Founded in 1919, Loblaws has long been an iconic Canadian retail institution, with stores across Canada, a hugely popular rewards program, a bank, and its own credit cards.

Store brands include Real Canadian Superstore, Atlantic Superstore, Joe Fresh, and Shoppers Drug Mart, among many others.

But even with Loblaws’ enormous number of stores and the massive popularity of the PC Optimum rewards program, are these rewards the best way to save money at Superstores? We take a closer look.

Not sure which Loblaws brands are which? It can be pretty confusing, so we’ll start there, then get into some of the best ways to cut your grocery bill when shopping at Superstore and some other Loblaws grocery stores.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Shopping at Superstore

Most Canadians have been to a Loblaws-brand grocery store at one point or other, even if they don’t realize it. Loblaws is a huge corporation at this point, with over 20 different brands falling under its umbrella.

Here are a few of the best known Loblaws grocery chains.

Loblaws Supermarket

Loblaws Supermarket is the original Loblaws grocery chain, with stores now located in British Columbia, Alberta, and Ontario. You’ll find these in cities like Edmonton and Calgary.

| Locations | Alberta, British Columbia, Ontario |

| Best for | Every day grocery shopping |

| Flyer | Loblaws Supermarket flyer |

| Store hours | 7:00am – 10:00pm |

| Online shopping options | PC Express, Instacart |

Real Canadian Superstore

Real Canadian Superstore is what Loblaws Supermarket was rebranded to in western Canada, being called “SuperValu” for a brief time in between. Real Canadian Superstore has since expanded into Ontario as well. Cities include Winnipeg and Vancouver.

| Locations | Alberta, British Columbia, Manitoba, Ontario, Saskatchewan, Yukon |

| Best for | Stocking up and every day savings |

| Flyer | Real Canadian Superstore flyer |

| Store hours | 7:00am – 11:00pm |

| Online shopping options | PC Express, Instacart |

Atlantic Superstore

As you may guess from the name, Atlantic Superstore is the primary Loblaws brand out in the eastern part of the country.

| Locations | New Brunswick, Nova Scotia, PEI |

| Best for | Every day groceries for Atlantic Canadians |

| Flyer | Atlantic Superstore flyer |

| Store hours | 8:00am – 10:00pm |

| Online shopping options | PC Express, Instacart |

Wholesale Club

Wholesale Club is Loblaws’ response to Costco, in a few ways. It is a self-service wholesaler that focuses primarily on selling to small business customers, rather than individuals. Their product selection is more limited in some ways, but also includes bulk products and non-food items. Their hours are more limited as well.

| Locations | Alberta, British Columbia, Saskatchewan, Manitoba, Ontario, Quebec, New Brunswick, Nova Scotia, Newfoundland |

| Best for | Small businesses and bulk buys |

| Flyer | Wholesale Club flyer |

| Store hours | 7:30am – 6:00pm |

| Online shopping options | PC Express, Instacart |

Superstore: Joe Fresh Canada

Joe Fresh Canada is Loblaws’ discount clothing brand started in 2006, which has since expanded throughout Canada and even into the U.S. Most Joe Fresh locations are actually within other Loblaws grocery stores, such as Loblaws Supermarket and Atlantic Superstores, but they have started to open some standalone stores in larger centres.

Joe Fresh Canada sells a wide variety of clothing products, including Joe Fresh Kids, which you can also order online.

| Locations | All provinces and territories, except Nunavut |

| Best for | Inexpensive clothing and kidswear |

| Flyer | N/A |

| Store hours | Varies by location |

| Online shopping options | Joe Fresh website |

Shoppers Drug Mart

Shoppers Drug Mart was acquired by Loblaws in 2014, and has since expanded to over 1,600 locations in Canada. It’s a retail pharmacy chain that also sells bath and beauty products, some grocery products, and some seasonal goods.

| Locations | All provinces and territories, except Nunavut |

| Best for | Pharmacy, health, medical, and beauty products |

| Flyer | Shoppers Drug Mart promotions |

| Store hours | Varies by location |

| Online shopping options | Limited products available at ShoppersDrugMart.ca |

4 ways to save money at Superstore

Of course, with Superstores and related shops being so prevalent across Canada, chances are that most of us shop at 1 or 2 locations fairly regularly.

So, what’s the best way to save money at these stores?

