Skyscanner is a search engine for travel. Plug in where you want to fly to, and they'll show you the best prices for your flights from a variety of travel booking sites (including the airlines themselves).

But you can do more than just compare flight prices, you can also look for better deals on hotels and car rentals.

Here's how Skyscanner works and what it can do for you.

Key Takeaways

- Skyscanner allows people to search and compare flights, hotels, and car rentals.

- Skyscanner is simply a search engine, they refer you to other sites to make your booking.

- There are plenty of tools that Skyscanner offers to find the best price for flights.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

How to use Skyscanner for cheap flights

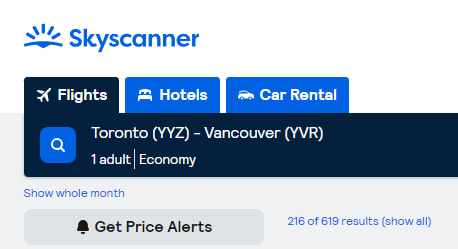

To demonstrate how to use Skyscanner to get the best deals on flights, we're going to examine what's available on a route within Canada that thousands of people fly every year – Toronto and Vancouver.

Start your Skyscanner search

When you land on the Skyscanner homepage, you'll be able to start searching for flights.

We're going to stick to direct flights (is there really a need to connect in Calgary for this?).

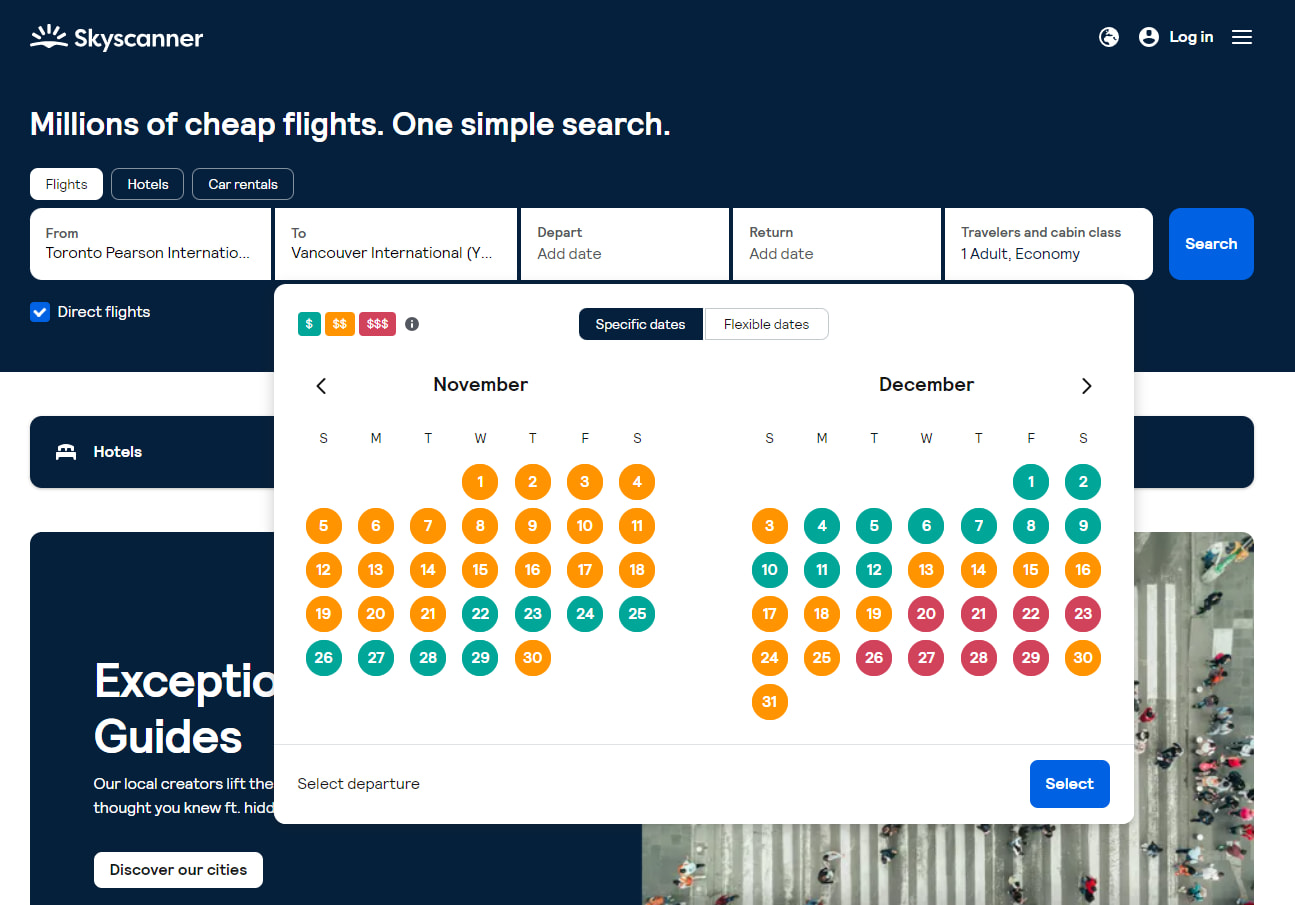

When you start to set a travel date, you'll instantly get an idea of what dates are cheaper. This can be very helpful if you've got some flexibility when you travel.

Let's pick some dates in one of the green zones. Once you click search, you'll have to give it a minute while it scans multiple travel websites for the best prices.

