We’ll start by saying there’s no single best program since it depends on where you shop and what you want from a rewards program. According to our research, the McDonald’s rewards program offers the most value – but VIPorter offers excellent return in the travel space, Amex Membership Rewards are some of the most flexible rewards, and the GeniusCash app offers big cash bonuses and up to 1% extra cash back that you can earn on top of other credit card rewards.

To help you find the best rewards program for you, we’ve researched 20+ programs in Canada and listed the best ones for specific categories. Take a look at the rewards summary table and read on to learn how you earn and use your points.

Key Takeaways

- In terms of return, the most valuable rewards program in Canada is McDonald's Rewards.

- Other top rewards programs in Canada include Aeroplan, Marriott Bonvoy, VIPorter, and Amex Membership Rewards.

- The GeniusCash app is a unique rewards program that offers up to 1% cash back on top of your existing rewards earn, plus big cash back bonuses of up to $250 each.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Best loyalty and rewards programs in Canada

We’ve broken down 20 different rewards programs based on their earn rates – from highest to lowest – and McDonald’s came out on top with nearly double the average earn rate than the second-place winner, Marriott Bonvoy.

To get the average earn rate, we used the primary way you can earn points. Some programs allow you to earn points in store and with a credit card, but we’ve only considered the in-store points. This means that you may be able to earn significantly more with a co-branded credit card.

| Rewards program | Best for… | Average value of 1 point | Primary ways to earn rewards | Average earn rate |

|---|---|---|---|---|

| McDonald's Rewards | Food | 0.13 cents | * McDonald's | 12.60% |

| VIPorter | Flights | 1.5 cents | * Flights * Credit cards | 7.5% |

| Marriott Bonvoy | Hotels | 0.97 cents | * Marriott Hotels * Credit card | 6.79% |

| Tims Rewards | Food | 0.66 cents | * Tim Hortons * Credit card | 6.60% |

| Aeroplan | Flights | 2 cents | * Air Canada * Star Alliance airlines * Credit cards | 4.00% |

| American Express Membership Rewards | Any Travel | 2 cents | * Credit cards | 4.00% |

| CIBC Rewards | Flights | 2.29 cents | * Credit cards | 3.44% |

| RBC Rewards | Flights | 2.33 cents | * Credit cards | 2.33% |

| MBNA Rewards | Any Travel | 1 cent | * Credit cards | 2.00% |

| Desjardins BONUSDOLLARS | Travel Or Cash | $1 | * Credit cards | 2.00% |

| National Bank À La Carte Rewards | Flights and Vacation Packages | 1 cent | * Credit cards | 2.00% |

| Journie Rewards | Gas | 1.88 cents | * Gas | 1.88% |

| TD Rewards | Any Travel | 0.5 cents | * Credit cards | 1.50% |

| BMO Rewards | Any Travel | 0.67 cents | * Credit cards | 1.34% |

| Scene+ | Travel, Groceries, Movie Tickets | 1 cent | * Sobeys & Safeway * Cineplex * Scene+ Travel * Recipe Unlimited Restaurants * Home Hardware * Credit cards | 1.00% |

| PC Optimum | Groceries & Gas | 0.1 cent | * Credit cards | 1.00% |

| Air Miles | Travel | 12.7 cents | * Credit cards | 0.64% |

| WestJet Rewards | Flights | 1 cent | * WestJet * Credit cards | 0.50% |

| More Rewards | Travel | 0.42 cents | * Save-On-Foods | 0.42% |

| Canadian Tire Triangle Rewards | Merchandise | 4 cents | * Canadian Tire * Credit cards | 0.400% |

1. McDonald's Rewards

Average earn rate: 12.6%

Best for: Food

Ways to earn: McDonald’s purchases

It may be surprising but McDonald's Rewards is one of the most valuable rewards programs in Canada.

The points themselves aren't worth very much – a paltry 0.126 cents each when you get a free coffee (points are worth less for other menu items). But considering you can earn 100 of them for every $1 spent, it's an amazing return of up to 12.6%.

The only way to earn McDonald's Rewards is by purchasing food at McDonald's restaurants. You earn 100 points per $1 spent on your food purchases, with special bonuses available from time to time to earn even more.

