Best American Express Credit Cards in Canada for 2026

The top Amex cards in Canada, ranked by 126+ data points

American Express cards are known for their generous perks and benefits. The American Express Cobalt Card is easily the best American Express Card in Canada, but the Scotiabank Gold American Express Card and American Express Gold Rewards Card are also highly ranked cards.

creditcardGenius scores every card in Canada using over 126 unique data points, giving you an unbiased ranking of all your options.

| Credit card | Average earn rate | Types of insurance | Current offer | |

|---|---|---|---|---|

| #1 | American Express Cobalt Card | 4.5% | 10 |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) |

| #2 | Scotiabank Gold American Express Card | 2.45% | 12 |  $100 GeniusCash + Up to 45,000 bonus points, first year free (terms) $100 GeniusCash + Up to 45,000 bonus points, first year free (terms) |

| #3 | American Express Gold Rewards Card | 2.95% | 11 | Up to 60,000 bonus points (terms) |

The best American Express cards give high rates of return for rewards and useful benefits like comprehensive travel insurance, lower interest rates, flexible redemption options, or waived foreign exchange fees.

This guide compares Canada’s top Amex cards, plus a few extras that are tailored to specific needs. We’ll also weigh in on what sets American Express cards apart (including some limitations), so you can confidently decide whether you want a card from this popular network – and which American Express card will offer the most value for you.

Key Takeaways

- The best American Express credit card in Canada is the American Express Cobalt Card.

- Amex cards have high return rates that cover the cost of their fees.

- Most Amex cards earn American Express Membership Rewards, worth up to 2 cents each.

- If you frequent Marriott Bonvoy hotels, you can offset your Marriott Bonvoy American Express Card fee with free nights.

The best American Express credit cards in Canada

Our Gold award for the #1 Amex credit card in Canada goes to the American Express Cobalt Card. This card consistently tops our data-driven ratings as not only the best American Express card but also the best credit card from any network. The American Express Cobalt Card boasts a 4.5% average rate of return, and its rewards points are both valuable (up to 2 cents per point) and flexible.

Our Silver award goes to the Scotiabank Gold American Express Card for its thorough insurance package and the fact that it charges no foreign exchange fee. (Most cards charge 2.5%, which can add up if you often shop abroad.)

And our Bronze award goes to American Express Gold Rewards Card. This card comes with travel perks, like the annual travel credit and airport lounge access. Every year, you get 4 free passes to Canadian Plaza Premium lounges.

While these cards score the highest overall, the best credit card for you will always depend on your unique circumstances. To round out our guide to the best Amex in the country, here are 3 cards that score best in specific areas:

| Category | Credit card | Current offer |

|---|---|---|

| Best Amex for hotel rewards | Marriott Bonvoy American Express Card | 110,000 bonus points (terms) |

| Best no fee Amex | American Express Green Card | 10,000 bonus points (terms) |

| Best Amex for premium perks | American Express Aeroplan Reserve Card |  $150 GeniusCash + Up to 85,000 bonus points (terms) $150 GeniusCash + Up to 85,000 bonus points (terms) |

The #1 American Express card in Canada: American Express Cobalt® Card

As the ambassador of Amex, the American Express Cobalt Card features some of the best benefits the brand has to offer.

The Amex Offers program provides you with discounts and opportunities for bonus rewards, while Front of the Line gives you early access to hotly contested event tickets and reserved seating blocks. Amex Experiences includes numerous exclusive, curated events and offers in dining, wellness, and shopping, but the crown jewel is The Hotel Collection. Book a stay of 2+ nights at select hotels, and you’ll receive a complimentary room upgrade (when available) and a $100 USD credit to spend on the premises.

But the Cobalt’s legendary status isn’t solely due to its benefits. Its rewards are sky-high, with groceries and restaurants getting you 5 points per $1 spent. And given that each American Express Membership Rewards point is worth up to 2 cents, the card’s 4.5% return rate is nearly double that of the competition – well worth the monthly $15.99 membership fee.

While you can redeem points on gift cards, merch, or statement credit, the most valuable option is travel – it’s why the Cobalt is also the best Aeroplan, grocery, rewards, and travel credit card in Canada.

