American Express credit cards are well-known for a few things: limited acceptance, fantastic perks, and valuable Amex Offers. These offers provide fun and valuable cash back or discounts on shopping and travel expenses, and they're updated every month.

Amex Offers are just one of the many benefits of using an American Express card, and if you don't know how to access them, you could miss out on some serious savings.

Here, we explain what Amex Offers are, how they work, how you can take advantage of them, and more.

Key Takeaways

- Amex Offers are limited-time discounts or bonuses you can get when shopping with your Amex card.

- Add the offers to your Amex in the mobile app or online.

- Check back frequently since Amex regularly changes its offers.

- The best Amex card to use is the American Express Cobalt Card, but there are many other excellent options available.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What are Amex Offers?

Amex Offers are discounts, rebates, or bonus points you can earn with specific retailers for a limited time. If you add the offer to your Amex card and shop with the merchant, you’ll get a statement credit, points, or miles.

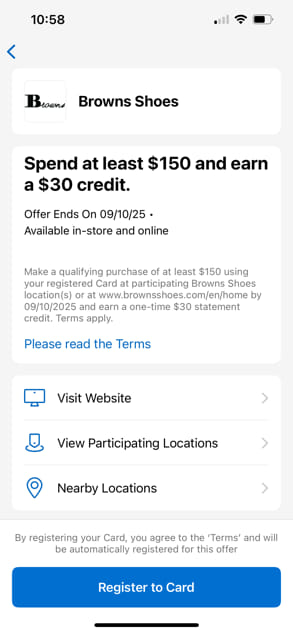

For example, if you spend $150 at Brown's Shoes, you could earn a $30 credit.

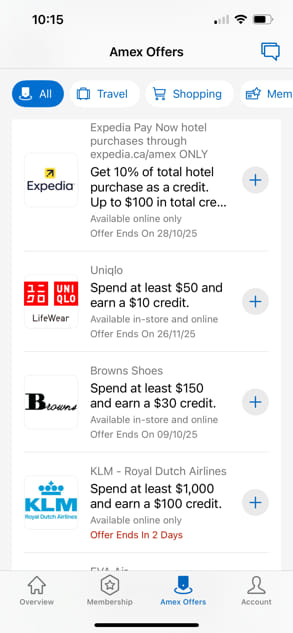

When you log into Amex Offers, here’s what you might see:

But don't forget that you need to load the offers you want to your Amex card to take advantage. And, of course, you must pay with your Amex card to get the deal.

How to find and take advantage of Amex Offers

First, you’ll need a qualifying Amex credit card. Luckily, all unsecured Amex cards include Amex Offers. But if you’ve got a prepaid gift card, you’re out of luck.

To see what offers are available to you, sign into your online account or open the Amex App, sign in, and scroll down.

Use your Amex account online

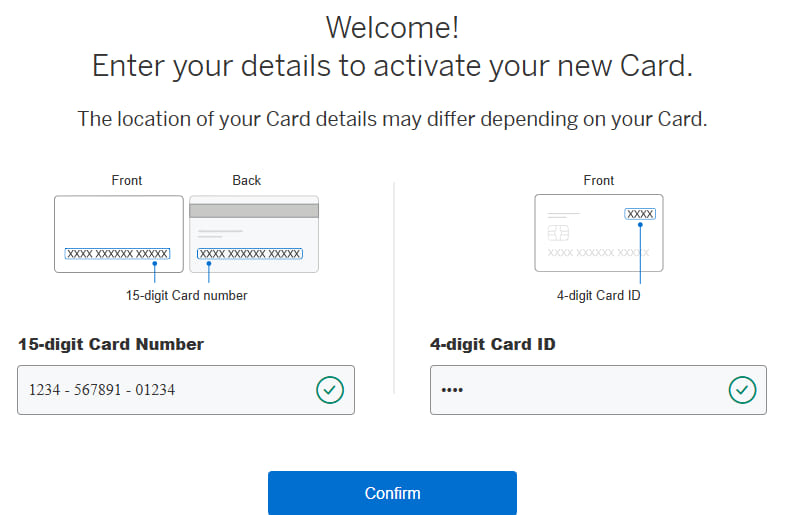

If you’re new to Amex, you’ll need to set up an online account. To do this, enter your 15-digit card number and four-digit card ID. Provide your contact details, and create a password to finish setting up the account.