2. VIPorter

Average earn rate: 7.5% Best for: Flights Ways to earn: Flights, credit cards

Porter frequent flyers will appreciate the airline’s streamlined rewards program. Earning points is simple: get rewards points by flying with Porter or using a co-branded Porter credit card. While you can only redeem your VIPorter points for travel, you can choose from routes with Porter, Alaska Airlines, and Air Transat. Plus, your VIPorter membership comes with unique perks and benefits based on your membership level.

The best card of the two VIPorter-branded credit card options is the BMO VIPorter World Elite Mastercard, which will earn you up to 4.5% back in Porter points (and give you fantastic World Elite Mastercard benefits).

3. Marriott Bonvoy

Average earn rate: 6.79%

Best for: Hotel stays

Ways to earn: Marriott hotel stays, credit cards

The best hotel rewards program in the world is Marriott Bonvoy, which has an average return of 0.97 cents per point. While this return rate is average, you can easily earn lots of points.

- You'll earn 10 points per U.S. dollar spent on your hotel stays, excluding taxes and fees.

- Factoring in the exchange rate, you'll earn around 7 points per $1 spent when you stay at Marriott hotels, for a 6.79% return on your spending.

You can also earn Marriott points with the Marriott Bonvoy American Express Card at rates of:

- 5 points per $1 spent at Marriott properties

- 2 points per $1 spent on all other purchases

Plus, it comes with an annual free night certificate worth 35,000 points and automatic Silver Elite status.

4. Tims Rewards

Average earn rate: 6.6%

Best for: Food

Ways to earn: Tim Hortons, credit cards

If you like starting your morning with coffee and timbits, the Tim Hortons rewards program will offer you points worth 0.66 cents each. You'll get 10 points for every $1 spent at Tims, giving you a return of up to 6.6% on your purchases.

You can supercharge your rewards by getting the Tims Mastercard, which gets you an extra 5 points per $1 spent at Tim Hortons. Unfortunately, you won’t earn rewards anywhere else.

5. Aeroplan

Average earn rate: 4%

Best for: Flights

Ways to earn: Air Canada, Star Alliance airlines, credit cards

Aeroplan is Canada's largest airline rewards program. You can use your points to fly not only on Air Canada, but just about any Star Alliance carrier. Our valuation of a single Aeroplan point is 2 cents each.

You earn points for flights based on how far you fly in miles, which is multiplied by a factor based on your fare class. For a standard fare, you’ll earn 25% or 50% of the miles flown domestically or internationally.

You can also earn points on Aeroplan credit cards. The best credit card is the TD Aeroplan Visa Infinite Card, which offers up to 1.5 points per $1 spent on purchases. Plus it includes benefits like free checked bags on Air Canada flights and preferred pricing on reward flights.

6. American Express Membership Rewards

Average earn rate: 4%

Best for: Any travel

Ways to earn: Credit cards

American Express Membership Rewards is a credit card-only rewards program. The points are very valuable, and the card has flexible earning and redemption options.

For the best value, transfer them to one of the 6 available airline programs – one of which is Aeroplan. Since these points transfer 1:1 to Aeroplan, we’re giving each Amex point a value of 2 cents each.

You also have these options at your disposal for travel, with the maximum point value (in cents per point, or CPP) for each:

- Fixed Points Travel Program: 1.75 CPP

- Transfer points 5:6 to Marriott: 1.16 CPP

- Redeem for any purchase: 1 CPP

To earn rewards, you can use one of 4 credit cards, which average 2 points for every $1 spent. To maximize your points, use the American Express Cobalt Card, which earns points at the following rates:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

