Credit Card Frequently Asked Questions

What is the difference between a credit card and a charge card?

A credit card enables you to buy and pay as you please, in lieu of cash, through borrowed money that should be paid back in full before the statement due date – otherwise you will pay interest rate fees in addition to the amount originally borrowed. If you choose not to pay in full, you must at least pay the minimum balance every month to avoid damaging your credit score.

Charge cards are similar to credit cards with one important difference: with charge cards, cardholders must pay their borrowed money (balance) in full before their statement due date. Unlike credit cards, charge cards do not allow cardholders to carry their balance from month to month. If you don’t pay your balance in full, you will be charged a much higher interest rate of around 30% annually and be reported for non-payment to the credit bureaus.

Currently only American Express issues charge cards in Canada with some, but not all, of their cards being charge cards.

Why (or why not) apply for a credit card?

Convenience, security and building a healthy credit history are three core reasons to apply for and use a credit card.

- Convenience – you don’t need to carry an exact amount of cash needed for any purchase or to book a hotel (or flight) online. You also never have to worry about NSF fees in your chequing account when you pay.

- Security – because the money spent on a credit card is borrowed, almost all credit cards come with zero liability fraud protection. This means that you should never be responsible for fraudulent purchases as long as you protect and use your card responsibly. Any stolen money will never leave your actual bank account.

- Building a healthy credit history – cardholders that pay their balance responsibly and on time build a credit history that allows them to access additional credit (like a car loan or mortgage) in the future.

Conversely, cardholders who are unable to handle a credit card responsibly should instead use it very sparingly or perhaps not at all.

What is an annual fee?

A credit card annual fee is the price you pay on a yearly basis for lavish rewards and perks (including welcome bonuses and insurance).

The annual fee is automatically charged every year and ranges from $13 to $699 for those cards that do have a fee.

When is an annual fee worth the cost?

Our rule of the thumb is based on your monthly spending: cards with an annual fee are typically worth it if your monthly spending exceeds $1,200. It may not be worth paying a fee if you spend less than that on your card.

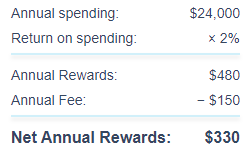

For more accurate results, use our monthly spending calculator because the specific spending amount you enter directly impacts our ‘Net Annual Rewards’ calculation, for example:

Note our default amount is $2K monthly spend (which you can personalize) and that each card comes with their specific return on spending (1% in this example).

How are ‘Net Annual Rewards’ calculated?

Net Annual Rewards are calculated by taking the cash value of expected rewards based on your monthly spend minus the card’s annual fee (if any). Any welcome bonus is excluded from the formula because it’s a one-time perk, not a yearly reward.

How is the ‘Genius Rating’ calculated?

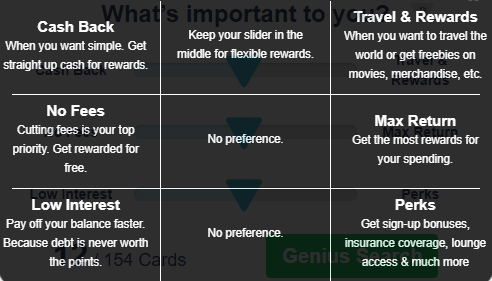

We track 126+ features of each card and compute one rating between 0 to 5 based on those features. That rating is then merged with your specific slider settings and is adjusted based on what’s most important to you. These 126+ features are grouped into four big buckets: rewards, perks, interest and insurance.

What is credit card interest?

Everything charged using a credit card is borrowed money and becomes your balance. If the balance is not paid in full by the statement due date, then cardholders are charged a monthly interest fee starting from the date each individual purchase was charged to the card.

