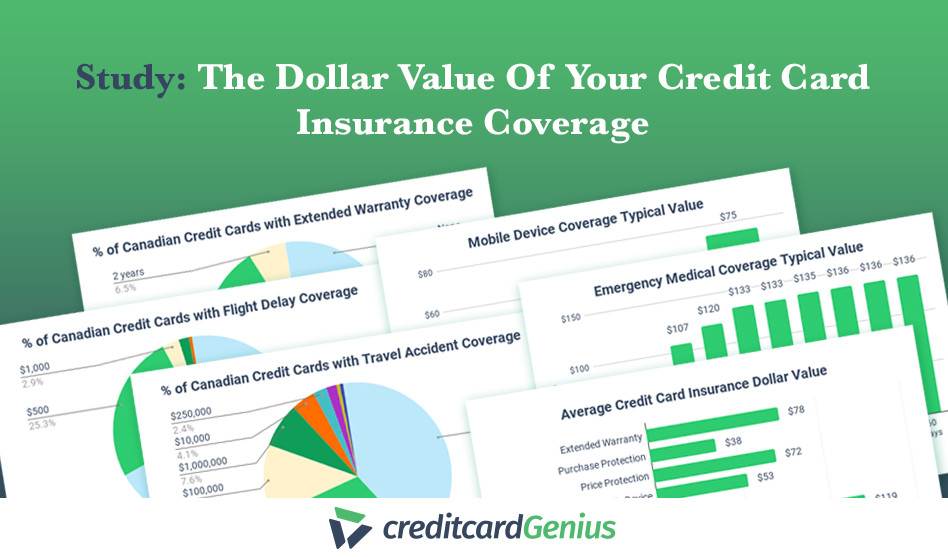

When most people think of credit card insurance, they automatically consider purchase protection, but did you know your credit card can have over a dozen incredible useful types of insurance?

While even the most basic card usually has some form of extended warranty coverage or purchase protection, some cards offer trip coverage, medical coverage, mobile device protection, and more.

We’re breaking down the different types of credit card insurance coverage to help you understand what to look for if you’re applying for a new card.

Want the full list of these 17 types of credit card insurance all in one page?

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What types of credit card insurance coverage can you get?

When it comes to the insurance coverage you get with your credit card, there are a variety of types and limitations. Take a look:

| Insurance coverage | Top credit card | Why? |

|---|---|---|

| Extended warranty | National Bank World Elite Mastercard | Offers longest coverage – up to 2 years (terms) |

| Purchase protection | National Bank World Elite Mastercard | Offers longest coverage – 180 days (terms) |

| Price protection | MBNA Rewards World Elite Mastercard | One of the few cards that offers it (terms) |

| Mobile device insurance | Tangerine Money-Back World Mastercard | Rare card that offers this coverage for no annual fee (terms) |

| Event ticket cancellation | Brim World Elite Mastercard | One of the rare cards that offers it (terms) |

| Emergency medical | National Bank World Elite Mastercard | Offers longest coverage – 60 days (terms) |

| Emergency medical over 65 | Scotiabank Passport Visa Infinite Card | Offers coverage for anyone over 75 as well (terms) |

| Travel accident | MBNA Rewards World Elite Mastercard | Offers the highest coverage – $1,000,000 (terms) |

| Trip cancellation | National Bank World Elite Mastercard | Offers the highest coverage – $2,500 (terms) |

| Trip interruption | National Bank World Elite Mastercard | Offers the highest coverage – $5,000 (terms) |

| Flight delay | Desjardins Odyssey World Elite Mastercard | Offers the highest coverage – $2,000 |

| Baggage delay | Scotiabank Gold American Express Card | Offers the highest coverage – $1,000 (terms) |

| Lost or stolen baggage | RBC Avion Visa Infinite Privilege | Offers the highest coverage – $2,500 |

| Personal effects | BMO AIR MILES World Elite Mastercard | Offers the highest coverage – $750 (terms) |

| Hotel burglary | RBC Avion Visa Infinite Privilege | Offers the highest coverage – $3,000 |

| Rental car theft and damage | American Express Cobalt Card | Offers the highest coverage – $85,000 (terms) |

| Rental car accident | BMO AIR MILES World Elite Mastercard | Offers the highest coverage – $200,000 (terms) |

| Rental car personal effects | BMO AIR MILES World Elite Mastercard | Offers the highest coverage – $1,000 (terms) |

Extended warranty

What it is: An extra (extended) warranty that kicks in once the manufacturer warranty has expired. Most credit cards on the market will double the original manufacturer’s warranty length up to a maximum of 1 to 2 extra years, depending on the card.