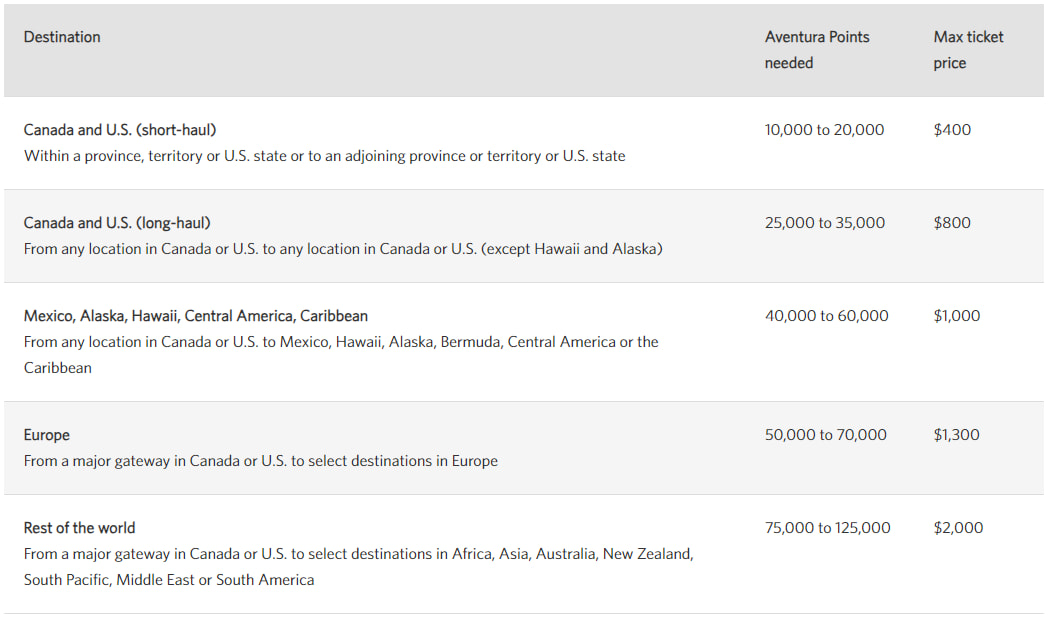

7. CIBC Aventura Rewards

Average earn rate: 3.44%

Best for: Flights

Ways to earn: Credit cards

CIBC's rewards program, Aventura Rewards, offers 2 ways to use your points for travel. The best value can be found using the Air Travel Redemption chart.

A long haul flight will provide value at up to 2.29 cents per point. You can also redeem for any travel from CIBC Rewards, where each point is worth 1 cent.

The only way to earn CIBC Rewards is with a credit card. The earn rates vary from just under 1 point per $1 spent up to 3 points per $1 spent. A good average would be 1.5 points per $1 spent, which gives a 3.44% return on your spending.

Although you have card options, the best of the bunch is the CIBC Aventura Visa Infinite Card, where you can earn up to 2 CIBC points per $1 spent and get perks like 4 free airport lounge passes per year.

8. RBC Avion Rewards

Average earn rate: 2.33%

Best for: Flights

Ways to earn: Credit cards

RBC's own Avion rewards program offers a few ways to use your points, but only for Avion cardholders in the elite tier. In this tier, you can transfer your points to 4 airline programs (including WestJet) and redeem points towards travel booked through RBC Rewards.

The best way to use them, though, is through the airline travel rewards chart. You can use points to cover the base airfare to a zone.

The best value you can extract is up to 2.33 cents per point.

If you're not in the Elite tier, you'll only be able to transfer points to WestJet or redeem for any travel from RBC Rewards.

Most RBC Rewards cards earn 1 point per $1 spent on purchases. The best Avion card is the RBC Avion Visa Infinite, earning 1 point per $1 spent everywhere and a 25% bonus on travel purchases.

9. MBNA Rewards

Average earn rate: 2%

Best for: Any travel

Ways to earn: Credit cards

Another bank offers a very flexible rewards program: MBNA Rewards. The best way to use points is by booking travel through MBNA Rewards, where each point is worth 1 cent. Or, you can redeem them for a wide selection of e-gift cards, which give a near identical value of 0.99 cents per point.

There are 2 cards that earn MBNA Rewards points, giving you up to 5 points per $1 spent, with 2 points being a good all-round average.

You'll earn the most points with the MBNA Rewards World Elite Mastercard:

- 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category)

- 1 point per $1 spent on all other purchases

On top of that, you'll get 10% bonus points every year on your birthday, up to a maximum bonus of 15,000 points.

