Your credit score in Canada, ranging from 300 to 900, is a key factor in determining your financial health. A score of 660 or higher can improve your chances of securing better credit cards, loans, and lower interest rates. In this guide, we’ll dive into how your score is calculated, how to check it, and practical steps to improve it.

Key Takeaways

- Your credit score is a 3-digit rating of your financial trustworthiness on a scale of 300 – 900.

- A good credit score in Canada (660+) helps you qualify for better credit products, higher amounts of credit, and lower interest rates.

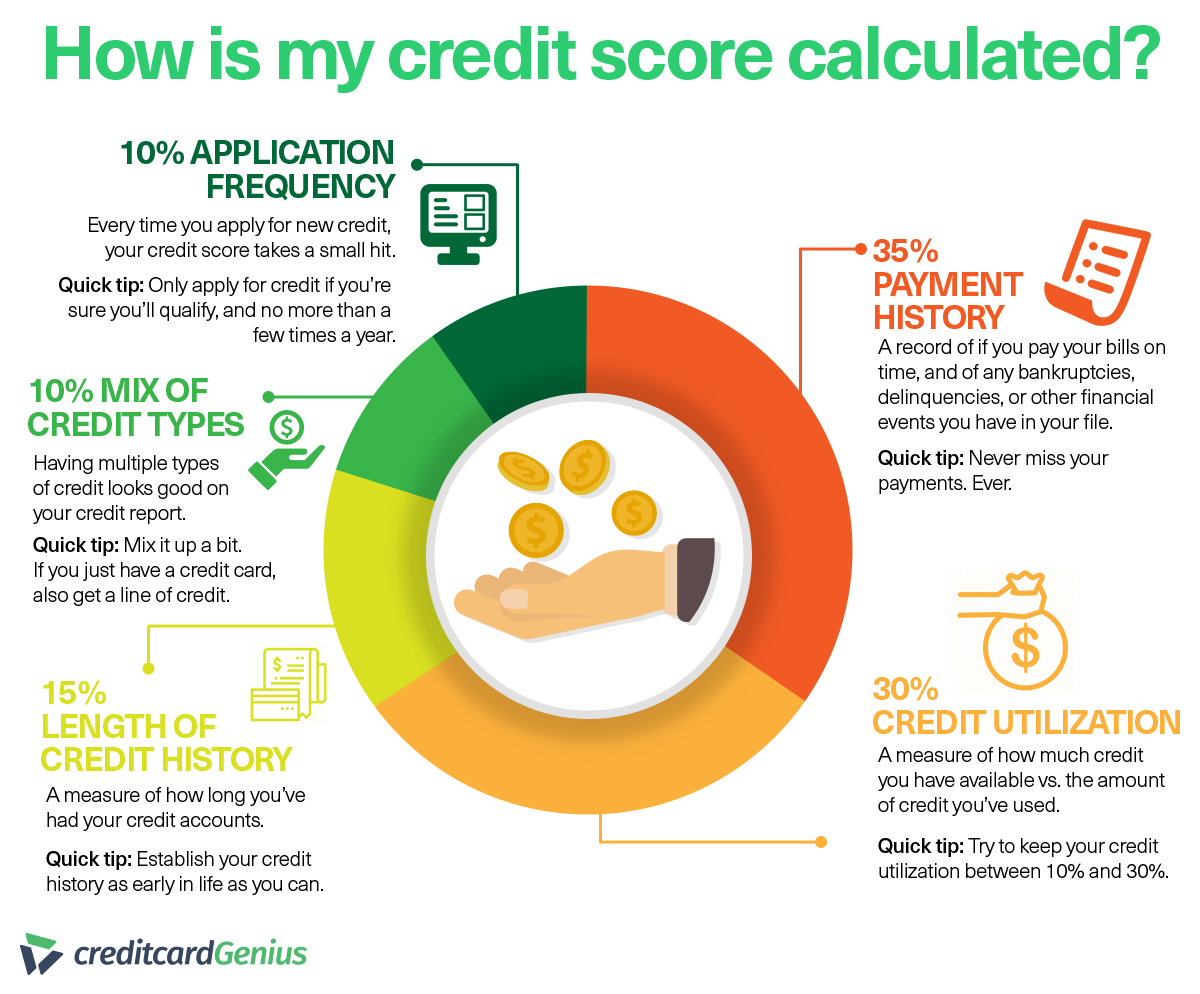

- Credit bureaus use 5 factors to calculate your credit score: payment history, credit utilization ratio, length of credit history, credit mix, and credit application frequency.