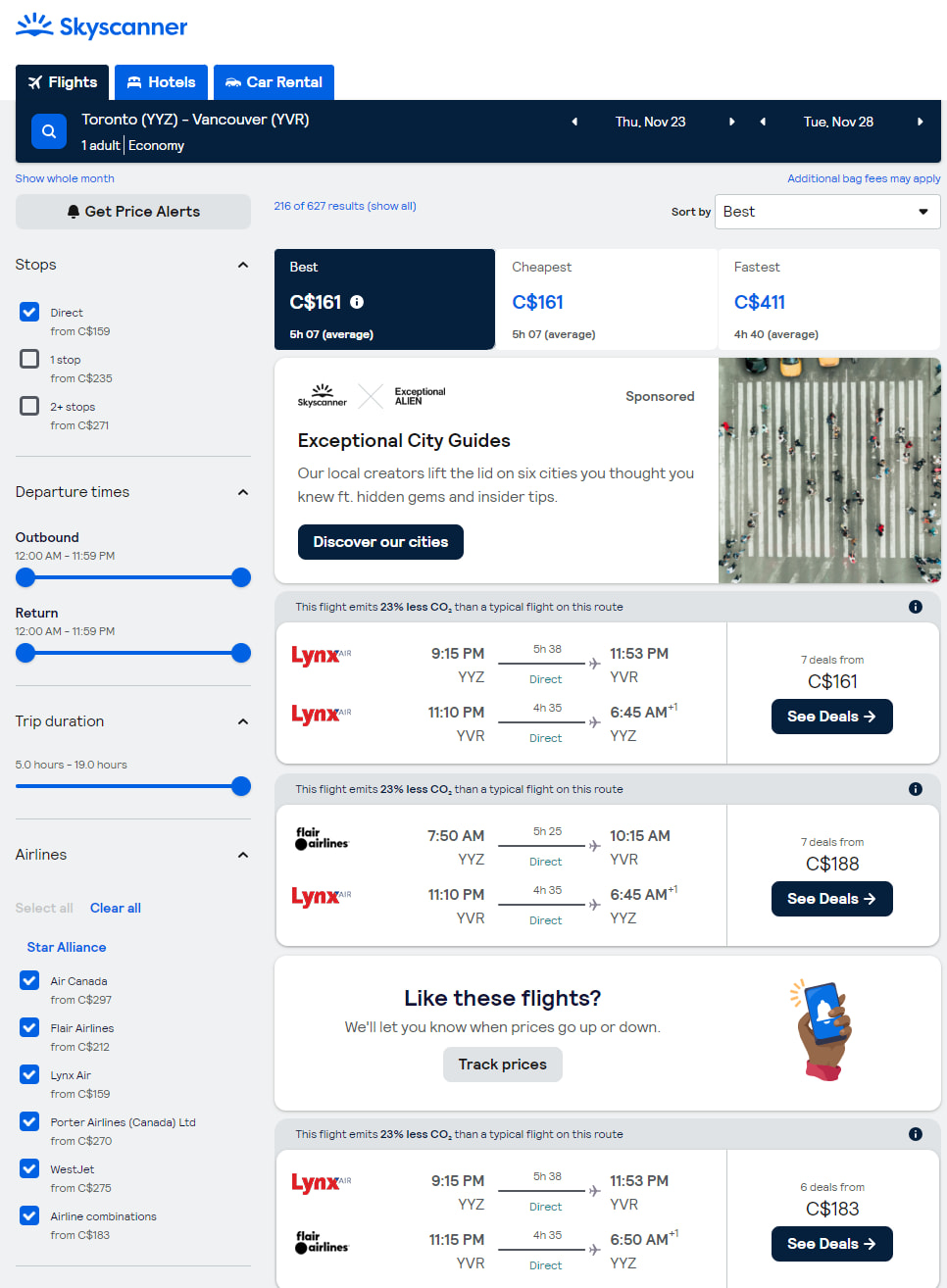

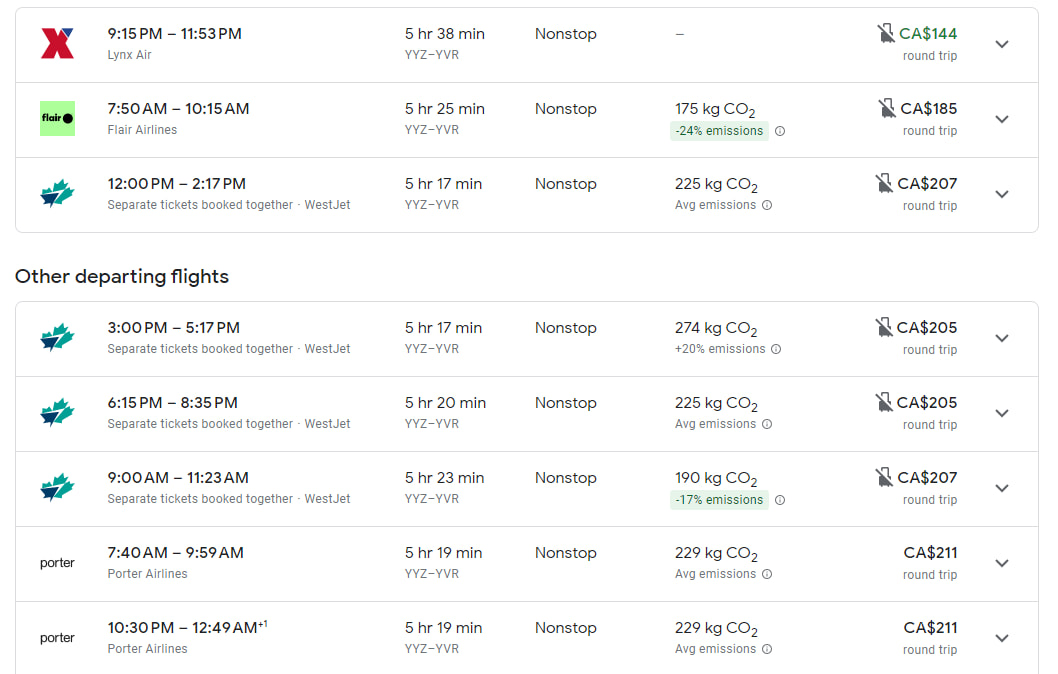

Here's the first batch of results that I got.

Skyscanner results will mix and match airlines to help get you a better deal, as you can see in a few of these results.

Advanced search features

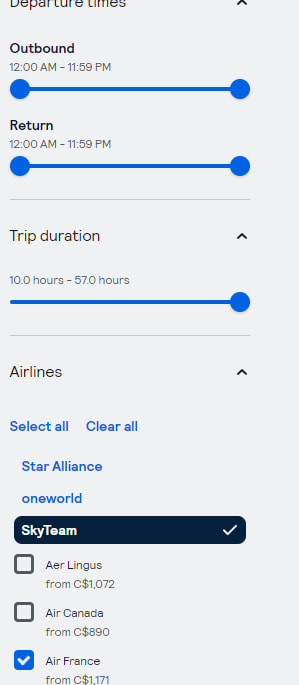

At this stage, we've got our initial results. There are plenty of advanced search features to better tweak what you might be looking for.

