Pros & cons

Pros

- Get up to 60,000 welcome bonus points.

- Earn up to 2 points per $1 spent on purchases.

- $100 annual travel credit.

- 4 free passes to Plaza Premium lounges in Canada.

- 4 ways to redeem points for high value.

- 11 types of insurance included.

Cons

- Lower acceptance as an American Express.

- High annual fee of $250.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 60,000 points which translates to an estimated $1,200.◊

For all welcome bonus details click here.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With American Express Gold Rewards Card, here's how you earn rewards:

- 2 points for every $1 spent on gas , groceries , drugstores , and travel

- 1 point for every $1 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For American Express Gold Rewards Card in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Transfer points to Aeroplan | $1,062 | |

| Fixed Points Travel Program | $929 | |

| Transfer points to Marriott Bonvoy | $616 | |

| Any travel | $531 | |

| Statement credits | $531 | |

| Charity donations | $531 | |

| Gift Cards | $409 | |

| Shopping at Amazon.ca | $372 | |

| Merchandise | $361 |

Calculating your annual rewards

$36,000 annual spending x 2.95% return on spending = $1,062 annual rewards

$1,062 annual rewards − $250.00 annual fee = $812 net annual rewards

Details and eligibility

- Estimated Credit Score

- 725 - 759

- Personal Income

- N/A

- Household Income

- N/A

- Annual Fee

- $250.00

- Extra Card Fee

- $0

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance

- 21.99%

- Balance Transfer

- N/A

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Travel Accident

- $500,000

- Emergency Medical Term

- 15 days

- Emergency Medical Maximum Coverage

- $5,000,000

- Trip Cancellation

- $1,500

- Trip Interruption

- $1,500

- Flight Delay

- $500

- Baggage Delay

- $500

- Lost or Stolen Baggage

- $500

- Hotel Burglary

- $500

- Rental Car Theft & Damage

- Yes

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

American Express Gold Rewards Card's 4.0 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from American Express

American Express Gold Rewards review

The American Express Gold Rewards Card is one of the best all-around credit cards in Canada.

It offers a terrific mix of high rewards, premium perks, and travel insurance. Here's everything it has to offer.

Earning rewards with the American Express Gold Rewards Card

The American Express Gold Rewards Card is a member of the Amex Membership Rewards program, which is one of the most flexible credit card rewards programs there is.

Here's what you'll earn for points on all your purchases:

- 2 points for every $1 spent on gas, groceries, drugstores, and travel

- 1 point for every $1 spent on all other purchases

How does that translate into annual rewards? Based on spending $2,000 per month, you're looking at earning 53,100 points per year.

Redeeming your American Express Membership Rewards

53,100 sounds like a lot of points. But what can you use them for? You've got 4 different ways to use them for travel. Here are the details on each one.

One point to note as you read – always check the value of your redemptions, and make sure you get at least 1 cent per point. If it's less than that, you'll want to stick with option 4.

Here's the formula to use:

