Many credit cards offer valuable perks and benefits, including airport lounge access, free roadside assistance, exclusive retail offers, and more. According to our research, the best benefits packages contain over $4,000 of insurance, travel perks, and freebies, though you’d best be prepared to pay $500 or more in annual fees.

We've compiled extensive information about the top-valued credit card perks for Canadians and laid it all out here. You'll find details regarding which are the most valuable perks, how you can make the most of them, which banks and networks offer perks cards worth considering, and plenty more to help you understand which card is best for you.

Key Takeaways

- The most valuable credit card benefits available in Canada are airline companion vouchers, worth an estimated $702 each.

- The most common type of benefit is credit card insurance, which adds an average of $374 to 108 different credit cards.

- On average, TD and Visa Infinite Privilege credit cards offer the most additional value.

- We value the American Express Aeroplan Reserve Card’s benefits – which include an airline companion voucher, a free night’s stay, and the largest welcome bonus – at $4,335.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

The 10 most valuable credit card benefits

In today’s highly competitive market, banks and payment networks use benefits credit cards to win over new customers. Modern cards offer everything from concierge services to insurance coverage to free airline tickets – the biggest challenge is determining which benefits are worth the annual fee (and your time).

To answer this question, we evaluated over 118 credit cards sporting at least $20 in benefits, for a total of 1,200+ points of data. Not counting insurance, the average Canadian credit card offers $575 worth of benefits, which range in value from $72 – $702:

| Rank | Benefit | Average value | Percent of cards with benefit |

|---|---|---|---|

| 1 | Airline companion voucher | $702 | 6.8% |

| 2 | Free night’s stay | $649 | 11.9% |

| 3 | Credit card insurance | $354 | 91.5% |

| 4 | Welcome bonus | $362 | 69.5% |

| 5 | Airport lounge access | $320 | 25.4% |

| 6 | Free checked bags and priority airport services | $215 | 4.2% |

| 7 | Annual credits | $177 | 11.0% |

| 8 | First annual fee rebate | $120 | 14.4% |

| 9 | Roadside assistance | $120 | 2.5% |

| 10 | Automatic payments | $72 | 84.7% |

The combined value of all benefits ranges from $20 – $5,000 per card, but the super-premium travel credit cards at the high end of the scale don’t come cheap. Be prepared to pay at least $500 per year and to spend a lot of time wining, dining, and travelling to get your money’s worth.

1. Airline companion voucher

Value: $260 – $864

Most valuable option: A $599 Air Canada voucher for a flight to Asia

How it works: Using an airline companion voucher, you can take a single travelling companion on a roundtrip to any destination for a flat reduced fee. The only catch is you must fly with a certain airline and, with the exception of the WestJet RBC World Elite Mastercard, meet a minimum spending threshold to earn your voucher.

There are 4 Aeroplan credit cards, 1 British Airways, and 2 WestJet credit cards with this perk. Our top pick is the TD Aeroplan Visa Infinite Privilege Credit Card, which requires at least $25,000 in net purchases before you can pick up an Annual Worldwide Companion Pass starting at just $99.

2. Free night’s stay

Value: $200 – $4,200

Most valuable option: Get 2 free nights when you book 6 nights using Aeroplan points

How it works: Until December 31, 2025, Aeroplan credit cardholders will get 1 free night if they book 3 nights with Aeroplan points, and 2 free nights after booking 6 nights.

If you don’t like Air Canada, your only option is a hotel credit card like the Marriott Bonvoy American Express Card. It includes one free night’s stay per year (worth up to $340) and automatic Silver Elite Status, which carries perks like preferred pricing and 2 PM late check-outs.