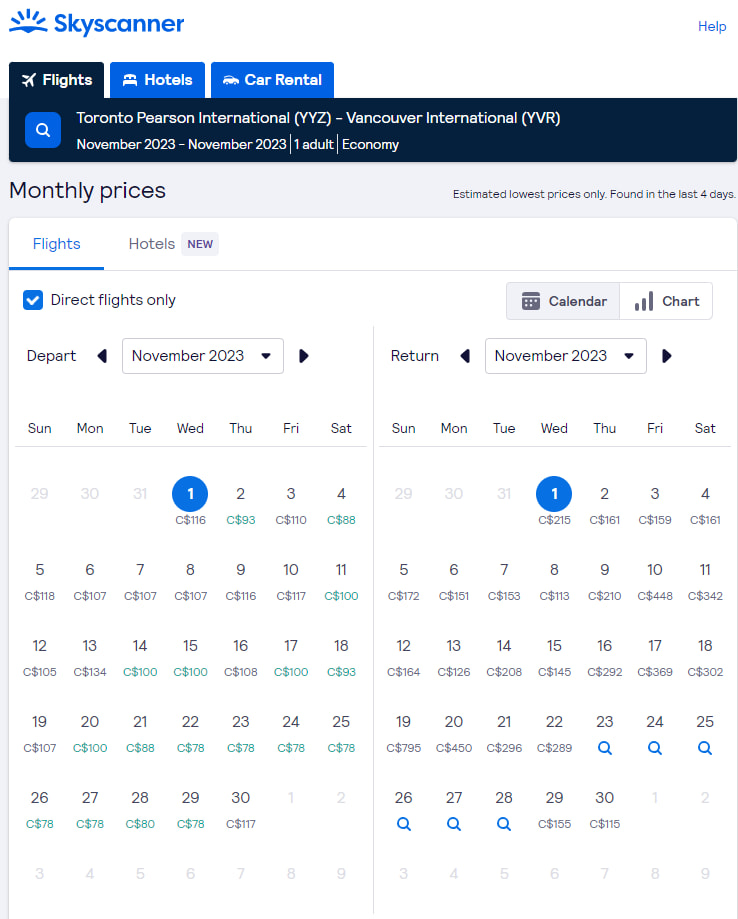

The first thing you can do is get a better idea on prices based on the exact day which you fly. You can find this right under your search by selecting "Show whole month". Then you can see the lowest price for flights on all days of the month.

Sadly, it won't carry over the dates you already selected. But this way you can see the lowest price for every day of a month.

Then you can look at the number of stops. On the home page, we said we only wanted a direct flight. But you change your mind on the results page. In fact, Skyscanner will show you the lowest round trip prices if you do want to add a stop or 2.

In our case, a direct flight is the cheapest option.

Next up is your departure. If you have a preferred time of day you'd like to leave, you can modify the results here.

This can be especially important for direct flights from Vancouver/Calgary/Edmonton to Toronto and cities farther east. The airlines will run overnight flights in this direction. If you don't want one, you can set it up so you don't see those.

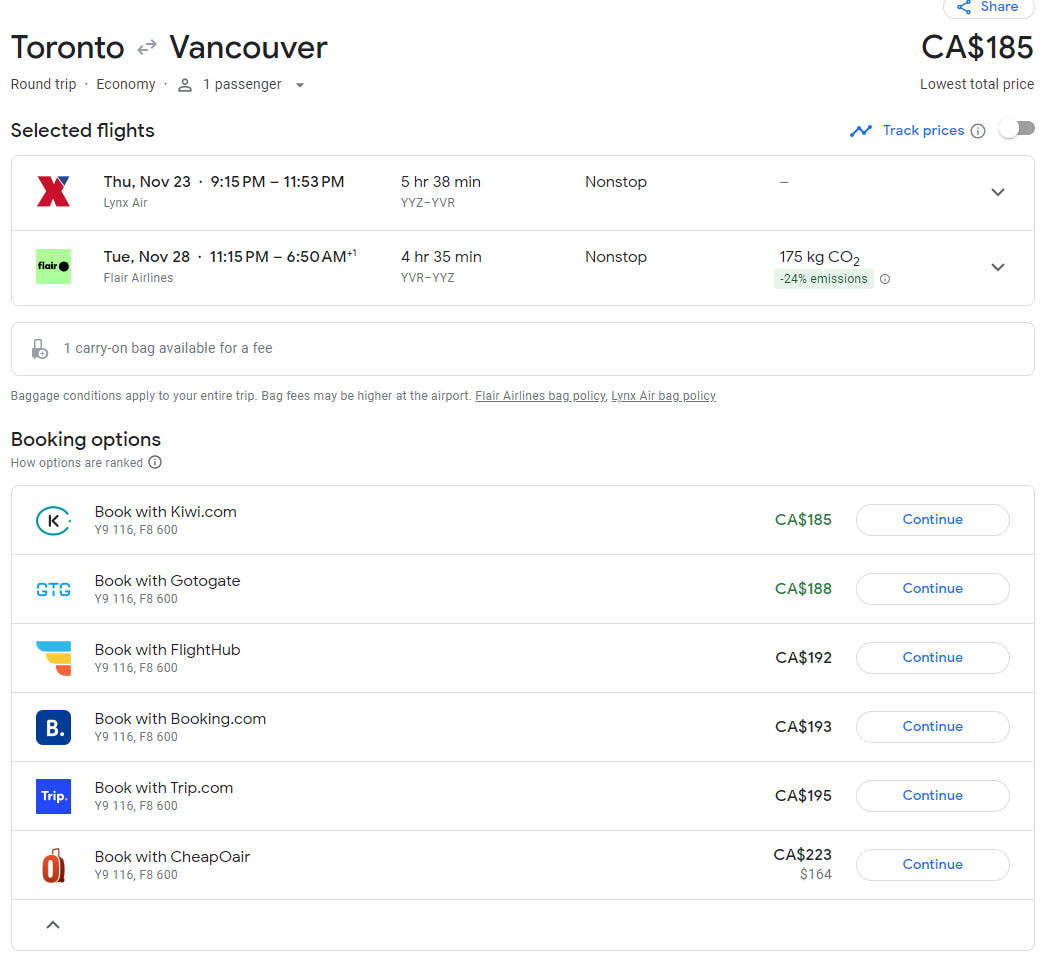

For instance, the first flight result you see does this – the Flair flight from Vancouver to Toronto leaves at 11:15 pm and gets in at 6:50 am the next morning.

There's also a trip duration meter you can adjust, but that's more useful when you have connecting flights and want to make sure you don't have a super-long layover somewhere.

Then you can change what airlines can display results. So if you're a frequent flyer for an airline, have a preferred airline, or really want to fly Porter for the delicious snacks and free beer and wine, you can adjust your results to only see that airline.

You can also simply search by airline alliance as well. You can do that here (it would just eliminate all airlines but Air Canada), but say you're flying from Toronto to Rome, you can change the list to just one airline alliance.

Lastly, if you want to lower your carbon footprint, Skyscanner can simply show you the results with flights with lower CO2 emissions.

In our search, it didn't change anything (at least for the top results) – for these, it looks like everyone is using newer planes that burn less fuel.

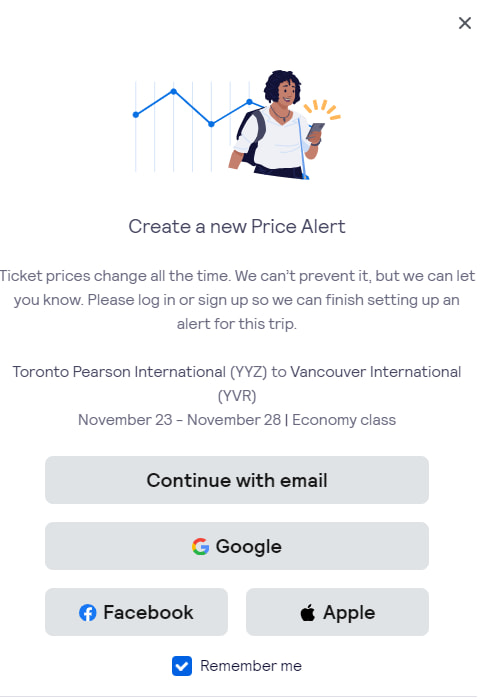

Price alerts

If you're just searching for flights and not planning on booking anything right away, you can sign up for price alerts.