10. Desjardins BONUSDOLLARS

Average earn rate: 2%

Best for: Travel or cash

Ways to earn: Credit cards

Desjardins BONUSDOLLARS give you a variety of ways to redeem your rewards, all with the same value where 1 BONUSDOLLAR equals an actual dollar. You can use those rewards towards gift cards, select purchases on your Desjardins credit card, and Desjardins financial products.

Desjardins BONUSDOLLARS is a credit card-only rewards program. The best card is the Desjardins Odyssey World Elite Mastercard, which will earn you up to 3% back in BONUSDOLLARS on all your purchases.

11. National Bank À La Carte Rewards

Average earn rate: 2%

Best for: Flights and vacation packages

Ways to earn: Credit cards

National Bank operates an in-house rewards program called À La Carte Rewards. You can redeem points for travel through National Bank's travel site, which is powered by Air Transat, for a value of 1 cent each.

Alternatively, you can redeem points towards any travel charged to your National Bank rewards card – but the points are only worth 0.83 cents each that way.

To earn the most À La Carte Rewards, the National Bank World Elite Mastercard offers up to 5 points per $1 spent, and comes with an annual $150 credit that you can use towards travel expenses like baggage fees and airport parking.

12. Journie Rewards

Average earn rate: 1.88%

Best for: Gas

Ways to earn: Gas

Journie Rewards is the rewards program for several gas stations in Canada: Ultramar, Fas Gas, Pioneer, and Chevron. With Journie Rewards, you'll earn 1 point per litre of fuel purchased and 2 points per $1 spent on car washes and convenience store purchases.

There are 3 tiers to the Journie Rewards:

Overall, you'll spend about $480 to save $9 – a return of 1.88% or 0.03 cents per point.

If you opt to collect Aeroplan points instead of getting fuel savings, you can earn 1 point per $3 spent on fuel. If you link your Aeroplan and Journie Rewards accounts, you'll replace the last tier with getting 300 Aeroplan points.

13. TD Rewards

Average earn rate: 1.5%

Best for: Any travel

Ways to earn: Credit cards

If you bank with TD, chances are you’ve come across its TD Rewards program. To earn TD points, make purchases with 1 of 4 TD Rewards credit cards and take advantage of the many bonus opportunities that pop up.

We’ll warn you in advance: TD Rewards points don’t offer a lot of value. Travel is typically your best redemption option – specifically, booking travel through Expedia For TD gives you the highest point value of 0.5.

Cardholders who don’t travel much might redeem points on Amazon.ca (which gives you 0.33 CPP) or through the TD Rewards shopping platform (for 0.27 CPP). You can also redeem the points for cash, but for only half the value of the Expedia travel option.

Fortunately, it’s easy to quickly rack up TD Rewards points, especially if you reach for the TD First Class Travel Visa Infinite Card. Not only can you earn up to 8 points per $1 spent on purchases, but it also comes with a $100 travel credit for Expedia For TD, which you can apply to hotel and vacation package bookings of more than $500.

14. BMO Rewards

Average earn rate: 1.34%

Best for: Any travel

Ways to earn: Credit cards

If you’re a BMO credit cardholder, it’s easy to start earning BMO Rewards points. We found that the BMO eclipse Visa Infinite Card will earn you the most points, with up to 5 points per $1 spent on essentials like gas and groceries. Plus, it comes with an annual $50 lifestyle credit and the ability to earn 10% bonus points when you add an authorized user.

Although travel gives you the most value for your points, you have lots of flexible redemption options. You can put your points towards travel bookings, statement credits, gift cards, investment rewards with BMO, and merchandise rewards (including Apple).

15. Scene+

Average earn rate: 1%

Best for: Travel, groceries, movie tickets

Ways to earn: Sobeys & Safeway, Cineplex, Scene+ travel, Recipe Unlimited restaurants, Home Hardware, credit cards

Scene+ has quickly become one of the best flexible rewards programs due to its high number of equally valuable redemption options and places you can earn them just by shopping.