1. Browse the Superstore flyers

Shopping the Superstore flyers can save you a huge amount of money over the course of a year, if you make a habit of it.

In fact, we try to avoid paying full price for anything, and by doing so, we shave hundreds of dollars off our grocery bills every year.

Menu planning

We do this by planning our weekly menus around the Superstore flyers:

- get the new flyer (usually on Thursday),

- go through it to see what’s on sale,

- plan a menu around those items, and

- build a grocery list around that menu plan.

It’s rare that you can get everything on sale, but by planning menus like this you’ll always save some money.

Stock up on sale items

We also stock up on non-perishable items when they’re on sale. I can’t think of the last time we paid full price for things like shower gel, garbage bags, tin foil, or toilet paper.

If you have some space and can stash away some non-perishable items, it’s a great idea to stock up on those when they’re on sale.

2. Collect PC Optimum Rewards

Another way to save at Loblaws stores is by collecting PC Optimum Rewards, which you can join for free.

You can redeem PC Optimum points at a rate of 10,000 points for $10 in purchases at participating Loblaws stores.

With regular PC Optimum membership you’ll only earn points at most Loblaws brand stores through bonus offers, but you’ll earn:

- 15 points for every $1 spent at Shoppers Drug Mart, and

- 10 points for every litre of fuel or $1 spent on convenience and car wash purchases at Esso and Mobil gas stations.

Watch the flyers for PC Optimum bonuses

Another reason to pay attention to the Superstore flyers is because they’re a quick way to see some of the best PC Optimum bonuses available from week to week.

For example, right now, if you buy 2 bags of frozen Green Giant vegetables for $2.99 each, you’ll get 2,000 PC Optimum points. So, for spending $5.98 on some veggies you can throw in the freezer, you’ll get $2 worth of PC Optimum points. That’s like 33% cash back.

Keep an eye out for seasonal sales

It’s possible to spot some really good deals in the Superstore flyers as the stores change their seasonal products, such as when they start putting the summer grilling stuff away and bring out the Halloween decorations.

Be sure to watch for any super sales, as well, such as Black Friday or Boxing Day.

Check your PC Optimum offers

Also, check in on your PC Optimum offers every week. I just checked mine, and if I spend $60 at Shoppers Drug Mart tomorrow, I’ll get 20,000 PC Optimum points. That’s $20 in points for effectively 33% cash back.

If you tend to forget to check for these, you can sign up for free email notifications that will let you know when you have new offers available. It’s a super easy way to save a lot of money on stuff you’d be buying anyways.

There’s nothing special you have to do to use them except scan your card when making your purchase.

PC Financial Mastercards

If you have a PC Financial Mastercard, however, you can earn even more PC Optimum points. Depending on which of these Mastercards you have, you’ll earn:

- bonus points for in-store purchases at Loblaws banner stores,

- bonus points for purchases at Shoppers Drug Mart and Esso, and

- points for every other $1 spent on the card.

If you’re very keen on collecting PC Optimum points, having a PC Financial Mastercard is a way to significantly boost your earn rate.

On the other hand, if you’re just interested in saving the most money, there may be other credit cards better for your wallet.

3. Join PC Insiders

Do you shop at Loblaws stores a lot? Like a lot a lot? You might consider getting a PC Insiders subscription.

For $119 per year, you will get:

- 10% back in PC Optimum points on all PC products,

- free and priority PC Express pickup,

- free shipping from Shoppers and Joe Fresh online, and

- a few other little perks and bonuses.

Is PC Insiders worth it?

That’s hard to say.

I haven’t subscribed because I don’t shop exclusively at Loblaws stores, so the $119 fee would cut pretty deeply into my PC Optimum profits.

Instead I just maximize my PC Optimum points by watching the flyer and taking advantage of PC Optimum offers to get bonus points whenever I can.

4. Open a PC Money account

President’s Choice Financial has introduced the PC Money account, which is a new way to save money at Loblaws stores.

This is a no monthly fee prepaid Mastercard. The idea is simple: You deposit money into your PC Money account, then use your PC Money card to spend that money wherever you want, including online.

If you do this, you’ll earn 10 PC Optimum points for every $1 you spend through your PC Money account, no matter where you shop.

The best part? This stacks on top of any other PC Optimum points you collect in those transactions, so, for example, you’ll earn 25 points for every $1 you spend at Shoppers Drug Mart.

But is a PC Money account worth it?

We’re unconvinced.

The major drawback is that your PC Money card acts more like a debit card than like a proper credit card.

10 PC Optimum points per $1 is a 1% rate of return, which really isn’t that great, especially since you can only redeem those points at participating Loblaws locations.

And you’re also missing out on other valuable credit card benefits like purchase protection, complimentary insurance, travel perks, and more.

All in all, you can probably do better with any number of rewards credit cards that will give you a bunch of extra perks and benefits besides.

Want to get the most out of your PC Optimum points? We’ve got you covered.

Best cash back cards for Superstore

As we mentioned earlier, President’s Choice Financial has a PC Financial Mastercard that will boost your PC Optimum earn rate. Here are the particulars:

| Annual fee: | $0 |

| Type of reward: | PC Optimum points |

| Reward details: | * 10 points for every $1 spent at Loblaws grocery stores * 25 points for every $1 spent at Shoppers Drug Mart * At least 30 points per litre of fuel at Esso gas stations * 20 points for every $1 spent on PC Travel purchases * 10 points for every $1 spent everywhere else |

| Average rate of return %: | 1.1% |

| Purchase interest rate: | 20.97% |

| Income requirement: | None |

The PC Financial Mastercard is a very rudimentary credit card that gives you a way to boost your PC Optimum earn rate, and not a whole lot else.

It has no annual fee, which is great, but the standard earn rate of 10 points per $1 spent is only getting you 1% back on your spending, which is pretty dismal.

And, you can only redeem those points for purchases at participating Loblaws stores, meaning they’re a lot more limited than regular cash back rewards, which you can use for whatever purchases you like.

You’re also missing out on all the other goodies that you’ll get with most regular credit cards, such as complimentary insurance coverage, purchase protection, and other perks and benefits.

There are 2 other versions of the PC Financial Mastercard mentioned on their website – the PC Financial World Mastercard, and the PC Financial World Elite Mastercard. You can learn more about these cards in our in depth review.

4 top cash back credit card alternatives

Here are some alternative cash back credit cards you might want to consider.

| Credit Card | Average Earn Rate on Groceries % | Annual Fee | Apply for Card |

|---|---|---|---|

| Scotia Momentum Visa Infinite | 4% | $120 (first year free) | Apply now |

| BMO CashBack Mastercard | 3% | $0 | Apply now |

| MBNA Smart Cash Platinum Plus Mastercard | 2% | $0 | Apply now |

| Brim Mastercard | 1% | $0 | Apply now |

1. Canada’s best cash back credit card

GC: $20

Canada’s best cash back credit card – the

Your cash back will kick off with a generous welcome bonus of 10% cash back for the first 3 months, up to $2,000 in spend. Then you’ll earn:

- 4% cash back on groceries and recurring bills (up to $25,000 spent annually),

- 2% cash back on gas and transit purchases (up to $25,000 spent annually), and

- 1% cash back on all other purchases.

A 4% earn rate on 2 common everyday categories is almost unheard of from a cash back credit card, and you’ll also get 2% back on all of your commuting expenses.

In addition to its rewards, this Scotiabank cash back card also comes with 11 types of insurance coverage, Visa Infinite benefits, and the annual fee will be waived for the first year you have the card.

One thing to keep in mind, of course is that, as a Visa Infinite card, the Scotia Momentum Visa Infinite has pretty steep income requirements of $60,000 personal, or $100,000 household. This unfortunately puts it out of reach for many Canadians.

2. 5% intro earn rate and 1.99% on balance transfers for 9 months

One of the best no fee cash back credit cards for groceries is the

You’ll start with an introductory earn rate of 5% cash back for the first 3 months, up to $2,500 in spend. After that you’ll earn:

- 3% cash back on groceries, up to $500 spent per month,

- 1% cash back on recurring bill payments, up to $500 spent per month, and

- 0.5% cash back on all other purchases.

This card also has a balance transfer offer of 1.99% on balance transfers for 9 months, with a 1% fee for the amount transferred. This is a great way to deal with any stubborn high-interest credit card debt you may have lingering on another card.

And purchases made with the BMO CashBack Mastercard are covered by BMO’s extended warranty and purchase protection.

