TD Rewards is the official rewards program of TD Canada Trust. You can earn TD Rewards Points for every purchase with a TD credit card and redeem them in 6 rewards categories: cash, gift cards, merchandise, online shopping, Starbucks Stars, and travel.

Although it’s easy to earn TD points by booking travel with Expedia or using a TD credit card, we’ll be honest: your points aren’t worth as much as other popular rewards programs. Fortunately, we’ll show you some strategies to earn the most points and choose redemption options that give your points the best value.

Key Takeaways

- TD Rewards is the rewards program of TD Canada Trust.

- Members can earn TD Rewards Points by using a TD credit card, shopping with program partners, and taking advantage of bonus offers.

- There are 6 TD Rewards redemption categories worth up to 0.5 cents CAD each.

- The best TD Rewards credit card is the TD First Class Travel Visa Infinite Card.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What are TD Rewards?

Just like CIBC runs the Aventura Rewards program, TD Canada Trust runs the TD Rewards program.

You’ll need 1 of 4 TD Rewards credit cards to start collecting TD Rewards Points. Save up enough points and you can redeem them in one of 6 categories: cash, gift cards, merchandise, online shopping, Starbucks Stars, and travel.

TD Rewards overview

Currency: TD Rewards Points

Rewards categories: Book any-way travel, Expedia For TD, redeem for cash, shop the catalogue, shop with points at Amazon.ca, Starbucks Stars

Pros:

- 2,000+ merchandise rewards in 25+ categories

- 65+ gift card brands

- 6 rewards categories

- 4 TD Rewards credit cards

- 4 eligible purchase categories

- Points worth up to 0.5 cents CAD each

- No travel reward blackout dates or seat restrictions

- Points are transferrable and don’t expire with an active credit card

- Points can be redeemed towards any travel purchase

Cons:

- $5,000–$25,000 annual cap on eligible grocery and restaurant purchases

- 1 points conversion partner

- Points worth as little as 0.21 cents CAD each

- Points expire after 1 year of inactivity or 90 days after cancelling a credit card

- TD credit card required

What are TD Rewards Points worth?

TD Rewards Points yield a fixed value of 0.25–0.5 cents CAD each in every rewards category except merchandise, where their value floats between 0.21–0.35 cents CAD each.

From the most to least valuable, there are 6 ways to use TD Rewards Points.

| Rewards category* | Options | Value in cents per point (CPP) |

|---|---|---|

| Expedia For TD | * Activities * All-inclusive resorts * Car rentals * Cruises * Flights * Hotels * Vacation packages |

* 0.5 CPP |

| Book any-way travel | * Accommodation expenses * Activity expenses * Transportation expenses |

* 0.4 CPP (per first $1,200) * 0.5 CPP (per remainder over $1,200) |

| Shop with points at Amazon.ca | * Any non-excluded Amazon purchase | * 0.33 CPP |

| Shop the catalogue | * eGift cards * Gift cards * Merchandise |

* 0.25 CPP (gift cards) * 0.27 CPP (merchandise average) |

| Redeem for cash | * Credit card statement credits | * 0.25 CPP |

| Starbucks Stars | * Convert points manually (one-time) * Convert points automatically |

* N/A |

* TD Rewards Points can no longer be redeemed for a $250 Education Credit through HigherEdPoints.com.

The clear winner is Expedia For TD, with one exception: a 6 or 12-month Xbox Game Pass Core Membership eGift Card yields 0.4 and 0.5 CPP, respectively.

You can find other deals and figure out whether a reward is worth your points by using the following formula:

Value of reward in $ / value of reward in points x 100 = value in cents per point (CPP)

Or you can follow our recommendations: steer clear of cash, gift cards, and merchandise, and don’t visit Amazon unless there’s a big sale. You’re better off getting at least 0.4 CPP of value by booking travel through a provider of your choice or Expedia For TD.

How to earn TD Rewards Points

The only way to earn TD Rewards Points is to use a TD credit card. You can collect up to 9 TD Rewards Points on every dollar, except for what you spend on bank fees, cash advances, interest charges, and refunds.

To get even more points, stick to high-earning purchase categories such as:

- Expedia For TD: Earn 4–9 points for every $1 spent in 7 categories – including car rentals, cruises, flights, and hotels – through ExpediaForTD.com.

