Pros & cons

Pros

- Up to 100,000 115,000 bonus points.

- 4 lounge passes in Mastercard Travel Pass.

- 14 types of insurance included.

- Up to 5 points per $1 spent on purchases.

Cons

- Low point value of 0.67 cents per point.

- High income requirements of either $80,000 personal or $150,000 household.

Your rewards

$150 GeniusCash offer

On approval, receive $150 GeniusCash on us when you apply for BMO Ascend World Elite Mastercard using this offer page.

GeniusCash offer expires on Feb 28, 2026.

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 115,000 points which translates to an estimated $771.◊

For all welcome bonus details click here.

Welcome bonus offer ends Oct 31, 2026.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With BMO Ascend World Elite Mastercard, here's how you earn rewards:

- 5 points per $1 spent on travel

- 3 points per $1 spent on dining , entertainment , and recurring bills

- 1 point per $1 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For BMO Ascend World Elite Mastercard in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Travel | $370 | |

| Investments | $370 | |

| Experiences | $359 | |

| Gift Cards | $309 | |

| Merchandise | $298 |

Calculating your annual rewards

$36,000 annual spending x 1.03% return on spending = $370 annual rewards

$370 annual rewards − $150.00 annual fee = $220 net annual rewards

Details and eligibility

- Estimated Credit Score

- 560 - 659

- Personal Income

- $80,000

- Household Income

- $150,000

- Annual Fee

- $150.00

- First Year Free

- Yes

- Extra Card Fee

- $50

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance Δ

- 23.99%

- Balance Transfer Δ

- 23.99%

- Balance Transfer

- 0.00%

- Transfer Term

- 12 months

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Travel Accident

- $500,000

- Emergency Medical Term

- 21 days

- Emergency Medical Maximum Coverage

- $5,000,000

- Trip Cancellation

- $1,500

- Trip Interruption

- $2,000

- Flight Delay

- $500

- Baggage Delay

- $500

- Lost or Stolen Baggage

- $500

- Personal Effects

- $750

- Hotel Burglary

- $1,000

- Rental Car Theft & Damage

- Yes

- Rental Car Accident

- $200,000

- Rental Car Personal Effects

- $1,000

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

BMO Ascend World Elite Mastercard's 5.0 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Top cards from BMO

BMO Ascend World Elite Mastercard review

If you are looking for flexible rewards and one of the best insurance packages on the market, the BMO Ascend World Elite Mastercard should be on your shortlist.

Here are the full details on this BMO credit card.

Earning rewards with the BMO Ascend World Elite Mastercard

You'll be earning BMO Rewards points on every purchase you make with this BMO Mastercard – a flexible rewards program where you can redeem your points in a variety of ways.

Welcome bonus

BMO gives you a valuable incentive to sign up, worth up to 115,000 points.

You'll earn 115,000 points after spending $4,500 in the first 4 months, $10,000 in the first 6 months and $20,000 in the first year.

115,000 BMO Rewards points are worth up to $770.5 in travel rewards. To sweeten the deal, BMO will waive the first year fee.

Earning BMO Rewards on every purchase

On top of the bonus, you’ll be earning 1 BMO Reward points for every $1 spent on the card, plus 3 BMO Rewards points for every $1 spent on dining, recurring bills. and entertainment up to $10,000 annually combined. And on travel, you'll earn 5 points per $1 spent, on up to $3,000 in annual spend.

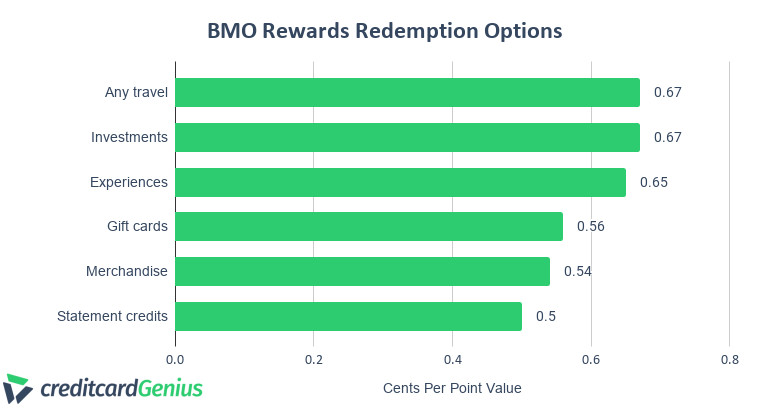

Redeeming BMO Rewards

Unlike some rewards, BMO Rewards are flexible and can be used for all kinds of things.

Here are your main redemption options, and what each point is worth.

| Redemption Option | Value in cents per point (CPP) |

|---|---|

| Travel | 0.67 CPP |

| Investments | 0.67 CPP |

| Experiences | 0.65 CPP |

| Gift Cards | 0.56 CPP |

| Merchandise | 0.54 CPP |

| Statement Credits | 0.5 CPP |

Redeeming for travel is your best value, as you'll get 0.67 cents per point. One thing to note, however, is that you'll need to book your travel through the BMO travel agency.

On the plus side, they do price match – so as long as you do your homework, you could get a good deal. Plus, you can book right through their website.

At this value, you're getting a return of at least 1.34%, with a maximum of 2%.

Read our detailed review about the BMO Rewards program here.

3 benefits to the BMO Ascend World Elite Mastercard

Beyond earning rewards, what are some other benefits to the BMO Ascend World Elite Mastercard? Here are 3 things we like about it.

1. Membership in Mastercard Travel Pass with 4 free passes

Want some airport lounge access? This card offers a membership to Mastercard Travel Pass, and also includes 4 free passes.

Once you've used your 4 passes, each visit will cost US$32.

2. BMO travel insurance

Next, we have the insurance. More specifically, travel insurance.

The BMO Ascend World Elite Mastercard has one of the best insurance packages out there. 14 different types of travel and purchase insurance which includes rare coverage for:

- 21 days of emergency medical,

- $2,000 of trip interruption fees, and

- $750 of personal effects coverage that covers all your belongings for the entire duration of your trip – not just while you’re in transit! (In the credit card world, that is a pretty big deal.)

Rest assured knowing that you'll be covered in case something unexpected happens on your travels.

3. World Elite Mastercard perks

This World Elite Mastercard card also comes with typical World Elite perks:

- Priceless Cities,

- World Mastercard Experiences, and

- 24/7 concierge.

What else is offered as part of the World Elite program? You can find out more here.

2 downsides to the BMO Ascend World Elite Mastercard

There are some downsides to this credit card. Here are 2 things to be mindful of.

1. High annual fee

First, the card has a relatively high annual fee of $150, more than the typical $120 fee premium credit cards charge.

You'll get the first year free, however, allowing you to take the card for a test drive.

2. High income requirements

As a World Elite Mastercard, it also has high income requirements:

- $80,000 personal, or

- $150,000 household.

This requirement will put the card out of the reach of many.

Want more information? Our full blog review covers every detail of this card.

Comparison to the BMO eclipse Visa Infinite

There's a new BMO Rewards card on the block – the

Here's how these credit cards compare in a few areas.

| BMO Ascend World Elite Mastercard | BMO eclipse Visa Infinite | |

|---|---|---|

| Welcome bonus | 115,000 points (terms) | 80,000 points (terms) |

| Annual fee | $150 (waived for the first year) | $120 (waived for the first year) |

| Rewards | * 5 points per $1 spent on travel * 3 points per $1 spent on dining, entertainment, and recurring bills * 1 point per $1 spent on all other purchases |

* 5 BMO Rewards points for every $1 spent on dining, groceries, gas, and transit * 1 point per $1 spent on all other purchases |

| Average Earn Rate | 1.03% | 1.61% |

| Insurance coverages | 14 types | 6 types |

| Special features | * Access to Mastercard Travel Pass and 4 free passes * World Elite Mastercard benefits |

* $50 annual lifestyle credit * 10% bonus rewards when you add an authorized user |

| Income requirements | * Personal: $80,000 * Household: $150,000 |

* Personal: $60,000 * Household: $100,000 |

So which is better? That all depends on what you're after. In terms of rewards, the eclipse Visa Infinite is ahead. Based on our typical $2,000 monthly spend, it has a higher average earn rate of 1.61%.

When looking at the special features of each card, which is better depends on what you want. The BMO eclipse has the annual $50 lifestyle credit, and bonus rewards when you add an authorized user. The BMO Ascend World Elite offers airport lounge access, and also includes double the amount of insurance coverages.

Truth be told, you can't go wrong with either of these BMO credit cards.

To summarize

As a premium travel credit card, the BMO Ascend World Elite Mastercard not only offers rewards, but top notch insurance coverage, as well as premium perks.

FAQ

What does the BMO Ascend World Elite Mastercard earn for rewards?

Part of the BMO Rewards program, the BMO Ascend World Elite Mastercard earns 5 points per $1 spent on travel, 3 points per $1 spent on dining, bills, and entertainment, and 1 point per $1 spent on all other eligible purchases.

What can BMO Rewards be used for?

BMO Rewards are flexible rewards points that can be used for many things, including travel, gift cards, statement credits, and merchandise.

What is the welcome bonus worth with the BMO Ascend World Elite Mastercard?

The BMO Ascend World Elite welcome bonus is worth up to 115,000 points. 115,000 BMO Rewards points are worth $770.5 when redeemed for travel.

Key benefits

BMO is not responsible for maintaining the content on this site. Please click on the Apply now link for the most up to date information.

User reviews

Reviewed by 53 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

I will probably cancel the card. I went on a trip to Europe and used this card extensively, but about 2/3 of the travel expenses were not considered "eligible travel expense" either for the purchase (5 points back) or redemptions (1.3x value). The quoted 5 points quickly turned into 1 point and the value went from 0.67% to 0.5% per point. The dinning was also just 3 points (1.5%-2% value back) which I can get better elsewhere. The lounge pass was not valuable as thought. I hit some major airports and could use the passes at only a few lounges and about 1/2 were not in my terminal. One lounge closed their waitlist at 125 people and an estimated 4 hour wait was expected. I see more value elsewhere, even with a lower annual fee.

BMO stopped allowing PAD payments from other banks. I spent enough to collect the welcome bonus and then cancelled it.

They stopped allowing pre-authorized payments from other banks. Now you need a BMO bank account to make an automatic payment. Their support is also in South America.

great - everything else I write is to meet the minimum 60 characters

Worst experience ever. I did not receive my welcome bonus because I used the card to pay property tax. I even paid some extra fee for that but BMO said it does not count.

All other cards treat tax payment as usual.

$150 GeniusCash + Up to

$150 GeniusCash + Up to