Online shopping is an often-overlooked category of credit card spending. If you’re a huge online shopper and want the most out of your purchases, choose a card that gives you the best rewards for cash back (and no foreign exchange fees if you shop international sites).

We’ll give you our list of top cards and mention some alternative payment methods so you can continue to shop smart.

Key Takeaways

- Most online shopping earns you a flat earn rate of 1% to 5% depending on the card and retailer.

- If you often shop on international sites, choose a card with no foreign exchange fees.

- Pay attention to how often cash back cards pay out rewards, since some only do so once a year.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

The best credit cards for online shopping

Since you can use almost any credit card to buy things online, we wanted to clearly define what makes a card the best for online shopping.

First, it needs to have a high, flat earn rate. Most online retailers generally don't fall under any specific payment category (which are usually things like groceries, restaurants, gas), so the cards need to earn you plenty of cash no matter where you're shopping.

If you know you’ll be purchasing things on international websites, choosing a card with no foreign exchange fees is also an important factor, since you’ll save yourself the 2.5% foreign transaction fee.

You’ll also want to pick a card that you’re eligible for with no annual fee (or one you don’t mind paying).

Here are our favourite cards that offer high earn rates on every purchase.

| Credit Card | Welcome bonus | Rewards | Annual fee/income requirements | Apply |

|---|---|---|---|---|

| SimplyCash Card from American Express | 5% cash back for the first 3 months, up to $2,000 in spend | * 2% cash back on gas * 2% cash back on groceries (up to $300 cash back annually) * 1.25% cash back on all other purchases | None | Apply Now |

| SimplyCash Preferred Card from American Express | 10% cash back for the first 3 months, up to $2,000 in spend. Plus, earn $50 when you make a purchase on month 13 | * 4% cash back on gas and groceries * 2% cash back on all other purchases | $119.88, no income requirements | Apply Now |

| National Bank ECHO Cashback Mastercard | No welcome bonus at this time | * 1.5% cash back on online purchases, gas, and groceries * 1% cash back on all other purchases | $30, no income requirements | Apply Now |

| Home Trust Preferred Visa | No welcome bonus at this time | * 1% cash back on all purchases | None, $15,000 personal | Apply Now |

| Neo Mastercard | after your account is opened | * Average of 5% cash back at partner retailers * 1% cash back on gas and EV charging, up to $500 spent monthly * 1% cash back on groceries, up to $500 spent monthly | None | Apply Now |

| Rogers Red Mastercard | No welcome bonus at this time | * Earn 2% unlimited cash back on all eligible non-U.S. dollar purchases if you have 1 qualifying service with Rogers, Fido, Comwave, or Shaw * Earn 1% unlimited cash back on eligible non-U.S. dollar purchases * Earn 2% unlimited cash back on all eligible purchases made in U.S. dollars | None | Apply Now |

| Rogers Red World Elite Mastercard | No welcome bonus at this time | * Earn 2% unlimited cash back on all eligible non-U.S. dollar purchases if you have 1 qualifying service with Rogers, Fido, Comwave, or Shaw * Earn 1.5% unlimited cash back on eligible non-U.S. dollar purchases * Earn 3% unlimited cash back on all eligible purchases made in U.S. dollars | * No annual fee * $80,000 personal, $150,000 household | Apply Now |

SimplyCash Card from American Express

Return on online shopping: 1.25%

If a no annual fee card is your game, then the

And if you’re worried about Amex cards’ limited acceptance, don’t be. Most online retailers accept Amex (the notable exception being Costco).

Pros:

- 5% cash back bonus for the first 3 months spending

- No annual fee

- Includes Amex Offers and benefits

Cons:

- Limited insurance included

- Cash back only paid out once per year

SimplyCash Preferred Card from American Express

Return on online shopping: 2%

For a higher earn rate, and a lower annual fee of $119.88 compared to most premium cards, there's the

With this card, you'll earn 2% cash back on every purchase, even online ones, with no caps to worry about.