Value of 1 point in cents = Total savings / Points used

1. Transfer to airline partners

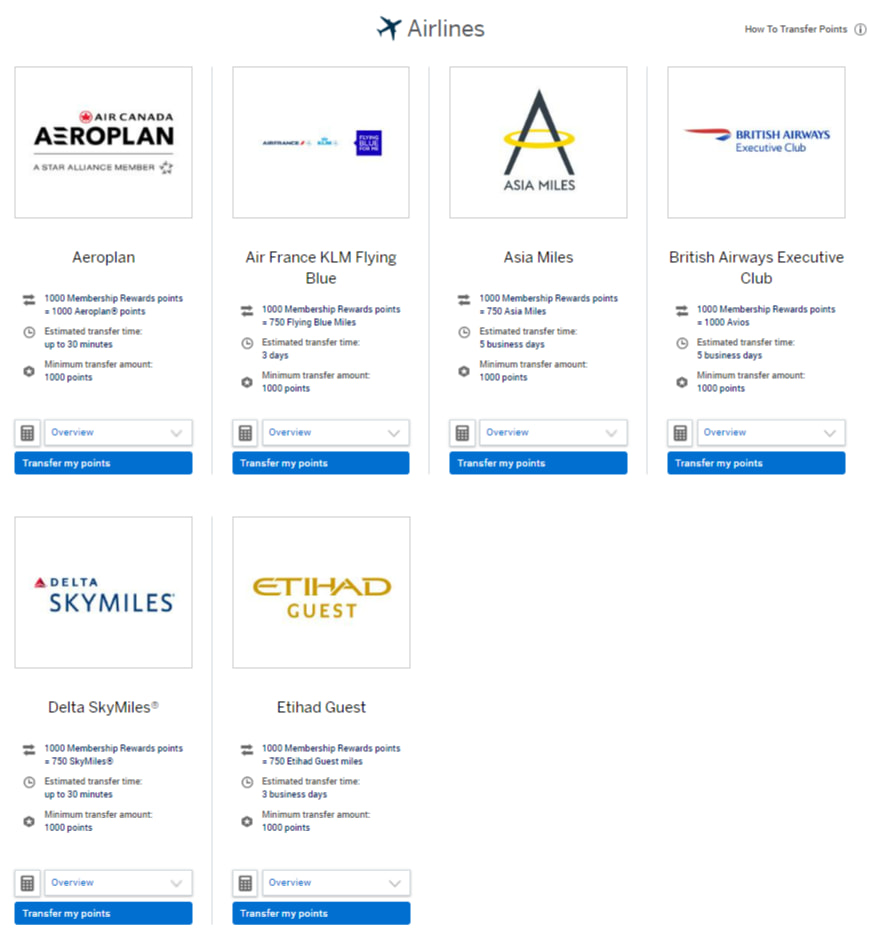

For the best value for your points, you can transfer your Amex Membership Rewards points to one of 6 airline partners – here are the choices.

We'll focus on Aeroplan since that's the one airline program here that provides the best access for Canadians.

We value an Aeroplan point at up to 2 cents when redeemed for flights, which turns 53,100 points into $1,062.

So that's the best way to use them. Is there any reason not to do it, assuming you find a redemption you want?

Well, when you transfer points to a partner, you'll lose out on the credit card insurance this card provides (and it's quite good).

When it comes to credit card insurance, using points to pay for travel only applies if you redeem your points with the rewards program that card is part of. When you transfer them to Aeroplan, that no longer happens.

If you value your insurance, you may want to consider passing on this redemption option.

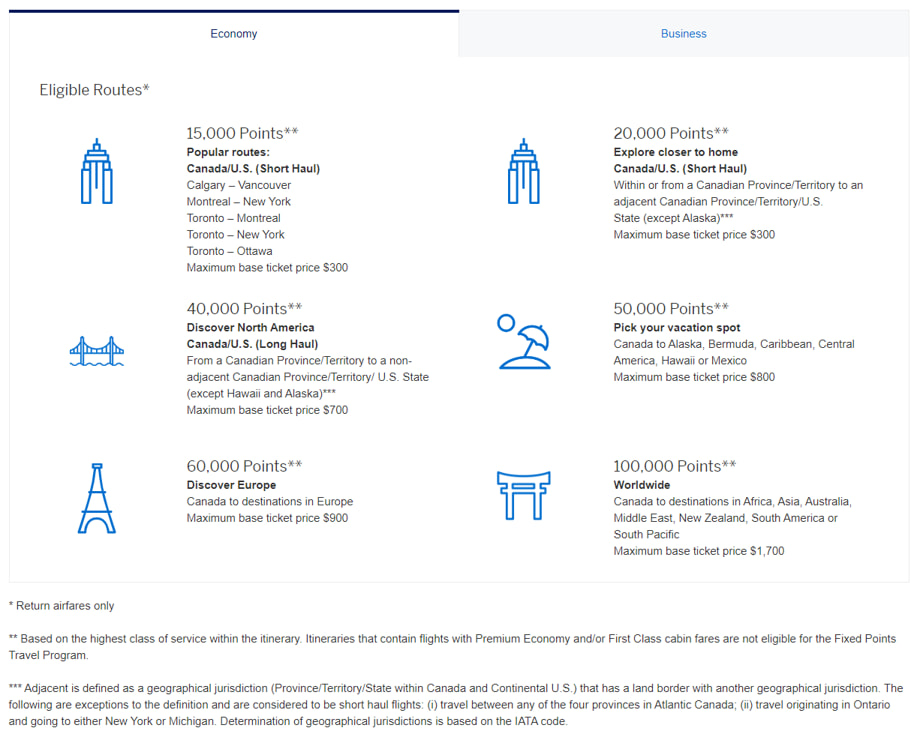

2. Fixed Points Travel program

Next up in terms of value is the Fixed Points Travel program.