You can earn points through personalized offers (like at Sobeys and Safeway) or a per-dollar rate (at Cineplex, Expedia through Scene+, Home Hardware, and Recipe Unlimited restaurants). When you redeem your points, they're worth 1 cent each, and you can get that value in the following ways:

- Any travel

- Sobeys or Safeway

- Cineplex

- Home Hardware

- Recipe Unlimited restaurants

You can also earn Scene+ points everywhere with Scene+ credit cards issued by Scotiabank. There are 5 personal cards to choose from but you'll earn the most points with the Scotiabank Gold American Express Card.

- 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 5 Scene+ points per $1 spent on groceries, dining, and entertainment

- 3 Scene+ points per $1 spent on gas, select streaming services, and transit

- 1 Scene+ point per $1 spent on foreign currency purchases

- 1 Scene+ point per $1 spent on all other purchases

It's a full-featured card with 12 types of insurance and a special bonus – no foreign exchange fees – for a standard $120 annual fee.

16. PC Optimum

Average earn rate: 1%

Best for: Groceries and gas

Ways to earn: Credit cards

PC Optimum is the rewards program of Canada's largest grocer (Loblaws) but extends to other places as well. You can earn points:

- On personalized offers at Loblaws stores

- At Shoppers Drug Mart – 15 points per $1 spent

- While filling up at Esso stations – 10 points per litre or $1 spent in the convenience store

When you’re ready to redeem your points, you've got a few options:

- 10,000 points = $10 off your bill at Loblaws and Shoppers Drug Mart

- 4,000 points = 10¢ off per litre on up to 40 litres at Esso gas stations

- 10,000 points = a free car wash of any kind at Esso car washes

If you want to earn even more points, apply for a PC Financial Mastercard. There are 4 cards to choose from – 3 of which have no annual fee.

17. Air Miles

Average earn rate: 0.64%

Best for: Travel

Ways to earn: Credit cards

Air Miles have a typical earn rate of 1 Air Mile per $20 spent. This can vary, and many partners offer bonuses from time to time so that you can earn even more.

When redeeming your miles, travel is your best bet. Car rentals, specifically, provide the best average value, with flights and cash miles as your next best options.

You can also boost your Air Miles bank with an Air Miles credit card. The BMO AIR MILES World Elite Mastercard will help you make the most of your miles. You’ll earn:

- 1 Mile for every $12 spent

- 3x the Miles for every $12 at participating Air Miles partners

- 2x the Miles for every $12 spent at any eligible grocery, liquor, and wholesale stores

Once per year, you can save 25% of the cost of an Air Miles reward flight up to a maximum of 750 miles saved. Using them for flights makes every mile you collect more valuable. Plus, you’ll get an excellent insurance package with 14 types of coverage included.

18. WestJet Rewards

Average earn rate: 0.5%

Best for: Flights

Ways to earn: WestJet and partner flights, credit cards

WestJet operates WestJet Rewards, through which you earn WestJet dollars on base spend for air travel and vacation packages (that is, not including taxes and fees). You can also earn WestJet dollars with a few of their partners, including Delta, Air France, and KLM.

At the lowest tier, you'll earn 0.5% back in WestJet dollars. Frequent WestJet flyers can earn up to 8% back.

A WestJet dollar is worth the same as a real dollar. You can use them to book flights with WestJet or partners, but WestJet dollars can only be used to pay for base airfares or vacation packages. You always have to pay the taxes and fees.

WestJet also has its own lineup of credit cards issued by RBC. The WestJet RBC World Elite Mastercard will get you the most rewards and benefits:

- 2 WestJet points per $1 spent on WestJet or WestJet Vacations purchases

- 2 WestJet points per $1 spent on groceries, gas, EV charging, public transit and rideshare

- 1.5 WestJet point per $1 spent on all other everyday purchases

It also comes with an annual companion voucher and free first checked bags on WestJet flights.

19. More Rewards

Average earn rate: 0.42%

Best for: Travel

Ways to earn: Save-On-Foods

If you live in Western Canada, More Rewards is the rewards program for Save-On-Foods. It earns 1 point per $1 spent on all purchases, plus bonus points on select products. You'll also earn 1 point per $1 spent at these retailers:

- Coast Hotels

- Speedy Glass

- Accent Inns

- Jim Pattison Auto Group

- Panago Pizza

- More Rewards Travel

If you want to get the most out of your points, redeem them for travel through the More Rewards travel portal. That way, they're worth 0.42 cents each.

20. Triangle Rewards

Average earn rate: 0.4%

Best for: Merchandise

Ways to earn: Canadian Tire, credit cards

Canadian Tire's all-digital rewards program, Triangle Rewards, is worth 0.4% back in Canadian Tire Money, where each dollar is worth the same as a regular dollar.

It's not a lot, but Canadian Tire is full of big promotions where you can earn up to 30x the Canadian Tire Money on select days and specific products. Canadian Tire also has a paid membership program called Triangle Select, where you can earn 10x the rewards on every purchase.

Canadian Tire issues a pair of Triangle Mastercards, which help you earn even more rewards at the store.

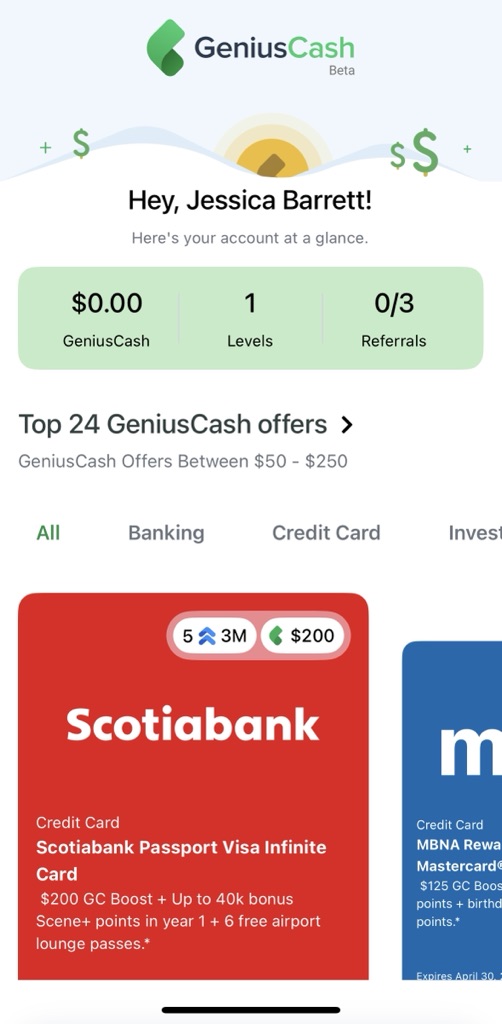

BONUS: GeniusCash

Average earn rate: Up to 1%

Best for: Cash back

Ways to earn: Connected card spending; GeniusCash Offers on creditcardGenius, moneyGenius, or the GeniusCash app

GeniusCash by moneyGenius is a unique rewards program that boosts your existing credit card rewards with up to 1% extra cash back and exclusive Offers worth up to $250 each.

Once you securely connect your cards, Max analysis will provide personalized recommendations that help you increase your rewards return. GeniusCash Quests do double duty, levelling up your financial knowledge and earning you GeniusCoins that you can use to level up your bonus cash back.

GeniusCash has become synonymous with big cash bonuses, but the app now contains exclusive Offers that aren’t available anywhere else. See an Offer you love, apply through the app, get approved, and get a cash payout of up to $250 – it’s that simple.

The GeniusCash app is free to use and available for download from the App Store and Google Play.

FAQ

What are the best reward programs in Canada?

The best reward program for you depends on what rewards you’re looking for. Overall, we think Aeroplan, McDonald’s Rewards, Marriott Bonvoy, and Amex Membership Rewards are some of the best programs since they offer competitive earn rates and great redemption options.

What are the types of loyalty programs?

Loyalty programs usually reward you for shopping or getting services from a certain retailer. You might earn discounts, earn points faster, or get cash back for purchases made at the retailer. Some provide a combination of these perks.

What is the biggest loyalty program in Canada?

Aeroplan is currently the biggest loyalty program in Canada. This means you have multiple ways to earn points and participate in the program.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 14 comments