Pros & cons

Pros

- Get up to 85,000 welcome bonus Aeroplan points.

- Earn up to 3 Aeroplan points per $1 spent on purchases.

- Free checked bags when flying with Air Canada.

- Preferred pricing on Aeroplan flight awards.

- Unlimited access to Maple Leaf lounges when flying with Air Canada.

- 11 types of insurance included.

Cons

- Lower acceptance as an American Express.

- Only high value rewards are redeeming for Air Canada flights.

- High annual fee of $599.

Your rewards

$150 GeniusCash offer

On approval, receive $150 GeniusCash on us when you apply for American Express Aeroplan Reserve Card using this offer page.

GeniusCash offer expires on Apr 15, 2026.

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 85,000 points which translates to an estimated $1,700.◊

For all welcome bonus details click here.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With American Express Aeroplan Reserve Card, here's how you earn rewards:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on dining and food delivery purchases in Canada

- 1.25 points per $1 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For American Express Aeroplan Reserve Card in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Flights | $1,004 | |

| Air Canada Gift Cards | $502 | |

| Car rentals | $452 | |

| Vacation packages | $416 | |

| Hotels | $411 | |

| Merchandise | $371 | |

| Gift Cards | $356 |

Calculating your annual rewards

$36,000 annual spending x 2.79% return on spending = $1,004 annual rewards

$1,004 annual rewards − $599.00 annual fee = $405 net annual rewards

Details and eligibility

- Estimated Credit Score

- 660 - 724

- Personal Income

- N/A

- Household Income

- N/A

- Annual Fee

- $599.00

- Extra Card Fee

- $199

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance

- 21.99%

- Balance Transfer

- N/A

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Travel Accident

- $500,000

- Emergency Medical Term

- 15 days

- Emergency Medical Maximum Coverage

- $5,000,000

- Trip Cancellation

- $1,500

- Trip Interruption

- $1,500

- Flight Delay

- $1,000

- Baggage Delay

- $1,000

- Lost or Stolen Baggage

- $1,000

- Hotel Burglary

- $1,000

- Rental Car Theft & Damage

- Yes

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

American Express Aeroplan Reserve Card's 3.8 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Top cards from American Express

American Express Aeroplan Reserve Card review

Want to feel like a VIP when travelling with Air Canada? The American Express Aeroplan Reserve Card provides just that.

You'll get access to an unsurpassed level of perks with Air Canada, all while earning up to 3 Aeroplan points on every purchase.

Here's what this card has to offer.

Earning Aeroplan rewards with the Amex Aeroplan Reserve card

Let's first start with the rewards, where you'll be earning Aeroplan points on every purchase.

The welcome bonus promotion doesn't disappoint with this card – in fact, it's one of the best available in Canada.

You'll earn up to 85,000 points after spending $7,500 in the first 3 months, and spending $2,500 in month 13.

Considering we value an Aeroplan point at 2 cents when redeemed for flights, this bonus has a total value of $1,700 .

As for your everyday purchases, you'll earn:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on dining and food delivery purchases in Canada

- 1.25 points per $1 spent on all other purchases

3 benefits to the American Express Aeroplan Card

Besides rewards, it's the perks that make this card stand out.

1. Air Canada benefits

The Amex Aeroplan Reserve Card is in the high-tier of Aeroplan-branded cards. And as such, it comes with a standard set of Air Canada benefits.

First, here's the set of benefits that are also available on mid-tier cards – like the

- free first checked bag on Air Canada for the cardholder and up to 8 others travelling on the same reservation,

- preferred pricing on Aeroplan flight rewards,

- 1,000 Elite Status Qualifying Miles for a lower annual spend of every $5,000 spent annually.

The free checked bags are easy savings anytime you fly with Air Canada. With a checked bag starting at $30 one way (plus tax), that's a savings of at least $60 on every round trip flight.

And to stretch out your points further, the preferred pricing on rewards will allow you to use fewer points on reward flights.

The fun doesn't stop there. You can skip ahead to the front of the line with Air Canada, courtesy of these benefits:

- priority check-in,

- priority boarding, and

- priority baggage handling.