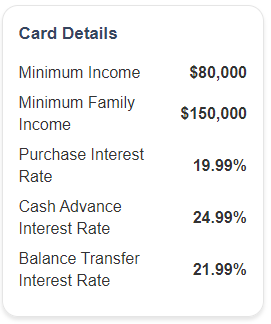

The interest rate is an annual percentage rate, typically around 19.99%, applied to the running overdue balance amount on the card. The interest fee only completely ceases when the balance is paid in full. Most credit cards have at least three types (sometimes four) types of interest rates:

-

- Purchase Interest Rate

- Cash Advance Interest Rate

- Balance Transfer Interest Rate

- Balance Transfer Promotional Rate

We include details about the interest rates of each credit card we list on our standalone card page along with the card’s minimum income requirements

What are credit card rewards?

Credit card rewards are the most lucrative form of rewards available to consumers for simply spending money on things they would buy anyway. Credit card rewards can be thought of as a rebate, or a return, on your spending. This return on spending can range between 0% (no rewards) to 2% (best cash back card) to well over 3% (best travel card).

If you’re really good at redeeming airline miles, you can actually achieve returns up to 10% when you redeem for high value (and high demand) business class flights … but that requires a lot of dedication and know-how.

How is the return on spending % calculated?

Return on spending is the amount of credit card rewards you get back in your pocket in relation to how much money you spend on the card. If you spend $100 and get $2 worth of rewards back, then your return on spending would be $2 divided by $100, which is 2%.

Unfortunately, not all points have the same value. Additionally, many cards offer bonuses on certain types of spending or even have tiers or caps on the amount of rewards you can earn annually. Our algorithm calculates all of that for you so you can quickly determine the best reward value for you.

What type of rewards can be earned?

Cash back, travel, merchandise or store rewards are some of the rewards you can earn with a credit card. Let’s go over these three types of rewards in brief:

Cash back

It’s the simplest, and often the most desirable, type of reward there is.

Here’s how it works: you get refunded a specific percentage of your purchases back to you either as a statement credit, a cheque or even direct deposit. The frequency of how often you can redeem your cash back depends on your card. Most offer an annual statement credit, but some allow you to redeem your cash however and whenever you want.

Also pay attention to tiers, limits or restrictions. A card may offer 10% cash back however if it’s only good for the first three months with a $100 cap – then you can do better.

Travel

Cash may be most desirable (at least for most), but travel rewards are often the most lucrative out of these three. Our top 10 travel cards have a return on spending ranging from 2.5% to over 3.5% (compared to 1.5% to 2% for the top cash back cards).

The caveat is that travel rewards are complicated and can be confusing for those just starting out. Read this article for more guidance:

When A Travel Rewards Card Is Worth It – And When It Isn’t

Merchandise / store

Merchandise or store credit cards reward you with products or merchandise from specific stores. Here are some common examples:

- Air Miles – points that are easy to earn and have a wide range of partner stores including Staples, Sobeys, Shell, Aldo and more.

- SCENE points – redeemable at Cineplex to watch movies for free (or at a discount).

- Canadian Tire Money – a popular loyalty program by Canadian Tire that allows you to buy anything Canadian Tire sells in-store.

- Walmart Rewards – allows you to buy anything you want from a Walmart store.

- GM Dollars – rewards you can apply towards the purchase of new GM vehicle.

What are ‘Flexible’ rewards?

Flexible rewards are similar to travel rewards but have fewer restrictions, blackout dates, and reward availability problems. You are also typically given more choice in the number of ways you can redeem your rewards like:

- Flights on any airline with no restrictions

- Travel purchased from any travel provider

- Investments at a particular bank or investment company

- Merchandise you can select from a rewards catalogue

- Gift cards to a wide range of stores

While having a number of different options is nice, how you choose to redeem impacts the value of your rewards. Flights and travel still typically offer the highest value, but usually not as much as you could achieve using true airline miles.

For example, if you were to redeem American Express Membership Rewards for flights using the Fixed Points Travel Program each point is worth up to 1.75 cents. However, if you choose to redeem for a statement credit for the groceries you just bought, each point is only worth 0.7 cents. In this case you are getting 2.5x the reward value by choosing the flights.

