Pros & cons

Pros

- Earn an extra 10% cash back for the first 2 months, up to $1,000 spent.

- Unlimited 2% cash back on up to 3 categories of your choice.

- 1.95% on balance transfers for 6 months.

- No annual fee.

- Cash back is deposited every month.

Cons

- Only earns unlimited 0.5% cash back on non-accelerator category purchases.

- Limited insurance included.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 11.13% in your first 2 months on up to $1,000 in spending which translates to an estimated $106.◊

For all welcome bonus details click here.

Welcome bonus offer ends Apr 30, 2026.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With Tangerine Money-Back Credit Card, here's how you earn rewards:

- 2% cash back on purchases in up to 3 Money-Back Categories

- 0.5% cash back on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For Tangerine Money-Back Credit Card in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Statement credits | $410 | |

| Direct deposit | $410 |

Calculating your annual rewards

$36,000 annual spending x 1.14% return on spending = $410 annual rewards

$410 annual rewards − $0.00 annual fee = $410 net annual rewards

Details and eligibility

- Estimated Credit Score

- 560 - 659

- Personal Income

- $12,000

- Household Income

- N/A

- Annual Fee

- $0.00

- Extra Card Fee

- $0

- Card type

- Credit

- Purchase

- 20.95%

- Cash Advance

- 22.95%

- Balance Transfer

- 22.95%

- Balance Transfer

- 1.95%

- Transfer Term

- 6 months

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

Tangerine Money-Back Credit Card's 4.4 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Tangerine Money-Back credit card review

Tired of boring run-of-the-mill cash back credit cards? You've come to the right place.

The Tangerine Money-Back Mastercard is a unique NO ANNUAL FEE cash back credit card that lets you choose where you earn bonus rewards ‒ and update those preferences when your needs change.

Tangerine credit card rewards

When it comes to earning rewards, you're in charge of how they're earned and how they're paid to you.

Tangerine credit card categories

So how are you in control? You get to pick the categories where you earn your 2% cash back.

Here are the choices available:

There's a wide assortment of categories to choose from.

How many do you get to choose? If you get your rewards issued as a statement credit, you'll get to choose 2.

But if you get them deposited into a free Tangerine Savings account, you can choose 3 categories (you can sign-up for one here).

Purchases outside of your chosen categories will earn 0.5%.

How much cash back you can earn with a Tangerine credit card

We'll use our typical $2,000 monthly spend, which is broken down as follows:

- groceries – $350,

- gas – $200,

- drugstores – $100,

- restaurants – $150,

- recurring bills – $300,

- travel – $100, and

- all other purchases – $800.

Total annual rewards with 2 categories

Let's start with a scenario where you get to choose 2 categories at 2%. In this case, we'll go with groceries and recurring bills, our 2 highest categories.

Here's a breakdown of what you would earn in rewards: 2% on groceries and bills and 0.5% on all other purchases. The total annual rewards is $237.

Total annual rewards with 3 categories

Now, let's do the same, but you can choose between 3 categories at 2% because you have a Tangerine Savings account. For our 3rd category, we'll choose gas in addition to groceries and bills.

Now the total annual rewards is $273. An extra $36 just by having a free Tangerine Savings account.

Changing your Money-Back categories

Spending patterns change? No problem – your categories aren't locked in once you choose them.

You'll be able to change any of your categories whenever you like – just note that it will take 90 days for the change to take effect. However, it will happen right away if it's your first time requesting a change.

Getting your cash back rewards

So how do you get a hold of your rewards?

Your rewards get paid out once per month. You can choose to either get them as a statement credit, or deposited into a Tangerine Savings account.

Either way, you'll never have to wait a year for them like most cash back credit cards.

4 Tangerine credit card benefits

Beyond just earning rewards, Tangerine credit cards have a few other features.

1. Insurance coverage

You'll get a couple of types of insurance coverage included with a Tangerine credit card.

They are:

- extended warranty, and

- price protection.

It doesn't look like much but, according to our study on credit card insurance, extended warranty coverage is worth about $78 annually and price protection is worth $38.

2. Promotional balance transfer rate

Have some existing credit card debt? You'll get an introductory rate of 1.95% on balance transfers for the first 6 months, with a fee of 3% on the amount transferred (minimum $5).

