Most Canadians are juggling multiple payment due dates, and setting up credit card auto payments is a convenient way to lessen the mental load.

To do this, you simply specify how much to pay, which account the payment should come from, and the date the payment should be made. As long as you pay off your full credit card balance each month, you’ll avoid high interest payments and you'll never be late on your bills.

However, there are a few important considerations, so read on to learn if this payment strategy is right for you.

Key Takeaways

- Credit card auto payments make it very easy to ensure all your bills are paid on time.

- You can set up credit card auto payments online or through your credit card app.

- You can specify payment dates, amounts, and adjust withdrawals whenever you like.

- Auto payments make sense if you have the funds to pay off the card balance in full instead of only making minimum payments.

- Don't use credit card auto payments if don't typically make more than the minimum monthly required payment for your card as the interest charges will add up very quickly.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What are credit card autopayments?

Credit card autopay is a feature that allows you to set up your credit card to automatically pull a payment out of your bank account on a set schedule.

Most banks and credit cards allow you to do this, and you can usually pay either the minimum amount, the full balance, or a set amount in between. You can (usually) set it up so your credit card does this multiple times each month, if you so choose.

How to set up automatic credit card payments

Most credit card issuers make it easy to set up auto payments for your credit card, right through their online app or website.

The steps usually go something like this:

- Sign in to your online banking and select your credit card account

- Find the option to set up pre-authorized payments

- Select the bank account you want the payments to come from (which are often your bank or another financial institution)

- Set your payment schedule

- Select your payment option, typically the minimum payment, the full balance, or a custom amount

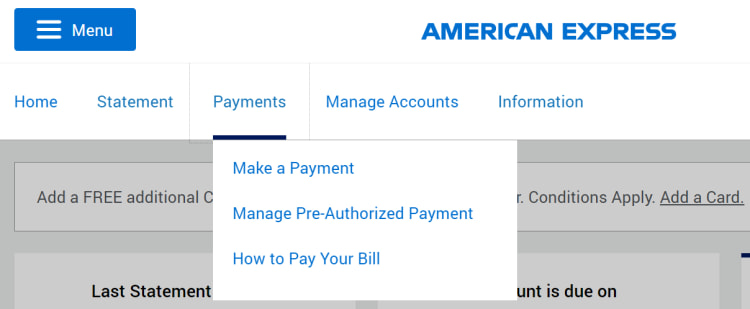

For example, with an American Express credit card, all you have to do is sign in and then go to the top Payments tab and click "Manage Pre-Authorized Payment":

Once there, it's as simple as connecting your bank account and choosing whether you want to pay the minimum amount or the full balance. Amex will then withdraw that money from your account on the due date specified on your statement (and send you an email when they do).

It's usually as simple as that.

One thing to keep in mind is that payments can take a bit of time to process, so don't set your payments to come out on your statement due date if you can help it – give yourself some breathing room and have your payments applied a few days ahead of time at least.

Which credit cards offer auto payments in Canada?

While many Canadian credit cards offer the auto payments feature, some don't.

Here's a quick list of the major issuers that generally offer autopay. Keep in mind that they don't necessarily offer it on all their cards. For example, it may not be available for business credit cards.

Here are three top credit cards that offer the convenience and simplicity of autopay.

| Credit card | Welcome bonus | Rewards | Annual fee and income requirements | Interested? |

|---|---|---|---|---|

| American Express Cobalt Card | Up to 15,000 points after spending $750 every month for the first year | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | * $191.88 * No income requirements | Apply now |

| BMO CashBack World Elite Mastercard | up to $480 cash back in the first 12 months | * 5% cash back on groceries, up to $500 in monthly spend * 4% cash back on transit, up to $300 in monthly spend * 3% cash back on gas, up to $300 in monthly spend * 2% cash back on recurring bills, up to $500 in monthly spend * 1% cash back on all other purchases | * $120 * Personal: $80,000 * Household: $150,000 | Apply now |

| MBNA Rewards Platinum Plus Mastercard | Up to 10,000 points after spending $500 in the first 90 days and signing up for paperless e-statements | * 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category) * 1 point per $1 spent on all other purchases | * $0 * No income requirements | Apply now |

Benefits of auto paying with your credit card

Why would you bother with auto payments? Here's a quick rundown of the benefits:

1. Never miss a payment again

99% of the time, we're organized and make sure we take care of that credit card payment as soon as the statement comes in. But then there's that 1% of the time when we're super busy, or on vacation, or it just slips our mind, and we miss a payment.