Silver award American Express card: Scotiabank Gold American Express® Card

Normally, currency exchange rate fees take the fun out of souvenir shopping, but you can save on the industry-standard 2.5% with the Scotiabank Gold American Express Card. It’s one of the few no foreign exchange fee credit cards in Canada and one of only 3 Amex cards to collect Scene+ points.

Frequent flyers can also make use of its complimentary Priority Pass membership. For the low annual fee of $120, you get 12 types of insurance and $500,000 worth of travel accident coverage, plus almost a month of emergency medical coverage. And you can enjoy access to 1,500+ of the best airport lounges in the world (though there are no free passes with this card).

Bronze award American Express card: American Express Gold Rewards Card

It may not earn as much as the American Express Cobalt Card, but the American Express Gold Rewards Card is stacked with perks and benefits. Cardholders travel in comfort (and safety) with a complimentary Priority Pass membership, four free visits to any Plaza Premium Lounge, $150 in annual travel credits, and 11 of the 17 types of credit card insurance available in Canada.

The American Express Gold Rewards Card also offers an impressive welcome bonus of up to 60,000 points. If you transfer these points to Aeroplan, you can get $1,200 in value just from your welcome bonus.

The downside is its modest returns. But, like the American Express Cobalt Card, this card doesn’t have any income eligibility restrictions, making it widely available for Canadians.

Read more: Amex Cobalt vs. Amex Gold

The best Amex card for hotels: Marriott Bonvoy® American Express®* Card

The Marriott Bonvoy American Express Card is a steady earner that collects Marriott Bonvoy points with every purchase – but its biggest draw is automatic Marriott Bonvoy Silver Elite status. You’ll enjoy VIP treatment at 30+ hotel chains with 10% bonus points per stay, a 2:00 PM check-out, complimentary in-room Wi-Fi, and 15 Elite Night Credits so you can qualify for Gold Status faster.

The annual certificate for one free night for stays of up to 35,000 points is enough to offset the MB Amex’s $120 annual fee, though we wish it had better insurance coverage.

This card comes with only 8 types of insurance, not including popular travel coverage like emergency medical.

The best Amex card for no fee: American Express® Green Card

The American Express Green Card earns points at a flat rate of 1 Amex Membership Rewards point per $1 spent (plus one extra point when you book a car or hotel on Amex Travel Online). What this card lacks in increased earn rates, it makes up for by being a no-fee card.

Plus, even though this card’s earn rate may sound modest, Amex Membership Rewards are highly valuable. If you transfer those points to Aeroplan and redeem them on a flight, you’ll receive 2 cents per point for a total return of 2%.

The best premium Amex card: American Express® Aeroplan®* Reserve Card

With an annual fee of $599 and a welcome bonus worth up to $1,700, the American Express Aeroplan Reserve Card is definitely a premium credit card.

In addition to the usual American Express benefits, you’ll also enjoy perks on Air Canada flights, including free checked bags, priority check-in, unlimited Maple Leaf Lounge access, and the opportunity to earn a free companion flight voucher.

And, if you’re flying into Toronto-Pearson, you’ll get extra perks like complimentary valet parking, priority security, and discounts on car care and parking.

Compare all top American Express credit cards by Genius Rating

Since American Express offers such an extensive list of credit cards, we used our data-driven Genius Rating to compare all its offerings. Here’s how the best Amex credit cards stack up:

Awards are given out once a year but rating and rankings can shift throughout the year. The #1 card for 2026 is pinned to the top.

The Genius Rating methodology

To come up with each card’s Genius Rating, we analyzed over 126 features of each card and broke them into 7 main categories:

- Rewards (31%)

- Fees (20%)

- Insurance (16%)

- Perks (16%)

- Interest (7%)

- Acceptance (5%)

- Approval (5%)

Then, we ran those through our algorithm, which calculated a score out of 5 – our Genius Rating. You can learn more about how we analyze and rank credit cards to determine Genius Ratings.

How to choose the right American Express credit card

If you know you’d like to apply for an American Express credit card but aren’t sure which card, run through the Genius Rating factors in detail, considering your own preferences and lifestyle.