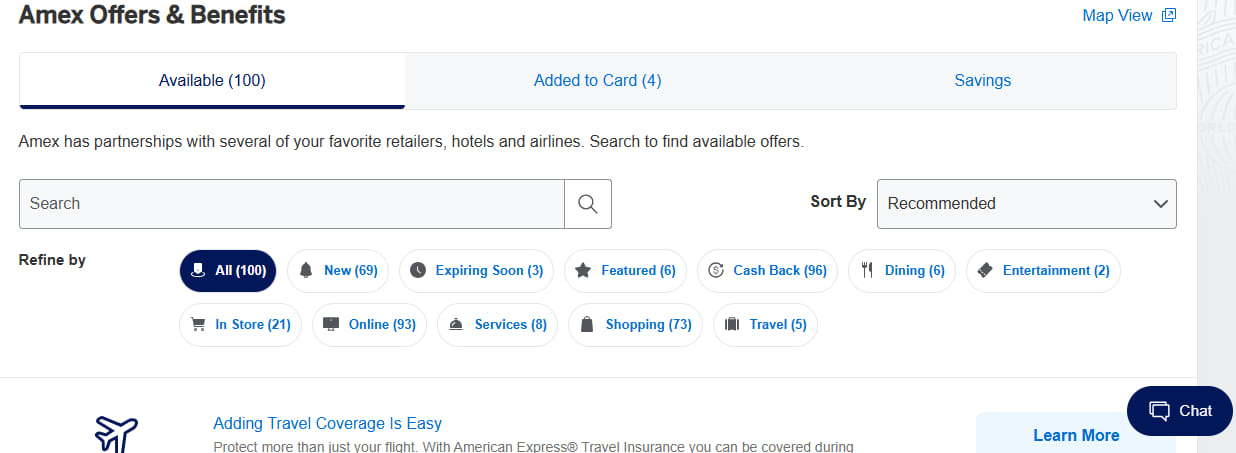

Once you’re logged into your shiny new account, scroll down to see the Amex Offers and Benefits.

If you’re interested in an offer, click on the arrow next to it to reveal the offer’s details and terms. You’ll see who is eligible, what purchases qualify, and how the reward is paid out.

To take advantage of the offer, simply click "Add to Card." Then, when you use the provided link and make a purchase with your Amex card, you’ll get the deal.

Use the Amex mobile app

Start by opening the Amex mobile app and selecting the credit card you want to see offers for.

Once there, tap on the Amex Offers button at the bottom of the screen and choose the individual offers you’d like to add to your card.

Many offers are limited to a certain number of cards, so be sure to only register for the offer if you plan on using it.

Also, remember to read the terms of the offer to ensure you understand the requirements for receiving your bonus rewards.

Best American Express Credit Cards

So, what American Express credit cards have access to this?

Any American Express credit card is eligible, including Scotiabank Amex cards. The only exception is corporate cards.

So with that said, here are some of our favourite Amex cards:

| Category | Amex credit card | Welcome bonus | Annual fee | Average earn rate | Apply now |

|---|---|---|---|---|---|

| Best overall | American Express Cobalt® Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) | $191.88, charged out as $15.99 per month | 4.5% | Apply Now |

| Best for hotels | Marriott Bonvoy® American Express®* Card | 110,000 bonus points (terms) | $120 | 2.09% | Apply Now |

| Best for cash back | SimplyCash® Preferred Card from American Express | 10% cash back for the first 3 months + $50 (terms) | $119.88 | 2.55% | Apply Now |

| Best premium card | American Express Platinum® Card | Up to 100,000 bonus points (terms) | $799 | 2.45% | Apply Now |

| Best for no foreign transaction fees | Scotiabank Gold American Express® Card | Up to 45,000 bonus points, first year free (terms) | $120 | 2.45% | Apply Now |

| Best for perks and benefits | American Express® Gold Rewards Card | Up to 60,000 bonus points (terms) | $250 | 2.95% | Apply Now |

| Best no fee card | American Express® Green Card | 10,000 bonus points (terms) | $0 | 2.1% | Apply Now |

American Express Cobalt® Card

Our top-rated card, the American Express Cobalt Card offers the most rewards of any card we've seen.