So many of us are guilty of it.

Setting up credit card autopay is like asking your robot butler to take care of these things for you, and robots are pretty good at remembering stuff. You'll never miss a payment again.

2. Never carry a balance (and never pay interest charges)

If you're responsible with your credit card and only use it to buy things you already have the funds for, credit card autopay will ensure you never accidentally carry a balance.

We all know what carrying a credit card balance means – steep interest charges that can pile up fast. With autopay, you can avoid this problem entirely.

3. Protect (and build) your credit score

Missed payments and a growing pile of debt will hurt your credit score, and the more it happens, the worse it gets.

Credit card autopay not only helps save you money, but it also ensures that your credit score stays in tip-top shape.

Drawbacks of automatic credit card payments

Auto payment drawbacks mostly boil down to the same core problem: automating something makes it pretty easy to forget about it altogether.

1. Ending up in overdraft

If you're spending more on your credit card than you have coming in every month, your credit card auto payments may push your bank account into overdraft. And this can be a pretty expensive proposition, especially if it happens regularly.

Only set up credit card autopay if you're certain you'll have the money in your account to cover each payment on the date it's withdrawn.

2. Neglecting to check your statements

Autopay can make you complacent about checking your credit card statements. When your statement arrives, you take a cursory glance, but that's it.

This is a very bad habit to get into. Your credit card statement is one line of defence you have against credit card fraud and erroneous charges.

Always take a few minutes to check your credit card statement in detail every month, whether you have autopay set up or not. The faster you notice and report problems to your credit card issuer, the easier they'll be to get sorted out.

3. Only making the minimum payment

It can be tempting to set up credit card autopay just to cover the minimum payment each month, taking care of the rest manually.

This ensures you never miss those crucial minimum payments, but it also risks you forgetting the "pay the rest yourself manually" part.

Only making minimum payments on your credit card is a terrible idea. You'll start racking up interest charges in no time, and you could end up in a debt spiral you can't escape – and you won't even realize it's happening until it's too late.

If you're going to set up credit card autopay, we strongly recommend that you don't set it and forget it as a minimum payment option. You're better off skipping auto payments entirely at that point and just paying your credit card manually, the old-fashioned way.

FAQ

Can I set up auto payment for my credit card?

Yes, you can set this up yourself. Log into your card’s website or mobile app and head to the payments option. Look for 'Auto Payment' and choose the amount and the account it should be paid from each month.

Is it a good idea to automate credit card payments?

If you’re someone who has a hard time remembering to make credit card payments, then yes, automatic credit card payments are a great idea. If possible, make your payments in full to avoid carrying a balance.

Can I make my car payment with a credit card in Canada?

You can do this only if your auto loan lender agrees. That said, just because you can make the payment with your card doesn’t mean you should. Only pay with a card if you can pay off the debt.

Does having auto pay on a credit card affect credit score?

Using auto pay is an excellent idea if you’re making full payments, but if you’re only making the minimum payment, you could damage your score. The interest charges can add up very quickly, leading you into a debt spiral.

Is autopay good for credit?

Credit card autopay can be good for your credit, as long as you always have the money in your bank account when your automatic payment kicks in. If you don't, you risk going into overdraft or accidentally missing a payment.

Is it good to pay your credit card early?

Yes and no. It’s good to pay off your full statement balance each month as soon as the statement is posted. But, you don’t want to pay off your balance any earlier, as it won’t positively affect your credit score.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments