Canada's Best Credit Card Rankings: Methodology

Wonder how we get our rankings and our genius scores?

It's quite complicated, and requires plenty of math, which is done using algorithms.

And our numbers aren't just based on rewards – we look at over 126 features of credit cards. These include 17 types of insurance, a long list of perks, different types of rewards, and even acceptance rates. And this is done for every credit card in our database – all

We take all these factors, put them through our algorithm, and get a score out of 5 – our Genius Rating. This way, you can see just how good a credit card really is when taking into consideration every aspect and comparing it against all other cards.

We wanted to make a way for Canadians to compare credit cards painlessly, with no fear of bias or dishonesty.

So that's why at creditcardGenius, we're devoted to helping you maximize your rewards, finding perks you'll actually use, and getting you the best credit card for your wallet.

The database with the most credit cards

Our

This all goes back to being your most trustworthy and unbiased credit card tool. It makes us the most comprehensive as well.

How we compare the best credit cards in Canada

Want to know more about our Genius Rating? We don't blame you.

We have 7 main categories + user reviews, which you can find a full breakdown of on our Sliders page:

- Rewards,

- Low Fees,

- Low Interest,

- Insurance,

- Perks,

- Approval,

- Acceptance, and

- User reviews.

Any score you see on the site is based on these 8 components with a set configuration behind it, which is why the same card can have different scores on different parts of the site. On our blog, many card views are set to "best mode," which is where our algorithm gives more weight to the card's top 2 components (excluding approval, acceptance, and user reviews).

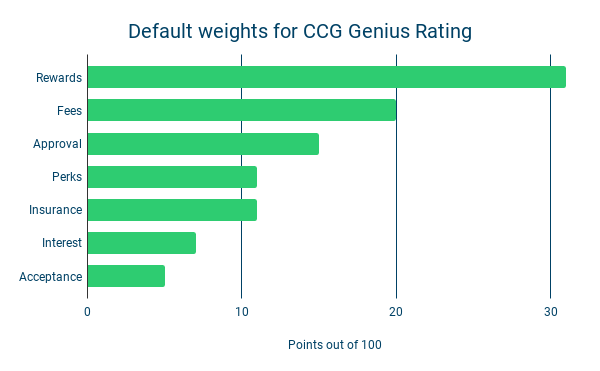

On our Compare Credit Cards page, you'll notice all sliders in the left column are set to the middle. This is what we call "default mode" and the weights look like this:

But we don't live our lives by default – we each have our own preferences for what we want in a credit card. That's why you can change the sliders to reflect what's important to you.

Let's look at what happens to the weights when you select a preference. Just note that on the compare cards page, user reviews can't be selected in the sliders.

Category-based best credit cards in Canada

Every time you move one of the sliders, the weight for each compenent shifts accordingly.

Moving one slider will change the weight of that compenent to be about half, then all the other components will make up the rest of the weighting, keeping the same ratio they have in the default weightings.

Let's go through the main compnenents to give you an idea of what this looks like. Keep in mind that selecting more than one slider will further split and change the weightings.

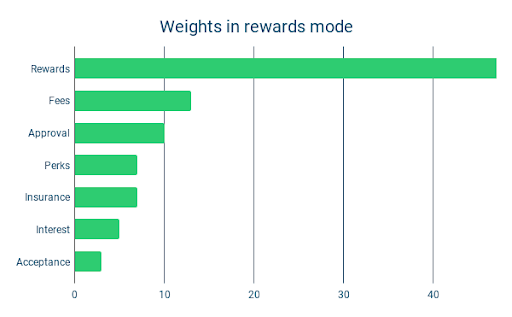

Credit card rewards

You'll want to choose "Cash" on the sliders if you like your rewards to be paid out in the form of cold, hard cash (or statement credits).

Or if you'd rather get the most valuable rewards possible, and love to do a bit of travelling, then move that first slider to "Travel."

Either way, here's what the weights will look like in the rewards state:

Low fee credit cards

If you love credit cards, but aren't ready for the commitment of an annual fee, slide your marker to "Low fees."

The weights will change like so:

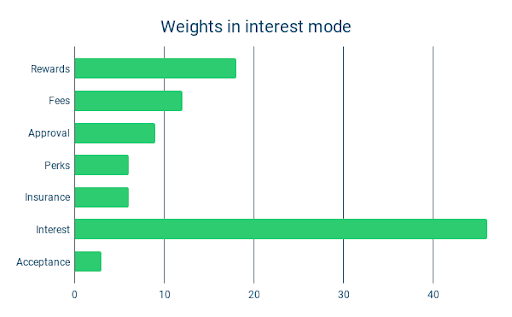

Low interest credit cards

If you're carrying a bit of a balance on a credit card, or tend to often, low interest credit cards could help save you a lot of money.

Here's what the weights will look like behind the scenes if you slide over to "Low interest."

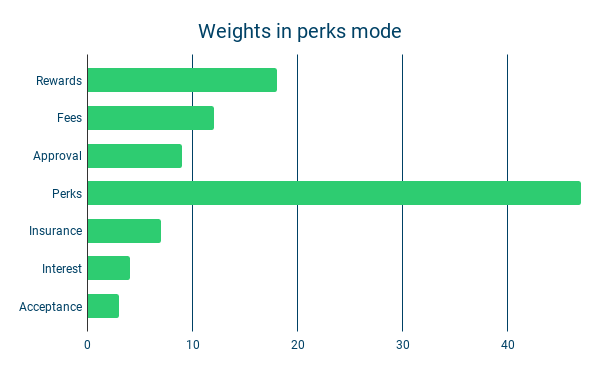

Credit card perks

If rewards are all well and good, but what you really want is to feel like a VIP, then perks could be the options for you.

This is how the weights shift when you select them:

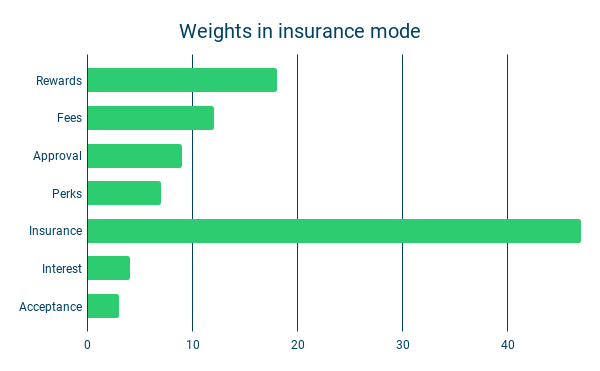

Credit card insurance

But maybe instead of flashy perks, you just want some peace of mind.

This is how the weights will look if you choose "Insurance" as your preference:

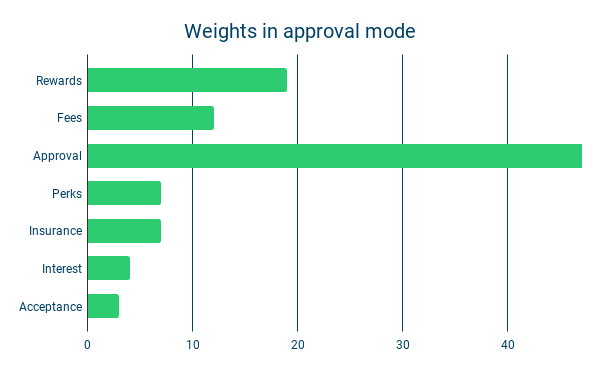

Credit cards with good approval

If your income is under $60k annually or your credit score isn't as good as you'd like it to be, you're better off sliding over to the "Approval" side.

Keep in mind this will give a bit of a boost to American Express cards, since they all have no income requirements.

Here's what the weights look like in this state:

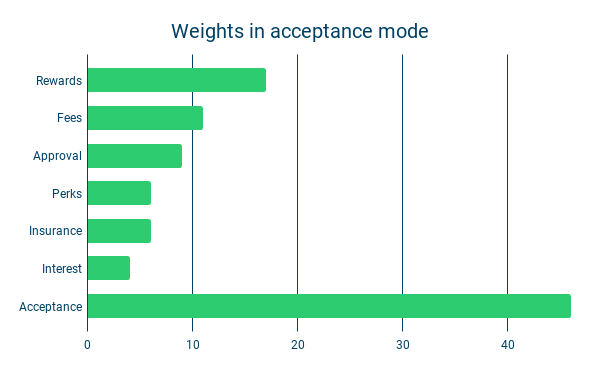

Credit cards with good acceptance

If you don't want to worry about your card being accepted at some merchants, set your preference to "Acceptance."

This will give a boost to Mastercard and Visa while nerfing Amex.

Here are the new weights in this state:

User reviews

User reviews also play a role in genius ratings. Everytime you leave a review for a card, you're also helping determine its score. This way, real world experience for credit cards becomes part of the equation.

Once a card has 5 reviews, they start being taken into account for a card's overall score. The maximum change user reviews can make is to increase or decrease a genius rating by 10%, and this amount depends on the average user review rating. The maximum boost only happens when a card gets over 100 reviews and gets an average score of 5 stars.

How we calculate credit card rewards

The other important number you'll see on our card summaries is annual rewards.

These are calculated based on our default spending, which we estimated based on various sources. The default breakdown looks like this:

Doesn't really look like your monthly spending? No problem, you can edit any of these fields to be a more accurate estimate for you. The "Annual Rewards" number will be recalculated in real time to reflect your changes.

Try it out for yourself in the left-hand column of our Compare Credit Cards page.

For our ranking pages and card displays in articles, we use this typical $2,000 spend for scoring annual rewards (unless we say so otherwise).

Oh and did we mention it's unbiased?

So now you have a better idea of how everything works behind the scenes. With all the numbers, algorithms, and math going on – there's not much room for bias to seep in.

We'll show you the best credit cards in Canada, based on your needs, spending habits, and wants. And not based on our compensation or partnerships.

Find out more about how we make money here.

FAQ

What is a Genius Rating?

Our Genius Rating is our scoring system. Every credit card gets a score out of 5, making them easy to compare.

How do we calculate our Genius Rating?

Our Genius Ratings are calculated using an algorithm. We take data from over 126 features of credit cards, put it through our algorithm, and get a final score out of 5 that's free of bias.

What general categories do Genius Ratings come from?

We have 8 general categories that go into calculating our Genius Rating. On our compare credit cards page, you can adjust the sliders, and the scores you see will change based on what you prefer.

They are:

- rewards,

- fees,

- interest,

- perks,

- insurance,

- acceptance,

- approval, and

- user reviews.