Best Air Miles Credit Cards in Canada for 2026

Credit cards that boost your Air Miles rewards earnings.

The BMO AIR MILES®† World Elite®* Mastercard®* is the best Air Miles credit card for Canadians. Cardholders enjoy the usual World Elite Mastercard perks and benefits, plus enhanced Air Miles earn rates.

In summer 2026, Air Miles will rebrand as Blue Rewards. Air Miles credit cards are no longer available to new cardholders. For alternatives, explore Canada’s best BMO credit cards.

While not as popular as they once were, Air Miles credit cards earn Miles that act as points. These Miles can be redeemed for travel or for instant discounts on purchases at the cash register. It all depends on how you want to use them.

This article reviews the top three Air Miles cards for Canadians, explaining the best features, their downsides, and everything in between.

Key Takeaways

- The best Air Miles credit card is the BMO AIR MILES World Elite Mastercard.

- The BMO AIR MILES Mastercard is the best no-fee Air Miles card, and the BMO AIR MILES World Elite Business Mastercard is the best business Air Miles option.

- The Aeroplan program is slightly more valuable than Air Miles as users can earn points in more areas of everyday spending.

- The Air Miles program remains a worthwhile, rewarding program for many Canadians.

The best Air Miles cards compared

Although the Air Miles rewards program has experienced some turbulence, it remains a valuable and fairly popular rewards program.

There are three official Air Miles credit cards available in Canada, all issued by BMO. We ranked them based on their ability to earn Air Miles, provide credit card insurance for shopping and travelling, and offer a reasonable annual fee.

| Category | Credit card | Annual Fee | Insurance package | Welcome bonus | Learn more |

|---|---|---|---|---|---|

| Best overall | BMO AIR MILES World Elite Mastercard | $120 | 14 types | Up to 7,000 bonus miles, first year free (terms) | Learn more |

| Best no fee | BMO AIR MILES Mastercard | $0 | 2 types | Up to 1,200 1,600 bonus miles (terms) | Learn more |

| Best business | BMO AIR MILES World Elite Business Mastercard | $149 | 13 types | Up to 8,000 miles (terms) | Learn more |

Note: The BMO Air Miles Mastercard for students has been discontinued. Students are encouraged to check out the BMO CashBack® Mastercard®* for students instead.

1. BMO AIR MILES®† World Elite®* Mastercard®*

Rewards:

- 1 Mile for every $12 spent

- 3x the Miles for every $12 at participating Air Miles partners

- 2x the Miles for every $12 spent at any eligible grocery, liquor, and wholesale stores

If you meet the card's high income requirements and don't mind paying an annual fee of $120, the BMO AIR MILES®† World Elite®* Mastercard®* gives you the highest earn rate of any Air Miles credit card. First, there's the welcome bonus: for a limited time, you'll enjoy up to 7,000 bonus Air Miles – the biggest bonus of any card on this list.

Then there's the earnings potential. The standard earn rate is 1 Mile per $12 spent, but it jumps to 2 Miles at grocery, liquor, and wholesale stores, and to 3 Miles at partner locations like Shell or Pharmasave.

With this premium Air Miles card, you earn up to 5x the Miles when you bundle at least two travel products – either flight and accommodations or flight and car rental. And since it's a World Elite Mastercard, you'll enjoy travel perks like concierge service, a free DragonPass membership, rental car and hotel discounts, and the best travel insurance of any credit card in Canada.

Pros:

- Automatic Onyx status

- 25% off one Air Miles flight redemption per year

- Discounts at Alamo, Enterprise, and National car rentals

- 14 types of insurance

- Up to 7 cents off per litre at Shell

- Free Instacart+ membership for six months

- World Elite Mastercard benefits

Cons:

- High income requirements

- Lower rewards than other premium cards

2. BMO AIR MILES®† Mastercard®*

Rewards:

- 1 Mile per $25 spent on all purchases

- 3x the Miles for every $25 at participating Air Miles partners

- 2x the Miles for every $25 spent at any eligible grocery, liquor, and wholesale stores

You don't have to pay an annual fee to get an Air Miles credit card with excellent rewards. The BMO AIR MILES®† Mastercard®* isn't just a no-fee credit card, but it also has lower income requirements than its more premium counterparts. You won't get the same luxurious perks, but you'll still earn at least 1 Mile per $25 spent, plus the usual multipliers at partner and food, liquor, and wholesale stores.