- Groceries and restaurants: Earn 3–6 points for every $1 spent on up to $5,000–$25,000 of eligible spending per category per year.

- Recurring bills: Earn 2–6 points per $1 spent on pre-authorized payments such as bills, donations, investments, membership fees, savings contributions, or subscriptions.

At the time of writing, members can also earn 1–9.5 points per $1 spent at Starbucks and 200 bonus Starbucks Stars by linking their credit card and Starbucks accounts through EasyWeb or the TD mobile app. What a wonderful way to start the day!

TD Rewards credit cards

TD is the only major bank in Canada to use a single payment network: Visa. Fortunately, Visas make exceptional travel credit cards thanks to their high acceptance rates and numerous perks and benefits.

The best card that they offer is the TD First Class Travel Visa Infinite Card. Not only can you earn up to 8 points per $1 spent on purchases, you'll get an annual $100 travel credit, 12 types of insurance, and more. If you’d prefer a no fee option, try the TD Rewards Visa Card.

There are 4 TD Rewards credit cards available in Canada:

| TD First Class Travel Visa Infinite Card | TD Platinum Travel Visa Card | TD Rewards Visa Card | TD Business Travel Visa Card | |

|---|---|---|---|---|

| Welcome TD Rewards Points | 165,000 | 50,000 | 15,152 | 30,000 |

| Rewards | * 8 points per $1 spent on Expedia For TD * 6 points per $1 spent on groceries and restaurants * 4 points per $1 spent on recurring bills * 2 points per $1 spent on all other purchases |

* 6 points per $1 spent on Expedia For TD * 4.5 points per $1 spent on groceries and restaurants * 3 points per $1 spent on recurring bills * 1.5 points per $1 spent on all other purchases |

* 4 points per $1 spent on Expedia For TD * 3 points per $1 spent on groceries and restaurants * 2 points per $1 spent on recurring bills * 1 point per $1 spent on all other purchases |

* 9 points per $1 spent on Expedia For TD * 6 points per $1 spent on foreign transactions, recurring bills, and restaurants * 2 points per $1 spent on business purchases |

| Annual eligible spending cap | * $25,000 (Groceries and restaurants) | * $15,000 | $5,000 | * N/A |

| Annual fee | $139 | $89 | $0 | $149 |

TD First Class Travel Visa Infinite Card

Let’s start with the card that gives you the biggest bonus and some of the best earn rates: the TD First Class Travel Visa Infinite Card. Yes, there is a steep annual fee, but it’s waived for the first year. In addition to earning up to 8 points per $1 spent through Expedia For TD, you’ll also get an annual $100 travel voucher and a dozen types of insurance coverage. We think the rewards and benefits are worth the modest annual fee after the first year.

Pros:

- Up to 165,000 welcome bonus points

- 12 types of insurance coverage

- Annual $100 travel credit

Cons:

- High income requirements of either $60,000 personal or $100,000 household

- Points only worth 0.5 cents each

TD Platinum Travel Visa Card

Despite being a platinum card, the TD Platinum Travel Visa Card doesn’t come with as many rewards and benefits as the previous card. However, if you don’t meet the high income requirements or you’d like a lower annual fee, the Platinum card might be better for you.

You’ll earn up to 6 points per $1 spent on Expedia For TD and enjoy a solid insurance package when you travel. There’s no annual travel credit, but the annual fee is waived for your first year.

Pros:

- Up to 50,000 welcome bonus points

- 9 types of insurance coverage

- $89 annual fee waived for the first year

Cons:

- Points only worth 0.5 cents each

TD Rewards Visa Card

Let’s look at the only fee-free TD Rewards card, the TD Rewards Visa Card. Since there are no annual fee or income requirements, the card doesn’t help you rack up points as fast as others. You’ll only earn up to 4 points per $1 spent on Expedia For TD, but you do have the opportunity to snag a welcome bonus of up to 15,152 points.

There’s only basic insurance included but this could be a great starter credit card for people who like travelling with Expedia and don’t want to pay for the privilege of using a rewards card.

Pros:

- No annual fee or income requirements

- Up to 15,152 welcome bonus points

- 3 types of insurance coverage included

Cons:

- Points only worth 0.5 cents each

- Low base earn rate leads to a 0.5% return on other purchases

TD Business Travel Visa Card

If you travel frequently for business and primarily use Expedia for booking, the TD Business Travel Visa Card has your name on it. You’ll earn up to 9 points per $1 spent on Expedia For TD. Plus, you’ll have the opportunity to earn up to 30,000 welcome bonus points. This can help offset the card’s $149 annual fee (waived for the first year).

Since it’s a business card, you’ll enjoy access to TD’s card management tool, which helps you track business expenses and apply spending controls. You can also link the card to the Visa SavingsEdge Program to earn score discounts on your business purchases.

Pros:

- Up to 30,000 welcome bonus points

- First year fee waived for primary cardholder and 2 additional cardholders

- 10 types of insurance coverage included

Cons:

- Redemption options are less valuable than other rewards programs

How to view TD Rewards Points

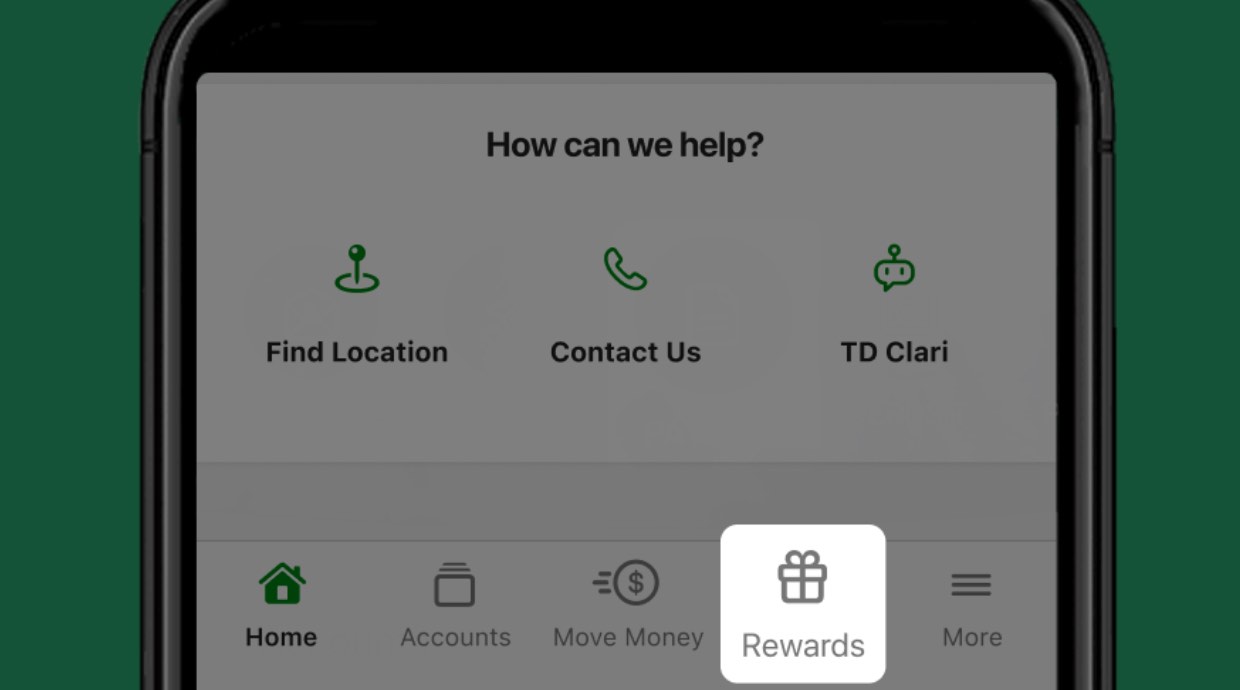

You can view your TD Rewards Points balance on EasyWeb by logging in, clicking "Manage," and selecting “My TD Rewards.” On the TD mobile app, you can tap “My TD Rewards” at the bottom of the screen to see all your options.

Image source: TD

Image source: TD

How to redeem TD Rewards Points

You can redeem your TD Rewards Points online through one of 5 websites: ExpediaForTD.com, EasyWeb.TD.com, the TD mobile banking app, Amazon.ca, or TDRewards.com.

Don’t worry, we won’t leave you hanging – we take every TD Reward category by category and step by step in the sections below.