Click on "Get Price Alerts" in the top left corner and a popup appears.

You do need to sign up, otherwise they won't be able to tell you when the price of the flights have dropped.

Booking your flight

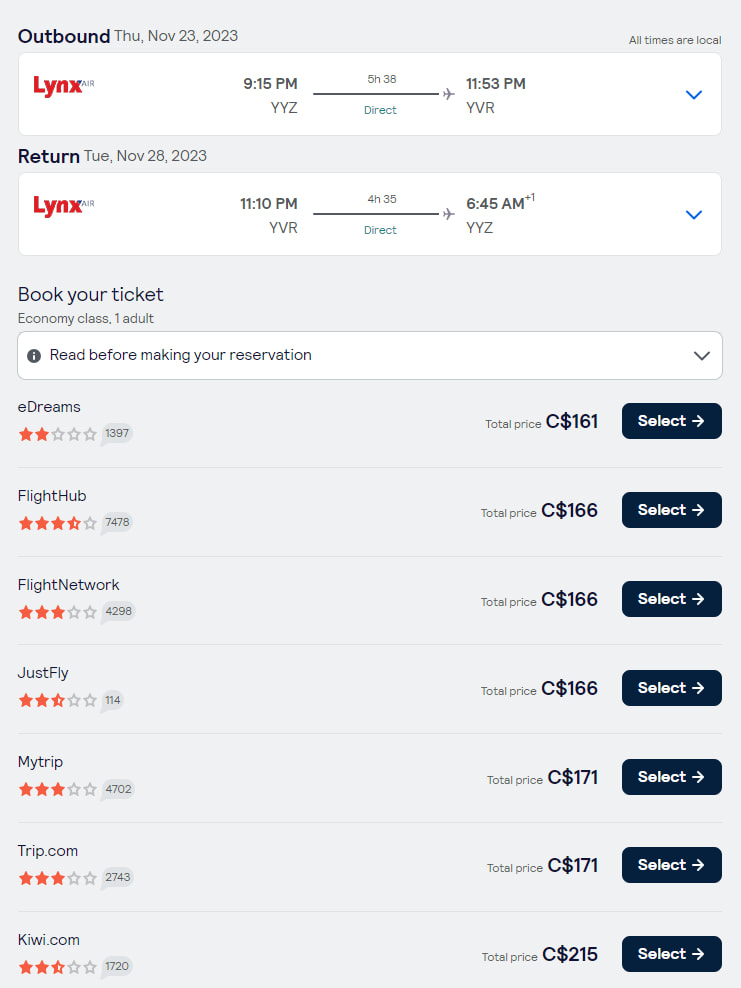

So you've tweaked your settings and found the flights you want. Let's book them.

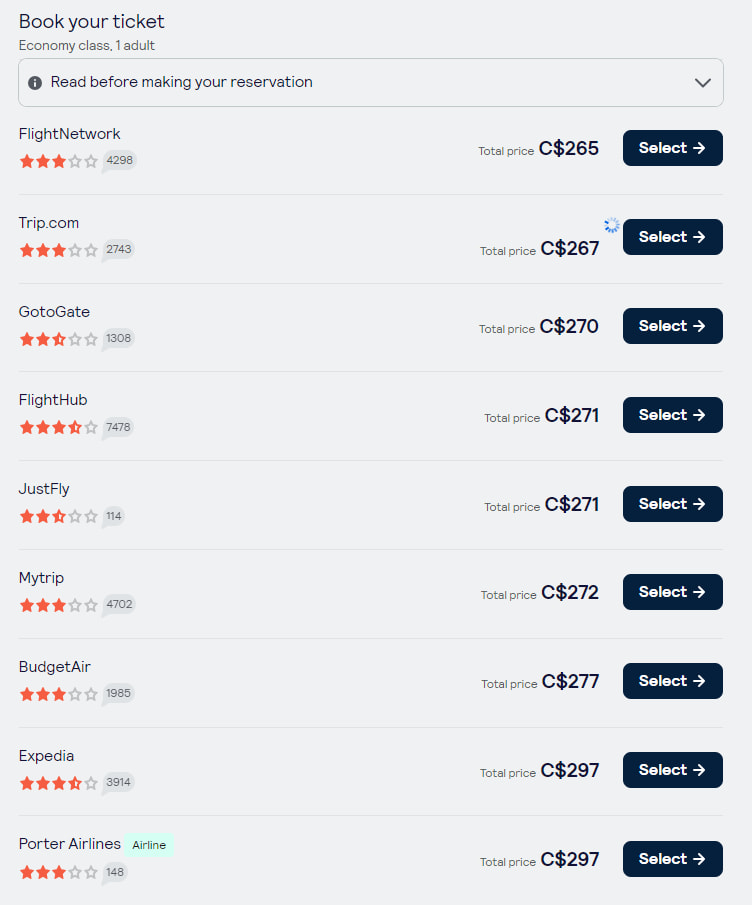

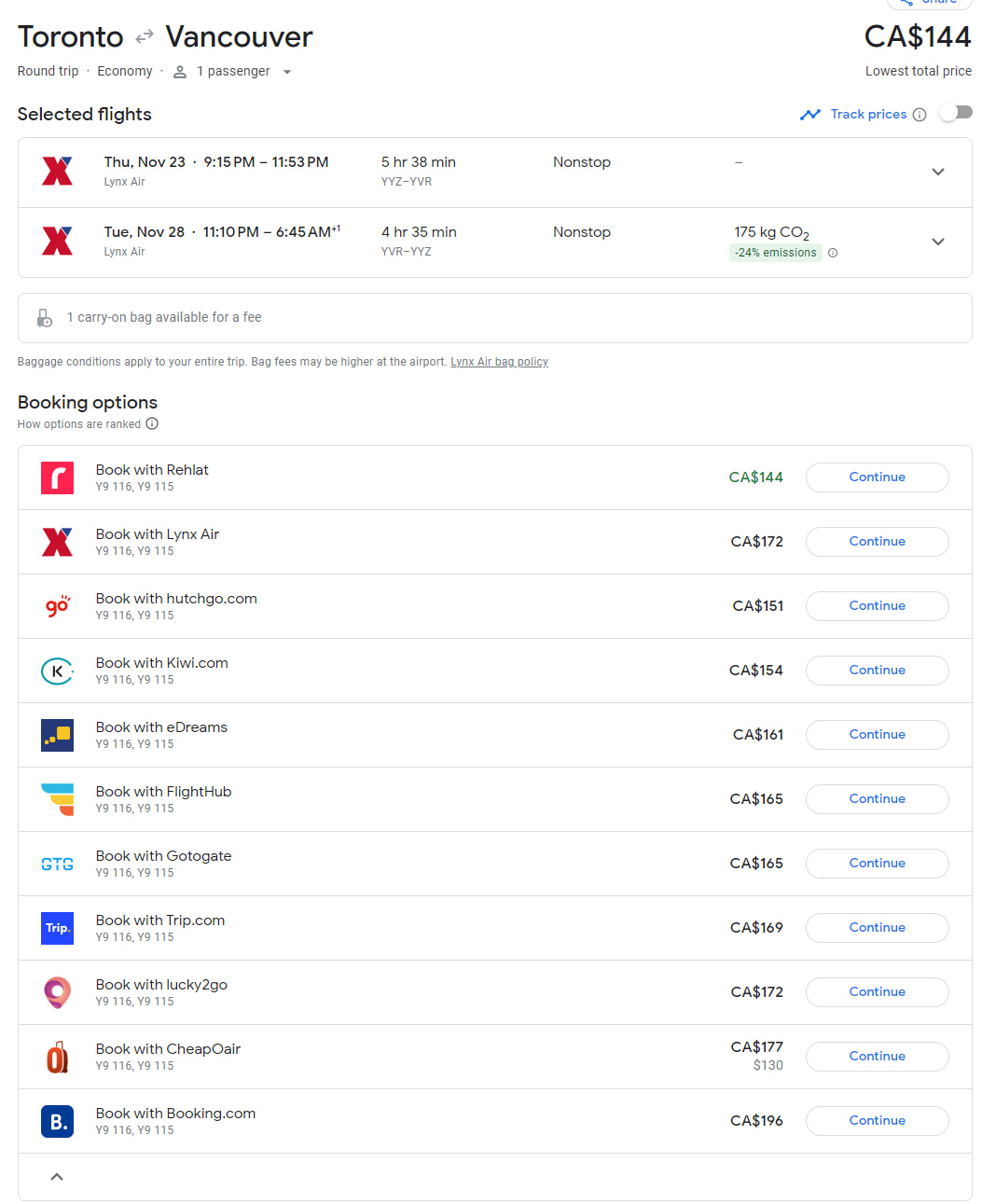

Let's first look at the cheapest option. All of these options were with Lynx. On the next page are the websites you can book this trip with.

Oddly enough, even when choosing between flights offered by one specific airline, you won't always see the airline site itself listed here. For the top Lynx and Flair flights here, neither airline site is listed.

But when I look at Porter, it is there. So this seems to be dependent on the airline.

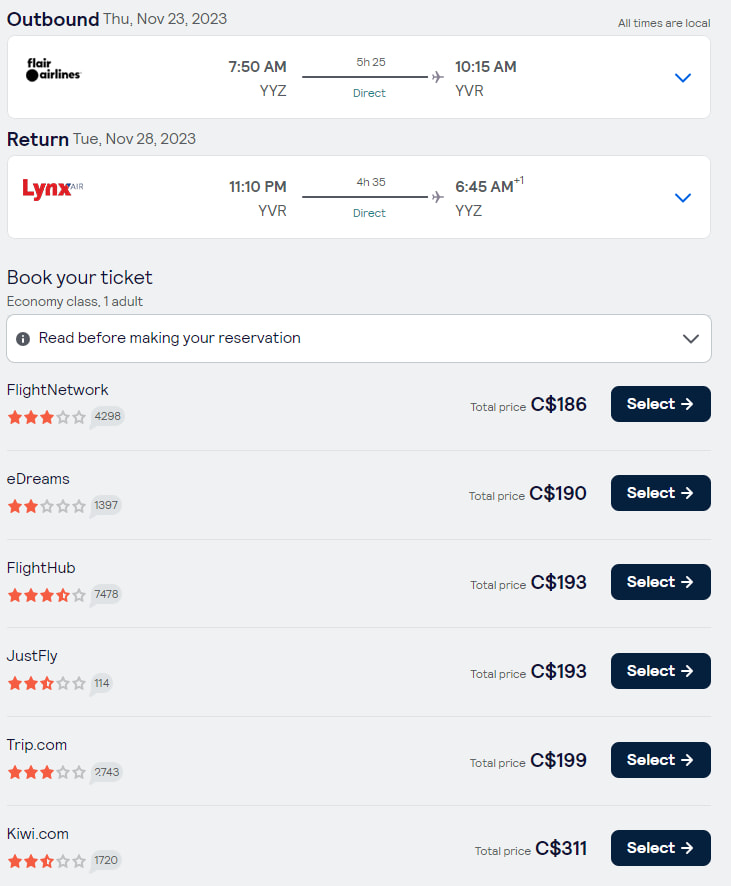

As to what a mixed trip looks like, here's the first set of flights that involved both Lynx and Flair.

Skyscanner will search plenty of sites to find the best price.

Comparison to Google Flights

Google Flights is a very popular search engine for flights. And while it works the same and has a lot of the same features, there are a few differences.

Here's how Google Flights is better and where Skyscanner has a bit of an edge.

Where Google Flights is better

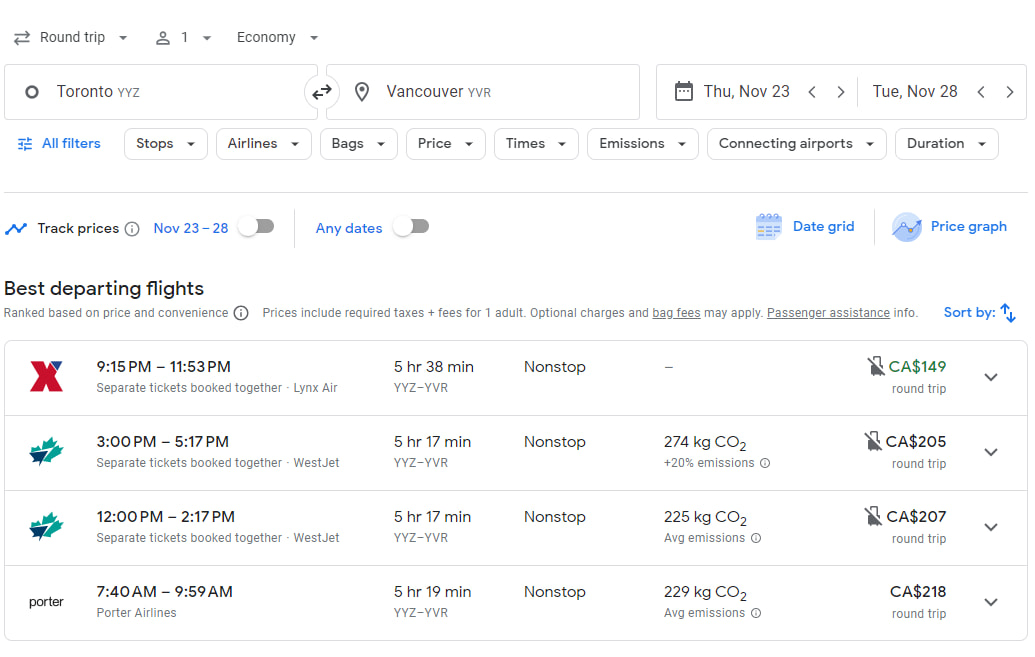

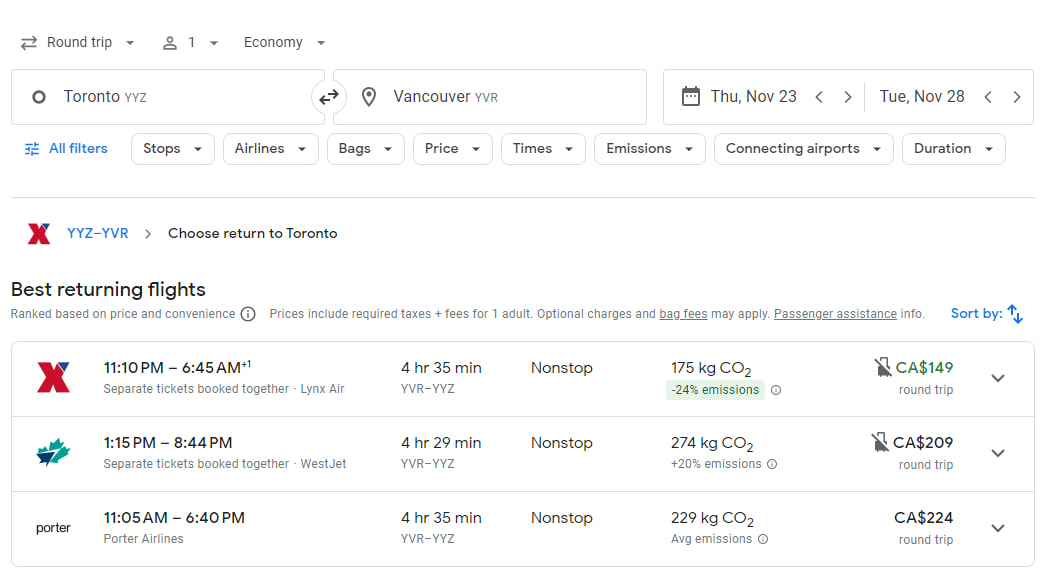

The biggest thing Google Flights does better is allowing you to individually pick your departing and returning flights, whereas Skyscanner just shows both flights at the same time.

Here's our Toronto to Vancouver results, where you pick your departing flight.

And here's the page to pick my return flight.

It's easier than trying to sort through all kinds of combinations or adjusting settings to find the flights that suit you best.

There are also many more booking options with Google for this Lynx round trip flight, including Lynx themselves.

You can also book a mixed airline trip too if a travel provider has it. Here's our Lynx and Flair mixed trip.

When it comes to baggage, Google Flights will also let you know if you can bring a larger carry-on for free.

If you like, you can filter out results where you don't get a free large carry-on.

Google has all the same features otherwise, from a date calendar, tracking prices, and limiting the airlines in your search results.

Where Skyscanner is better

The biggest thing Skyscanner does better is delivering mixed airline itineraries. For our search, most of the results on Skyscanner were for separate airlines, which allows you to look for a better price.

With Google Flights, when you click on one airline, they tend to show the best flights first and usually will point you towards a returning flight with the same airline.

Skyscanner is also more upfront with the total cost of your itinerary. With Google Flights, the price you see on the first flight selection page is simply an estimate – you won't know the actual cost until you go to pick a returning flight.

Other Skyscanner search tools

Flights isn't the only travel search tool that Skyscanner offers. Here are some quick details on there 2 other tools.

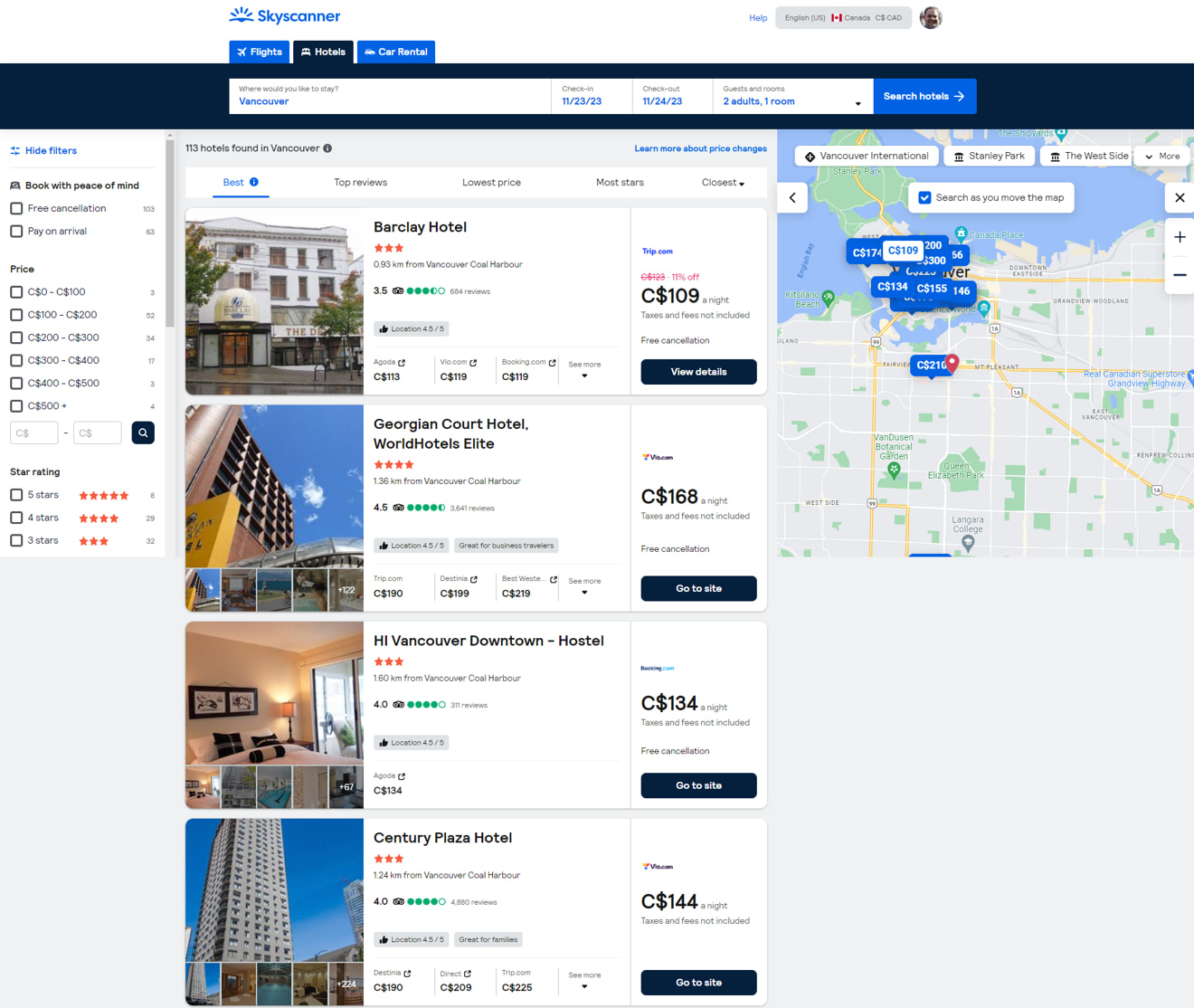

Skyscanner and hotels

Skyscanner is an excellent tool for searching for hotels. Here's an example of the search results for a 1 night stay in Vancouver.

Unlike with flights, you won't be able to see a list of sites to book your hotel. When you click on "Go to site," you'll be taken to the site and will typically be shown a list of hotels for you to look at for the same search you did at Skyscanner.

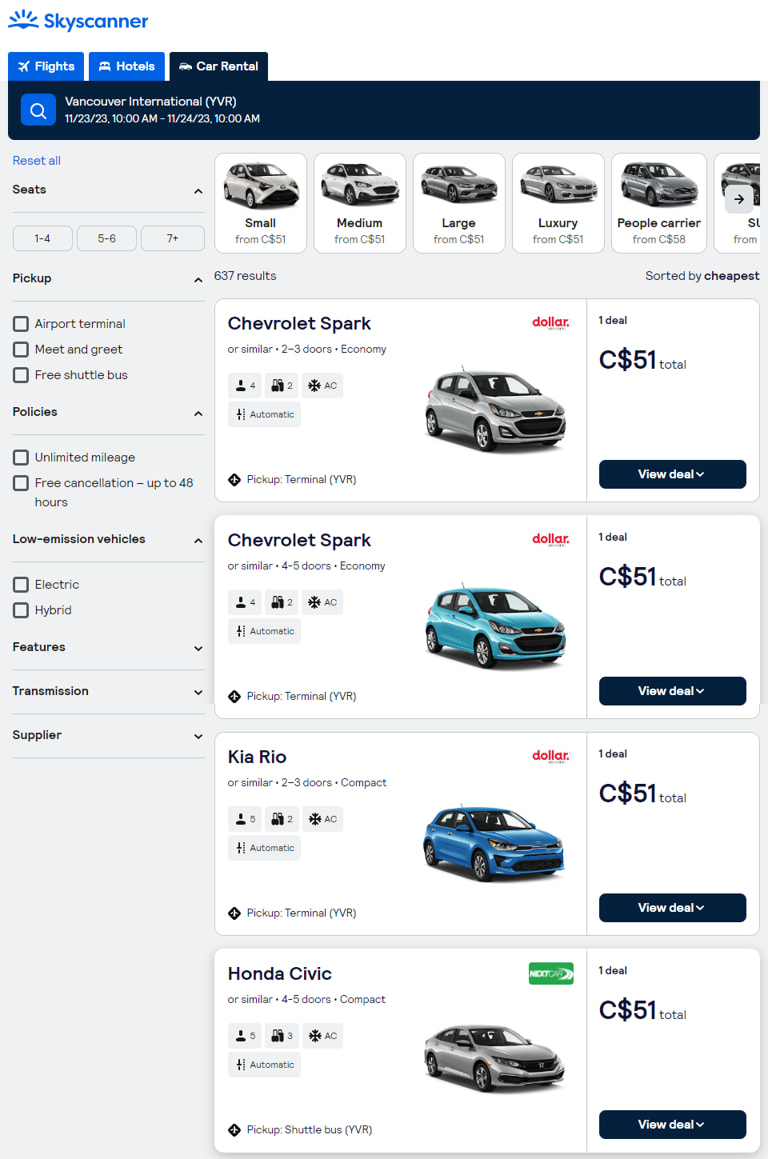

Skyscanner and car rentals

Car rentals is the last area where you can use Skyscanner to compare prices.

Using our hypothetical trip to Vancouver, here are some 1-day car rental prices at Vancouver International airport.

At the top, you can select what size car you want. And on the left, there are plenty of ways to modify the results to better find the car you need.

Best credit cards for free flights

If you want a free flight and don't want to be limited to one airline, a flexible rewards credit card is the key to being able to use your rewards points for any purchase.

With some, you can either use the credit card site or simply charge any booking to your card and use your points to pay for the purchase afterwards, with no loss of point value. Others, however, require you to book through a specific site to get the best value. Or if they do allow any travel booking, your rewards are worth less.

Here are some of your top options (with their sister no fee cards mentioned if that's your preference).

| Credit Card | Welcome Bonus | Earn Rates | Annual Fee, Income Requirements | Apply Now |

|---|---|---|---|---|

| American Express Cobalt Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | * $191.88 * None | Apply Now |

| Scotiabank Gold American Express Card | Up to 45,000 bonus points, first year free (terms) | * 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 5 Scene+ points per $1 spent on groceries, dining, and entertainment * 3 Scene+ points per $1 spent on gas, select streaming services, and transit * 1 Scene+ point per $1 spent on foreign currency purchases * 1 Scene+ point per $1 spent on all other purchases | * $120 * $12K personal | Apply Now |

| MBNA Rewards World Elite Mastercard | 30,000 bonus points (terms) | * 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases | * $120 * $80K personal/$150K household | Apply Now |

| TD First Class Travel Visa Infinite Card | Up to 165,000 bonus points (terms) | * 8 points per $1 spent on travel booked online through Expedia For TD * 6 points per $1 spent on groceries, restaurants, and public transit * 4 points per $1 spent on recurring bill payments, streaming, digital gaming, and media * 2 points per $1 spent on all other purchases | * $139 * $60K personal/$100K household | Apply Now |

| BMO eclipse Visa Infinite Card | Up to 80,000 bonus points, first year free (terms) | * 5 BMO Rewards points for every $1 spent on dining ($6,000 per year), groceries ($6,000 per year), gas, and transit * 1 point per $1 spent on all other purchases | * $120 * $60K personal/$100K household | Apply Now |

| RBC Avion Visa Infinite | 55,000 bonus points (terms) | * 1.25 points per $1 spent on travel * 1 point per $1 spent on all other purchases | * $120 * $60K personal/$100K household | Apply Now |

1. American Express Cobalt Card

The most flexible rewards program is American Express Membership Rewards. And it's one of the reasons the American Express Cobalt Card is the best credit card in Canada.