Keep in mind: If you take Tangerine up on this part of the offer, don't use your credit card for new purchases. Why? The payments you make go towards the portion of your balance that has the lowest interest rate. Meaning, those new purchases you make will start accruing interest at 19.95%.

3. No annual fee and a fair to good credit score requirement

Not having to pay an annual fee seals the deal. The entire package won't cost you anything as long as you NEVER carry a balance. All together, you have a solid primary credit card for daily use, or an even better compliment for almost any wallet.

To make things sweeter, this card also comes with a lower credit score approval than most cards. You'll only require a credit score of 600 to be considered for approval. Of course, this isn't guaranteed, but if your score is a little shaky, you'll have an easier time being approved for this card.

4. Available for students

If you're a student with no credit history whatsoever, the Tangerine Mastercard is available for you.

It has lower credit score requirements and has no income requirements either. It makes for an excellent student credit card.

The consummate companion credit card

Tangerine credit cards make for an ideal companion card in almost anyone's wallet, for 2 reasons:

- you pay $0 annual fee, and

- you get to choose how you earn 2% cash back.

The last point is key.

With 10 categories to choose from, there's a category you can select that's different from any of your other credit cards.

Top cash back card paired with Tangerine credit card

Additional cash back rewards: $42

So, let's see how it pairs with our top cash back credit card – the

- 4% cash back on groceries and recurring bill payments

- 2% cash back on gas, transit, rideshares, and food delivery

- 1% cash back on all other purchases

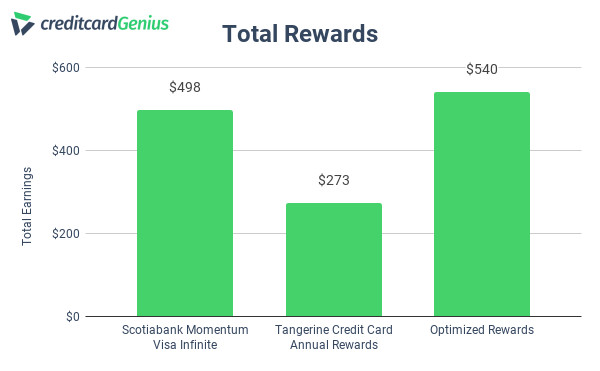

Based on our typical $2,000 annual spend, this card earns $498 in cash back per year.

Let's add a Tangerine credit card to pair with it and pick 3 different 2% categories to supplement our earnings:

- restaurants,

- drugstores, and

- home improvement.

So, this combined wallet has the following earn rates:

- 4% cash back on groceries and recurring bills,

- 2% cash back on gas, drugstores, restaurants, and home improvement, and

- 1% cash back on everything else.

Here's how they compare alone (with Tangerine using our 3 category example above), and combining them together.

| Spending Category (Monthly Spend) | Scotiabank Momentum Visa Infinite | Tangerine Credit Card Annual Rewards | Optimized Rewards |

|---|---|---|---|

| Groceries ($350) | $168 | $84 | $168 |

| Gas ($200) | $48 | $48 | $48 |

| Bills ($300) | $144 | $72 | $144 |

| Drugstore ($100) | $12 | $6 | $24 |

| Restaurants ($150) | $18 | $9 | $36 |

| Home Improvement ($100) | $12 | $6 | $24 |

| Travel ($100) | $12 | $6 | $12 |

| Other ($700) | $84 | $42 | $84 |

| Total | $498 | $273 | $540 |

Just by combining a Tangerine credit card with the Scotiabank Momentum Visa Infinite, you've earned an extra $42 in cash back. And there are no extra costs for doing so as well.

Here's a summary chart, showing all 3 sets of annual rewards together.

High flat rate paired with Tangerine credit card

Additional cash back rewards: $77

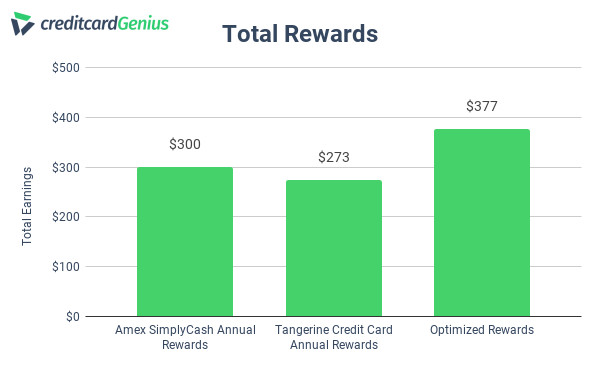

Now, let's create a no fee credit card super combo with the

Meaning, when spending $2,000 per month, you would earn $300 cash back every year.