Things to note: Our credit card pick triples the extended warranty offered by the manufacturer, up to 2 years. You should also check the coverage limit per claim. Most credit cards come with $10,000 extended warranty, but this amount can vary.

Keep in mind that if the original warranty was only 30 days, then you will be limited to 30 extra days for a total of 60 days with the warranty doubling. You will only get the full extra year if the original coverage is at least a year to begin with.

Our top credit card pick: National Bank World Elite Mastercard

Purchase protection

What it is: Purchase protection covers your purchases in the event that they are lost, stolen, or damaged. The coverage typically lasts for 90 days after you put the full cost of the purchase on your card, with a select few cards stretching it as far as 180 days after purchase. Almost all credit cards offer either extended warranty, purchase protection, or both.

Things to note: Credit card issuers usually place a limit on how much purchase protection you’ll get. Check your card’s purchase protection limit before making a big purchase to ensure it will be covered.

Our top credit card pick: National Bank World Elite Mastercard

Price protection

What it is: Price protection coverage will reimburse you the difference in price if something you purchase goes on sale for a predetermined amount of time after you make the purchase.

You just need to purchase the item on your card and then prove it is for sale at the same store or somewhere else for a lower price.

Things to note: There is usually either an annual limit or a lifetime limit on the amount you can claim. Food and other perishable items are also normally excluded.

Our top credit card pick: MBNA Rewards World Elite Mastercard

Mobile device insurance

What it is: Some cards come with automatic insurance that will cover your mobile phone or tablet against being lost, stolen, or damaged. This is a rare type of credit card insurance, so you may not want to assume that your devices are covered until you’ve read your card’s certificate of insurance.

Things to note: Although mobile device sounds useful, it’s often not quite as good as it sounds because the amount you are covered for is reduced according to the age of your device. That said, it’s still better than nothing if you have to replace your phone or tablet.

Our top credit card pick: Tangerine Money-Back World Mastercard

Learn more: Which credit cards offer mobile phone insurance in Canada?

Event ticket cancellation

What it is: If you hold a ticket to a sporting event, theatre show or concert, you can be reimbursed up to either the cost of your tickets or the maximum coverage amount (whichever is less) if you can't attend for a covered reason.

Like most coverages, you'll need to charge the full cost of your tickets to the credit card for coverage to take effect.

Things to note: Event ticket cancellation might be the rarest of all insurance types. Currently, only Brim Financial cards carry this insurance. All of their cards offer $1,000 in coverage.

Our top credit card pick: Brim World Elite Mastercard

Emergency medical

What it is: One of the most important types of insurance to have is emergency medical, which ensures your medical bills are covered if you get sick or injured when traveling. In most cases, medicare will no longer apply and your work health plan may or may not cover you for travel. Emergency medical policy covers you during a qualifying trip.

Things to note: Most cards offer 15 to 50 days of coverage up to 60 days, but only if you’re under 65.

Our top credit card pick: National Bank World Elite Mastercard

Emergency medical over 65

What it is: If you’re a senior, you’ll need to look for credit cards that offer medical coverage to seniors since most credit cards only extend coverage to cardholders under 65. Read through your card’s insurance carefully because some cards offer coverage to seniors but at greatly reduced terms.

Things to note: It’s rare to find a card that includes medical coverage for cardholders over 65 years old, but it’s not impossible. We’ve put together a list of the best credit card insurance for seniors in this age range.

Our top credit card pick: Scotiabank Passport Visa Infinite Card

Travel accident

What it is: If you suffer dismemberment or loss of life while traveling on a common carrier like a plane or a train, you or your family can receive a large lump sum payout. This is sometimes called accidental death and dismemberment coverage.

Things to note: Some cards cover you for up to $1 million in travel accident insurance but it does range heavily depending on the type of accident and which card you choose. Be sure to read the fine print.