Rewards

Take a moment to think about what kind of rewards you want. After all, there’s no point in getting a card with great travel rewards if you would prefer to get cash back or flexible redemption options.

| Credit card | Rewards program | Rewards | Redemption options | Average rate of return |

|---|---|---|---|---|

| American Express Cobalt Card | American Express Membership Rewards | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | * Transfer points to Aeroplan * Fixed Points Travel Program * Transfer points to Marriott Bonvoy * Any travel * Statement credits * Gift cards * Shopping at Amazon.ca * Merchandise | 4.5% |

| Scotiabank Gold American Express Card | Scene+ | * 6 Scene+ points per $1 spent at Sobeys, Safeway, FreshCo and more * 5 Scene+ points per $1 spent on groceries, dining, and entertainment * 3 Scene+ points per $1 spent on gas, select streaming services, and transit * 1 Scene+ point per $1 spent on foreign currency purchases * 1 Scene+ point per $1 spent on all other purchases | * Cineplex theatres * Restaurants * Travel through Expedia Scene+ * Sobeys store discount * Any travel * Statement credits * Gift cards * Apple & Best Buy Merchandise | 2.45% |

| American Express Gold Rewards Card | American Express Membership Rewards | * 2 points for every $1 spent on gas, groceries, drugstores, and travel * 1 point for every $1 spent on all other purchases | * Transfer points to Aeroplan or Marriott Bonvoy * Fixed Points Travel Program * Any travel * Statement credits * Charity donations * Gift cards * Merchandise * Shopping at Amazon.ca | 2.95% |

| Marriott Bonvoy American Express Card | Marriott Bonvoy | * 5 points per $1 spent at Marriott properties * 2 points per $1 spent on all other purchases | * Travel packages * Hotels * Transfer to Aeroplan for flights * Flights * Gift cards * Merchandise * Car rentals | 2.09% |

| American Express Green Card | American Express Membership Rewards | * 1 point per $1 spent on all purchases | * Transfer points to Aeroplan or Marriott Bonvoy * Fixed Points Travel Program * Any travel * Statement credits * Charity donations * Gift cards * Merchandise * Shopping at Amazon.ca | 2.1% |

| American Express Aeroplan Reserve Card | Aeroplan | * 3 points per $1 spent on Air Canada * 2 points per $1 spent on dining and food delivery purchases in Canada * 1.25 points per $1 spent on all other purchases | * Flights * Air Canada gift cards * Car rentals * Vacation packages * Hotels * Merchandise * Gift cards | 2.79% |

Tip: No matter what credit card you use, you could be earning bonus cash back on top of your card's rewards. Input your monthly spend in the GeniusCash app, and level up to earn real cash.

Fees

Fortunately, American Express issues a range of credit card options – no-fee cards, standard-fee cards, and premium cards.

While most credit cards charge fees annually, some Amex cards (like the American Express Cobalt Card) charge a monthly fee for cardholders outside of Quebec. For the sake of comparison, we’ve listed the total annual cost for these cards.

| Credit card | Annual fee |

|---|---|

| American Express Cobalt Card | $191.88 |

| Scotiabank Gold American Express Card | $120 |

| American Express Gold Rewards Card | $250 |

| Marriott Bonvoy American Express Card | $120 |

| American Express Green Card | $0 |

| American Express Aeroplan Reserve Card | $599 |

In November 2025, the American Express Cobalt Card raised its monthly fee, causing many Canadians to wonder if the card is still worth its price tag. We did the math, and it is – as long as you spend your points wisely.

No-fee cards can’t compete with the premium credit cards that offer things like welcome bonuses, discounts, and travel benefits. But if you don’t plan to spend much on the card or won’t make use of the perks, a no-fee card may be the right fit for you.

If you’re planning to use your credit card abroad, don’t forget to check whether or not your preferred Amex charges foreign exchange fees. All the top American Express cards in this guide charge the standard 2.5% foreign exchange fee, with the exception of the Scotiabank Gold American Express Card, which waives the fee completely.

Perks

Amex credit cards offer entertainment benefits, travel perks, and more.

American Express cardholders get access to Front Of The Line, which includes early access or reserved seating for concerts, sports events, theatre performances, and exclusive dining opportunities.

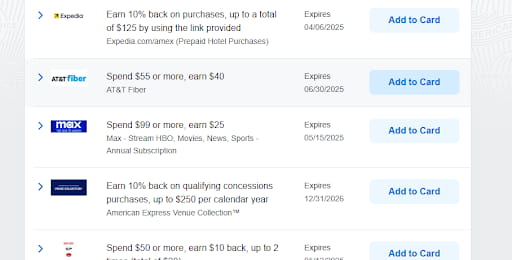

You can also benefit from Amex Offers, which you can think of as digital coupons to add to your account. You can access personalized deals and discounts through your online account or mobile app.

