Pros & cons

Pros

- Best credit card in Canada.

- Get up to 15,000 welcome bonus points.

- Earn up to 5 points per $1 spent on purchases.

- 4 ways to redeem points for high value.

- 10 types of insurance included.

Cons

- Lower acceptance as an American Express.

Your rewards

$100 GeniusCash offer

On approval, receive $100 GeniusCash on us when you apply for American Express Cobalt Card using this offer page.

GeniusCash offer expires on Apr 15, 2026.

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 15,000 points which translates to an estimated $300.◊

For all welcome bonus details click here.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With American Express Cobalt Card, here's how you earn rewards:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas , transit , and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For American Express Cobalt Card in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Transfer points to Aeroplan | $1,620 | |

| Fixed Points Travel Program | $1,418 | |

| Transfer points to Marriott Bonvoy | $940 | |

| Any travel | $810 | |

| Statement credits | $810 | |

| Charity donations | $810 | |

| Gift Cards | $624 | |

| Shopping at Amazon.ca | $567 | |

| Merchandise | $551 |

Calculating your annual rewards

$36,000 annual spending x 4.50% return on spending = $1,620 annual rewards

$1,620 annual rewards − $191.88 annual fee = $1,428 net annual rewards

Details and eligibility

- Estimated Credit Score

- 660 - 724

- Personal Income

- N/A

- Household Income

- N/A

- Annual Fee ᔥ

- $191.88

- Extra Card Fee

- $0

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance

- 21.99%

- Balance Transfer

- N/A

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Mobile Device

- $1,000

- Travel Accident

- $250,000

- Emergency Medical Term

- 15 days

- Emergency Medical Maximum Coverage

- $5,000,000

- Flight Delay

- $500

- Baggage Delay

- $500

- Lost or Stolen Baggage

- $500

- Hotel Burglary

- $500

- Rental Car Theft & Damage

- Yes

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

American Express Cobalt Card's 5.0 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from American Express

American Express Cobalt review

If you want the best credit card in Canada, look no further. The American Express Cobalt Card is the best of the best, racking up awards at a pace no other credit card can match.

So what makes the best credit card in Canada? Here's what makes this card special.

Amex Cobalt rewards

The rewards are what give the American Express Cobalt Card the crown as best credit card in Canada. Here's what you'll earn and the best ways to use them.

Earning points with the American Express Cobalt Card

The Amex Cobalt is part of the American Express Membership Rewards program. Here's what you'll earn for points on all your purchases:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

That's a lot of points on purchases. Based on spending $2,000 per month across various categories, you can earn around 81,000 points per year.

That's a lot of points – but what can you use them for, and what are they worth? Let's just say, you have some really strong options.

Redeeming your Amex Membership rewards points

American Express Membership Rewards is one of our favourite rewards programs. The main reason is because your points are flexible and can be worth a ton.

Here's a summary of all your redemption options, and what each point is worth.

Here are the full details on all the travel options.

Transfer points to Aeroplan and 5 other airlines

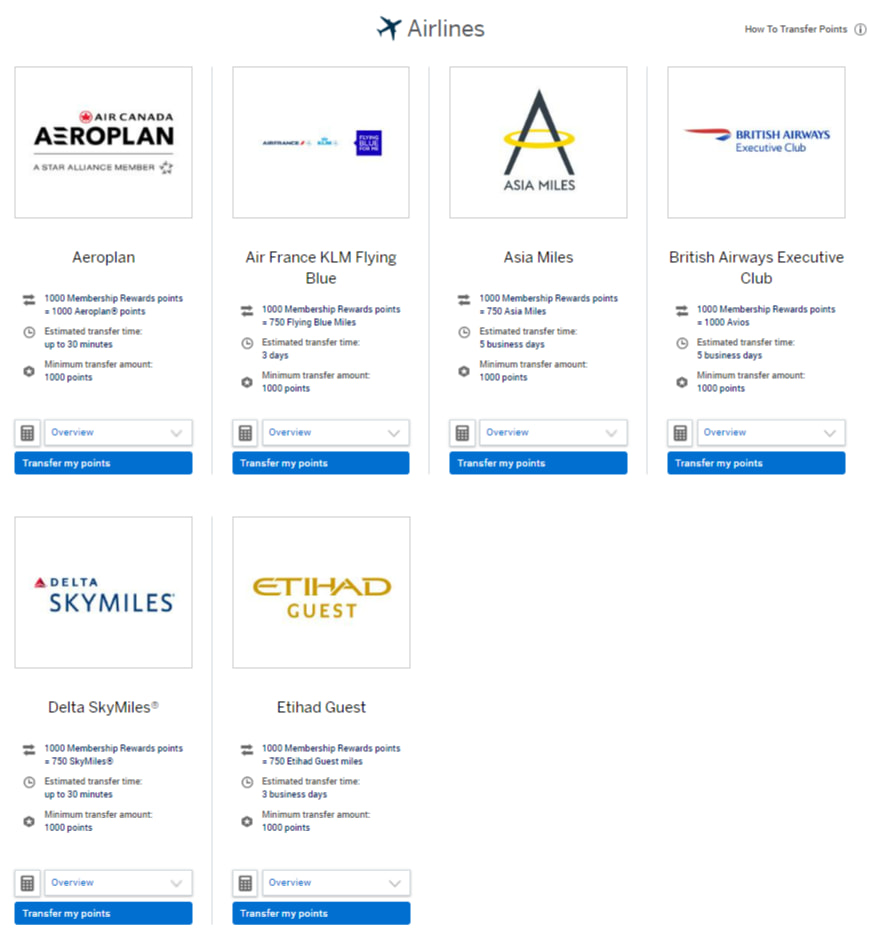

For best value, transferring your points to airline partners can yield the best results. You have 6 airline partners you can transfer points to.

For most Canadians, your best option will be Air Canada, and we'll focus on it here. Your Amex points transfer at a 1:1 ratio, and the transfer happens quickly – no more than 30 minutes.

Each Aeroplan point is worth 2 cents each, giving an Amex point the same value.

Those 81,000 points you earn per year are worth up to $1,620, a return of 4.5% on your spending.

In fact, because of all the points earned, the American Express Cobalt Card also happens to be our top rated Aeroplan credit card.

