Pros & cons

Pros

- 10% cash back for the first 3 months, up to $2,000 in spend.

- Up to 4% cash back on purchases.

- 11 types of insurance included.

Cons

- High income requirements of $60,000 personal or $100,000 household.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 10% in your first 3 months on up to $2,000 in spending which translates to an estimated $159.◊

For all welcome bonus details click here.

Welcome bonus offer ends Apr 30, 2026.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With Scotia Momentum Visa Infinite Card, here's how you earn rewards:

- 4% cash back on groceries and recurring bill payments

- 2% cash back on gas , transit , rideshares, and food delivery

- 1% cash back on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For Scotia Momentum Visa Infinite Card in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Statement credits | $747 |

Calculating your annual rewards

$36,000 annual spending x 2.08% return on spending = $747 annual rewards

$747 annual rewards − $120.00 annual fee = $627 net annual rewards

Details and eligibility

- Estimated Credit Score

- 725 - 759

- Personal Income

- $60,000

- Household Income

- $100,000

- Annual Fee

- $120.00

- First Year Free

- Yes

- Extra Card Fee

- $50

- Card type

- Credit

- Purchase

- 20.99%

- Cash Advance

- 22.99%

- Balance Transfer

- 22.99%

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Mobile Device

- $1,000

- Travel Accident

- $500,000

- Emergency Medical Term

- 15 days

- Emergency Medical Maximum Coverage

- $1,000,000

- Trip Cancellation

- $1,500

- Trip Interruption

- $2,000

- Flight Delay

- $500

- Baggage Delay

- $500

- Lost or Stolen Baggage

- $500

- Rental Car Theft & Damage

- Yes

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

Scotia Momentum Visa Infinite Card's 4.4 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from Scotiabank

Scotiabank Momentum Visa Infinite Review

For the family household (or any household really), the Scotiabank Momentum Visa Infinite offers up to 4% cash back on your everyday purchases – a key reason it's a top rated cash back credit card.

Here's what makes this card a king of cash back credit cards.

Earning rewards with the Scotia Momentum Visa Infinite

The Scotiabank Momentum Visa Infinite earns straight cash back, so there's no need to worry about complicated rewards programs.

To get you started, you'll earn 10% cash back for the first 3 months, up to $2,000 in spend. That's $200 right there.

And the high earn rates don't stop there. On your purchases, you'll earn:

- 4% cash back on groceries and recurring bills (up to $25,000 spent annually),

- 2% cash back on gas and transit purchases (up to $25,000 spent annually), and

- 1% cash back on all other purchases.

Not many cash back credit cards are offering 4% cash back on 2 major categories, plus 2% on your commuting expenses, all while earning at least 1% cash back on all other purchases.

Based on our typical monthly spend, you'll be earning $498 in cash back rewards every year you have the card.

3 benefits to the Scotiabank Momentum Visa Infinite

Besides the rewards, what other benefits are there to the Scotia Momentum Visa Infinite?

Here are 3 other reasons to like it.

1. Insurance coverage

Most cash back credit cards don't include extensive insurance coverage – it's usually reserved for travel credit cards.

But the Scotia Momentum Visa Infinite includes 11 types of insurance coverage.

One rare insurance it includes is mobile device coverage. Simply charge your new mobile phone (or your plan if it covers the cost of your device) to the card, and you'll be covered for up to $1,000 in the event of loss, theft, accidental damage, or mechanical failure.

2. Visa Infinite benefits

Though it's a cash back credit card, it still includes all the standard travel benefits you get as Visa Infinite cardholder.

These benefits include:

- Visa Infinite Luxury Hotel Collection,

- Visa Infinite Dining series, and

- Visa Infinite Wine tasting.

3. Ability to get the annual fee waived every year with the Scotiabank Ultimate Package

While this credit card has a standard annual fee of $120, there is a way to get it waived every year.

The Scotiabank Ultimate Package has an annual fee waiver on select Scotiabank credit cards, including this one.

The account does have a monthly fee of $30.95, but this can also be waived if you maintain a minimum daily balance of $5,000.