Scroll through all your offers and save as many as you like. If you use your Amex to purchase the deal, you’ll earn the rewards.

Additionally, some of the best American Express credit cards come with their own extra benefits.

- The American Express Aeroplan Reserve Card offers unlimited access to Air Canada’s award-winning Maple Leaf airport lounges.

- The American Express Gold Rewards Card offers a $100 annual travel credit.

- The Marriott Bonvoy American Express Card offers an annual Marriott Free Night Award certificate, awarded every year on your card’s anniversary.

Note that your Marriott Bonvoy American Express Card won’t grant you a Marriott Free Night Award certificate immediately when you open the card. You’ll need to wait until you’ve had the card for one year. However, once you get your first one, this free hotel stay will offset the cost of your card for years to come.

Learn how much your credit card benefits are worth.

Insurance

Insurance is often overlooked as a credit card benefit, but it’s valuable, and coverage varies by card.

In addition to travel insurance, the American Express Cobalt Card offers mobile device insurance, which protects against loss, theft, and damage – as long as the full cost of your phone was charged to your card.

- The American Express Cobalt Card offers 10 types of insurance.

- Read more about the American Express Cobalt Card’s insurance coverage.

The Scotiabank Gold American Express Card has the most extensive insurance of the top Amex cards, including emergency medical over the age of 65, as well as mobile device insurance.

- The Scotiabank Gold American Express Card offers 12 types of insurance.

- Read more about the Scotiabank Gold American Express Card’s insurance coverage.

The American Express Gold Rewards Card offers more comprehensive travel insurance than the American Express Cobalt Card, adding on trip cancellation and trip interruption. Its offerings are very similar to the Scotiabank Gold American Express Card, but it doesn’t include mobile device insurance.

- The American Express Gold Rewards Card offers 11 types of insurance.

- Read more about the American Express Gold Rewards Card’s insurance coverage.

The Marriott Bonvoy American Express Card includes some travel insurance, such as travel accident coverage and flight delay, but doesn’t include emergency medical, trip cancellation, or trip interruption.

- The Marriott Bonvoy American Express Card offers 8 types of insurance.

- Read more about the Marriott Bonvoy American Express Card’s insurance coverage.

As a no-fee card, the American Express Green Card offers limited insurance, including only extended warranty and purchase protection. Don’t use this card to book your next vacation, as it doesn’t include any travel insurance.

- The American Express Green Card offers 2 types of insurance.

- Read more about the American Express Green Card’s insurance coverage.

The American Express Aeroplan Reserve Card offers very similar insurance to the American Express Gold Rewards Card. But, since it’s a premium card, it doubles the amount of coverage available for flight delay, baggage delay, lost or stolen baggage, and hotel burglary.

- The American Express Aeroplan Reserve Card offers 11 types of insurance.

- Read more about the American Express Aeroplan Reserve Card’s insurance coverage.

Interest rates

All the best American Express cards charge roughly the same amount of interest.

The Scotiabank Gold American Express Card charges 20.99% purchase rate interest, while other cards charge 21.99%. However, if you carry a balance, you’ll want to find an even lower rate:

Approval

In addition to its great benefits and rewards, American Express is also known for offering cards that are easier to qualify for—even with its premium cards.

While the best Mastercards and Visa cards typically require personal income upwards of $60,000–80,000 or household income over $100,000–$150,000, the best American Express credit cards typically don’t have any income requirements.

The only card in this guide with an income requirement is the Scotiabank Gold American Express Card, and that card’s required income is much more accessible than others at $12,000 per year.

However, credit score still factors into approval. You’ll need an estimated credit score of at least 660–724 to get most of these cards. The American Express Green Card and American Express Aeroplan Reserve Card have higher estimated requirements, at 725–759.

Low credit score? Learn how to build credit or check out the best secured credit cards that are easiest to get approved for.

To ease your application process, Amex lets you do a soft credit check before you apply, so you can find out whether you’re likely to be approved without any hit to your credit score.