With Membership Rewards, you can redeem your points in several ways towards a free flight. Each option has a different value for a points as well (also included):

- transfer points to 6 airline partners, including Aeroplan (2 cents per point),

- use the Fixed Points Travel program (1.75 cents per point), and

- redeem points towards any purchase made to the card (1 cent per point).

Plenty of options at your disposal. You can also transfer your points to Marriott and Hilton.

As to what this credit card offers, here's what you'll earn on all your purchases:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

That works out to 81,000 points per year based on a typical $2,000 monthly spending, which can turn into $810 towards any travel booking.

All this for an annual fee of $191.88 that gets charged out as $15.99 per month.

There's also a no fee card that earns Membership Rewards: the American Express Green Card, which offers 1 point per $1 spent on all purchases.

2. Scotiabank Gold American Express Card

The Scene+ program is an excellent choice when it comes to redeeming rewards for free travel. And the best Scene+ credit card is the Scotiabank Gold American Express Card.

You can use the Scene+ Expedia portal and book any travel you can find there.

But if you have a Scene+ credit or debit card, you can also use your points to pay for any travel purchase charged to your card. The only rule is you have to redeem at least 5,000 points.

Either way you choose to use your points for travel, they're worth 1 cent each. And that same value also applies to these redemptions:

- groceries at Sobeys and Safeway,

- any purchase at Cineplex theatres,

- Home Hardware, and

- restaurant bills at Receipe Unlimited restaurants.

So here's what the Scotiabank Gold American Express Card will earn you for Scene+ points everywhere:

- 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 5 Scene+ points per $1 spent on groceries, dining, and entertainment

- 3 Scene+ points per $1 spent on gas, select streaming services, and transit

- 1 Scene+ point per $1 spent on foreign currency purchases

- 1 Scene+ point per $1 spent on all other purchases

Assuming a $2,000 monthly spend, this card will earn you 88,200 points per year, or $882 when used towards any travel purchase.

It also includes these features for a $120 annual fee:

- no foreign exchange fees, and

- 12 types of insurance.

For the no fee crowd, there are a pair of cards you can look at with the Scotiabank American Express Card and the Scotiabank Scene+ Visa Card.

3. MBNA Rewards World Elite Mastercard

MBNA Rewards is another valuable option. Each point is worth 1 cent when redeemed for any travel booked through MBNA Rewards.

But even though you're limited to just making a booking through MBNA Rewards, they do allow price matching on flights and vacation packages to help ensure you're getting a good deal.

And if travel doesn't work out, you can also redeem your points for e-gift cards, which have almost identical value.

The MBNA Rewards World Elite Mastercard is the best MBNA Rewards credit card, offering these earn rates:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

When spending $2,000 per month, that's 102,960 in annual reward points. And there's also the birthday bonus on top of that, where you'll earn 10% bonus points over what you earned in the past year, up to 15,000 points.

Including the birthday bonus, that's $1,133 in annual travel rewards. It has a $120 annual fee and income requirements of either $80,000 personal or $150,000 household.

There's also a no fee MBNA Rewards card in the MBNA Rewards Platinum Plus Mastercard.

4. TD First Class Travel Visa Infinite Card

TD Rewards operates a travel booking portal in conjunction with Expedia, the aptly named Expedia For TD. Using Expedia For TD offers the best value for TD Rewards points at 0.5 cents.

You can redeem your points towards any travel charged to your card, but your value declines 20% to 0.4 cents per point.

And to earn the most points towards free travel, you'll want to use the TD First Class Travel Visa Infinite Card. Here's how many points you can earn on purchases:

- 8 points per $1 spent on travel booked online through Expedia For TD

- 6 points per $1 spent on groceries, restaurants, and public transit

- 4 points per $1 spent on recurring bill payments, streaming, digital gaming, and media

- 2 points per $1 spent on all other purchases

That will give you 139,600 points per year, worth $698 in travel bookings through Expedia For TD.

It also offers its own birthday bonus where you'll get 10% of the points you earned, up to 10,000 bonus points.

On top of that, this card also includes a $100 annual travel credit for use at Expedia For TD. You can only use it on hotel and vacation package bookings, and they need to be at least $500.

If you can use it, that helps offset the $139 annual fee. It also has income requirements of $60,000 personal or $100,000 household.

There is also a no fee TD Rewards card with the TD Rewards Visa Card.

5. BMO eclipse Visa Infinite Card

When it comes to redeeming points for travel with BMO Rewards, you can only use them towards travel bookings made with their card. You'll have complete freedom to book anything you want.

To earn the most points, you'll want to get the BMO eclipse Visa Infinite Card. Here's what this will earn you for points on all your purchases:

- 5 BMO Rewards points for every $1 spent on dining ($6,000 per year), groceries ($6,000 per year), gas, and transit

- 1 point per $1 spent on all other purchases

That gives you 85,200 points per year. With each point worth 0.67 cents when redeemed for travel, that's $571 travel rewards per year.

And it offers these 2 unique benefits:

- annual $50 lifestyle credit, and

- 10% bonus points when you add an authorized user.

All this for an annual fee of $120 and income requirements of either $60,000 personal or $100,000 household.

6. RBC Avion Visa Infinite

Our last credit card we'll review is the RBC Avion Visa Infinite. A part of the Elite tier in Avion Rewards, you get several options to redeem your points for travel, including how much they're worth:

- transfer points to WestJet (1 cent),

- Air Travel Redemption Schedule (2.33 cents),

- transfer points to 3 other airlines including British Airways (1.75 cents), and

- any travel through RBC Rewards (1 cent).

With the RBC Avion Visa Infinite, here's what you earn for points:

- 1.25 points per $1 spent on travel

- 1 point per $1 spent on all other purchases

That works out to 36,450 points per year, or $364.5 per year in any travel rewards.

This card has a $120 annual fee and $60,000 personal or $100,000 household income requirements.

Unfortunately, there aren't any no fee Avion cards. The closest option is the RBC ION Visa but it doesn't offer all of the travel options above, just transfers to WestJet or travel bookings.

Your experiences with Skyscanner

Skyscanner is a popular tool to use to find a better deal on flights.

What experiences do you have with Skyscanner?

Share them with everyone in the comments below.

FAQ

What is Skyscanner?

Skyscanner is simply a search engine for flights, car rentals, and hotels. You'll be able to find the lowest prices for flights from many different providers.

Is Skyscanner legit?

Skyscanner is a legitimate website, but it's just a search tool. You don't make any bookings with Skyscanner, they simply refer you to another site to actually make your booking.

What can you book through Skyscanner?

You don't make any bookings with Skyscanner, they are simply a comparison and search tool. However, you can search for the following:

- flights,

- hotels, and

- car rentals.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.