Your credit card statement is a detailed summary of your card activity over the past 30 days, including your balance, due payment, and payment deadline. Learning to read and understand this statement is crucial for managing your finances effectively, avoiding unnecessary interest charges, and spotting billing mistakes. In this guide, we’ll explain how to navigate your credit card statement for better financial management.

Key Takeaways

- A statement shows how you used your credit card during the last 30 days, how much money you currently owe, and when you need to pay it.

- Your bank delivers one statement per month and expects payment before the next one arrives.

- Paying the total card balance listed on your statement resolves your debt and saves you from paying interest.

- Paying the minimum balance listed on your statement keeps your account in good standing at the cost of interest charges.

- You can request help from your bank or credit union in reading and understanding your credit card statement.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

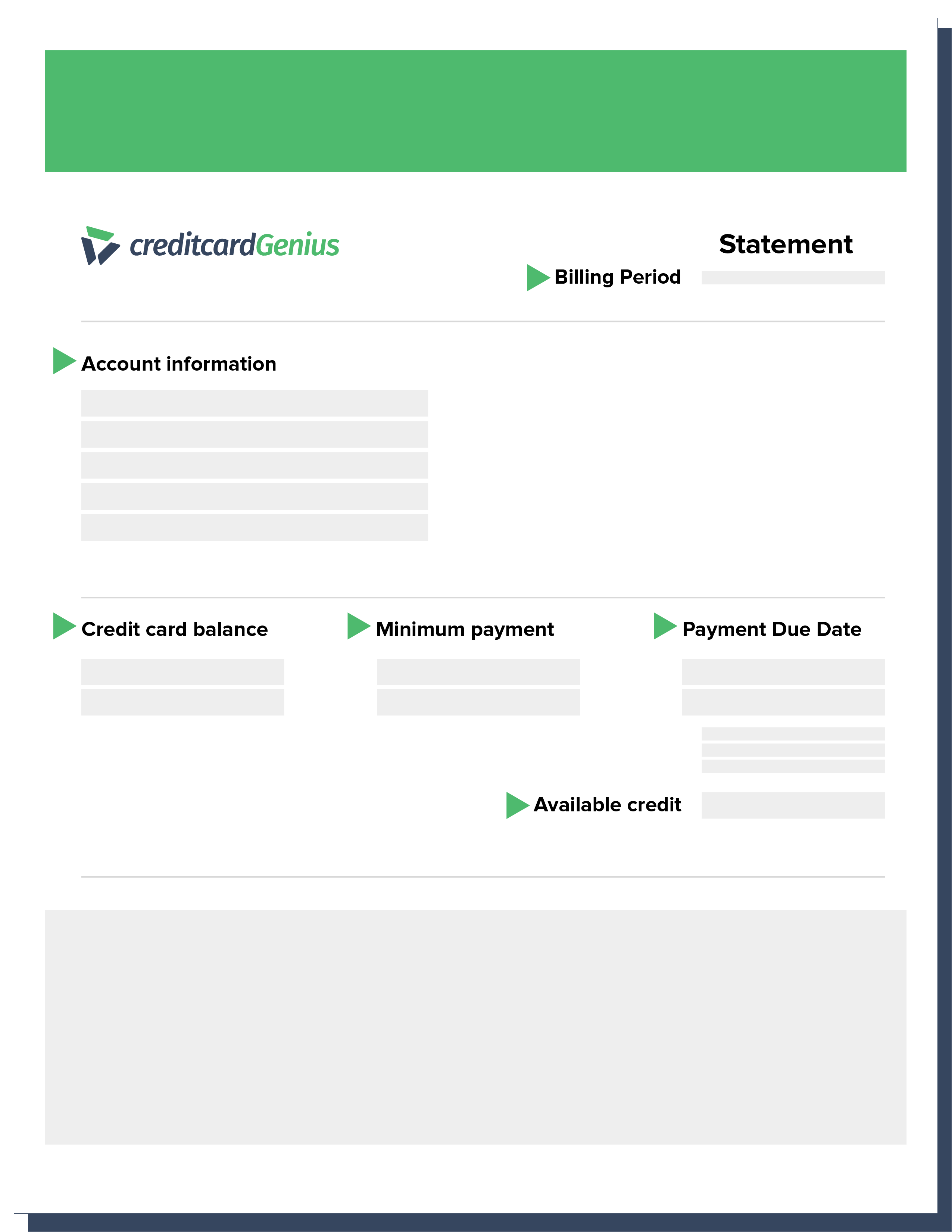

10 credit card statement essentials

Over 40% of Canadians have difficulty reading and understanding their credit card statements – and for good reason. Every bank in Canada labels and organizes information differently, making it a struggle to figure out how much money you owe, how to pay, and when.

We're putting your paperwork into plain language as part of our series on how credit cards work. Here’s how to find the 10 most essential pieces of info on your credit card statement, what they mean, and what to do with them.

1. Your account information

Also known as: Account details, cardholder details, or cardholder information

Where to find it: At the top of the page

What it contains:

- Your name

- Your address

- The name of your card

- Your account number

- The names of anyone else officially listed on your credit card

Your account information confirms you’ve received the right credit card statement. Every credit cardholder can receive an electronic or paper statement, including the primary cardholder, additional cardholders, and joint borrowers.

Check your account information to see if it is correct and up-to-date, and call your bank if it’s not.

2. Your credit card billing period

Also known as: Billing cycle, billing start/end date, statement opening/closing date, statement period, or statement start/end date

Where to find it: At the top of the page or under "Account Information" or “Account Summary”

What it contains:

- The date your billing period began

- The date your billing period ended

Every statement covers a credit card billing period, lasting 28 to 31 days. Banks, credit unions, and other credit card issuers usually send their customers 12 credit card statements per year or roughly 1 per month.

Check the billing period to make sure you’re looking at your most recent and up-to-date credit card statement.

You may not receive a statement if you haven’t used your credit card for 3 months, your balance is $10 or less, or your card is suspended or cancelled.

3. Your credit card balance

Also known as: Account balance, amount due, new balance, or total balance

Where to find it: At the top of the page or under "Account Summary"

What it contains:

- How much money you owe, including any overdue amounts

- How much money you’ve borrowed to date

- How much money you’ve paid to date

- Any credit card fees you have to pay

- Any interest fees you have to pay

Your credit card balance represents how much money you currently owe on your credit card, including everything you’ve borrowed and repaid to date. Paying your card’s balance before the due date helps you avoid interest and negative impacts on your credit score.

Check your credit card balance to see how much debt you carry and if you can afford to pay off your credit card.

4. Your minimum payment

Also known as: Minimum amount due

Where to find it: At the top of the page or under "Account Summary," “Payment Information,” or “Payment slip”

What it contains:

- Your credit card’s minimum payment

- How long it’ll take to pay your credit card balance if you make only the minimum payment each month

Your minimum payment is the least amount of money you can pay to keep your credit card in good standing and prevent your credit score from dropping. But it won’t prevent your bank from applying interest fees.

Check your credit card’s minimum payment to help you decide what to pay this month. It’s always better to pay more than the minimum.

Credit card minimum payment = the higher of $10 + credit card interest + credit fees OR % of credit card balance

5. Your payment due date

Also known as: Minimum payment due date

Where to find it: Next to your minimum payment or under "Account Summary," “Payment Information,” or “Payment Slip”

Your payment due date shows how long you have to pay your current credit card balance (or minimum payment) before your bank applies interest or late payment fees.

Check your credit card payment due date to see if you can make your chosen payment amount in time. Remember, Canadian banks take 2 to 3 business days to process payments. Set a reminder alarm or contact your bank if you think you’ll be late.

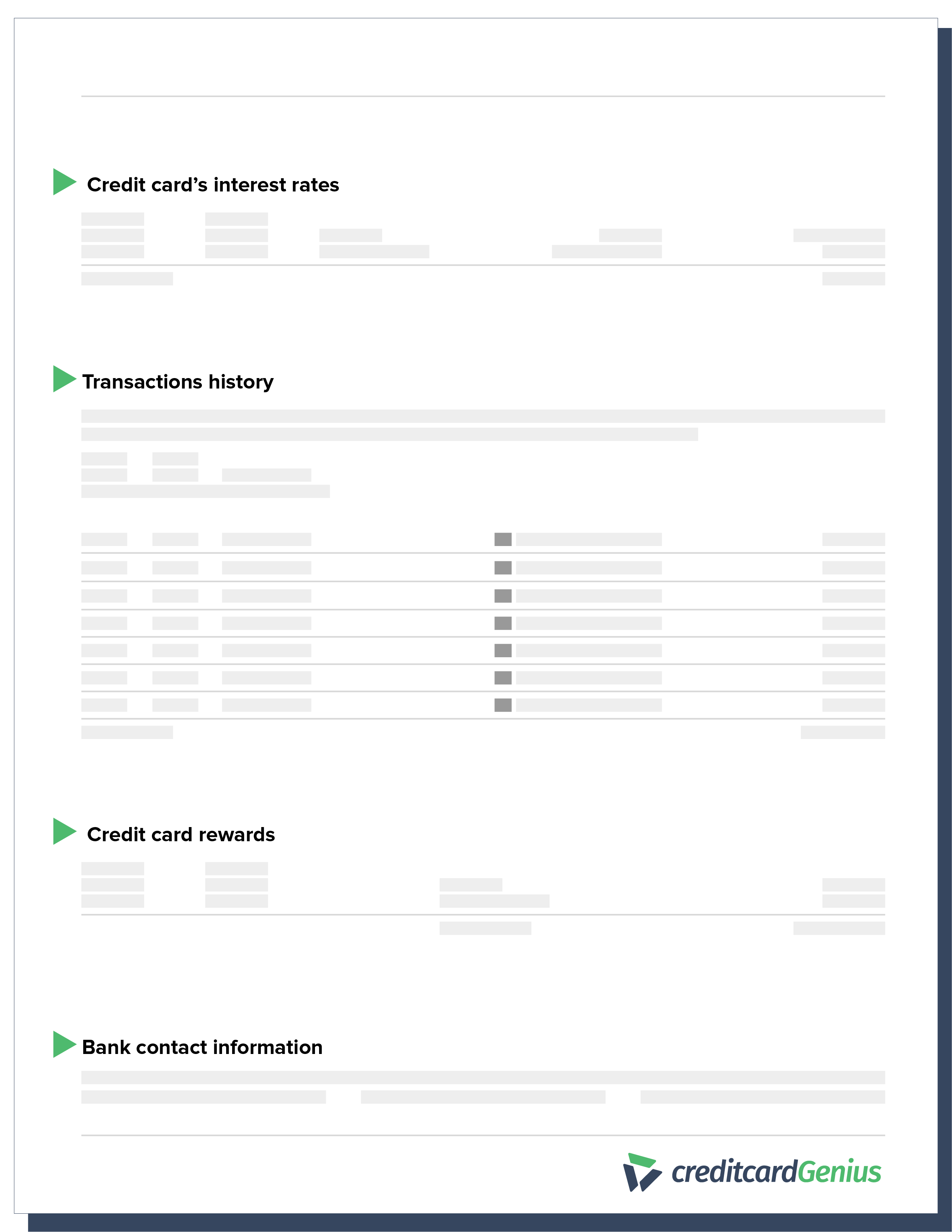

6. Your credit card’s interest rates

Also known as: Annual interest rate, monthly interest rate

Where to find it: At the end of your statement, in the fine print, or on the back of the pages

What it contains:

- The interest rate applied to purchases

- The interest rate applied to cash advances

- The interest rate applied to balance transfers

- Promotional interest rates

- Late payment penalty interest rates

Credit card interest is the fee your bank charges for borrowing money. Although it might be labeled "annual" or “monthly,” interest is calculated and applied daily.

If you pay off your credit card balance each month, you’ll get a 21 to 55-day interest-free grace period on new purchases. Unfortunately, cash advances don’t have grace periods and often have higher interest rates.

Interest fees are the number one reason Canadians fall into credit card debt. Check your credit card’s interest rates to see which transactions are more expensive and calculate how much interest you'll pay if you don’t pay off your card.

Credit Card Interest Calculator

7. Your transaction history

Also known as: Account activity, account history, charges and credits, details of your transactions, or statement activity

Where to find it: Look for a list of dates, vendor descriptions, and charges below your account summary

What it contains:

- Every transaction made in the previous billing period

- Transaction dates

- Posted dates

- Merchant names and descriptions

- Amounts charged and credited

A credit card transaction is any purchase, payment, or other action you make with your credit card. The transaction date is the day you made the action, and the posting date is when your bank officially confirmed and added it to your credit card balance up to 5 days later.

Check your credit card’s transaction history to ensure you were charged the correct amount, and look for any transactions you don’t remember, which could indicate fraud. Call your bank if you notice anything suspicious.

Some banks list shortened merchant names and others add different icons for clothes, groceries, restaurants, etc. Some banks mark purchases with a ‘-’ and payments with a ‘+’ and others don’t. Look for a few transactions you recognize to learn what system your bank uses.

8. Your credit card rewards

Also known as: Cash back summary, points summary, or rewards summary

Where to find it: On the side or at the bottom of the page

What it contains:

- Cash back or points earned

- Cash back or points deducted

- Total cash back or points currently on your credit card

The best rewards credit cards in Canada give you cash back or points each time you use your credit card. You can spend the cash however you’d like, or redeem points for exciting rewards.

Check your credit card rewards to see how much money or points you earned during the last billing period. If you aren’t getting as much cash back or points as you feel you should be, contact your bank.

