthy of mention is the offers. They have a dozen offers active that can help you earn statement credits back. I have earned $250 a year. So that might make the card slightly worthwile.

Another good thing about this card is the huge credit limit. Easy to be approved. Very robust security. Amazing customer service. Amazing user interface - intuitive, simple, lots of information.

×2 Award winner

×2 Award winner