- You can improve your credit score by paying your bills on time, budgeting your spending, diversifying your credit portfolio, and apply for no more than 3 credit products per year.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is a credit score?

A credit score is a 3-digit rating of your financial trustworthiness as calculated by a credit bureau.

There are only 2 credit bureaus in Canada: Transunion and Equifax. Each bureau has access to slightly different information and uses a different formula to calculate your credit score, but they both use a scale from 300 – 900.

Millions of banks, credit unions, businesses, institutions, employers, government agencies, and landlords trust credit scores to tell them one thing: how likely you are to repay any money you borrow.

What is a good credit score in Canada?

In Canada, a good credit score is 660 or higher. This means you’re likely paying your bills on time, managing your spending responsibly, and keeping your finances in good shape. A strong credit score not only reflect your financial habits but also helps you access better opportunities, such as:

- Better approval chances for car loans, mortgages, and lines of credit

- Access to promotional offers, like zero-interest deals or longer repayment terms

- Higher credit limits and larger loan amounts

- Better chances of qualifying for rental housing

- Lower insurance premiums

- Increased financial flexibility overall

The higher your score, the more financial doors will open to you.

Our data shows that higher earners generally tend to have higher credit scores.

Unsurprisingly, older individuals typically have higher credit scores than younger ones. Those under 24 have little in the way of credit history or mix, while those over 65 tend to have a long credit history with a proven track record of paying multiple large loans off throughout their lifetime.

