American Express Membership Rewards is one of the top rewards programs in the country, and one of the reasons we love it is because of its flexibility. Amex allows you to transfer your hard-earned points to 6 airline and 2 hotel rewards programs, including Aeroplan. Before you convert your points, you’ll want to look at point values to ensure you’re getting the most for your points (and don’t worry, we’ve got you covered!).

Key Takeaways

- To transfer Amex points, log into your rewards account and select how many points and which program you’d like to transfer to.

- Transferring Amex points to Aeroplan offers the best value for your points at 2 cents per point.

- Although some point transfers take only a few minutes, others can take several days to go through.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What are Amex Canada transfer partners?

Put simply, Amex Canada transfer partners are rewards programs in Canada that accept the transfer of Amex Membership Points.

There’s a lot to love about the American Express Rewards program. Purchases made with an Amex card earn you points towards travel, cash back, merchandise, hotel stays, and gift cards. But if you’re a member of another loyalty program – say, Aeroplan – and want to boost your points, Amex allows you to transfer points to partner programs.

Beware: Not all point transfers give you equal value.

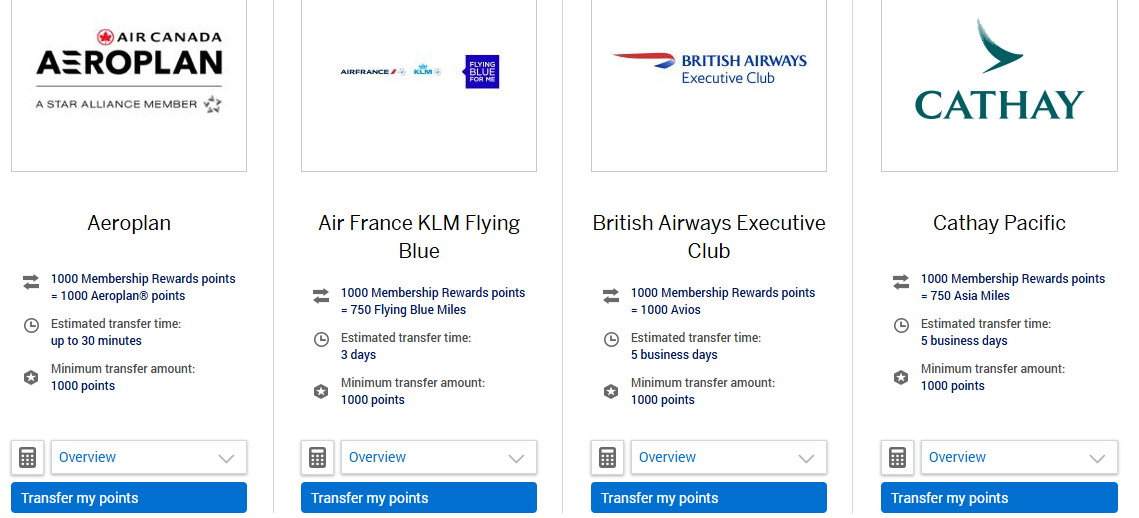

All Amex Canada transfer partners

Amex currently partners with 6 airlines and 2 hotel groups, allowing you to easily transfer points between them. We looked at the transfer rates and restrictions of each to help you decide whether transferring your American Express Membership Points is worth it.

Air Canada Aeroplan

Transfer rate: 1:1

Read our guide: Air Canada’s Aeroplan rewards program

Aeroplan might be one of the most widely recognized transfer partners for Amex. It gives you a straight transfer in terms of points and access to Star Alliance airlines, an extensive network of airlines that serves 195 countries.

Of all the transfer partner options, Aeroplan gives you the best value when you redeem points for flights – up to 4 cents per point (CPP) if used for flights. This makes it our top transfer pick.

Air France KLM Flying Blue

Transfer rate: 1:0.75

Read our guide: Your guide to Air France KLM Flying Blue

Flying Blue reward members can transfer points at a 25% loss, but the points could retain good value when used for flights. Air France and KLM are two major international airlines with plenty of flight options across more than 500 global destinations, and our research shows reward flights valued at up to 2.89 CPP.

Note that it can take up to 3 days to transfer points.

British Airways Club

Transfer rate: 1:1

Read our guide: Your guide to the British Airways Club

Like Aeroplan, you can transfer your Amex points 1:1 for the British Airways Club points. While it can take up to 5 days for your transfer to be completed, 1,000 Membership Points will give you 1,000 Avios. BA points are worth an average of 2.5 CPP when redeemed for flights on British Airways, according to our research – and as a oneworld alliance member, you should have lots of flight options.