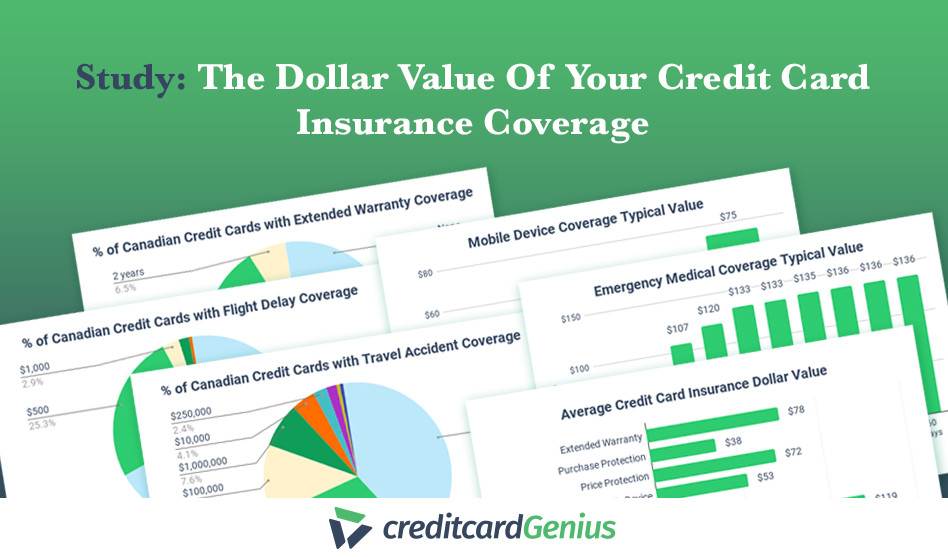

3. Credit card insurance

Value: $2 – $247

Most valuable option: Emergency medical coverage over 65 packaged with travel insurance credit cards for seniors

How it works: With the right credit card, you can say goodbye to pricey rental car insurance and cell phone protection plans. The average credit card carries $374 worth of insurance coverage for shopping, travel, and rental cars.

With 14 types of coverage, the BMO Ascend World Elite Mastercard is one of our top picks for travel insurance. However, shoppers will find the MBNA Rewards Platinum Plus Mastercard’s extended warranty, purchase protection, and price protection coverage more valuable.

4. Welcome bonus

Value: $20 – $1,700

Most valuable option: 40,000 points when you sign up for the TD Aeroplan Visa Infinite Card

How it works: Welcome bonuses put an average of $362 back in your pocket, but the best credit card offers can stretch all the way to $1,500 or more. Unfortunately, you must meet the spending requirements before you can get your dough – and if the bank suspects you of "churning" cards for bonuses, it could close your account.

The bigger the welcome bonus, the larger the annual fee. The TD Aeroplan Visa Infinite Card offers a staggering 40,000 Aeroplan points for $139 per year, while the no fee American Express Green Card offers a modest (though very valuable!) 10,000 Amex point.

5. Airport lounge access

Value: $25 – $706

Most valuable option: Unlimited access for the cardholder plus one guest to the Amex Global Lounge Collection with a American Express Platinum Card

How it works: Getting airport lounge access with your credit card feels amazing – you can put up your feet, read a book, and enjoy unlimited beverages and drinks simply by flashing your card at the door. DragonPass powers most lounge access benefits, which include 0 – 6 free visits worth up to $420 in value.

The American Express Platinum Card is the best lounge access credit card by far, boasting unlimited visits for the cardholder and a guest to the Priority Pass and Amex Global Lounge Collection. If you don’t want to spend $799 per year, the 4-pass BMO Ascend World Elite Mastercard is the best budget pick.

6. Free checked bags and priority airport services

Value: $9 – $1,980

Most valuable option: Free checked bags and priority airport services for up to 9 travellers with a premium Aeroplan credit card

How it works: In Canada, only 4 types of credit cards include air travel benefits: Visa Infinite Privilege cards, American Express Platinum cards, WestJet cards, and Premium Aeroplan cards.

| Visa Infinite Privilege cards | Amex Platinum cards | RBC WestJet World Elite Mastercard | Premium Aeroplan cards | |

|---|---|---|---|---|

| Maximum beneficiaries per trip | 2 | 9 | 9 | 9 |

| 1st free checked bag | ❌ | ❌ | ✅ | ✅ |

| Priority baggage handling, boarding, and check-in | ❌ | ❌ | ❌ | ✅ |

| Priority security | ✅ | ✅ | ❌ | ✅ |

| Airlines | Any | Any | WestJet | Air Canada |

| Value per traveller (one way) | $9 | $9 | $35 | $110 |

| Extras | * Dedicated parking spaces* * Parking discounts * Priority taxi/limo lane* | * 15% parking discount * 15% Car Care discount * Free valet services at Terminal 1 * Preferred pricing | * Preferred pricing | * Preferred pricing * Unlimited Maple Leaf Lounge access for cardholder and one guest |

* Not available at all airports.

As you can see, the most valuable benefits are restricted to a single airline: Air Canada.

With a premium Aeroplan credit card, cardholders enjoy priority security (estimated value: $9); priority baggage handling, boarding, and check-in ($66); and a free 1st checked bag ($35). Apply these benefits to up to 8 other travelling companions on the same booking for a roundtrip, and you’re looking at $1,980 in total savings.

7. Annual credits

Value: $50 – $500

Most valuable option: $200 in travel credits, $200 in dining credits, and a $100 NEXUS fee rebate per year with the American Express Platinum Card

How it works: Annual credits are often restricted to certain purchases or restaurants, but they’re easy to calculate and use. Swipe your card and – if the credit isn’t applied automatically to your credit card balance – check your transaction history for the option to redeem it.

American Express, BMO, CIBC, TD, and National Bank all offer cards with yearly travel, dining, and NEXUS credits ranging from $50 - $200 each. The most affordable option is the BMO eclipse Visa Infinite Card, which applies a $50 "lifestyle credit" to your first purchase of $50 or more each year – it’s like free money!

8. First annual fee rebate

Value: $29 – $149

Most valuable option: Get a $139 rebate for the first year when you sign up for the TD First Class Travel Visa Infinite Card

How it works: Generally, only credit cards with annual fees between $99 – $150 offer annual fee waivers. Anything less isn’t much of a benefit; anything more will cost the bank too much money if the cardholder cancels.

A few cards, like the Scotiabank Gold American Express Card, remain free if you open a chequing account in the same bank and maintain a minimum balance. If you’d rather make the savings permanent, perhaps you’d prefer a no annual fee credit card instead.

9. Roadside assistance

Value: $69 – $120

Most valuable option: Canadian Tire’s Gold roadside assistance package

How it works: With roadside assistance, you can count on help with lockouts, dead batteries, fuel delivery, towing, and more. Both the BMO CashBack World Elite Mastercard and TD Cash Back Visa Infinite Card include 24/7 assistance provided by the Dominion Automobile Association, but the Triangle World Elite Mastercard is a better deal. For no annual fee, you’ll get a Gold roadside assistance package worth $115 per year.

Note: You can add roadside assistance to other select TD credit cards for a fee.

10. Automatic payments

Average value: $72

Most valuable option: Any

How it works: Credit card autopay is a common but under-appreciated feature that automatically withdraws your credit card payment from your bank account. It’ll save you the industry-standard 20% interest fee if you forget to pay your bills and help build your credit score in Canada.

How to maximize your credit card benefits

To increase your chances of getting a significant value from your credit card benefits, try to match your existing shopping habits to the credit card that best rewards them.

Annual credits and fee waivers offer easy, instant savings, while other credit card benefits demand more effort. Depending on the benefit and how often you remember to use it, you could save:

- Up to $99.99 on grocery deliveries using a PC Optimum credit card

- $30 – $50 in supplementary credit card fees

- Up to 25% off car rental rates

- $20 every 20 minutes using credit card concierge services

- $2.50 for every $100 spent using a no foreign exchange fee credit cards

Then there are the benefits that are harder to quantify, such as priority customer service, preferred pricing, and exclusive member deals. We recommend researching your credit card benefits and posting the list somewhere visible, or intentionally scheduling time to use them.

Pro Tip: Maximizing rewards programs can help you get even more value out of your credit card.

Best benefits credit cards in Canada

Based on the 10 most valuable credit card benefits (and the value of their insurance packages), the 5 most valuable benefits cards in Canada with a 4.0+ rating are as follows:

| Credit card | Annual fee | Welcome bonus | Benefits value | Insurance value |

|---|---|---|---|---|

| TD Aeroplan Visa Infinite Privilege Credit Card | $599 | 85,000 Aeroplan points | $4,235 | $833 |

| TD Aeroplan Visa Infinite Card | $139 | 40,000 Aeroplan points | $3,015 | $661 |

| CIBC Aeroplan Visa Infinite Privilege Card | $599 | 85,000 Aeroplan points | $2,901 | $1,037 |

| American Express Platinum Card | $799 | 100,000 Amex points | $2,031 | $500 |

| CIBC Aventura Visa Infinite Card | $139 | 45,000 Aventura points | $1,481 | $661 |

Given the value packed into Aeroplan credit cards, it’s no surprise the top 3 cards all feature airline companion vouchers, free checked bags, and priority airport services. An old favourite, the Amex Platinum, offers premium airport lounge access and massive annual credits, while the CIBC Aventura Visa Infinite rounds out the list with a generous welcome bonus.

Most valuable credit card benefits by bank

Now that you know which credit card benefits are worth your time and money, it’s time to put the same question to the biggest banks in Canada.

| Bank | Average benefits value | Average insurance value |

|---|---|---|

| TD | $1,606 | $489 |

| American Express | $1,364 | $347 |

| CIBC | $799 | $350 |

| RBC | $560 | $332 |

| BMO | $384 | $247 |

| Scotiabank | $359 | $546 |

| Desjardins | $220 | $619 |

| Tangerine | $167 | $179 |

| MBNA | $156 | $255 |

| National Bank | $100 | $431 |

Although averages favour banks with more premium credit cards (and penalize banks with a wide variety of low-fee cards), these numbers can still tell us a lot. For example, as we’ll show in the next section, high-end Visa credit cards tend to hold the most benefits value, which puts TD at the top of the list.

Amex benefits owe much of their value to in-house programs – such as Amex Offers, Amex Membership Rewards, and Centurion Lounges – that keep costs low and rewards high. Without substantial travel partnerships, the rest of the Big 5 Banks lag behind, followed by smaller banks that lack the capital to offer luxury benefits.

Most valuable credit card benefits by network

Banks aren’t the only companies using benefits to lure customers – payment networks do it too! American Express credit cards offer an average of $1,229 in benefits, followed by Visa at $718, and Mastercard at $195.

However, if you only look at each network’s top cards, the numbers tell a different story.

| Visa | American Express | Mastercard | |

|---|---|---|---|

| Top-tier program | Visa Infinite Privilege | American Express Platinum | World Elite Mastercard |

| Minimum income requirements | $150K personal or $200K household | N/A | $80K personal or $150K household |

| 24/7 concierge | ✅ | ✅ | ✅ |

| Golf benefits | ✅ | ❌ | ✅ |

| Car rental benefits | ✅ | ✅ | ❌ |

| Exclusive dining reservations/events | ✅ | ✅ | ❌ |

| Airport lounge benefits | * Free DragonPass membership * Up to 6 free visits | * Free Priority Pass membership * Free Amex Centurion Lounge membership * Unlimited access plus one guest | * Free DragonPass membership * Up to 2 free visits |

| Airport lounge benefits value | $370 | $650 | $175 |

| Hotel benefits | * Automatic Sandman and Sutton Place Diamond status * 3 PM late check-out * $25 USD food and drink credit * Complimentary breakfast * Complimentary in-room WiFi * Complimentary room upgrade on arrival | * Automatic Hilton Honors and Marriott Bonvoy Gold status * 12 PM early check-in * 4 PM late check-out * Complimentary breakfast * Complimentary in-room Wi-Fi * Complimentary room upgrade on arrival | * None |

| Average card benefits value | $1,915 | $1,746 | $555 |

In our study, Visa Infinite Privilege credit cards won out thanks to their Aeroplan benefits and massive welcome bonuses. In reality, the Amex Platinum likely offers more value; some of its benefits, like Fine Resorts + Hotels (which provides an estimated $600 USD of value per stay) fell outside the scope of our study.

What is clear is that World Elite Mastercards aren’t competitive at the super-premium level, but they offer decent benefits for $150 per year or less.

Methodology

Our study considered 118 benefits credit cards (defined as those offering at least $20 in benefits) and over 10 types of benefits. Whenever possible, we used the estimates provided on each credit card’s official webpage, but we used the following methods to calculate the value of:

- Airline companion vouchers: WestJet offers credit cardholders the chance to trade 1 airline companion voucher for 4 lounge vouchers, each worth a maximum of $65 at its flagship Elevation Lounge. Air Canada’s top voucher value ($1,600) is based on the difference between a $599 voucher to Asia and the maximum price of a comparable route using its flight reward chart, assuming $0.02 per point.

- Automatic payments: We applied a 1-month 20% interest fee to the average Canadian credit card balance ($4,625 according to TransUnion in Q3 2023).

- Credit card insurance: We drew all values from our study on the value of Canadian credit card insurance.

- Free night’s stay: A 1-night Marriott stay certificate is worth up to 35,000 Marriott Bonvoy rewards points, which we multiplied by $0.97. A 1-night stay at an Aeroplan HotelSavers hotel is worth 10,000 - 105,000 points, which we multiplied by $0.02.

- Priority baggage handling, boarding, and check-in: We based our calculations on a $650 last-minute upgrade to Business Class on an Air Canada domestic flight, minus the cost of unrelated amenities. Some Business Class benefits – such as in-flight entertainment – have no posted cost and so were not subtracted.

- Priority security: We based our calculations on 15 minutes spent at Pearson Airport multiplied by the average hourly wage in Toronto of $36 (courtesy of the Economic Research Institute (ERI)).

The values provided are rather generous and some assume the presence of travelling companions. We encourage you to investigate the values of credit card benefits as they apply to your personal situation before committing to a new card.

FAQ

What credit card provides the best benefits?

For priority airport services, airport lounge access, and a sizable welcome bonus, we recommend the TD Aeroplan Visa Infinite Privilege Credit Card.

Are credit cards with lounge access worth it?

Unfortunately, lounge access benefits probably aren’t worth it. As more airport lounges welcome credit cardholders, guests report increasingly crowded conditions and lapses in service quality.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×3 Award winner

×3 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments