Best Canadian Tire Credit Cards in Canada for 2026

If you meet the high income requirements, the Triangle World Elite Mastercard is the best Canadian Tire credit card. Of the 3 cards that earn Canadian Tire money, this Mastercard offers the highest earning rates and includes some attractive benefits like roadside assistance.

Don’t meet the income requirements? You’ve still got 2 other no-fee card options that are easier to qualify for and still earn CT money. If you’re new to the Canadian Tire Rewards Program, we’ll also walk you through the best ways to earn and redeem rewards, so let’s get started.

Key Takeaways

- The best Canadian Tire credit card is the Triangle World Elite Mastercard.

- Canadian Tire offers 3 branded credit cards that earn Canadian Tire Triangle rewards or cash back.

- If you opt for a Canadian Tire Mastercard, you can only redeem your rewards at Canadian Tire stores or its affiliates.

- There are plenty of better alternatives to earn more rewards, including the SimplyCash Preferred Card from American Express.

Best Canadian Tire credit cards in Canada

| Triangle World Elite Mastercard | Triangle Mastercard | Canadian Tire Cash Advantage Mastercard | |

|---|---|---|---|

| Annual fee | $0 | $0 | $0 |

| Type of reward | Canadian Tire Triangle Rewards | Canadian Tire Triangle Rewards | Cash back |

| Reward details | * 4% CT Money at Canadian Tire stores * 3% CT Money on grocery store purchases * 1% CT Money on all other purchases * Collect 5 cents CT Money per liter on reg/mid grade fuel, or 7 cents on premium fuel at Gas+ and Husky stations | * 4% CT Money at Canadian Tire stores * 1.5% CT Money at grocery stores * 0.5% CT Money everywhere you shop * Collect 5 cents CT Money per litre at Gas+ and Husky stations | * 0.25% up to $1,500 spent annually * 0.5% between $1,500 and $3,000 spent annually * 1% between $3,000 and $24,000 spent annually * 1.5% over $24,000 annually * 2x cash at Canadian Tire stores and gas bars |

| Average rate of return % | 1.48% | 0.82% | 1.17% |

| Purchase interest rate | 21.99% | 21.99% | 21.99% |

| Income requirements | $80K personal or $150K household | None | None |

Triangle World Elite Mastercard

There are only a few options for store-branded cards, but if we had to choose the best, but the Triangle World Elite Mastercard is the best Canadian Tire credit card. At an average of 1.48%, this card offers the highest return, giving it an edge over the Triangle Mastercard.

There are some steep income requirements ($80,000 personal or $150,000 household), but this card offers better rewards because of them. For instance, it includes roadside assistance, basic purchase insurance, and valuable World Elite Mastercard benefits – all for no annual fee.

Pros:

- Up to 4% back in CT money

- Free roadside assistance

- No annual fee

Cons:

- High income requirements

- Limited insurance

Triangle Mastercard

The Triangle Mastercard is the easiest Canadian Tire credit card to get since there’s no annual fee and no income requirements. This makes it quite appealing for many Canadians.

Because of its easy accessibility, though, you’re getting a very basic card with pretty low earn rates. While your purchases at Canadian Tire earn you 4% CT money, you’ll only earn 1.5% CT money on grocery purchases and 0.5% on all other purchases.

Pros:

- 4% back at Canadian Tire stores

- 1.5% back on groceries

- No annual fee

Cons:

- Only 0.5% back on other purchases

- No insurance package

Canadian Tire Cash Advantage Mastercard

Instead of Canadian Tire Money, the Canadian Tire Cash Advantage Mastercard rewards you directly with cash back. In fact, you'll earn double cash back when shopping at any of the Canadian Tire family of stores. You're already saving on the annual fee, since there isn't one, so these cash back rewards are essentially bonus savings.

That said, the earn rate is still lower than the Triangle World Elite Mastercard – and one of the biggest caveats is that you'll have to spend more to earn more. If you don't use this card often, you'll get very low returns.

Pros:

- Up to 1.5% cash back on purchases

- 2x the cash back at Canadian Tire stores

- No annual fee

Cons:

- Tiered rewards system is complicated

- No insurance

How to earn and redeem Canadian Tire rewards

Canadian Tire replaced its old paper-based money with the digital Triangle Rewards program. If you have a Canadian Tire card already (or decide to apply for one), here’s what you can expect.

To earn Triangle Rewards points, make purchases – it’s that easy. You’ll earn on your purchases at Canadian Tire and affiliated stores, including:

- Mark's/L'Équipeur

- SportChek

- PartyCity

- Sports Experts

- Atmosphere

- Pro Hockey Life

- Sports Rousseau

- Hockey Experts

- L'Entrepôt du Hockey

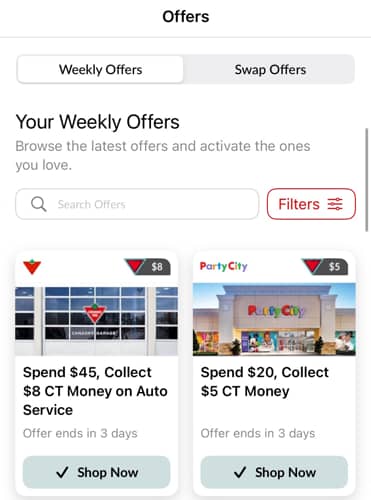

When you download the Triangle Rewards app, you’ll get limited-time bonus offers that can help you earn double, triple, or even five or ten times the points on eligible purchases.

Triangle Rewards points are valued 1:1 with Canadian dollars – so if you have $5 in Triangle Rewards points, you can redeem them for $5 CAD off your purchase at any of the above stores. Simply let the cashier know, and they’ll apply your points.

Is a Canadian Tire credit card worth it?

If you’re a loyal Canadian Tire customer and aren’t fussed about earning rewards that you can use elsewhere, you might consider a CT card. After all, there’s no fee, and it’s pretty easy to qualify for the card.

That said, even CT fans can benefit from choosing a different rewards credit card. Our favourite is the SimplyCash Preferred Card from American Express. Your hands aren’t tied with using the card – you’ll earn fantastic rewards, and you have flexible redemption options. And yes, you can still use the card at Canadian Tire.

Canadian Tire financing plan

One of the biggest attractions of CT-branded cards is the Canadian Tire financing option you’ll enjoy: 24 months of no-fee, interest-free financing on purchases over $150. That’s in addition to the CT money you’ll earn by using the card at Canadian Tire.

Here’s how it works: Charge a purchase of at least $150 at a participating retailer. The amount of your purchase is deducted from your CT card’s credit limit, but the amount is divided into 24 equal monthly payments. You aren’t charged interest or any fees, which can save you money as you pay off the purchase.

For example, you spend $300 on hockey equipment from SportChek. That $300 is divided into 24 payments, totalling $12.50 per month. Overall, you’ll earn $12 in CT money.

Triangle Rewards vs. other popular programs

If you haven’t committed to a loyalty program (or you’re wondering if it’s worth enrolling in yet another program), take a look at how these popular programs compare.

| Triangle Rewards | PC Optimum | Scene+ | |

|---|---|---|---|

| Where you can earn | * Canadian Tire * Sport Chek * Mark’s * Party City * L’Equipeur * Sports Experts * Petro-Canada … and more | * Loblaws * Shoppers Drug Mart * No Frills * Real Canadian Superstore * Esso/Mobil | * Scotiabank * Cineplex * Sobeys * Foodland * Home Hardware * Expedia |

| Program currency | Triangle Rewards Dollars (CT Money) | PC Optimum Points | Scene+ Points |

| What you earn | 0.4% back in CT Money | * 15 points per $1 at Shoppers Drug Mart and Pharmaprix * 10 points per litre at Esso/Mobil * Varying points at grocery stores * Bonus points/offers available | * 5 points per $1 at Cineplex * 1 point per $1 at Cineplex Stores, RecRoom, and Playdium * 3 points per $1 on hotel and car rentals through Expedia * 50 points per $50 spent at Home Hardware * Up to 20% back with retail partners * 1 point per $2 spent at select convenience stores * 1 point per $3 at select restaurants |

| Redemption option (highest earning option in bold) | * Cash redemption at Canadian Tire, Mark, Sports Chek, and other participating retailers | * Car wash at Esso or Mobil * Cash back at participating retailers * Annual fee discount * Donate points * Gas discount | * In-store discounts * Travel credits * Gift cards * Statement credits |

| Point value | $1 CT dollar = 1 CAD | 0.1 to 0.21 CPP | 0.67 to 1 CPP |

| Mobile app | Yes | Yes | Yes |

| Special features | * Free to join * Increase your earn rate and get extra rewards if you sign up for Triangle Select * Receive personalized weekly offers * Earn more during Triangle Bonus Days | * Free to join * Get members-only pricing * Share PC Optimum accounts * Earn more with a PC Optimum credit card or by opening a PC Money Account | * Free to join * Members-only deals and pricing at partnering grocery stores and pharmacies * Earn more points by using a Scene+ credit card |

| Best card | Triangle World Elite Mastercard | MBNA Rewards World Elite Mastercard | Scotiabank Gold American Express Card |

To help you decide the best program for you, think about where you spend the most money and find the program that rewards you the most for it.

Canadian Tire credit card alternatives

If you’re serious about earning rewards, we recommend looking beyond Canadian Tire-branded cards. You’ll find plenty of other options with better earn rates, features, and perks.

| Category | Credit card | Average earn rate | Annual fee |

|---|---|---|---|

| Best flat rate cash back | SimplyCash Preferred Card from American Express | 2.55% | $119.88 |

| Best no-fee cash back | SimplyCash Card from American Express | 1.46% | $0 |

| Best no-fee Mastercard | MBNA Rewards Platinum Plus Mastercard | 1.54% | $0 |

1. Best flat rate cash back credit card for Canadian Tire

Rewards:

- 4% cash back on gas and groceries

- 2% cash back on all other purchases

If you're looking for a flat-rate cash back card that has a good earn rate for all your spending (at Canadian Tire and everywhere else), the SimplyCash Preferred Card from American Express is worth a second look.

Although there is an annual fee, you’ll earn up to 4% back on gas and groceries and 2% back everywhere else. If you’re still on the fence about the card, its generous welcome bonus of 10% cash back for the first 3 months, up to $2,000 in spend. Plus, earn $50 when you make a purchase on month 13 might seal the deal.

Pros:

- 10 types of included insurance

- American Express and Front of the Line

- Access to Amex Offers

- Additional cards are free

Cons:

- Lower acceptance as an American Express

- Cash back only paid out once per year

2. Best no-fee cash back credit card for Canadian Tire

Rewards:

- 2% cash back on gas

- 2% cash back on groceries (up to $300 cash back annually)

- 1.25% cash back on all other purchases

If you like the idea of a cash back credit card for shopping at Canadian Tire but are balking at the annual fee, check out the SimplyCash Preferred Card from American Express's little brother, the SimplyCash Card from American Express.

It's similar to the premium version, but since it doesn't have an annual fee, the earn rate and welcome bonus are lower. But it’s a solid card, and you’ll still earn 5% cash back for the first 3 months, up to $2,000 in spend.

Pros:

- 10 types of included insurance

- American Express Invites and Front of the Line

- Access to Amex Offers

- Additional cards are free

Cons:

- Lower acceptance as an American Express

- Cash back only paid out once per year

- $119.88 annual fee

3. Best no-fee Mastercard for Canadian Tire

Rewards:

- 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category)

- 1 point per $1 spent on all other purchases

Would you rather collect travel rewards than cash back? If so, check out the MBNA Rewards Platinum Plus Mastercard. You'll start with a welcome bonus of up to 10,000 bonus MBNA Rewards points after spending $500 in the first 90 days and signing up for paperless e-statements. Then you’ll earn 2 points for every $1 spent on restaurants, groceries, and select recurring bills.

You can redeem MBNA Rewards for travel, cash back, merchandise, gift cards, and charitable donations. With its flexibility and high earn rate, this card gives you the most purchasing power.

Pros:

- Valuable earn rate

- 3 types of insurance

- No annual fee

- Flexible rewards and redemption options

Cons:

- Annual caps on bonus categories

- Poor cash redemption value

FAQ

What credit card does Canadian Tire have?

Canadian Tire offers 3 branded Mastercards, the best of which is the Triangle World Elite Mastercard. This card provides an average earn rate of 1.48% as well as roadside assistance and other benefits. The Triangle Mastercard and Canadian Tire Cash Advantage Mastercard are slightly less valuable, but are available for no annual fee.

What credit score is needed for a Canadian Tire credit card?

Canadian Tire requires a good credit score to get any of its credit cards. Specifically, you’ll need a score between 760 and 900 to qualify. If your score needs improvement, focus on paying down debt and making timely payments consistently.

What is the minimum income for the Triangle World Elite Mastercard?

World Elite Mastercards typically have high income requirements, and the Triangle World Elite Mastercard is no exception. You’ll need at least $80,000 in personal or $150,000 in household income per year to qualify, as well as an approximate credit score between 760 and 900.

Are the Canadian Tire Mastercard and the Triangle Mastercard the same?

Yes, these are different names for the same Canadian Tire credit card. The Triangle Mastercard doesn't have any income requirements, nor does it charge an annual fee, but it still earns an average 0.82% earn rate. Users can earn up to 4% back for every $1 spent at Canadian Tire-owned stores.

What does the Triangle Mastercard offer for rewards?

Triangle Mastercard cardholders earn 4% CT Money at Canadian Tire, 1.5% CT Money at grocery stores, and 0.5% CT Money on all other purchases. Plus, users collect 5 cents CT Money per litre at Gas+ and Husky stations.

Editorial Disclaimer: The content here reflects the author's opinion alone. No bank, credit card issuer, rewards program, or other entity has reviewed, approved, or endorsed this content. For complete and updated product information please visit the product issuer's website. Our credit card scores and rankings are based on our Rating Methodology that takes into account 126+ features for each of 228 Canadian credit cards.

×2 Award winner

×2 Award winner

$50 GeniusCash + Earn up to $100 in bonus cash back.

$50 GeniusCash + Earn up to $100 in bonus cash back.