Pros:

- 10 types of insurance included

- 10% cash back bonus for the first 3 months spending

- 4% cash back on gas and groceries

Cons:

- Cash back only paid out once per year

National Bank ECHO Cashback Mastercard

Return on online shopping: 1.5%

Another great card for shopping online is the

This card doesn't have a high base earn rate for an annual fee of $30 (it's 1%, which is still good), but it offers 1.5% cash back on online shopping (which excludes travel), gas, and groceries (up to $25,000 per year).

Pros:

- Redeem cash back on demand

Cons:

- Limited insurance included

Home Trust Preferred Visa

Return on online shopping: 1%

If you’re specifically looking for a great card to use for foreign purchases, check out the

It's a rare card with both no foreign transaction fees, as well as no annual fees. You'll earn 1% cash back on all eligible purchases with no limits on how much you earn. Just note that you won't earn cash back on foreign currency purchases.

Pros:

- Low credit score requirements

- Flat rate earning across all spending

Cons:

- No rewards on foreign exchange purchases

- Limited insurance included

Neo Mastercard

Return on online shopping: Up to 5% back with retail partners

Our next card, the

But, Neo has plenty of partners where you can earn bonus rewards on your purchases – and there is a long list of them.

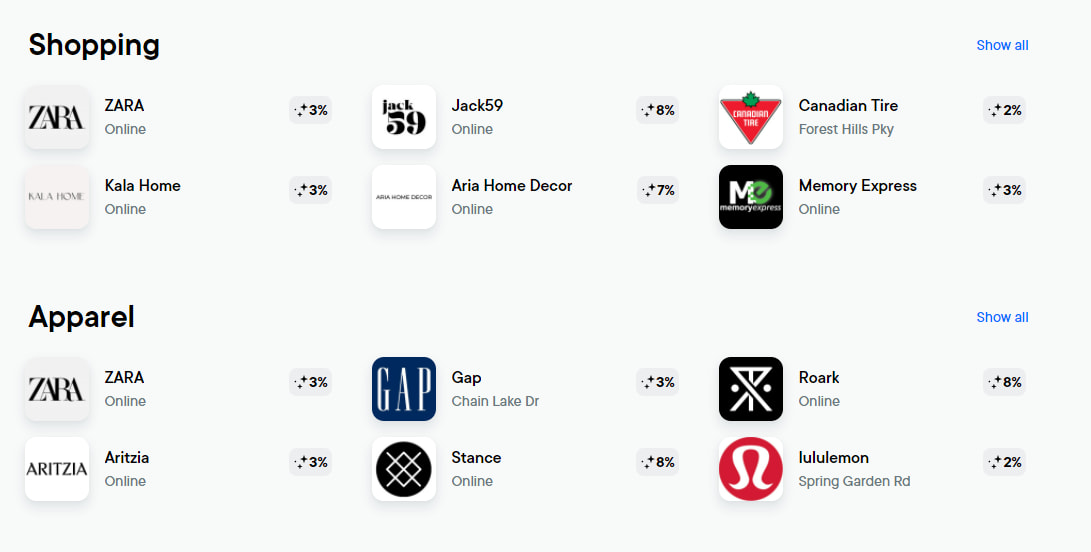

Here's just a sample of what's available.

With the Neo card, you can earn an average of 5% back at these retailers – an astonishing return.

Pros:

- Ability to upgrade your card to Neo Premium for more rewards and benefits

- Redeem your cash back at any time

- Retail partners offer welcome bonuses

Cons:

- Does not earn rewards everywhere

- No insurance included

Rogers Red Mastercard

Return on online shopping: Up to 2% back

The Rogers Red Mastercard earns cash back a little differently. If you have a qualifying Rogers service, you can earn 2% back on non-USD purchases. Without a service, you’ll only earn 1% back. Making purchases on U.S. sites? You’ll also get 2% back.

With no annual fee and low credit requirements, it’s pretty easy to qualify for this Rogers card.

Pros:

- No annual fee

- Redeem cash back anytime

Cons:

- Best deal only available to Rogers customers

- Limited insurance included

Rogers Red World Elite Mastercard

Return on online shopping: Up to 3% back

There are really only a few key differences between the basic and premium card. Mainly, the Rogers Red World Elite Mastercard is harder to qualify for, but you’ll get World Elite Mastercard benefits and better insurance coverage.

Plus, the cash back rate is bumped up to 3% for USD purchases.

Pros:

- No annual fee

- Includes 6 types of insurance coverage

- Redeem cash back on demand

Cons:

- High income requirements of $80,000 personal or $150,000 household

Alternatives to credit cards for online shopping

While credit cards are usually the payment of choice for online purchases, you have other options at your disposal.

Here are a few other ways you can make online purchases without the use of a credit card.

Prepaid cards

Prepaid Visa, Mastercard, and Amex cards are a way to pay for purchases online. You can buy them in stores (for a fee, beware of those), or get one that's issued specifically to you. Many of these cards offer some rewards as well.

Here are a couple of options.

To earn rewards on every purchase, the

You'll earn 0.5% cash back on every purchase and pay no foreign exchange fees.

For even more from a prepaid card, there's the

For either an annual fee of $144 or a monthly fee of $18, you'll earn the same 0.25% cash back on every purchase, and earn 1.5% cash back on groceries, transportation, food, and drinks.

The best part? You can switch back and forth between regular and premium KOHO when you like.

Use a Visa Debit or Mastercard Debit card

Have either a Visa Debit or Mastercard Debit card? You may be able to use them for online purchases if the merchant accepts them.

This page has a list of merchants where you can use a Visa Debit card, and this Mastercard page has details on merchants that accept Mastercard Debit.

To get one of these cards, you'll need a chequing account that includes these cards as your regular debit card.

These banks offer Visa Debit cards:

- CIBC

- RBC

- Scotiabank

- TD

For Mastercard Debit, only BMO offers them.

Best merchants for shopping online

So, what are some of the top merchants for online shopping? Here are a few of the bigger options in Canada, and what they offer.

| Retailer | What they sell | Membership required? | Shipping policies |

|---|---|---|---|

| Amazon.ca | Just about anything | Can order without, but need a membership for free shipping | Free shipping for members on orders over $35 |

| Superstore | Groceries from Loblaws, Real Canadian Superstore, and Atlantic Superstore | No, but you don’t have to meet a minimum order requirement as a member | * $4.57 flat delivery fee per order * Must pick up if delivery isn’t available in your area |

| Canadian Tire | Everything that’s available in store plus more | No | * Pick up - free, same-day delivery - $9.99 flat fee plus tax, and shipping - price varies, available |

| Walmart | Everything that’s available in store plus more | No, but Delivery Pass membership gets you free same-day delivery | * Pick up - free, delivery on $35+ orders or $7.97 if under $35, delivery - varies |

| Costco | Everything that’s available in store plus more | Not for online shopping | * Same-day delivery through Instacart for a fee, standard shipping for a fee |

FAQ

What is the best credit card for online shopping?

If you’re mainly looking for the credit card with the best cash back rate for online shopping, we’d have to go with the American Express SimplyCash Preferred, which gives you 2% back on all online orders.

What are the best alternatives to credit cards for online shopping?

If you prefer not to use a credit card, you can use prepaid cards, or a Mastercard or Visa debit card. Some merchants also allow you to use PayPal, so check out your payment options before reaching for your card.

What is the best site for online shopping?

There’s not a single best site for online shopping since merchants specialize in different things. We tend to appreciate sites that offer deals on shipping. For instance, we’d recommend Canadian Tire, Superstore, Walmart, and Costco.

How do you pay for online shopping?

You’ve got lots of options for making online purchases. You can use your credit cards, debit cards (including Interac), PayPal, and digital wallet like Apple Pay and Google Pay.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner  $50 GeniusCash + Earn up to $100 in bonus cash back.

$50 GeniusCash + Earn up to $100 in bonus cash back.

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.