You'll get a fully loaded bank account, and not have to pay a credit card annual fee.

1 drawback to the Scotia Momentum Visa Infinite

Is it perfect? Not quite. Here 1 thing to keep in mind.

2. Lower rewards if you don't spend lots on groceries or recurring bills

While it has good earn rates, if you don't spend a lot on groceries or recurring bills, or if you buy groceries at Walmart (and anywhere else that isn't classified as a grocery store), you won't get as much cash back as a card with a high base earn rate.

Comparison to the Amex SimplyCash Preferred card

So how does this card compare to one that does have a high base earn rate – the

Here's how they compare in a few key areas.

| Scotia Momentum Visa Infinite | Amex SimplyCash Preferred | |

|---|---|---|

| Earn Rates | * 4% cash back on groceries and recurring bills * 2% cash back on gas and transit * 1% on all other purchases | * 2% cash back on all purchases |

| Insurance Coverage | 11 types | 9 types |

| Getting Your Rewards | Once per year in November | Once per year in September |

| Annual Fee | $120, first year free | $99 |

Earning rewards

They're obviously very different when it comes to earning rewards.

One has a variety of bonus categories for earning cash back, and the other has a high flat earn rate on every purchase.

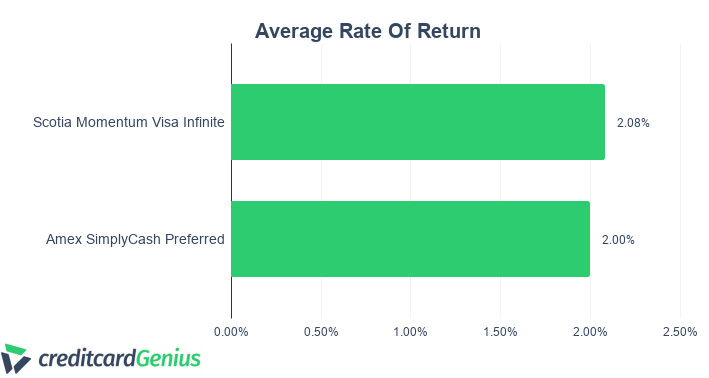

Here's the average earn rate for both, using our typical $2,000 monthly spend.

They're actually quite close in this regard. Which one is better for you depends on how much you spend on groceries and recurring bills. If you spend more than $650 combined on groceries and bills, the Scotia card is better. Less than that, and the SimplyCash Preferred will earn you more rewards.

Insurance coverage

For cash back credit cards, they both offer good insurance packages.

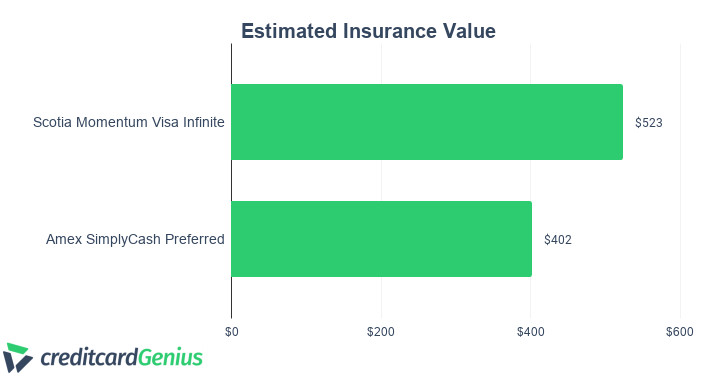

Here's our estimated dollar value on the insurance coverage for both of them:

The Scotia Momentum is ahead, which is helped by having a few more coverages, including mobile device insurance.

Getting your cash back rewards

When it comes to getting your rewards paid out, both cards are similar in this regard.

Both cards only provide statement credits once per year. Scotiabank pays out your cash back in November, while Amex pays it out in September.

Annual fee

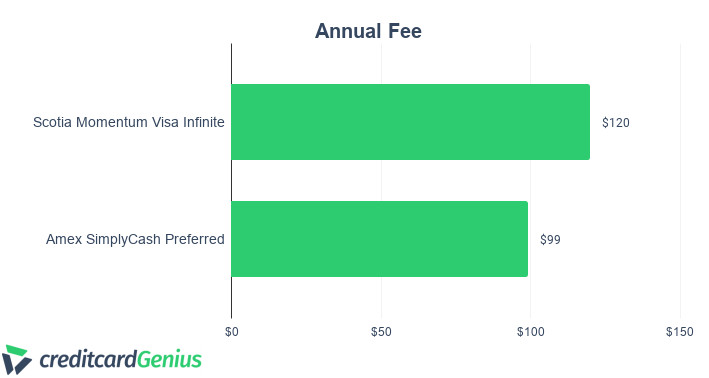

One slight advantage to Amex is the annual fee, which is a little lower than Scotiabank:

However, the Scotiabank credit card is first year free, and if you have the Ultimate Package, this fee will be waived every year.

FAQ

What does the Scotiabank Momentum Visa Infinite earn for rewards?

The Scotia Momentum Visa Infinite earns cash back rewards at these rates:

- 4% on groceries and recurring bills,

- 2% on gas and transit, and

- 1% on all other purchases.

What is the annual fee of the Scotiabank Momentum Visa Infinite?

The Scotiabank Momentum Visa Infinite has an annual fee of $120 that's waived for the first year.

How do you receive cash back with the Scotia Momentum Visa infinite?

You receive your cash back as a statement credit once per year, in November.

Key benefits

User reviews

Reviewed by 77 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Initial month of use - not very happy with it.

It should have been instant approval but it wasn't. Even though Im already a Scotia Amex holder with 2 years of on time payment, they still hassled me for IDs just to get this card. And a very low $15K credit. By comparison, I got my Amex cobalt card instantly (with a virtual card to use immediately) and $50K credit limit.

Secondly, I spent $1000 on groceries, no problem, but anything after that they start locking it. I couldn't buy anything with the card. After 1 hour on hold, they unlocked it but I still cant make purchases. its instant decline for anything over $200. Why force people to spend money within a short time frame if you are going to lock their card if they DO try to make big spends?

Overall very disappointing. The CIBC Visa is looking better as it has 4% cash back on groceries and gas. After my first year free I'm looking to try the CIBC and cancel this one.

I’ve had this card for almost 11 years. It’s been awesome for cash back. I was disappointed when they changed their cash back structure, but it turns out I spend about the same on recurring bills as I do on gas, so I didn’t actually lose anything. I think some of the bad reviews on here are ridiculous. Like you’re mad that they only pay out on your November statement? It’s plainly stated, maybe read terms and conditions. Also literally every recurring bill has paid 4% cash back, even my Deco windshield repair plan. Out of all of my 5 credit cards, this was the only one that temporarily reduced my interest rate during Covid, which was a huge help. I used to use this card for business expenses (before adding the Amex Business Platinum) so my credit limit was increased several times, and remains the highest limit across all my cards. I have Scotiabank’s ultimate bank account, which waives this card’s annual fee. I finally even used the infinite wine country benefit for a free wine tasting for 2 at a winery. Overall a fantastic credit card.

They hold your cashback all year, and only deposit your cashback once a year, in november.

And your promo cashback, you won't see it until november.

Frankly, skip this card, find a better one.

This card is a SCAM. I applied when there was SUPPOSEDLY 10% Cash Back the first 3 months, maxing out at $2K spend, so it SHOULD be $200 cashback. What they don't tell you is no matter what month you signup for the card (I signed up December 2022) I can't see a single cent of that cashback until November 2023! And on top of that, they don't even confirm you get the 10% until a year in, prior to then you only get 4% cashback (again which you can't even touch until November each year).

I like this card.

The welcome bonus is a great reward total, with easy to obtain spending requirements. The insurance is pretty good, and the required income/credit score isn't super high. Plus the everyday earn rates are really solid, especially for groceries.

It'd be nice if there were more categories to get 4% on, or even 5% on one or two categories like other cash back products, and you can't use it at Costco, which is a bummer for sure.

×2 Award winner

×2 Award winner