Acceptance

Though Amex is less widely accepted than Mastercard or Visa, a vast majority of retailers accept Amex, with more joining all the time.

That said, be aware that you can’t use your Amex at Loblaws and Costco. Smaller merchants or local shops might not accept the network (since it charges higher processing fees than Visa or Mastercard).

If you’re unsure whether or not a business will accept your Amex card, double-check with the Amex merchant map.

Pros and cons of American Express credit cards

Still deciding if you want an Amex card? Consider the pros and cons of this popular credit card network.

Pros:

- 24/7 customer service and a 4.5-star banking app

- Generous welcome bonuses

- High-value insurance packages

- Premium travel benefits, including Amex Global Lounge Collection

- Incredibly flexible rewards

- Low to no income requirements

- Unbeatable rewards, with the best cards earning 2.45% – 4.5% per dollar

- Valuable perks and benefits

Cons:

- Limited options for low-interest credit cards

- Limited options for no-fee credit cards

- Limited travel insurance for cardholders over the age of 65

- Less universal acceptance

- Rewards system can feel complicated

How does American Express Membership Rewards work?

Though the Scotiabank Gold American Express Card earns Scene+ points, and the Marriott Bonvoy American Express Card earns Marriott Bonvoy points, most Amex cards use the American Express Membership Rewards program.

You’ll earn Amex Membership Rewards points on every purchase, which accrue in your account without expiring as long as your credit card remains active.

You can check your points balance by using the Amex app or website. The most important thing to remember is that Amex Membership Rewards points don’t have a fixed value – it depends on how you choose to redeem them.

Find out exactly how much your Amex Membership Rewards are worth in each redemption category:

While the graph and calculator use an average, gift card value can vary. If you’re considering a redemption, divide the cost of a gift card or merchandise reward in $CAD by its cost in Amex Points to reveal the value of your points in $CAD. Don’t accept anything less than 1 cent per point!

FAQ

What is the highest-tier Amex card?

The most exclusive Amex offering is the invitation-only Centurion American Express credit card. It’s so exclusive that details about eligibility, rewards, and benefits aren’t publicized. However, you’re more likely to be invited if you spend over $500,000 annually on a Platinum Card. Reportedly, this card has a $10,000 invitation fee in addition to its $5,000 annual fee.

What is the best American Express card in Canada?

The American Express Cobalt Card is the best Amex card in Canada. It’s no surprise that this card keeps winning awards – it has fantastic earn rates on everyday purchase categories, a huge welcome bonus, flexible redemption options, and an annual fee that’s charged out monthly. With a American Express Cobalt Card, you can earn an estimated $1,620 in annual rewards.

How much income do you need for American Express in Canada?

Most Amex cards don’t have any income requirements, making them widely accessible to Canadians regardless of salary. This includes the American Express Cobalt Card, American Express Gold Rewards Card, and even the premium American Express Aeroplan Reserve Card. The Scotiabank Gold American Express Card requires $12,000 in annual income, but this is still lower than cards with comparable value.

Is an American Express card worth it in Canada?

Since American Express is known for offering great perks and rewards, yes, it’s worth carrying an Amex in Canada. These days, most merchants do accept American Express credit cards, though you will encounter some exceptions, like Costco and Loblaws. If you frequent these stores, it’s worth carrying a Mastercard as well.

What is the most prestigious American Express card?

The honour of the most prestigious Amex definitely goes to the Amex Black card, also known as the Centurion card. You can’t apply for this ultra-premium card. Instead, you have to be invited by Amex. However, American Express has other premium cards with excellent benefits. The top-ranking Amex for premium perks is the American Express Aeroplan Reserve Card.

Do small businesses accept Amex cards?

Many small businesses accept Amex, but it’s never a guarantee. Some small businesses use Square, which works with any Canadian-issued credit card, including American Express. But you may encounter businesses that don’t accept Amex – or even some that don’t accept credit cards at all, though this is increasingly rare. It’s always best to carry multiple payment options just in case.

Editorial Disclaimer: The content here reflects the author's opinion alone. No bank, credit card issuer, rewards program, or other entity has reviewed, approved, or endorsed this content. For complete and updated product information please visit the product issuer's website. Our credit card scores and rankings are based on our Rating Methodology that takes into account 126+ features for each of 228 Canadian credit cards.

×9 Award winner

×9 Award winner