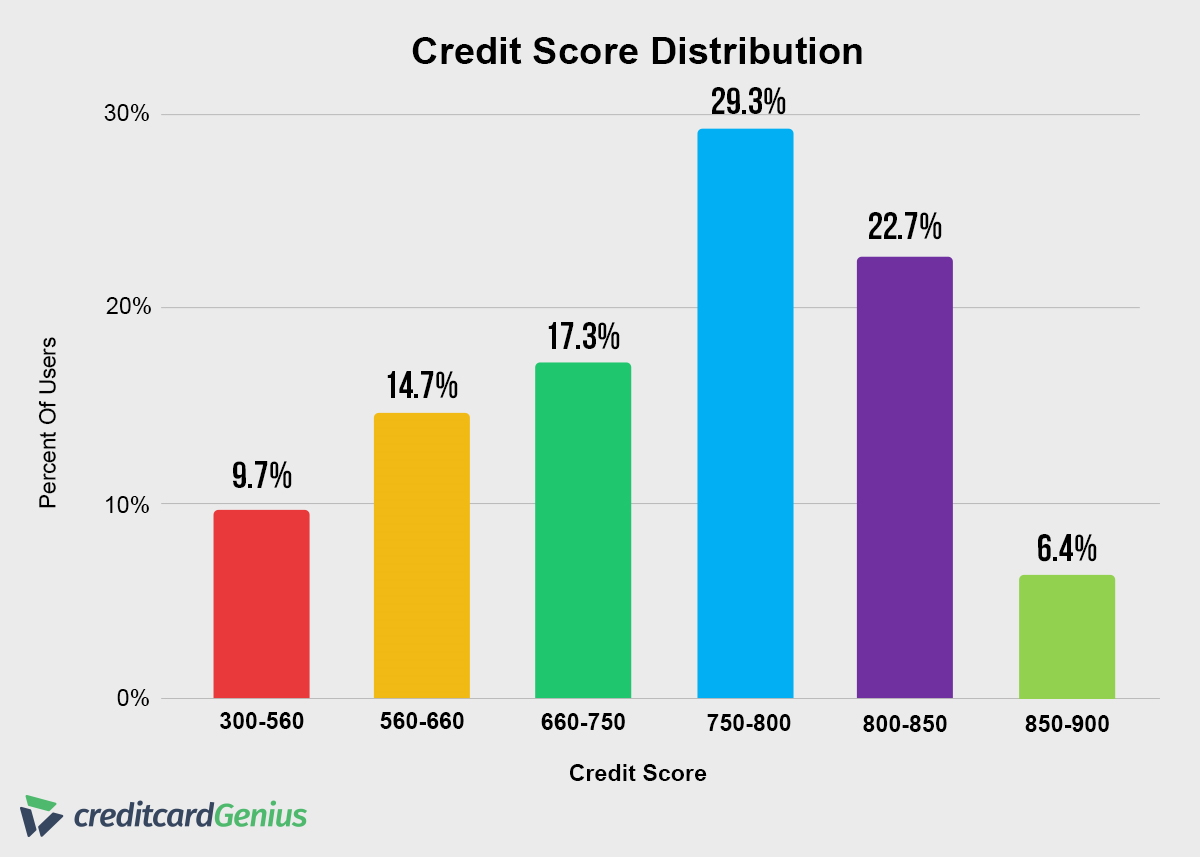

Finally, creditcardGenius readers tend to have solid credit scores! More than 58% of those who responded had a credit score of 750 or higher – in the very good to excellent range.

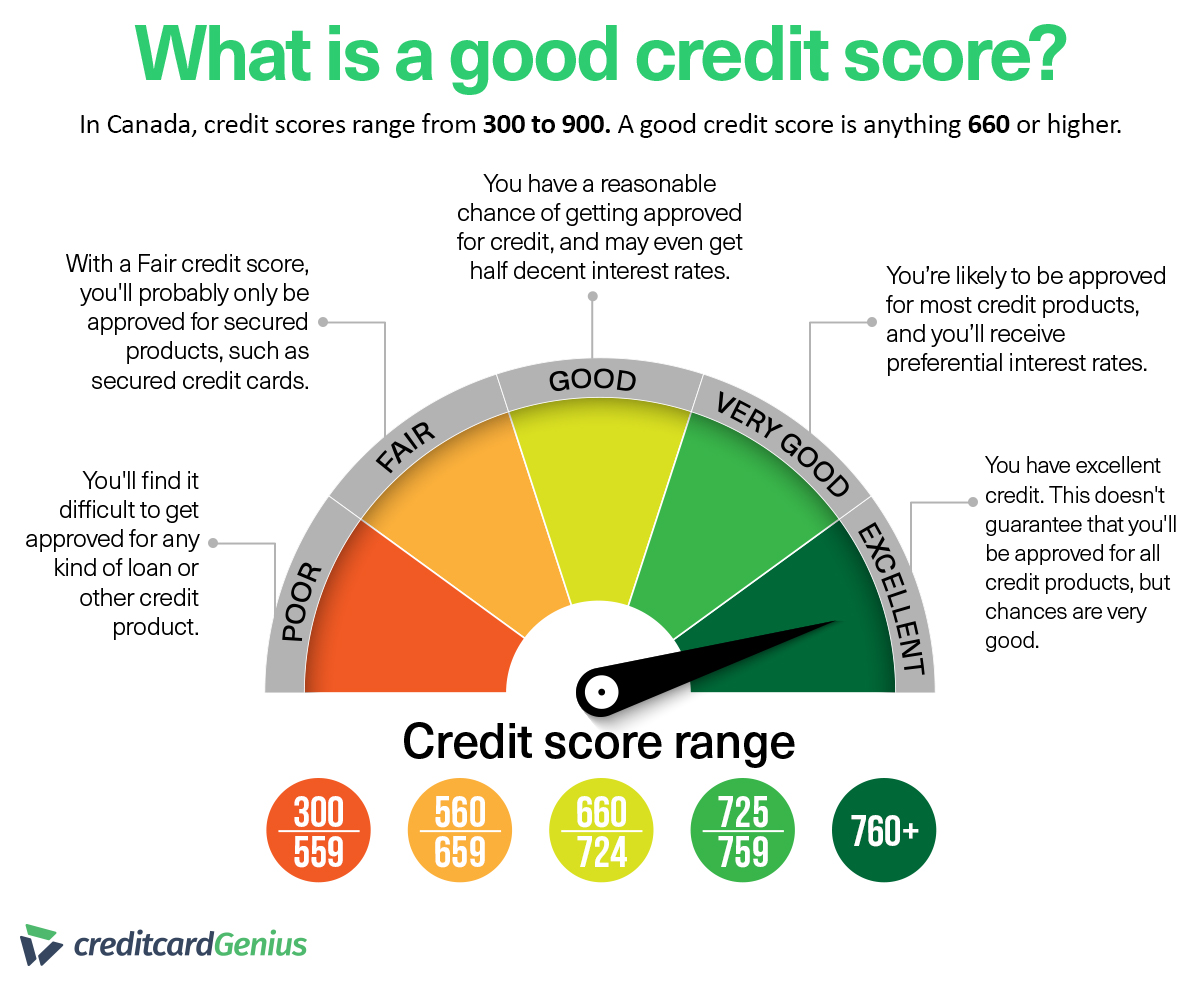

What your credit score says about you

Credit scores range from 300 – 900 in Canada with the average consumer scoring between 650 and 700. Here’s what your credit score says about you:

| Range | Rating | What it says about you |

|---|---|---|

| 760+ | Excellent | You can be trusted to repay large loans and have likely done so in the past. You qualify for exceptional insurance rates and rarified credit products, and while approval isn’t guaranteed, the odds are good. |

| 725 – 759 | Very Good | You have likely borrowed significant sums of money and repaid the majority on time. You’re likely to be approved for most credit products and receive preferential interest rates as a sign of trust. |

| 660 – 724 | Good | You have borrowed modest sums of money and mostly repaid the loans on time. You have a reasonable chance of being approved for common credit products and average interest rates. |

| 560 – 659 | Fair | You may have borrowed little money or failed several times to pay your debts. You’re most likely to be approved for secured credit products and banks tend to levy heavier interest rates to avoid losing money. |

| 300 – 559 | Poor | You have little to no credit history or have repeatedly failed to repay lenders. Many lenders may see you as a major risk and may not be willing to provide you with credit. |

Your credit report contains your name, date of birth, and current and previous home addresses, as well as your employment history, how much credit you have access to, and how much you’ve used. It may also contain bankruptcy or collections information, your registered liens, and hard credit checks from the last 3 years. Credit bureaus take 30 – 90 days to update your report with new information.

How to check your credit score

Credit bureaus can deliver your credit score on its own or as part of a credit report. A credit report summarizes your information and history in several different categories: personal, financial, and credit-related.

Both Equifax and TransUnion charge $24.95 per month to monitor your credit score, detect possible fraud, insure you against ID theft, and provide unlimited credit score checks.

Fortunately, there are 4 ways to check your credit score for free:

- Ask Equifax for your free monthly credit report online, in-person, by mail, or by phone at 1-800-465-7166.

- Ask TransUnion for your free monthly Consumer Disclosure online, in-person, by mail, or by phone at 1-800-663-9980. Customers in Quebec can ask for their credit score for free as often as they want.

- Ask your bank. Many banks and financial institutions provide their customers with free credit-checking tools through a website, app, or customer service phone number.

- Get a free credit score from a third-party company. If you use a third-party credit-checking service, proceed with caution. At best, the company could sell your data to turn a profit – at worst, it could steal your identity.

Check our credit report at least once each year to verify accuracy and ensure nobody has stolen your identity and opened credit cards or loans in your name. Immediately report any discrepancies to the credit bureau.

5 credit score factors – and how to improve them

Equifax and TransUnion don’t pull your credit score out of thin air. While we don’t have all the details of their proprietary (and secret) algorithms, we’ve identified the 5 biggest factors contributing to your credit score:

Payment history + credit utilization ratio + length of credit history + credit mix + credit application frequency = credit score

Building up your credit score is a matter of improving these 5 categories. Here’s how.

1. Payment history

Percentage of credit score: 35%

The more punctual you are in paying down your car loan, credit card balance, line of credit, mortgage, and/or utility bills like electricity or gas, the higher your credit score.

If you miss a payment deadline, it’ll damage your credit score after 30 days. The damage only gets worse the bigger the payments, the more frequently you miss them, and the longer you take to repay them – and yes, interest charges count, too.

Unfortunately, negative info can remain on your credit report for 6 – 10 years.

How to improve your credit score:

- Always pay more than the minimum payment

- Pay off your credit card(s) in full whenever possible

- Pay your bills on time (ideally within the interest-free grace period)

- Read your credit card statements carefully to understand what you owe and when

2. Credit utilization ratio

Percentage of credit score: 30%

Your credit utilization ratio is how much credit you’ve spent versus your total credit available expressed as a percentage.

Amount of credit used in $ / amount of credit available in $ x 100 = credit utilization percentage

Lenders don’t like to see a credit utilization ratio above 30%. If you have a credit limit of $10,000 and your balance is $9,000, you’re using 90% of your credit – which indicates you regularly meet your spending limits. In an emergency, your spending could exceed your income, leaving your bills unpaid.

How to improve your credit score:

- Increase your credit card limits

- Never max out your credit limit

- Pay off your credit cards before the statement closing date

- Set a budget and stick to it

3. Length of credit history

Percentage of credit score: 15%

All else being equal, if two Canadians apply for a loan, the one with the longest credit history is more likely to be approved. Repaying your bills is great, but repaying your bills regularly over a long period of time is even better.

How to improve your credit score:

- Apply for a no fee credit card

- Apply for a student credit card

- Buy a low-cost cell phone plan and pay your bills on time

- Follow a plan to expand your wallet with multiple credit cards

- Keep at least one older account open

4. Credit mix

Percentage of credit score: 10%

Juggling multiple credit products – like a car loan, mortgage, and premium credit card – demonstrates your ability to handle multiple payment deadlines and loans. If you only have a basic credit card, it may be time to diversify.

How to improve your credit score:

- Apply for a line of credit

- Apply for a car loan, mortgage, or student loan

- Put utility services in your name

There’s only one exception to the rule: whatever you do, avoid payday loans. The small boost they provide to your credit score isn’t worth the predatory interest rates.

5. Credit application frequency

Percentage of credit score: 10%

Every time you apply for a new credit card, the issuer makes a hard credit check that temporarily drops your credit score. Multiple hard credit checks can indicate that you’re desperate to borrow more money or trying to live beyond your means.

The solution is to apply for only 3 rewards credit cards each year and read the eligibility requirements. If you get rejected on a technicality, you’ll have undergone a hard credit check for nothing.

How to improve your credit score:

- Don’t apply for more than 3 new credit cards each year

- Use the creditcardGenius quiz to reveal which credit cards you’re eligible for

Unless you’re willing to manage multiple deadlines and read the fine print, we don’t recommend churning credit cards for welcome bonuses.

Bonus: Credit cards that improve your credit score

Paying your bills on time is the bread and butter of a good credit score, but several products can help boost your credit rating.

Our recommendations have low interest rates, instant approval, and low qualifying credit scores because they’re secured credit cards. Make a security deposit and – because there’s no risk to the bank – you’ll receive a credit card that you can start using to build your credit score.

The size of your security deposit determines your credit limit for a secured credit card. With the Neo Secured Mastercard, your deposit can be as little as $50 – plus, it’s the only secured credit card to offer cash back rewards.

While the Home Trust Secured Visa Card requires a minimum security deposit of $500, it has 2 advantages: Visa is accepted almost everywhere and it has a foreign exchange fee of just 2%. If you shop outside the country online or in-person, consider adding it to your wallet.

It can be difficult to qualify for more conventional credit cards when you're a student, so many banks offer a credit card that is specifically designed for those without a long credit history. The BMO CashBack Mastercard for students is the top student credit card in Canada and can help you build your cedit score and history while earning cash back rewards.

Do you know what your credit score is?

How often do you check your score? Have you ever taken action to improve your score to get credit card approval or better loan terms?

Share your experiences in the comments below.

FAQ

What is the average credit score in Canada?

The average credit score in Canada typically falls around 650 to 700. This can vary slightly depending on the source, but scores in this range are generally considered fair to good.

What is a good credit score in Canada?

A good credit score in Canada is 660 or more, which can help you qualify for more credit products, higher limits, and lower interest rates.

What does a bad credit score mean?

A credit score of 559 or less indicates that you may have trouble paying your bills on time. To minimize financial risk, lenders charge higher interest rates to borrowers with low credit scores.

How can I check my credit score for free?

You can check your credit score for free by contacting Equifax, TransUnion, your banking institution, or a third-party service in-person, online, by mail, or by phone.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

$50 GeniusCash + Guaranteed approval* + Earn cashback on gas & groceries.*

$50 GeniusCash + Guaranteed approval* + Earn cashback on gas & groceries.*

×1 Award winner

×1 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 37 comments