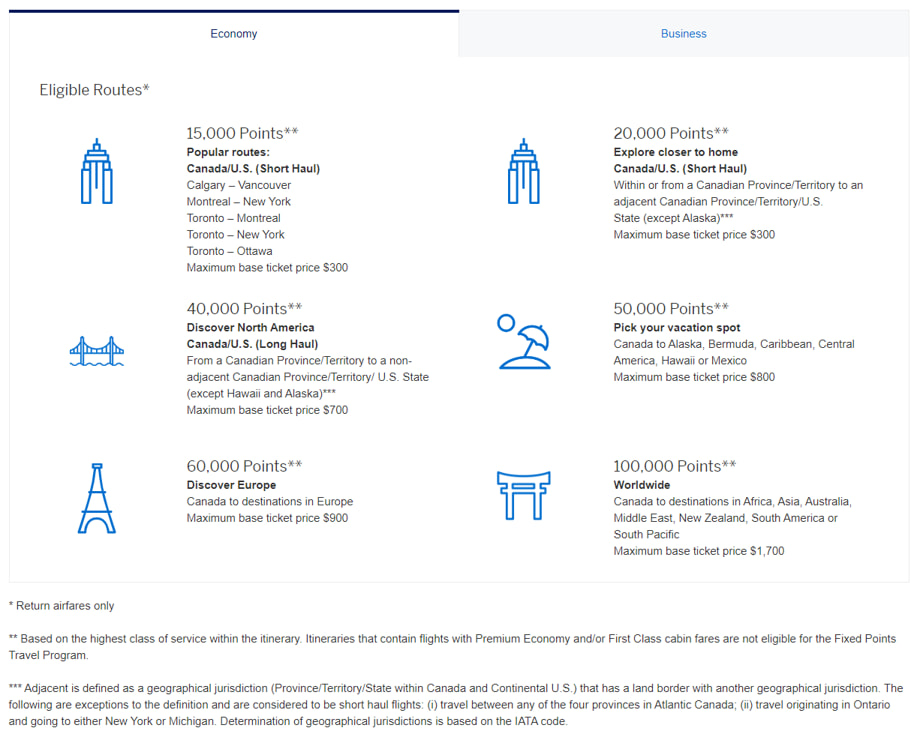

Fixed Points Travel Program

The next best value you'll get is by using the Fixed Points Travel Program.

What is it and how does it work? Basically, you use a set number of points to fly to a specific zone. These points only cover the base airfare of your ticket, meaning you'll be required to pay any taxes, fees, and carrier surcharges.

What does it look like? Here's the economy class version of the chart:

If you maximize this chart, you can get a value of up to 2 cents per mile on select short-haul routes. That being said, this is only possible on a limited number of flights – and most people aren't going to redeem for a free flight between Toronto and Montreal or Ottawa.

The next best sweet spot is on long-distance flights within North America. For 40,000 points, you can save up to $700, for a value of 1.75 cents per point.

If you can maximize this value, your 81,000 points collected per year are worth up to $1,417.5 – a return of 3.94% on 24K in annual spending.

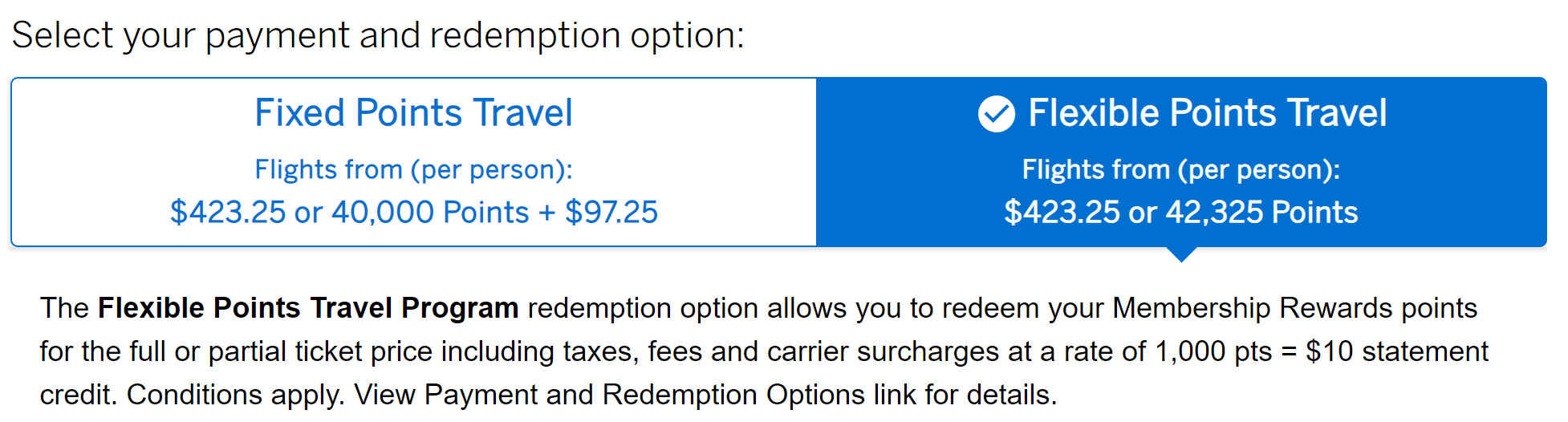

How do you use the chart? Simply make a flight booking through American Express Travel. If you have enough points for the redemption, the Fixed Points Travel Program will be available for you to use.

Here's an example of what it looks like when you make a booking.

Just note that the entire cost of the flight will be charged to your card, and you'll get a statement credit within 5 - 10 business days.

One point to make – make sure you get at least a value of 1 cent per point, otherwise you'll be better off redeeming your points for any travel.

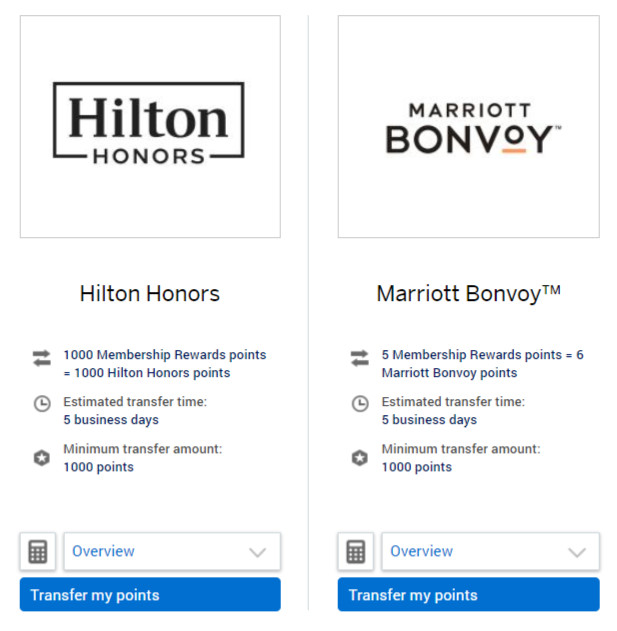

Transfer points to hotel programs

The one transfer option you can use with this card is to hotel partners. You can transfer your points to 2 hotel programs at certain transfer ratios:

We'll focus on Marriott Bonvoy since the transfer ratio is better and provides more value.

When redeemed for hotel stays, an average Marriott Bonvoy point is worth 0.97 cents each.

So what does that make a Cobalt point worth? Transferred to Marriott, your 81,000 points become 97,200 Marriott points, which are worth $943.

Redeem points for any purchase

If any of the above options aren't giving you a value of at least 1 cent per point, you can redeem your points for any purchase made to your card, including travel. All you do is apply your points to a purchase of your choosing, just note that you need to redeem at least 1,000 points.

Each point is always worth 1 cent when redeemed this way, giving 81,000 points a value of $810.

A bonus? If you booked a flight using the Fixed Points Chart and you have some points left over, you can use this option to help pay for the taxes and fee bills if you like.

4 benefits of the Amex Cobalt credit card

There's more to this card than just the rewards. Here are a few other things this card offers.

1. Large welcome bonus

Let's start with the outstanding welcome bonus you can get.

You'll earn 1,250 points every month you spend $750 in the first year, for a maximum of 15,000 points earned.

This is a great way to get your next rewards-covered vacation kick-started – especially since it's worth about $300 when you maximize your redemptions.

2. American Express benefits

On top of all these points, you'll get some great Amex benefits as well.

The first is Amex Invites and Front of the Line. Amex cardholders get exclusive access to ticket sales to the hottest concerts through Ticketmaster, so there's less stress trying to get tickets to your favourite bands.

For even more rewards, there's Amex Offers. You can earn easy bonus cash back when you make purchases through select merchants. To see what offers are available, you can find them here.

3. Insurance coverage

Finally, know you'll be covered on your journeys with the purchase and travel insurance provided by this card.

You'll get access to 10 different types of coverages – find all the details by clicking on the insurance tab above.

4. Access to the Hotel Collection

For booking hotels, having the American Express Cobalt Card gives you access to The Hotel Collection.

When you book hotels through the collection, you're eligible for a room upgrade at check-in if it's available, and you'll get up to US$100 credit to use at the hotel.

2 downsides of the Amex Cobalt

Are there a couple of downsides? Unfortunately, there are.

1. Amex acceptance

It's true, American Express credit cards simply aren't accepted as much as Visa or Mastercard. But it's improving all the time.

The only major retailers where they can't be used are Loblaws and Costco stores. Amex also has a map where you can see retailers in your area that take Amex. If your usual spots all take it, you're good to go.

2. Relatively high annual fee

The only other downside – the annual fee is a little high. The fee gets charged out as $12.99 per month, making the annual fee $155.88, a little higher than most premium cards.

Comparison to the Amex Gold Rewards

So how does it compare to another top Amex Membership Rewards card – the American Express Gold Rewards Card?

This card offers the full suite of Membership Rewards redemptions, including transferring to airlines. It also includes a few extras that the Cobalt card doesn't.

Here's how they compare in a few areas.

| Amex Cobalt | Amex Gold Rewards | |

|---|---|---|

| Earn Rates | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | * 2 points for every $1 spent on gas, groceries, drugstores, and travel * 1 point for every $1 spent on all other purchases |

| Welcome Bonus |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) | Up to 60,000 bonus points (terms) |

| Insurance Coverage | 10 types | 11 types |

| Annual Fee | $191.88, charged out as $15.99 per month | $250 |

| Perks | * Amex offers and Front Of The Line | * $100 annual travel credit * Airport lounge access * Metal credit card * NEXUS fee rebate * Amex offers and Front Of The Line |

| Apply Now | Apply Now | Apply Now |

The real difference in these cards lies in the rewards and perks.

Want the most rewards? The Cobalt Card is by far the better choice. Based on a typical monthly spend, we estimate you would earn 81,000 points with the Cobalt card, while the Gold Rewards Card only earns 53,100 points – an increase of 40%.

But the Gold Rewards makes up for that in perks. Between lounge access, and an annual travel credit, the Gold Rewards card is here to make your travelling life easier, albeit at a higher annual fee of $250.

It's up to you to decide which is better for you.

Leave a review

These are our thoughts on what we've determined is the best credit card in Canada.

But what about you? If you have the card, or have had it in the past, leave a review so others can see a real world opinion on it.

FAQ

What does the Amex Cobalt credit card earn for rewards?

The Amex Cobalt earns Membership Rewards points at these rates:

- 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month)

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on foreign currency purchases

- 1 point per $1 spent on all other purchases

What is the annual fee for the Amex Cobalt card?

The Amex Cobalt has an annual fee of $191.88, which gets charged out as $15.99 per month.

Are there any transfer options for the points earned with the Amex Cobalt card?

Points earned with the Amex Cobalt credit card can be transferred to Aeroplan (and 5 other airlines programs) at either a 1:1 or 4:3 ratio, as well as to both Marriott Bonvoy at a 5:6 ratio, and to Hilton Honors at a 1:1 ratio.

Key benefits

User reviews

Reviewed by 80 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Good card for collecting points, cant go wrong with it, cant collecting points outside of canada. Other than that its a great card to have

Points are unbeatable and unbeatable earn rates on food. Sucks that you don’t get bonuses outside Canada anymore but still a keeper

This was a fabulous card, and now it’s just good. Why? A month ago, they changed the travel reward from 2 points to 1 point. Then today, I checked my statement and notice that for this past statement, any US restaurant and grocery charges are now 1 point instead of 5. No notice given. So the card is pretty useless in the US. Very disappointing.

Overrated card. Only worth for restaurant rewards otherwise it’s useless for all other categories. Its doesn’t come with upfront points. I highly not recommending this card and go for a card that rewards for all categories and comes with with worth points upfront. Otherwise a free mbna rewards card is definitely more worth

I've had this card since it was introduced. It has always been a great card, probably the best in Canada, and I have maximized the rewards as much as I can. The only downside I see is low acceptance. I still use my VISA more than Amex Cobalt because of the low acceptance.

Now, in case you haven't heard, Amex will reduce the travel rewards from 2% to 1% starting Oct 8, 2024. To me, that was one of the most attractive feature of this card and it's going away. I find it insulting from American Express that I have learned this from the news and websites like this and not from them directly. So far, not a word and I suspect they will try to get away with this downgrade under the radar to minimize customer complaints. I will be cancelling my card pretty soon as soon as I redeem all my points. Shame on American Express.

×9 Award winner

×9 Award winner