Cathay Pacific

Transfer rate: 1:0.75

Read our guide: Your guide to Cathay Pacific Asia Miles

If you frequently fly in Asia, you may already be a Cathay Pacific Asia Miles member. While Cathay Pacific only operates in 3 Canadian cities, it has a huge network of over 200 destinations and 8,000+ routes.

You will lose some immediate point value when you transfer Amex points and it may take up to 5 days for the transfer to go through. But, if you use your Cathay points towards flights, their value holds up well: you’ll get an average of 2.99 CPP.

Delta SkyMiles

Transfer rate: 1:0.75

Read our guide: Your guide to the Delta SkyMiles program

Your points will lose 25% of their value when you transfer them to Delta SkyMiles, but Skymiles are worth an average of 2.32 CPP when used towards vacation packages and a respectable 2 CPP when used for flights. Delta has an extensive airline network, and it only takes around 30 minutes to transfer Amex points.

Etihad Guest

Transfer rate: 1:0.75

Like Skymiles, you’ll lose 25% of your points when you transfer them to the Etihad Guest program, where it costs you 1,000 Membership Points for 750 Etihad miles – takes up to 10 days to complete your transfer, which is longer than any other transfer partner. While you can use Etihad miles for flights, upgrades, and merchandise, this probably isn’t your most valuable transfer option.

Hilton Honors

Transfer rate: 1:1

Read our guide: How to maximize the Hilton Honors program

At first glance, the Hilton Honors program might look like a good transfer program – after all, it’s a 1:1 ratio and you’ll have hundreds of properties to choose from. Unfortunately, your points are worth a measly 0.5 CPP with Hilton Honors. If you book with the Amex Hotel Collection instead, you’ll retain a value of 1 CPP – and trust us, you won’t be short on hotel options.

Marriott Bonvoy

Transfer rate: 5:6

Read our guide: How to maximize the Marriott Bonvoy rewards program

Marriott Bonvoy is the only partner on our list that gives you more points for what you transfer – 20% more, to be exact. But Marriott Bonvoy points are worth significantly less than Amex ones, offering just 0.97 CPP on average for hotel stays. Like we suggest above, if you want to use your Amex Membership Points for accommodation, you’re best to look at options in the Amex Hotel Collection – or even use Pay with Points to cover the cost of the hotel charged to your credit card, which offers a value of 1 CPP.

How to transfer Amex Membership Points

To transfer points, log into your Amex rewards account and click on the "Use Points" tab. Scroll down to “Transfer Points” to pull up your current options. You’ll see transfer partners, a brief description, and a helpful calculator that lets you estimate how much your Amex points are worth after the transfer.

Should you transfer your Amex Membership Rewards to partner programs?

If you’re booking flights and already participate in an airline rewards program, you’ll often get a better deal by transferring your Amex Membership Rewards to that loyalty program.

At best, you’ll earn around 2 CPP for flights through Amex, but transferring them to a partner airline program can get you a value of up to 4CPP, which is a substantial return.

If you need to transfer points, be sure to give yourself enough time for the transaction to process before you confirm a booking.

Can you transfer Canadian Membership Rewards to US partners?

The short answer: no, you can’t make a straight transfer of points from your Canadian card to an Amex U.S. partner because Amex in Canada is issued by a completely different banking entity.

That said, there is a workaround if you’re set on transferring your Canadian points to access Amex’s U.S. partners – but you must also hold a U.S. Amex card. First, call the customer service number on the back of your Canadian card, and request to do an international points transfer. They’ll use the current exchange rate, so you may not get a 1:1 transfer.

You can only complete 1 international transfer every 12 months, and the process can take up to 2 weeks to complete.

FAQ

Does it make sense to transfer Amex points to Aeroplan?

Of all your transfer options, moving points to Aeroplan makes the most sense in terms of point value. You’ll retain a straight 1 to 1 transfer ratio, so you won’t lose out on the points you’ve worked hard to collect. Plus, if you use the points for a qualifying flight during the off-season, your points can be worth up to 4 CPP.

Is it better to transfer Amex points to an airline?

It can be better to transfer your Amex points to an airline – if this airline offers a higher CPP value. Refer to the transfer partner descriptions above to decide whether it makes sense for you.

Is there an advantage to booking through Amex Travel?

Travel costs vary no matter which platform you use to book. Your points will often have the most value when booking off-season travel, or in areas with many flight or hotel options. It never hurts to log into your Amex rewards account to see what it would cost through Amex Travel compared to other options.

What is the best Amex transfer partner?

Aeroplan is one of the best transfer options for your Amex points, giving you a value of anywhere from 2 to 4 CPP. You’ll max your value by booking a flight during the off season, where you’re more likely to hit the higher end of the range.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.