Earn 5 points per $1 spent on groceries and dining, 2 points on travel, gas and transit, and 1 point on all other purchases. And with each Amex Membership Rewards point worth up to 2 cents, you're looking at an excellent overall return on any spend you put on the card.

You can earn up to 15,000 bonus points after spending $750 every month for the first year.

While this card has an annual fee of $191.88, it charges it at $15.99 per month, which can make this cost feel more manageable.

Marriott Bonvoy® American Express®* Card

If free hotel stays are your game, you can't go wrong with the Marriott Bonvoy American Express Card.

To start off, earn 110,000 Marriott points as a welcome bonus after spending $6,000 in the first 6 months and making a purcahse in month 15. Afterwards, users earn 5 points per $1 spent at Marriott properties, and 2 points per $1 on all other purchases.

The cherry on top is getting a free night stay every year on your card's anniversary (up to a 35,000 point value), which more than covers the $120 annual fee.

SimplyCash® Preferred Card from American Express

Prefer cash back rewards? The SimplyCash Preferred Card from American Express is here for you.

One of our top-rated cash back cards, you'll earn 10% cash back for the first 3 months, up to $2,000 in spend. Plus, earn $50 when you make a purchase on month 13. On your purchases, you'll earn:

- 4% cash back on gas and groceries

- 2% cash back on all other purchases

Plus, you can choose when you’d like to redeem your cash back – no need to wait until your card’s anniversary.

American Express Platinum® Card

Looking for premium benefits? The American Express Platinum Card is hard to beat. You’ll get more perks than any other card, including unlimited airport lounge visits for yourself and one guest, upgraded status in four hotel programs, an annual $200 travel credit, and more.

And don't forget about those Amex points:

- 3 points per $1 spent on dining

- 2 points per $1 spent on travel

- 1 point per $1 spent on all other purchases

Scotiabank Gold American Express® Card

Our top no-foreign transaction fee (and Scotiabank-issued) Amex card is the Scotiabank Gold American Express® Card. It begins with a sweet welcome bonus of up to 45,000 bonus points, which is worth as much as $315.

You'll also earn Scene+ points quickly with these great rates:

- 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more

- 5 Scene+ points per $1 spent on groceries, dining, and entertainment

- 3 Scene+ points per $1 spent on gas, select streaming services, and transit

- 1 Scene+ point per $1 spent on foreign currency purchases

- 1 Scene+ point per $1 spent on all other purchases

American Express® Gold Rewards Card

There’s a lot to love about the American Express Gold Rewards Card card, especially if you want all the perks and benefits that come from a premium credit card.

Sure, the earn rate isn’t as impressive as others on our list (you’ll get 2 points for every $1 spent on gas, groceries, drugstores, and travel, 1 point for every $1 spent on all other purchases), but there are many other benefits to enjoy:

- 11 types of insurance coverage

- Up to 60,000 welcome bonus points (valued at $1,200)

- $100 travel credit

- Four free passes to Plaza Premium lounges in Canada

- The choice of a gold and rose gold metal card

- $50 NEXUS travel credit every four years

American Express® Green Card

The American Express Green Card is an excellent choice for a reliable, no-frills Amex. It's a no-fee card, which saves you money right off the bat. And even though it costs you nothing to use the card, you’ll still earn a flat 1 point per $1 spent on all purchases and have access to the benefits of Amex Cards – including Amex Offers.

Although the card has very minimal insurance coverage (just 2 types), you'll get a solid 10,000 point welcome bonus, worth $200.

FAQ

What are Amex Offers?

Amex Offers are limited-time discounts or bonuses on travel, restaurants, and services with select retailers. You can access these offers by logging into your online Amex account, adding them to your card, and making the purchase with your Amex.

Do Amex Offers work?

Yes! Once you’ve added an offer to your card and met the terms of the deal, you’ll see the reward show up as a statement credit. You can also click the "Savings" tab to see how much you’ve earned.

How can I get the 100,000 points offer on Amex?

Amex regularly updates its welcome bonuses, so check the current offers. Whatever the bonus is, it usually requires opening a new card and meeting spending requirements, like 80000, 30000 points after spending $6,000 in the first 6 months and making a purcahse in month 15.

Is Amex Platinum only for the rich?

Not necessarily. The American Express Platinum Card has a high annual fee of $799, but it comes with a welcome bonus worth up to $2,000, earns high annual rewards, and doesn't have income requirements at all.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 6 comments