Note: You can’t redeem TD Rewards Points if you miss making 2 minimum payments in a row.

Expedia For TD

Options: Activities, all-inclusive resorts, car rentals, cruises, flights, hotels, and vacation packages

Most valuable option: Any option at 0.5 CPP

How to redeem:

The most valuable TD rewards belong to Expedia For TD, a travel portal owned and operated by its namesake, Expedia. You can either call 1-877-222-6492 to redeem over the phone or log directly into the website at ExpediaForTD.com.

Pick a category at the top, search by dates or destination, and refine your results by filtering for certain brands or sorting by price. You can check out once you add at least one item to your cart. Although Expedia For TD advertises a 10% – 38% discount on certain hotels, in practice, every booking yields about 0.5 CPP.

The site’s best feature is its attention to detail. For example, you’ll find amenities, check-in times, check-out times, pet policies, ratings, refund policies, and more on every hotel page. Plus, it’s one of the few rewards programs in Canada to offer price-matching.

TD Rewards members enjoy preferred room rates and a 24/7 customer support line, plus a discount at Avis and Budget. At checkout, you can pay for some or all of your purchase in TD Rewards Points at a rate of 200 points per $1 CAD.

If you run into trouble with your travel reservation, contact ExpediaForTD for help, not the TD Bank.

Book any-way travel

Options: Activity, accommodation, or transportation expenses

Most valuable option: Travel purchases over $1,200 at 0.5 CPP

How to redeem:

The fact that you can redeem TD Rewards Points for any travel or travel-related purchase from a provider of your choice makes it one of the most flexible credit card rewards programs in Canada. Just remember that freedom comes with a 20% price premium.

Here’s how it works: the first $1,200 of any eligible travel purchase trades 250 TD Rewards Points per $1 CAD, yielding 0.4 CPP. Compared to a booking on Expedia For TD – which yields 0.5 CPP – you lose $240 in potential value. Fortunately, you only need to trade 200 points per $1 CAD on the remainder.

To redeem, make your purchase(s), wait for them to post, then call TD customer service at 1-888-315-0603 or log into TDRewards.com within 90 days.

On the website, select "Redeem" and “Book Any Way Travel.” Enter the transaction dates and description from your credit card’s transaction history and the amount. You can add multiple transactions by clicking the green “+” in the bottom left corner.

Once you’re done, submit your transactions, and wait for your rewards to be approved. You should see a statement credit applied to your credit card balance in a few business days.

Shop with points at Amazon.ca

Options: Any non-excluded Amazon purchases

Most valuable option: Items on sale at 0.33+ CPP

How to redeem:

You can redeem TD Rewards Points for nearly everything on Amazon except digital products, Kindle eBooks, and Subscribe and Save products.

If you’ve ever used your TD credit card to pay for your Amazon shopping, your card is likely already enrolled in the program. You can verify your card’s enrollment status by visiting and logging into the Shop With Points page.

To manually enroll a TD credit card, visit the Amazon TD Rewards page and click "Link your rewards account." Sign in and follow the instructions to complete the process.

Once your card has been enrolled, you can shop as normal. Just make sure to select your TD credit card as the payment method at the checkout and to apply about 3 points per $1 CAD towards your purchase. You can pay for some or all of your total in TD Rewards Points.

If you return your Amazon purchase, the TD Rewards Points you spent will be credited back to your TD account.

Shop the catalogue

Options: eGift cards, gift cards, and merchandise

Most valuable option: 12-Month Xbox Game Pass Core Membership at 0.5 CPP

How to redeem:

We don’t recommend redeeming your TD Rewards Points for gift cards or merchandise, especially when you trade them for 0.33 CPP through Amazon. With the exception of the Xbox Game Pass, there are few rewards items and no gift cards that yield more than 0.25 CPP – even if they’re on sale.

So before you shop the TD Rewards Catalogue, grab a calculator and use the following equation:

Value of reward in $ / value of reward in points x 100 = value in cents per point (CPP)

Then visit TDRewards.com, log in, and select "Shop Now" at the bottom of the page. You can use categories and points cost filters to refine your results and pay for your purchase using TD Rewards Points, cash, or some combination of the two.

If you’re shopping for gifts, make sure to allow 5–10 business days for delivery of gift cards and regular merchandise, and 2–6 weeks for item shipping straight from the manufacturer. eGift cards will be sent to the recipient’s email inbox within 12 hours.

You can price match catalogue items by sending the product name, model number, advertised price, and advertisement location to [email protected].

Redeem for cash

Options: Credit card statement credits

Most valuable option: Any amount at 0.25 CPP

How to redeem:

TD Rewards statement credits yield a fixed value of 0.25 CPP at 400 points per $1, or 50% of their value on Expedia For TD. But there’s something to be said for cash back rewards – especially when you can redeem on demand.

To redeem your points for cash, log onto EasyWeb or the TD mobile app. Select "Pay With Rewards" and select the credit card you’d like to pay off. You can redeem a minimum of 10,000 points ($25), a maximum of your entire points balance, or a custom number. Select “Continue” then “Pay Now” and you’re done. You should see the credit applied to your balance within the next 5–7 business days.

Convert TD Rewards Points to Starbucks Stars

Options: Auto-recurring or manual (one-time) points conversions

Most valuable option: N/A

You can’t convert TD Rewards Points to Aeroplan Points, but you can convert them to Starbucks Stars.

According to our research, Stars are worth 3.56–6.78 cents CAD each. When you redeem them, skip the sandwich (250 Stars) – the biggest bang for your buck is a classic Venti coffee (50 Stars).

TD Rewards vs. other rewards programs

TD Rewards’s biggest rivals are Aeroplan, Aventura, and Avion. If you’re a homebody, steer clear – the top rewards category in all 4 programs is air travel.

| TD Rewards | Aeroplan | Aventura | Avion | |

|---|---|---|---|---|

| Membership requirements | Credit card | Credit card OR free account | Credit card | RBC account OR free account |

| Currency | TD Rewards Points | Aeroplan Points | Aventura Points | Avion Points |

| Rewards | * Gift cards * Merchandise * Statement credits * Travel |

* Events and attractions * Gift cards * Merchandise * Travel |

* Donations * Financial products * Gift cards * Merchandise * Points conversions * Travel * Statement credits |

* Donations * Financial products * Gift cards * In-store discounts * Merchandise * Points conversions * Travel * Statement credits |

| Top rewards category | Expedia For TD (0.5 CPP) | Air Canada flights (2 CPP) | Aventura Airline Travel Rewards (2.29 CPP) | Avion Air Travel Redemption Schedule (2.33 CPP) |

| Bottom rewards category | Redeem for cash (0.25 CPP) | Gift cards (0.71 CPP) | Payment with Points (0.63 CPP) | RBC Financial Rewards (0.58 CPP) |

| Special membership benefits | * Avis and Budget car rental discounts * Bonus Starbucks Stars * Book any travel |

* eUpgrades * Free checked bags and priority services on Air Canada * Maple Leaf Lounge access |

* None | * DashPass, Petro-Canada, and Rexall perks * Points conversions |

At first glance, TD Rewards don’t seem all that valuable, but Aventura and Avion award very few points on the dollar. The fastest way to earn Aeroplan points is to buy a flight ticket, but a low flight class and membership level can reduce your earnings by up to 90%.

Plus, fixed points values make it easier to calculate your rate of return, plan your redemptions, and save toward a specific goal. TD Rewards Points reliably yield 0.5 CPP, whereas Aeroplan airline ticket rewards demand a lot of advance research to achieve maximum value.

Ultimately, we’d say the best program for you depends on what rewards you want and where you shop. You’ll get the most rewards and value from the program whose purchase categories and partners match your existing spending habits.

In other words, if you love Expedia, the TD Rewards program is probably the right fit for you.

FAQ

Can you transfer TD Rewards Points to Aeroplan?

You can’t convert TD Rewards Points into Aeroplan Points, but you can convert them into Starbucks Stars.

Does TD Rewards price match?

The TD Rewards Catalogue price matches general merchandise, while Expedia For TD price matches hotels and flight/hotel packages through the Expedia Price Guarantee.

Do TD Rewards Points expire?

TD Rewards Points don’t expire as long as you hold an active, valid TD credit card. If you cancel your card, you’ll have 90 days to redeem your points, and if you go 1 year without earning or redeeming any new points, you could forfeit them all.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 18 comments