So, let's combine this card with our 3 category Tangerine setup to create this wallet:

- 2% cash back on groceries, bills, and gas, and

- 1.25% cash back on all other purchases.

| Spending Category (Monthly Spend) | Amex SimplyCash | Tangerine Credit Card Annual Rewards | Optimized Rewards |

|---|---|---|---|

| Groceries ($350) | $53 | $84 | $84 |

| Gas ($200) | $30 | $48 | $48 |

| Bills ($300) | $45 | $72 | $72 |

| Other ($1,150) | $173 | $69 | $173 |

| Total | $300 | $273 | $377 |

Adding these 2 cards together gives an increase of $77 in annual rewards. For 2 no fee cards, this is quite a good pairing.

Tangerine credit card downsides

This all seems well and good, but are there any downsides?

The only real big one is the base earn rate of 0.5%. If this is the only credit card you carry, you won't be earning much in rewards outside of your chosen categories. But this is easy to overcome, by pairing it with a no annual fee card that has a high base earn rate like the

The insurance coverage is also a little lacking, but does offer something in this department.

Tangerine World Mastercard

So what differences does the Tangerine World Mastercard have?

It has the exact same:

- unlimited, customizeable cash back rewards,

- balance transfer promo, and

- no annual fee.

In the insurance department, it also offers mobile device and rental car coverage.

And it has a few extra perks. You'll get a free membership to Mastercard Airport Experiences, but each visit will cost US$32.

And, you'll get access to World Mastercard benefits. Some noteworthy benefits include:

- World Mastercard experiences, and

- Priceless cities.

The only catch? You'll need either a personal income of $50,000 or a household income of $80,000 to qualify.

In summary

Think of Tangerine credit cards like a chameleon: extremely versatile and adaptable wherever you drop them. You can use one on its own ‒ or pair it with other top credit cards and get even more rewards.

Do you have a Tangerine credit card already?

Leave a review so others can know what your experience has been with the card.

Key benefits

User reviews

Reviewed by 80 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

great card

Thanks Tangerine

i think very very very very very very very very very very good

Not great. First of all, I get only 0.5% cash back on most online purchases. Secondly, the statements are so pale to read and difficult to scan with OCR, making my bookkeeping difficult. I gave up on this.

Declined with over 700 credit rating and 60K+ in savings with them, no reason given, that's me moving my cash elsewhere...

I had such high hopes. But...

1. Tangerine refuses to provide an option that does not require an OTP, which means I cannot download transactions into Quickbooks Online without a. receiving an error, b. entering a code, c. making a second request to download, d. entering a code again. Intuit has contacted Tangerine multiple times on behalf of multiple customers, but Tangerine will not budge.

2. No chat support. Only sending a message which typically takes 1-3 days to receive a reply, which is typically lacking any indication of their actually reading the question and applying brain power.

3. Many issues are met with the suggestion, or in fact the requirement, that I call in to resolve over the phone, which I find odd for a company that purports to be online-based. Inadequate resources to resolve issues online.

4. One example is that attempting to pay the card balance receives a message of, "Oops, something is wrong, please try later." Lasts for days. After no less than 4 messages, I finally heard from someone who said that paying the card balance can only be done from a Tangerine account, not an external account. No, payment cannot be pulled by Tangerine from a linked external account. It must be pushed (sent) from an external account to Tangerine.

5. Another example is that they were quick to fail to pay a charge from Facebook and tell me I had to call in to resolve. When I called in, I spent ONE HOUR on the phone listening to bad music and recorded messages of how they were helping other customers. No one ever picked up, after an hour! Ridiculous. I requested they call me, and have not heard back yet, but I suspect they will not do that either.

I'm done with these guys. Total waste of time.

×2 Award winner

×2 Award winner