9. Your available credit

Also known as: Remaining credit, spending power

Where to find it: Near your credit card balance or under "Account Summary"

What it contains:

- How much money you borrowed during your last billing period

- How much money you can still borrow using your credit card

Using your credit card to make a purchase, transfer a balance, or get a cash advance subtracts from your available credit, or how much money your bank will lend you. Paying off your credit card adds to it. If you make sure the amount of credit you use is low and the amount of credit available to you is high, you can improve your credit score.

Check your credit card’s available credit to see whether you’ve got enough spending power for big purchases and emergencies.

10. Your bank’s contact information

Also known as: Customer service, customer support

Where to find it: At the top of the page, at the bottom of the page, in the fine print, or on the back

What it contains:

- Your bank’s customer service contact information

- Your bank’s customer service hours

Canadian banks, credit unions, stores, and other credit card issuers must provide a local or toll-free telephone number that you can use to get in touch. You can also reach out via mail, email, or chat.

Use your bank’s contact information to ask them to explain your credit card statement or help you find a particular piece of info. If you see a strange transaction, lose your credit card, or have your wallet stolen, report it immediately. You can also ask your bank for a payment holiday or to move your payment due date so it falls on a more convenient day.

By law, your bank may only hold you responsible for up to $50 of unauthorized charges and must give you a way to report and resolve them.

How to spot fraudulent charges on your credit card statement

Spotting fraudulent charges on your credit card statement is the first step in protecting yourself from unauthorized transactions. Here are some tips on how to identify suspicious activity:

!ccg-list

- Review your transactions regularly: Make it a habit to look over your credit card statement every month. The more often you do this, the easier it will be for you to remember charges and the faster you can catch fraudulent ones.

- Look for unfamiliar charges: Fraudsters often start with small, unfamiliar charges, as they tend to go unnoticed. Pay attention to any charges that seem out of place, especially if they’re from merchants or countries you haven’t done business with.

- Check for duplicate charges: Fraudsters will duplicate charges to test stolen credit card numbers. Compare your recent purchases to your statements to ensure that you’re not being billed multiple times for the same item or service.

- Pay attention to high-value purchases: Look for larger-than-usual transactions, especially electronics or travel bookings. If you notice a large purchase that you didn’t make, act quickly to alert your card issuer.

- Check the date and amount: Verify that the date and amounts of the transactions align with your spending habits. Fraudulent charges might occur at odd hours or involve unusual amounts.

- Use your bank’s alerts and monitoring tools: Many banks and issuers offer account alerts for large transactions, unusual activity, or purchases abroad. Setting up these alerts can help you catch fraudulent charges in real time.

What to do if you spot fraudulent charges

If you find any suspicious charges on your statement, report them to your credit card issuer immediately. They’ll typically block your card and issue a new one. You may also be entitled to a refund or reimbursement for unauthorized purchases. Be sure to act fast, as delaying the report could affect your ability to dispute the charges!

How long should you keep your credit card statements?

It's a good idea to hold on to your credit card statements for at least 1 year. However, there are specific circumstances that might require you to keep them longer:

- Tax purposes: If you’re using your credit card for business expenses or need to keep records for tax filing purposes, holding on to statements for 6 years is a good idea. The Canada Revenue Agency may ask for records from up to 6 years back in case of an audit.

- Dispute resolution: If you’re involved in a dispute with a merchant or the credit card issuer, it’s wise to keep the relevant statements for at least 6 months after the transaction date, as this is the time frame within which you can usually challenge charges.

- Tracking personal finances: If you’re managing your finances carefully and need to track spending over time, holding onto your statements for a year or two helps you review your spending habits over time.

Once you’ve reviewed your statements and verified you don’t need them for tax or legal reasons, you’re pretty much safe to discard them after a year. Keeping electronic copies is also a good alternative for space-saving and easier access.

FAQ

What’s shown on a credit card statement?

Credit card statements contain vital information like your credit card balance, minimum payment amount, and payment due date.

Do you get statement notifications if you sign up for online credit card bills?

Most Canadian credit card issuers send a courtesy email whenever you receive a new statement. You also have the right to receive electronic alerts whenever the credit available on your card drops below $100 or a pre-set amount.

What’s the best time to pay my credit card?

If you want to present the best picture to Canadian credit bureaus, pay off your credit card in one or two payments at least 7 days before the end of your billing period. If you need to keep some cash in your bank account, pay at least 3 days before the end of your billing period.

Why aren’t my purchases earning credit card rewards?

Credit card purchases only qualify for rewards if the store that made them falls into the right category. You can see how your credit card issuer categorizes stores by checking your statement or calling customer service.

How long do I have to pay a credit card statement?

You have until the payment due date to pay your current credit card statement, about 21 to 55 days.

How do I get electronic credit card statements?

To request online statements, contact your credit card issuer to give your verbal or written consent. You can withdraw your consent and go back to paper statements at any time.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.