Cardholders looking for Air Miles rewards won't be disappointed. You'll earn automatic Gold status, which gives you 1 Mile per $10 spent on the Air Miles Travel website, 4 Miles per $10 spent on Air Miles travel packages, and up to 5% off merchandise rewards.

Aside from its Air Miles-related features, this card also has a surprisingly low promotional balance transfer interest rate of 0.99 % for 9 months. So if you're carrying credit card debt, this card could be the right tool to help you tackle it.

Pros:

- Automatic Gold status

- No annual fee

- Low credit score and income requirements

- Low-interest balance transfer promo offer

- Discounts at Alamo, Enterprise, and National car rentals

- Up to 7 cents off per litre at Shell

- Free Instacart+ membership for six months

Cons:

- Minimal insurance coverage

- Lower rewards than other no-fee credit cards

3. BMO AIR MILES®† World Elite®* Business Mastercard®*

Rewards:

- 1 mile for every $12 spent

- 4x the miles at participating Air Miles partners

The BMO AIR MILES World Elite Business Mastercard offers some of the highest earn rates among Air Miles credit cards – 1 Mile for every $12 spent, and 1.25x Miles for every $12 spent at Shell. This equates to an average earn rate of 0%.

This card also features business-specific benefits, includes an incredibly valuable insurance package, and provides an impressive 25-day grace period on your purchases. Plus, for a reasonable $50 fee, you can get supplementary cards for employees – cards that come with extra protection to ward against cardholders misusing funds. Specifically, you have the option to waive that cardholder's liability for wrongful charges.

Pros:

- Waived annual fee for the first year

- Welcome bonus worth up to $1,016

- Includes 13 types of insurance

- Save up to 7 cents per litre at Shell

- Extended grade period on purchases

- Extra protection on supplementary cards

Cons:

- High income requirements

- Low rewards compared to other premium cards

Compare top Air Miles cards by Genius Rating

Learn more about the Genius Rating methodology

BMO discontinued its Air Miles credit card for students, but students can still take advantage of the BMO CashBack Mastercard for students. This is the easiest card to qualify for, and it earns 1 Mile per $25 spent, with a 2x multiplier at grocery stores and a 3x multiplier at partner stores. Plus, there's no annual fee, and you'll enjoy a gas discount at Shell.

Air Miles vs. Aeroplan

| Feature | Aeroplan | Air Miles |

|---|---|---|

| Membership requirements | Aeroplan credit card OR free account | BMO AIR MILES credit card OR free account |

| Currency | * Aeroplan Points | * Cash Miles * Dream Miles |

| Rewards | * Events and attractions * Gift cards * Merchandise * Travel | * Events and attractions * In-store discounts * Gift cards * Merchandise * Travel |

| Top rewards category | Air Canada flights (4 CPP) | Concerts (21.6 CPP) |

| Bottom rewards category | Gift cards (0.71 CPP) | Merchandise (7.7 CPP) |

| Special membership benefits | * Flight eUpgrade credits * Free checked bags and priority services on Air Canada flights * Maple Leaf Lounge access | * Priority customer service * Travel bookings by phone |

While Air Miles and Aeroplan are both competent rewards programs, Aeroplan slightly edges out Air Miles in earning power, making it generally more valuable to an average Canadian. That said, always do your due diligence and review the details of both rewards programs to see which one is better for you.

Aeroplan pros and cons

Aeroplan pros:

- Better benefits like airport lounge access, free checked baggage, a free in-flight alcoholic beverage and snack, and free seat selection

- Better credit card options, including a wider selection of cards issued by more banks that have better rates of return and premium perks

- Better earning opportunities through its online shopping portal, bonus opportunities, credit cards, and travel rewards

Aeroplan cons:

- Less straightforward redemption process – redeeming points for the most value by booking Air Canada travel can be complicated

Pros and cons of Air Miles credit cards

To be frank, the going's been rough since Air Miles declared bankruptcy in 2023. Although BMO swooped in to make a purchase and save the day, the program's competitiveness has suffered as a result.

Pros:

- Advanced Mile earning rates

- Earn more Miles at participating stores

- Automatic Gold or Onyx membership status

- Frequent promotions for bonus earn rates

- Excellent welcome offer bonuses

- Multiple car rental and entertainment partner discounts

- Miles can be gifted and pooled

Cons:

- Limited selection of co-branded cards

- Fewer retail partners than competitors like Aeroplan or Scene+

- Lower earn rates than similar cards

- No points conversion partners

Calculate how much your Air Miles are worth

Wondering how much your Air Miles are worth and how best to spend them? Check out our Air Miles rewards calculator:

Is the Air Miles program worth it?

