Best Brim Financial Credit Cards in Canada for 2026

The best Brim Financial credit card is the Brim World Elite Mastercard, though its no-fee counterpart, the Brim Mastercard, isn't far behind. Both earn Brim Open Rewards and have low foreign exchange fees.

This article compares the rates, fees, features, and limitations of these Mastercards. There's also a comparison with the Wealthsimple Visa Infinite, a card from another top Canadian fintech issuer.

Key Takeaways

- The best Brim credit card is the Brim World Elite Mastercard, offering more extensive insurance and benefits than its alternative.

- Both Brim Mastercards earn Open Rewards that can be redeemed at any time.

- Brim Financial devalued its reward program in 2024, so if you’re looking for lots of rewards, there are many better options out there.

Best Brim credit cards

You might have noticed that Brim Financial credit cards don’t appear on creditcardGenius as much as credit cards from other issuers. That’s because the fintech company made a massive cut to its rewards program a few years ago and started charging foreign exchange fees with all of its cards.

Still, they do have features and benefits that many people find attractive. Take a look:

| Credit card | Annual fee | Rewards | Insurance coverage | Average earn rate | FX rate |

|---|---|---|---|---|---|

| Best overall: Brim World Elite Mastercard | $89 | * 1% cash back on all purchases | 12 types | 1.3% | 1.5% |

| Best basic: Brim Mastercard | $0 | * 0.5% cash back on all purchases | 4 types | 0.83% | 1.5% |

The overall best Brim credit card: Brim World Elite Mastercard

Rewards:

- 1% cash back on all purchases

The Brim World Elite Mastercard is Brim’s premium credit card. You'll earn 1% cash back on all spending and get an excellent insurance package, with 12 types of coverage – for a reasonable $89 annual fee. You can add supplemental cards, called Family Cards, for $50 each, and allow household members to have their own Brim credit card, but you get to set spending limits for them and track purchases.

Pros:

- 1.5% foreign exchange fee

- Mastercard Travel Pass

- 12 types of insurance

- Family Cards available

Cons:

- High income requirements

- Low earn rate

The best basic Brim credit card: Brim Mastercard

Rewards:

- 0.5% cash back on all purchases

If you prefer a card with no annual fee, consider the Brim Mastercard, Brim's more basic option. It offers 0.5% cash back on all purchases and comes with 4 types of insurance. Cardholders earn Brim Open Rewards, but at a slightly lower rate than the Brim World Elite version. Luckily, this card is easier to qualify for than Brim’s premium option – it requires a personal income level of just $15,000, but no household income requirement at all.

Pros:

- Low 1.5% foreign exchange fee

- 4 types of insurance included

- Redeem points towards any purchase at any time

Cons:

- Low earn rate

- No welcome offer

What is Brim Financial?

Brim Financial is a relatively new player in the credit card industry. Launching its first line of credit cards in 2018, Brim markets itself as a company that offers cutting-edge innovation and a uniquely digital financial experience.

By prioritizing the technological aspects of banking, Brim credit cards deliver top-of-the-line security and convenience through online banking, digital budgeting tools, and support for 5 digital wallets: Apple Pay, Samsung Pay, Google Pay, Fitbit Pay, and Garmin Pay.

Pros and cons of Brim credit cards

Brim credit cards have low foreign exchange fees and seemingly endless partner offers, but they also have unexceptional earn rates.

Here are a few more detailed pros and cons of Brim credit cards:

Brim credit card pros

- Good insurance coverage: Depending on which Brim card you choose, you’ll get up to 12 types of coverage included.

- Low foreign exchange fees: Most credit cards charge an extra 2.5% on purchases that aren't made in Canadian dollars, but Brim cards only charge 1.5%.

- Unique perks: Using your Brim card can earn you discounts. You can also upload your Brim card to 1 of 5 mobile payment methods, and the cards come with high-grade security.

- Opportunities to earn bonus rewards: Hitting a specific purchase amount or reaching a spending milestone with Brim partners can earn you extra rewards.

Brim credit card cons

- No boosted earn categories: You’ll have to look elsewhere if you want boosted earn rates on things like gas and groceries, since Brim only offers flat-rate cash back earning.

- Mediocre earn rates: Brim’s entry-level card offers a measly 0.5% cash back, while the World Elite offers just 1% – very low for a premium card with an annual fee.

- No welcome offers: Unfortunately, neither of the Brim Mastercards offer any type of welcome bonus for new clients.

Brim credit card features

In a crowded credit card landscape, here are the things that make Brim Mastercards stand out:

Low foreign exchange fees

You can use your Brim credit card when travelling and save on the usual 2.5% (or more) foreign transaction fee. Brim caps the foreign exchange fees at just 1.5%.

Flexible payment options

Brim credit cards can help take the sting out of larger purchases by offering installment plans. Any purchase of more than $500 qualifies.

You can spread your payments over 12, 16, 20, or 24 months, with a one-time fee plus a monthly processing fee of 0.475% of the transaction amount.

Here’s all you have to do to set up a flexible payment plan:

- Make a qualifying purchase of over $500. Keep in mind that restaurant, grocery, and liquor store purchases do not count for flexible payment.

- Open and log into the app, then select the purchase.

- Select a repayment term length.

- Choose "install" to agree to the repayment terms and conditions. Read through all the fees before confirming the plan.

Be careful: Installment plans can make it easy to overextend yourself financially. It’s best to use these plans sparingly and avoid carrying a balance on your credit card.

Insurance coverage

Both Brim credit cards include purchase insurance and some travel coverage. Take a look.

| Insurance type | Brim Mastercard | Brim World Elite Mastercard |

|---|---|---|

| Travel accident | * $100,000 personal * $300,000 accident | * $150,000 personal * $500,000 accident |

| Trip cancellation | X | * $2,000 per insured * Up to $5,000 for all insured |

| Trip interruption | X | * $5,000 per insured * Up to $25,000 for all insured |

| Mobile device | * Up to $500 | * Up to $1,500 |

| Extended warranty | * 1 year * Up to $25,000 per cardholder | * 1 year * Up to $25,000 per cardholder |

| Purchase protection | * 90 days * $1,000 per occurrence | * 90 days * $1,000 per occurrence |

| Emergency medical out of province | X | * 15 days * Max $5 million |

| Emergency medical for ages 65+ | X | * 3 days * Max $5 million |

| Flight delay | X | * Delay of 4+ hours * Max $1,000 for all insured |

| Baggage delay | X | * Delay of 6+ hours * Up to $1,000 for all insured |

| Lost or stolen baggage | X | * Up to $2,000 for all insured |

| Hotel burglary | X | * $2,500 per occurrence |

| Rental car | X | * 48 days * Max $85,000 |

Budgeting tools

As a fintech company, it’s perhaps unsurprising that Brim has a convenient app and online budgeting tools. You can instantly see how much you've spent on your card, in what category, and how it compares to the previous month.

You can also set monthly limits on a variety of categories. You’ll receive a notification when you’re approaching your limit – and another when you exceed it.

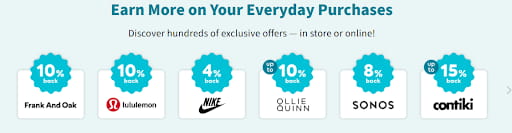

Maximize rewards with Brim's retail partners

Shopping with Brim's retail partners is especially rewarding. You'll forego your card's regular earn rate and instead earn rewards at a much higher rate – anywhere from 3% to 30%, depending on the retailer.

To find these partners, check out the Brim eStore, Brim’s online retail portal. By starting your shopping at the eStore, you ensure you’ll get the fantastic elevated rewards. Some retail partners offer different tiers that can yield a significant return on your spend. Plus, when you make purchases through Brim’s eStore, you’ll earn up to 30% back in points.

While you’re shopping, keep a sharp lookout for bonus rewards that some partners offer. For instance, if a partner offers 10% back, that overrides the regular 1% earn rate. Not bad for online shopping!

Since these bonuses and promotions change frequently, it doesn’t hurt to pop onto the site regularly. This way, you won’t miss out on great opportunities to earn even higher rewards. If you use the Brim app, it’s even easier to keep track of earning opportunities.

Pro Tip: Don’t forget that you can use your Brim cards for everyday purchases. Then, when you’re ready to redeem points, you can combine offers for even bigger bonuses!

When you’re ready to redeem your points, you’ve got a couple of options: redeem your points through the eStore for merchandise or use them against your statement balance. For every 100 points, you can get $1 toward your purchase or against your account balance.

Brim Mastercard vs Wealthsimple Card

If you're disappointed with your current Brim card (following the recent changes) or are simply curious about its close competitors, Wealthsimple is an attractive option to consider.

At the time of writing, the Wealthsimple Visa Infinite is quite new to the market and has a waitlist. Consider the following comparison to determine whether joining that list might be a good idea.

| Card name | Annual fee | Rewards | Pros | Cons | Welcome offer |

|---|---|---|---|---|---|

| Brim World Elite Mastercard | $89 | 1% cash back on all purchases | * Ability to redeem points towards any purchase made with the card * Low 1.5% foreign exchange fee * 12 types of insurance | * High income requirements | None |

| Wealthsimple Visa Infinite | $240 | 2% cash back on all purchases | * No foreign exchange fees * Luxurious Visa Infinite perks and benefits * Possible to have the annual fee waived | * Only 9 types of insurance |

FAQ

Is Brim available in Canada?

Yes, Brim Financial is a Canadian fintech company that was founded in 2017 and is based in Toronto. It currently offers only 2 credit cards: a basic Mastercard and a more premium World Elite Mastercard. Both earn Brim Open Rewards, have low foreign exchange fees, and offer flexible payment plans.

Are Brim credit cards good?

Yes, the Brim World Elite Mastercard and Brim Mastercard are good cards, though not the best. They earn rewards, but at fairly low earn rates. Brim cards used to offer more, including higher earn rates and no foreign exchange fees at all, but they changed things up in 2024 and the cards aren't as valuable as they used to be.

Do Brim cards have foreign exchange fees?

Yes, both Brim Mastercards charge a low foreign exchange fee of 1.5%. When they started offering credit cards back in 2017, Brim didn't charge foreign exchange fees. However, in May 2024, Brim changed things up and now charges a 1.5% exchange fee on foreign currency purchases.

How have Brim credit cards changed?

In May 2024, Brim announced a change from charging no foreign exchange fees to charging 1.5%. Plus, the rewards potential was more than cut in half for the Brim World Elite Mastercard – it once earned 1.5% cash back on the first $25,000 in spending each year, but now earns a flat 0.5% on all purchases.

What is the best insurance credit card in Canada?

The RBC Avion Visa Infinite Privilege is the best card if you’re looking for the most valuable and comprehensive travel insurance package, with an estimated value of $653. The BMO Ascend™ World Elite®* Mastercard®* is the best card if you’re looking for the most types of insurance coverage as it has 12 different types.