What is it? It's a fixed point chart you can use for flights. You use a set amount of points to fly to destinations in a specific zone. Those points cover the base airfare only – you have to pay any taxes and fees. There is a cap on the base airfare your points cover, but you can pay any overage.

Here's what the chart looks like:

The best value you can get is 2 cents per point on select short haul routes. But for most, the sweet spot is long haul flights within Canada and the Continental U.S., where your max value is 1.75 cents per point.

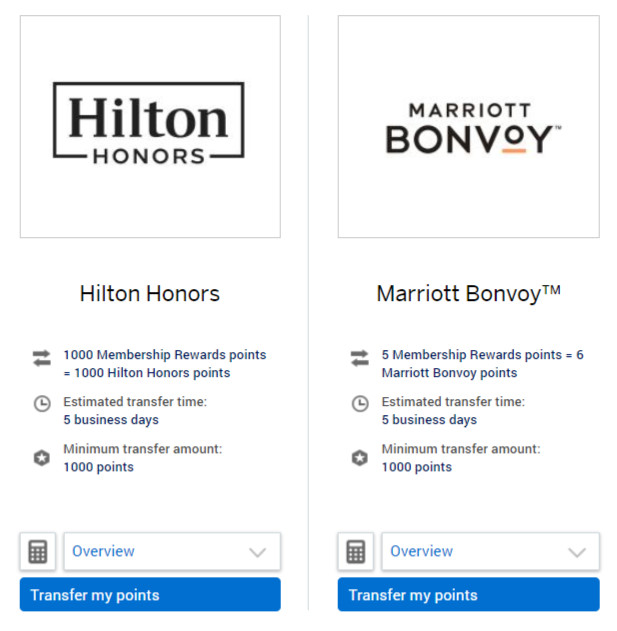

3. Transfer to hotel partners

Membership Rewards can be transferred to a pair of hotel programs – Marriott Bonvoy and Hilton Honors.

Here's what the points are worth for each program:

- Marriott Bonvoy – 0.97 cents

- Hilton Honors – 0.64 cents

It's definitely not worth transferring your points to Hilton, but it sure is to Marriott.

Since your points convert at a 5:6 ratio instead of 1:1, you're basically getting 20% more points for free. And that makes the value of each Membership Rewards point worth up to 1.16 cents each.

4. Redeem for any purchase charged to the card.

Finally, you can use your points for any purchase charged to your card, including travel. Every 1,000 points redeemed will save you $10 on the transaction of your choice, a value of 1 cent.

As such, always check the value of your redemptions if you may go with any of the above. If any of them fall below 1 cent per point, then stick with this option to get the best value,

Here's a summary of all your Amex Membership Rewards redemptions.

6 benefits to the American Express Gold Rewards Card

There's lots more to this card than just the rewards – here are 6 things this card brings to the table.

1. Annual travel credit

Every year you have the card, you get easy access to travel savings. You'll get a $100 travel credit you can use towards any travel purchase through American Express.

The only catch to it – whatever you book has to cost at least $100, otherwise you won't be able to use it.

2. Free Plaza Premium Lounge access

There is some airport lounge access included.

You'll get 4 free passes to Plaza Premium lounges located in Canada. These passes are also supplemented by a Priority Pass membership, though it doesn't include any free passes.

3. Metal credit card

It may seem like a small thing, but this card is made from metal, not plastic.

A metal credit card itself doesn't provide any benefits (other than it's much harder to cut up), but it gives you that feeling of premium in your hands. And you get your choice of colour – you can choose from gold or rose gold.

4. Terrific credit card insurance

The credit card insurance included is very good, with 11 types included.

You can head to the insurance tab above for all the details.

5. Top-notch welcome bonus

The welcome bonus will give you a big head start on your next set of travel plans.

You can earn 60,000 bonus points after spending $1,000 every month for the first year. Here's what those are worth for the 4 travel redemptions.

| Redemption | Welcome Bonus Value |

|---|---|

| Transfer To Aeroplan | $1,200 |

| Fixed Points Travel Program | $1,050 |

| Transfer To Marriott Bonvoy | $696 |

| Redeem Towards Any Purchase | $600 |

6. No income requirements

If this were a Visa or Mastercard, you would be looking at minimum income requirements of $60,000 personal or $100,000 household – possibly more.

Not here. It's an American Express card, which means it has no income requirements whatsoever.

2 downsides to the American Express Gold Rewards Card

On the flip side, here are 2 things to think about.

1. American Express acceptance

While it's not as bad as it can be made out to be, there's no denying the Amex acceptance isn't quite on par with Visa or Mastercard.

To check out Amex acceptance in Canada, Amex Canada has this map you can use, which will show you merchants in your area that accept Amex cards.

2. High annual fee

Credit cards are a compromise on things like rewards, fees, interest, perks, and insurance. There's always tradeoffs to make a credit card work.

In this case, since we have a card that excels in many areas, that means something has to give. And in this case, it's the annual fee. It's somewhat high at $250. Take this into account when looking at what this credit card has to offer.

Comparison to the American Express Cobalt Card

There are a few Amex Membership Rewards cards you can choose from.

One of them is the best credit card in Canada – the American Express Cobalt Card. Here's how they compare.

| American Express Gold Rewards Card | American Express Cobalt Card | |

|---|---|---|

| Earn Rates | * 2 points for every $1 spent on gas, groceries, drugstores, and travel * 1 point for every $1 spent on all other purchases | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

| Welcome Bonus | Up to 60,000 bonus points (terms) |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) |

| Insurance Coverage | 11 types | 10 types |

| Annual Fee | $250 | $191.88, charged out as $15.99 per month |

| Perks | * $100 annual travel credit * Airport lounge access * Metal credit card * NEXUS fee rebate * Amex offers and Front Of The Line | * Amex offers and Front Of The Line |

The Cobalt has the biggest advantage – the rewards. Here's what each card earns for points based on spending $2,000 per month.

American Express Gold Rewards Card – 53,100 points

American Express Cobalt Card – 81,000 points

Though the Cobalt card wins here, the American Express Gold Rewards Card is pretty much superior in other categories except for the annual fee.

So, if you just want the most rewards, go with Cobalt. Want those perks and insurance? Think about the Gold Rewards.

Leave a review

For those of you who have (or had) the Gold Rewards Card, what do you think of the card?

Leave a user review so others can see real world experience with it.

FAQ

Who should get the American Express Gold Rewards Card?

The American Express Gold Rewards Card is designed for someone who travels once a year. You'll earn rewards you can use in a variety of ways for travel, get some free airport lounge access, and have access to extensive travel insurance.

Is the American Express Gold Rewards Card worth it?

The American Express Gold Rewards Card is one of the best travel credit cards in Canada. Despite its high annual fee, it boasts high rewards, perks, and insurance coverage.

What credit score do you need for the Amex Gold Rewards?

To qualify for the American Express Gold Rewards Card, you need to have a good credit score – typically at least 660.

Is the Amex Gold Card a metal card?

The American Express Gold Rewards Card is a metal credit card and you get your choice of colour – gold or rose gold.

How do you qualify for an Amex Gold card?

To qualify for the Amex Gold Card, you'll need to be a resident of Canada and have reached the age of majority in your province or territory of residence. You'll also be subjected to a credit score check.

Key benefits

User reviews

Reviewed by 20 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

We spend a lot on groceries and travel. This card is a keeper! Other groceries Visa/MC have spending limit 2500 a month, 60K a year, etc. But this one is unlimited!

But if you dont plan on going over limits, my top choice for grocery are Scotia Amex, MBNA rewards both have earn rate higher than Amex gold and can act like cash back. Amex cobalt is great for students/young professionals but not very good for established households due to limations.

It's a great card and I plan to keep it. I had the card for over 2 years now. Where I live most vendors accept the card, with a few not accepting it. Loblaws is the major one not accepting accepting but I never shopped there anyways. I like the flexibility of the rewards program, I transferred my points to Aeroplan and Marriott Bonvoy in the past. I would consider transferring my points with Delta Skymiles and British Airways in the future.

Nothing against Amex but Aeroplan is horrible. You will never get any flights you want, you can’t contact them and they leave people stranded. There are better travel reward programs out there.

Just got my card in October. It's hard to earn the bonuses when there are so many retailers that don't accept it. Just in the first month $2600 had to be put on my Visa card because I couldn't use the American Express. Wish I hadn't gotten that card because it's hurting my points earnings.

Good and Easy to redeem rewards but make sure to have some extra cash, Amex is not accepted for some merchants.

×3 Award winner

×3 Award winner