Tip: To find cards with flexible rewards using our sliders, simply keep the slider in the middle between 'Cash Back' and 'Travel+'. Here is a brief explanation of our sliders settings:

What are credit card ‘Perks’?

Outside of the usual spending-based rewards, perks are add-on features and bonuses that a credit card may offer to cardholders.

Great credit card perks include welcome bonuses, roadside assistance, concierge service, airport lounge access, travel and purchase insurance, free or discounted companion flights, free checked bags, priority check-in and boarding, cheap currency conversion, car rental discounts…just to name a few.

Premium cards, typically those with an annual fee of $120 dollars or more, offer the best perks.

What is a signup (or welcome) bonus?

A welcome bonus is a one-time perk you receive when you apply and are approved for credit card in addition to meeting any special spending or other requirements of the bonus.

Typical welcome bonuses are given as a lump sum of points. We compute the value of the bonus applying a reasonable point value to the lump sum of points. Cash back cards sometimes give increased cash for a limited time with a cap. In that case, the welcome bonus value is equivalent to the extra cash you would earn above and beyond the normal amount.

We exclude welcome bonus from the ‘Net Annual Rewards’ calculation because it’s not a yearly reward.

What is included with credit card insurance?

Most cards with an annual fee include at least basic purchase insurance and extended warranty. Because insurance is a credit card perk, it follows that premium cards (typically with annual fee of $120 or more) offer the best insurance but even some no fee cards can have up to 7 types of insurance coverage included at no cost to you.

We recommend checking your card’s insurance certificate for the full details on the coverage your card has. If you’re curious about all the types of insurance coverage out there, we’ve compiled a list of

What are secured credit cards?

If you want to start building or re-build your credit history, getting a secured credit card is a good starting point. Secured credit card issuers require applicants to provide a cash deposit as a guarantee that money spent on the card will be paid back. Your card limit is typically set to the amount of cash deposit you provide (ie: if your deposit if $500, your card limit is also $500).

How do balance transfer promo cards work?

One of the best ways to reduce your soul-crushing interest rate on credit card debt is to transfer your high interest balance to a new no-fee card with a 0% interest rate up for a full year.

There are cards that offer promotional (temporary) low rates like 1.99% for 10 months for example. Read our top five low interest balance transfer card offers.

What is the ‘Your Personal Income’ slider for?

The most premium cards with the best rewards and perks often come with high minimum income requirements. This is for two reasons:

- Customers with higher incomes present less risk and higher spending potential to the credit card company. This means they are likely to get their money back and make more money by processing more transactions for higher income customers.

- The Canadian Department of Finance created a code of conduct for the credit and debit industry to protect merchants from increasingly higher credit card processing fees. The code requires that premium cards with higher fees can only be given to a “well-defined class of cardholders”.

We include details about the income requirements of each specific credit cards on every credit card detail page we have along with interest rate details.

Why do we ask for your monthly spending?

Your monthly spending amount directly impacts your ‘Annual Rewards’ amount. For example, using our default amount of $2,000 monthly spending for a card that has a 2% return on spending and a $150 annual fee, then we have:

…$330 net annual rewards.

The more accurate your monthly spending is – and even better if you are able to include your monthly spending breakdown – the more accurate we’ll be able to calculate the net annual rewards. That allows us to provide you with a ranked list of credit cards that best match your spending habits so you can maximize your rewards.

What are credit card ‘Networks’ and ‘Issuers’?

In Canada, there are three credit card Networks: American Express, Mastercard and Visa. Networks work with merchants and credit card issuers to ensure smooth and successful transactions.

Credit card issuers are the financial institutions, such as banks and credit unions, that oversee the application and approval process. They are also responsible for your debt and are on the hook for the money if you default on your payments. Browse by issuer in our best cards page.

How does creditcardGenius earn money?

Fair question. We receive a referral fee for some credit cards listed. However, our math-based algorithm solely dictates the results of our rating system. Our Genius Rating and rankings are strictly independent of compensation. Read our detailed disclosure for more information.