Great benefits to cut down on waiting in line.

Want some lounge access? Before departing for your flight, you'll get access to select Maple Leaf lounges. Kick back, and relax in style while waiting for your flight to depart.

The card also comes with a Priority Pass membership, for access to over 1,200 lounges worldwide. However, this membership doesn't include visits, you'll have to pay US$32 every time you want to enter a lounge.

Finally, spend $25,000 annually on the card, and you'll get access to a worldwide companion voucher. Buy one ticket for yourself, and bring someone else with you for a set base airfare of between $99 and $599, as well as any taxes and fees.

Play your cards right, and that can be enough to cover the annual fee.

2. Travel insurance that provides coverage on Aeroplan flight rewards

This card has you covered when it comes to travel insurance, even when travelling on Aeroplan flight rewards.

You'll get 11 types of insurance coverage, including flight delay, baggage delay, and hotel burglary. Click on the "Insurance" tab above for more details on what's included.

And since it's an Aeroplan-branded credit card, this insurance coverage works when you redeem your Aeroplan points for a flight, and pay any taxes and fees with your Amex card.

3. Toronto-Pearson airport benefits

Travel frequently through Toronto-Pearson airport? There are some special benefits waiting for you when you carry this American Express Aeroplan card.

You'll get:

- priority security,

- complimentary valet parking,

- 15% discount on parking, and

- 15% off car care services.

You can learn more about these benefits here.

3 Amex Aeroplan Reserve Card downsides

This card falls a bit short when it comes to acceptance and earn rates.

1. High annual fee

The Amex Aeroplan Reserve certainly provides a lot of goodies, but you're going to be paying for them. This card has a high annual fee of $599.

You'll need to make the most of the perks to help cover the annual fee.

2. Amex acceptance

It certainly is true that American Express cards are accepted less than Visa or Mastercards. With that said, it's not as terrible as you may think.

Most large retailers accept Amex cards, with 2 exceptions – Costco and Loblaws stores (excluding Shoppers).

Amex acceptance is improving all the time – this map can show you where their cards are accepted.

3. Doesn't earn the best rewards when compared to other Aeroplan credit cards

Even though it has a high annual fee, it doesn't have the best earn rates when compared to other Aeroplan cards.

Other top Aeroplan cards have bonus earn rates on basics like gas and groceries, which you're more likely to spend more money on than restaurants.

Unless you fly frequently with Air Canada, or eat out a lot, you may not earn the most rewards.

Comparison to the Amex Platinum Card

So how does this card compare to our top rated perks card – the

It also has a suite of great travel benefits that aren't restricted to one airline.

Here's how these cards compare in a few areas.

| Amex Aeroplan Reserve Card | Amex Platinum Card | |

|---|---|---|

| Earn Rates | * 3 points per $1 spent on Air Canada * 2 points per $1 spent on dining and food delivery purchases in Canada * 1.25 points per $1 spent on all other purchases |

* 2 points per $1 spent on restaurants and travel * 1 point per $1 spent on all other purchases |

| Annual Fee | $599 | $799 |

| Insurance Coverage | 11 types | 11 types |

| Main Perks | * Free first checked bag on Air Canada flights * Preferred pricing on Aeroplan flight rewards * Annual companion voucher * Air Canada VIP benefits * Unlimited access to Maple Leaf lounges |

* Ability to transfer points to 5 other airlines and 2 hotel programs * Amex Fixed Points Travel Program for high value flights with any airline * Redeem points for any travel charged to the card * Unlimited access to Priority Pass lounges * Annual $200 travel credit * Upgraded status with 4 hotel programs |

Earning rewards

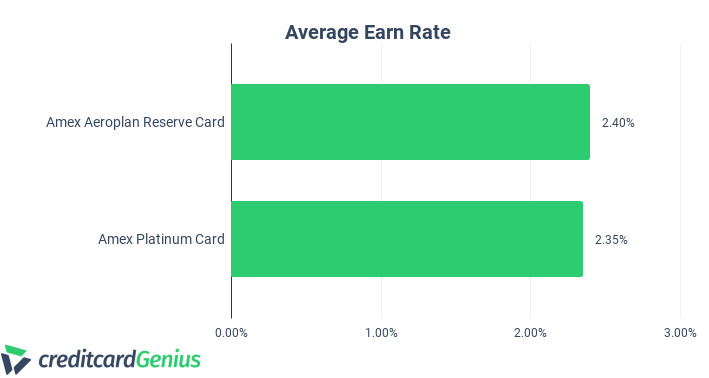

When it comes to earning rewards, these 2 cards are similar. They have the same earn rates, but the only difference is the categories you earn bonus rewards in.

With the Platinum Card, you earn 3 points per $1 spent on restaurants, and 2 points per $1 spent on any travel.

In terms of actual earn rate, they're quite close. Based on a typical $2,000 monthly spend, here's the average earn rate for both cards:

Annual fees

Both of these cards have high annual fees. In fact, they're some of the highest of all credit cards in Canada.

The Amex Platinum Card comes in higher at $799, whereas the Amex Aeroplan Reserve card is $599.

In this case, the Amex Aeroplan card will save you $100 every year.

Insurance coverage

When it comes to insurance coverage, these cards are nearly identical in terms of coverage.

Both have 11 types of coverage, the only differences are in the amounts for trip cancellation and interruption, where the Platinum Card has $1,000 more in coverage.

One advantage the American Express Aeroplan card has – you're covered on Aeroplan reward flights as well, as it's an Aeroplan-branded credit card. You'll need to put the full cost of the flight on your Amex Platinum Card to be eligible for insurance coverage.

Main perks

The perks are where these 2 cards diverge. With the Amex Aeroplan Reserve card, you get access to benefits with Air Canada.

With the Platinum Card, you get a diverse array of perks, some if which include:

- $200 annual travel credit,

- upgraded status in 4 hotel programs,

- access to the Amex Hotel Collection and Fine Hotels and Resorts,

- unlimited access to over 1,200 Priority Pass lounges, and

- more ways to redeem points thanks to the Amex Membership Rewards program.

So which is better? It all depends on whether you want Air Canada specific benefits, or benefits that apply to many different parts of your travel plans.

FAQ

What does the Amex Aeroplan Reserve card earn for points on purchases?

With the Amex Aeroplan card, you'll earn up to 3 points per $1 spent:

- 3 points per $1 spent on Air Canada

- 2 points per $1 spent on dining and food delivery purchases in Canada

- 1.25 points per $1 spent on all other purchases

Does the American Express Aeroplan Reserve Card come with Air Canada benefits?

Yes, as an Aeroplan-branded card, you'll get the first checked bag free, preferred pricing on Aeroplan flight rewards, an annual companion voucher when you spend $25,000 annually, plus VIP Air Canada benefits.

What is the annual fee of the Amex Aeroplan Reserve Card?

The Amex Aeroplan Reserve Card has an annual fee of $599.

Key benefits

User reviews

Reviewed by 9 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

The companion pass doesn't simply cover the fare up to the specified value. Oh no. That is the MINIMUM amount the fare has to reach for the companion pass to be deductible from it. For a flight to Europe, that means you're looking at getting one of the most expensive economy class tickets to be able to use that pass. Definitely not worth it.

Last year I earned over 2 million Aeroplan miles with this card. However, the reward points now required for flights are ridiculous. I used my miles for 2 return tickets from YVR to ICN in business class. Ended up spending over 500,000 miles per ticket. Nothing like the star alliance rewards redemption chart suggests. I've figured out that the more miles you have in your account the more they try to charge you when you try and book a reward ticket. I've worked out I'm better off paying with my RBC Visa Infinite Privilege card then booking business class tickets anywhere and pay with the RBC VIP card - get more Avion points- and then use the Avion points to pay for the tickets purchased at a rate of 2 per $. The companion ticket they offer is economy only and have never used this perk once. I did gain 50k status over the Covid time frame where they were offering a free upgrade from current status. This has since lapsed. 50/50 on wether I keep it or not.

Aeroplan will decline your credit card when purchasing a flight with points and cash, if you decline their travel insurance. Makes no sense since the reserve card has travel insurance. Called Amex, no issue with my cc. Purchases the same flight in points only and it went through! which led me to believe aeroplan refused to allow me to purchase the flight with points and cash, so that I could not use the travel insurance on my reserve card, free checked luggage and carry on, or its trip cancellation/delay features. I’m upset and will be canceling this cc before the 12 months is up. I’ve been eyeing the Amex gold as a better bang for buck as far as features relative to its low $250 af.

Great access to lounges, great insurance. Excellent customer service.

If you spend a lot on air canada tickets each year, as well as charging at least 25K to the card each year to get the companion pass, then this is a very good card to have because the benefits such as 3X Aeroplan points on Air Canada purchases, access to Maple Leaf Lounges (only in North America), priority checkin, baggage handling, and comprehensive insurance coverages will likely be worth more than the high $599 annual fee. But you need to carefully do the math for your own personal situation to see if you can derive all the benefits out of the card each year. If you only travel Air Canada less than 4-6 times per year, then this card might not be worth it after the first year. My experience with this card, which I’ve had for 2 years since AC revamped the Aeroplan program and Amex issued this new Reserve card to replace the “old” Reserve card and the discontinued Amex AeroPlan Plus Platinum card, is as follows:

1. Lounge access is a nice benefit but the amenities in the lounges have been somewhat curtailed during the pandemic. Food needs to be ordered from a menu and drinks are no longer self-serve. I understand these measures but the experience is still worth less than before the pandemic.

2. Checkin agents in many airports still don’t recognize the card and the privileges that go with it, so invariably I end up having to explain everything to the Agent in order to get priority checkin and baggage handling, and even then, some of my boarding cards still don’t reflect priority boarding, and requesting this at the gate is usually not successful because the gate staff aren’t familiar with the card. They seem to only recognize if you have Aeroplan Elite status, if not, you’re treated like everyone else at the gate.

3. Priority Security Lanes at Pearson Airport Toronto are hit or miss, depending on the staff working the lines. Just showing them the card doesn’t automatically confer you the priority lane, you must first have to visit the Amex Priority Security desk, (not advertised, I just found it by luck) to get a special tag to show the Security Line personnel to be able to get in the priority line. Even then, I didn’t find this faster because of the way all the converging queues are managed by other security personnel close to the check points.

4. My priority tagged baggage seldom appears first off the aircraft. It is seldom faster, and even then, I have had 2 cases of delayed/lost bags in 1 year alone, even though they were tagged priority.

5. The comprehensive insurance package has been valuable pre- Covid pandemic. Be aware that if you read the policies related to travel medical insurance and Trip Interruption and Cancellation Insurance, the policies specifically exclude any benefits directly or indirectly related to Covid-19, so no longer any benefits here; I’ve had to pay out of pocket for medical and travel insurance from another insurance company arranged by myself. I think Amex should have given existing cardholders a credit of some portion of the annual fee, but no luck here.

6. Customer service at Amex is the best in my experience, but I’ve found that the agents are somewhat limited in authorizing any annual fee credit to cardholders who believe they are not getting the full benefits from the card as advertised.

The welcome bonuses for the first year are excellent and it will be easy to get benefits that far exceed the high annual fee in the first year. After that, benefits are lower, unless you’re a very frequent flyer who only flies Air Canada. Some benefits, such as priority baggage handling and lounge access, are not available even if you are travelling on another Star Alliance airline other than Air Canada. So don’t expect to get any privileges from United Airlines or other Star Alliance carriers, for example. I also think they are stingy for not giving lounge access outside North America, even if travelling on Air Canada.

For the high annual fee, some will find it difficult to derive a lot of value from this card after the first year. I’ve earned a lot of Aeroplan points just by my normal spending, even if not on Air Canada, but the benefit obviously missing from the premium card is automatic Aeroplan Elite status, or one level higher if you already have status. So, do the math before applying for this card.

3.

$150 GeniusCash + Earn up to 85,000 Aeroplan®* points + Air Canada benefits.*

$150 GeniusCash + Earn up to 85,000 Aeroplan®* points + Air Canada benefits.*