Generally speaking, Air Miles is a good rewards program. The extent of your rewards will depend significantly on your spending habits, but as a free, easy-to-use program, there are virtually no downsides to joining the Air Miles program.

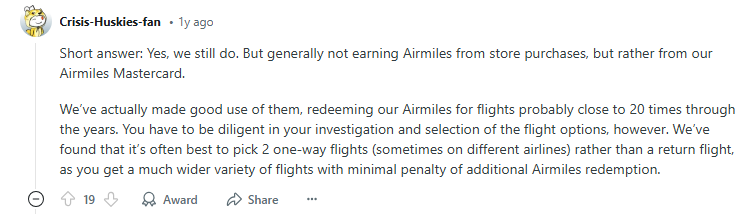

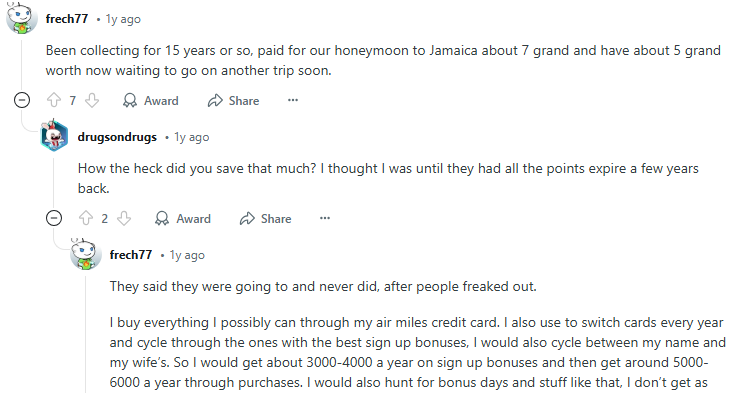

Many people continue to use the program, even over 30 years after its inception:

The general consensus seems to be that the Air Miles program can be worth it, though you'll have to put in a little extra effort to see real value from it.

FAQ

What is the best credit card to earn Air Miles on?

The best Air Miles credit card in Canada is the BMO AIR MILES World Elite Mastercard, which lets you earn up to 3 Miles per $12 spent. You'll also get automatic Onyx status, which boosts your earnings, a free DragonPass membership, and a fantastic welcome bonus worth as much as $889.

Can you get Air Miles without a credit card?

Yes, you can collect Air Miles simply by signing up for a free account and using the accompanying physical or digital membership card. However, the earn rates are significantly higher if you use an Air Miles credit card for your purchases, rather than using other payment methods and swiping your membership card.

Can I combine Air Miles with other loyalty programs?

Unfortunately, no, you can't combine Air Miles with other loyalty programs or convert them to points in different programs. Air Miles operates independently within its own ecosystem. However, you can earn Air Miles through various partners, including grocery stores, pharmacies, hardware stores, and gas stations. Plus, several BMO credit cards are co-branded and offer enhanced Air Miles earn rates.

What should I consider when choosing an Air Miles credit card?

First, consider whether you want to pay an annual fee and whether certain perks are worth it. The BMO AIR MILES Mastercard is an excellent no-fee option, but it has fewer benefits than the premium BMO AIR MILES World Elite Mastercard. Also, consider insurance – the World Elite card includes 14 types of coverage, while its no-fee counterpart offers just 2.

What is the difference between Air Miles and Aeroplan?

The key difference lies in how points are earned and redeemed. Air Miles is a broad retail rewards program that lets you earn points on everyday purchases at grocery stores, gas stations, and other retailers. Aeroplan is primarily a travel loyalty program tied to Air Canada, though it also offers earning opportunities through credit cards and select retail partners.

Does TD have an Air Miles credit card?

No, TD doesn't offer Air Miles cards – the only bank that can issue Air Miles credit cards is BMO. However, TD does offer a few Aeroplan cards, some of which are among the most valuable airline credit cards in Canada.

What is the best credit card in Canada for points?

The overall best points and rewards credit card in Canada is the American Express Cobalt® Card. This card earns American Express Membership Rewards, which are both very valuable and very flexible. Other top rewards cards include the CIBC Aventura Visa Infinite Privilege Card and American Express® Gold Rewards Card.