3. No fee cash back with a comprehensive insurance package

The

You’ll get 5% cash back on gas and grocery purchases for the first 6 months (up to a total combined spend of $500 per month), after which you’ll earn:

- 2% cash back on gas and grocery purchases (up to a total combined spend of $500 per month), and

- 0.5% cash back for all other purchases.

In addition, this card comes with 7 types of insurance coverage, including:

MBNA Smart Cash Platinum Plus® Mastercard® Please review your insurance certificate for details, exclusions and limitations of your coverage.Extended Warranty 1 year Purchase Protection 90 days Travel Accident $1,000,000 Trip Interruption $2,000 Rental Car Theft & Damage Yes Rental Car Accident $200,000 Rental Car Personal Effects $1,000

It’s always nice to have some added peace of mind.

4. No fee flat rate cash back with rare insurance coverage

Finally, our best no fee flat rate cash back credit card is the

You’ll earn 1 point for every $1 spent on the card, no matter where you shop, and with no caps or categories to worry about.

And you can use your Brim reward points to pay for any of those purchases, at a value of 1 cent per point, for a 1% rate of return.

And, of course, you can use that cash back for purchases you make anywhere, not just at Loblaws-brand stores like PC Optimum points.

Other perks?

You can earn up to $200 in bonus rewards after first purchases with participating retailers, and earn bonus rewards for shopping online at over 150 participating retailers.

You also get 5 types of complimentary insurance, including rare event ticket cancellation and mobile device insurance coverages. These alone could save you hundreds of dollars should unforeseen circumstances arise.

5 credit cards head to head

Let’s take a look at how these credit cards measure up, side by side.

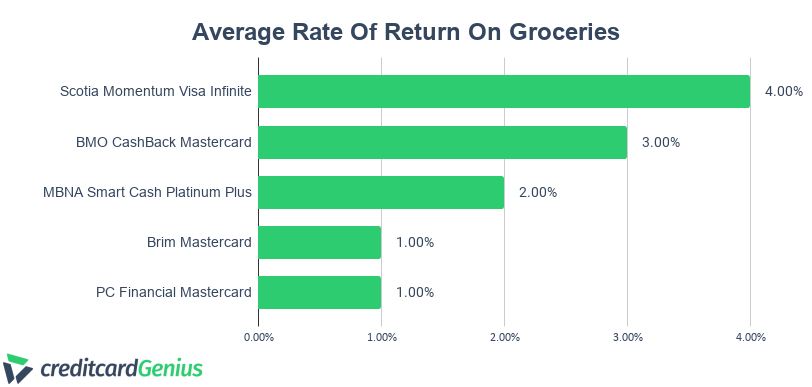

Average rate of return on groceries

When you’re looking for ways to save money on groceries, having a cash back credit card with a solid rate of return for that category is one of the best ways to get started.

Here’s how these 5 credit cards measure up.

The 4 alternative credit cards’ average rate of return is based on a $500 monthly spend on groceries. The PC Financial Mastercard’s average rate of return is based on the earn rate of 10 PC Optimum points for every $1 spent at Loblaws grocery stores.

Welcome bonus comparison

How about their respective welcome bonuses?

The Brim Mastercard has a welcome bonus of a sort, but it’s a bit trickier to earn.

You can earn up to $200 worth of bonuses after making first purchases at participating retailers, but it involves spending a lot of money at specific stores. So while you can earn some bonus cash, it’s a bit more complicated, and we don’t count this as directly comparable.

The PC Financial Mastercard currently offers a welcome bonus of 20,000 PC Optimum points, which is worth only $20.

In contrast, the bonus earn rates the other 2 credit cards currently offer are worth significantly more.

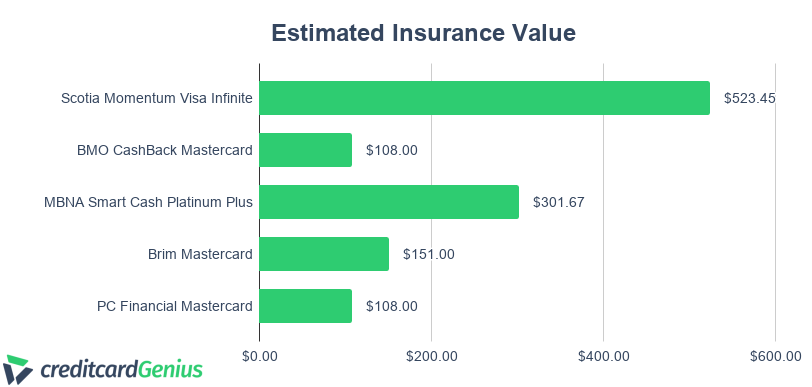

Estimated insurance value

We did an extensive and detailed study of credit card insurance to come up with the estimated value of the complimentary insurance included with every credit card in our database. Here’s how these credit cards compare.