Our top credit card pick: MBNA Rewards World Elite Mastercard

Trip cancellation

What it is: If you are forced to cancel your travel plans for a list of approved emergency reasons (like illness, a death, or natural disaster), then trip cancellation insurance can reimburse you for the non-refundable prepayments you’ve already made.

Things to note: Trip cancellation coverage is even rarer than emergency medical and limits are usually quite low, often capping out at $1,500 or less. When you’re in a bind, though, it’s way better than nothing.

Our top credit card pick: National Bank World Elite Mastercard

Trip interruption

What it is: If an approved emergency pops up and you need to cut your trip short, trip interruption insurance pays for the expenses to return home and reimburses you for travel you haven’t yet completed.

Things to note: Trip interruption insurance is more common than trip cancellation insurance, but it works similarly, covering your expenses up to a predetermined limit.

Our top credit card pick: National Bank World Elite Mastercard

Flight delay

What it is: If your flight is delayed for more than a predetermined amount of hours, your card will cover you (and maybe your traveling companions) for some food, lodging, and personal items you may need to purchase to stay comfortable during the delay.

Things to note: Coverage maxes out at $2,000 but is most commonly set to $500, if it is available at all. In some cases, coverage is shared across baggage delay and lost or stolen baggage coverage, as well, and can be spread across a period of multiple days.

Our top credit card pick: Desjardins Odyssey World Elite Mastercard

Baggage delay

What it is: If your baggage is delayed for a predetermined amount of time, your card will give you some money to pick up some clothes and necessities to help you get by until your baggage is returned to you.

Things to note: Coverage here tends to cap out at $1,000, again with $500 being the norm – but it’s a fair bit more common than flight delay coverage.

Our top credit card pick: Scotiabank Gold American Express Card

Lost or stolen baggage

What it is: In the event that your baggage is not just delayed but lost or stolen, this insurance will cover the cost of replacing its contents. This amount could fall anywhere between $300 and $2,500 per person, but $500 is what you should expect from most cards.

Things to note: Keep in mind that you can probably use baggage delay as a substitute for lost or stolen baggage coverage if your card has one and not the other.

In addition, most airlines have their own policies for reimbursing you if your luggage is lost or stolen, so check in with them. If you had expensive items in your luggage, you may be able to combine coverage from both.

Our top credit card pick: RBC Avion Visa Infinite Privilege

Personal effects

What it is: Personal effects coverage reimburses you for the loss, damage, or theft of your personal belongings at any point during your trip.

Most cards only cover you for your bags while you are actually in transit, but this coverage doesn’t just involve your bags – and it doesn’t matter when or how the loss happens. Even accidental damage to your personal items should be covered.

Things to note: This is exceedingly rare coverage and many policies still have exclusions or limitations on expensive belongings like jewellery, phones, computers, and high-end electronics, so read your policy carefully.

Our top credit card pick: BMO AIR MILES World Elite Mastercard

Hotel burglary

What it is: Hotel burglary coverage is similar to personal effects insurance but with a big limitation: it only covers your personal belongings if they’re stolen out of your hotel room. It’s still better than lost or stolen baggage coverage, which typically only applies while you are in transit on a common carrier.

Things to note: Some credit card issuers require a copy of a police report or evidence of forced entry in order to pay out a hotel burglary claim. Again, the list of exclusions is usually long with this coverage, so check your policy.

Our top credit card pick: RBC Avion Visa Infinite Privilege

Rental car theft and damage

What it is: Whenever you rent a car, you are offered additional collision or loss damage waiver insurance that can easily add up to $30/day to your total rental cost. This covers you for any loss or damage to the vehicle itself and nothing else. Personal liability is different.

Fortunately, one of the more standard types of credit card insurance is rental car theft and damage. If you have this coverage and pay for the cost of your rental on the card, you can safely decline the CDW/LDW coverage on your rental car contract and save that money.

Things to note: You may be on the hook for estimated damage costs immediately when they happen and have to get reimbursed later through the insurance company. Make sure you file a police report immediately if an incident takes place

Learn more: Rental car insurance in Canada

Our top credit card pick: American Express Cobalt Card

Rental car accident

What it is: This insurance doesn’t cover the rental car itself, your medical bills, or damage to anyone else’s property – like travel accident insurance, it pays out lump sums for specific injuries or the death of passengers traveling inside the vehicle.

Things to note: The payout is dependent on the severity of the accident. Keep in mind that your standard car insurance coverage should extend to your rental car.

Our top credit card pick: BMO AIR MILES World Elite Mastercard

Rental car personal effects

What it is: Nearly identical to personal effects or hotel burglary coverage, rental car personal effects insurance covers you for any items that are damaged or stolen out of your rental vehicle. Some cards don’t even require you to be in the car at the time.

Things to note: Again, this type of insurance doesn’t cover everything you may be transporting in your rental car. For instance, artwork, furniture, animals, and valuable collections might be excluded.

Our top credit card pick: BMO AIR MILES World Elite Mastercard

Which credit cards have the best insurance coverage?

Now that we’re up to date on the different types of insurance, you might be wondering which credit cards give you the best coverage.

While the National Bank World Elite Mastercard includes some of the best purchase and trip coverage, BMO credit cards typically have the greatest insurance packages.

BMO AIR MILES World Elite Mastercard

You saw this card mentioned as our favourite for personal effects, rental car accident, and rental car personal effects insurance, but the card includes an additional 11 types of insurance.

There is a $120 annual fee, but the first year is waived and the insurance coverage alone can make it worth the money.

If you’re not particularly interested in earning Air Miles, you might check out the BMO Ascend World Elite Mastercard. The annual fee is a little higher at $150, but the first year is waived and you have the potential to earn reward points at a faster rate. Plus, the card also comes with the same 14 types of insurance.

BMO CashBack World Elite Mastercard

This card definitely deserves special mention. Not only does it offer cardholders all but 3 types of insurance, but it also stands out because of its increased extended warranty and purchase protection.

While most cards only give 1 year of extended warranty and 90 days of purchase protection, the BMO CashBack World Elite Mastercard doubles that with 2 years and 180 days of coverage, respectively.

With an annual fee of $120 (that's waived the first year), this card gives you cash back rewards, great perks, and the relatively rare complimentary roadside assistance, which can help you out in a bind.

Always read the fine print

Insurance coverage is highly personalized and determined by the card issuer, which is why it’s so important to read your credit card’s certificate of insurance.

Not only will the fine print tell you what types of coverage you get, but you’ll also see the exclusions, term lengths, and coverage limits. Before you head out on a trip or make a purchase and assume you’ve got coverage, take a moment to check your policy.

FAQs

How do I make a credit card insurance or warranty claim?

Typically, you’ll get the product repaired or replaced through the manufacturer. Then, you’ll mail or scan and upload the receipt or invoice along with a claim form from your insurer. You should receive a reimbursement by cheque.

How do I make a travel insurance claim?

Most credit cards list a claim phone number on the back of the card. Call the number to be connected to an agent who will walk you through filing a travel insurance claim. Try to do this as soon as possible to get your claim paid out quickly.

Is anyone else covered by my credit card insurance, or is it just me?

It’s pretty common for one or more of your traveling companions to be covered along with you if you charge the travel costs for all passengers to your card. Again, read your card’s fine print to see exactly who is covered.

How soon do I need to report an incident?

There is usually a reasonable amount of time for you to report the incident – often up to 30 days – but it ranges by policy. The best tip is to call immediately after an incident happens and that way you’ll be sure that you don’t miss the window.

Is my insurance coverage automatic or do I need to activate it somehow?

In nearly all cases, purchase protection or trip coverage kicks in automatically as soon as you charge the purchase or trip to your card. Some cards require you to charge the full cost, while others might just require 80% or so.

Am I covered if I’m flying on rewards points?

Unfortunately, the answer to this for most types of coverage is no. If coverage is automatic without having to make a purchase, then you will still be covered. But, if you need to cancel your plans, return home unexpectedly, have a delayed flight or lose your bags, you most likely won’t be covered.

Does my credit card cover rental car insurance?

If you have a premium credit card, there’s a good chance that it has rental car coverage that extends to you and your passengers, the car itself, or your personal belongings. Coverage limits and exclusions vary by card, so check your exact coverage for details.

Do I get travel insurance with my credit card?

Many credit cards offer some form of travel insurance, like trip cancellation coverage, trip interruption coverage, rental car coverage, and lost or stolen baggage coverage. To find out if your credit card has travel insurance, read your card’s insurance statement.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×7 Award winner

×7 Award winner

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 15 comments