Here it’s clear that in terms of included insurance, the Scotia Momentum Visa Infinite is head and shoulders above the other cards.

While the Brim and MBNA credit cards still offer good value in terms of their insurance coverage, the PC Financial and BMO CashBack Mastercards include only basic purchase protection and extended warranty coverage.

Estimated perks value

Perks are another oft-overlooked value that most credit cards bring to the table.

We did a similar study to come up with the estimated perks value for each credit card, and this is how these 5 credit cards compare.

Here’s where the Brim Mastercard makes a solid showing, bringing a lot more value to the table than the no fee PC Financial Mastercard.

In the end, it seems fairly clear that while the PC Financial Mastercard is a good way to boost your PC Optimum rewards earn rate, there are other credit cards out there with higher earn rates on groceries, more flexible rewards, and a whole lot of other perks and benefits to boot.

Superstore online shopping

There are 2 ways to shop online at most Loblaws-brand grocery stores in Canada: PC Express and Instacart.

PC Express

PC Express used to be called “Click and Collect,” and is a system in which you select and pay for your purchases online, and then go to pick them up at your local store.

This can definitely be a convenience, in that you never have to set foot in the store yourself. They have dedicated personal shoppers that put your orders together for you, and you just stop by to pick them up at a selected time.

There are a few drawbacks to this method:

- you have to trust someone else’s selection of meats, produce, and similar items, and

- the most convenient pick up times tend to get booked up fairly quickly.

So, while it can save you time, you won’t necessarily get the same quality of items you would if you picked them yourself, and if you’re not shopping well in advance, you may not be able to pick up your items when it’s most convenient for you.

You’ll also have to pay a small fee for this service, usually $3 to $5 per order.

Instacart delivery

The other option is to use Instacart, which is a third-party grocery delivery service available in most major cities in Canada.

To order through Instacart, you have to use the Instacart website, and, like PC Express, you have to trust someone else to select your items for you.

The benefit is that Instacart will bring your order right to your front door, saving you having to drive anywhere.

Delivery times are often more convenient as well, in that you can either request the “Fast and Flexible” option which will get your order to you as quickly as possible, or you can select a 2 hour delivery slot on a selected day (up to 5 days in advance).

Instacart often waives delivery fees as well, which can be a nice bonus, but even if they don’t, the fees are pretty reasonable, usually in the range of $3.99 to $7.99.

Instacart and American Express

One major benefit of using Instacart to order your groceries is that Instacart accepts American Express.

Better yet? Instacart is in the “eats and drinks” category for Amex, meaning that if you have a card like the

It’s for this reason that we have chosen the American Express Cobalt Card as the best credit card for buying groceries in Canada.

Unfortunately, Loblaws stores don’t currently accept American Express, which is why ordering through Instacart is a great option for Amex cardholders.

GC: $100

Bottom line

So, there you have it. Our top tips for saving money when shopping at Superstore.

Whether it’s shopping the flyer, doing some strategic meal planning, maximizing your PC Optimum rewards, or using the best cash back credit card you can, there are lots of ways to save.

Do you have tips for Superstore shoppers we haven’t covered here?

Share them in the comments below.

FAQ

How do I order groceries from Superstore?

You can order groceries from most Loblaws-brand grocery stores either for pickup through PC Express, or for delivery through Instacart. You can read more about these 2 services here.

What stores offer grocery pickup?

Most Loblaws-brand grocery supermarkets and superstores offer grocery pickup through PC Express. You’ll have to verify if your store is included through the PC Express website, which you can read more about here.

Does Superstore accept American Express?

Loblaws-brand grocery stores do not currently accept American Express. Instacart does accept American Express, however, so you can use Instacart to order your groceries for delivery. Instacart also counts in the “eats and drinks” Amex category for rewards.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner  $20 GeniusCash + 10% cash back on purchases for 3 months + 4% cash back on groceries.*

$20 GeniusCash + 10% cash back on purchases for 3 months + 4% cash back on groceries.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments