When it comes to credit cards, we often focus on rewards and fees.

But there’s more to credit cards than just that. If you want to level up your rewards, credit card perks can give you EVEN more savings just by knowing they’re there.

If you’re an American Express Membership Rewards or Visa Infinite cardholder, you have access to their own hotel booking sites – the Visa Infinite Luxury Hotel Collection and the American Express Hotel Collection.

What’s more? Booking through these sites won’t just get you a nice hotel room, you’ll get extra benefits and credits for future trips as well.

To top it off, the experience is just like using any other hotel booking site, making it easy to take advantage of the programs.

So let’s explore both programs and see what they offer.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Summary of program benefits

| Benefit | Amex Hotel Collection | Visa Infinite Luxury Hotel Collection |

|---|---|---|

| On-property voucher | $100 USD | $25 USD |

| Free room upgrade | Yes | Yes |

| Complimentary continental breakfast for 2 | No | Yes |

| Complimentary Wi-fi | No | Yes |

| VIP guest status | No | Yes |

| Late check out | No | Yes |

| Price matching | No | Yes |

American Express Hotel Collection

Let’s start with the American Express program – the American Express Hotel Collection.

Featuring over 600 hotels from around the world, it too provides benefits when booking eligible hotels for a minimum 2 night stay with select American Express cards:

- $100 USD hotel credit on qualifying dining, spa, and resort activities, and

- free room upgrade if available.

It’s a pared down list compared to the Visa Collection, but does offer greater savings with the increased $100 USD hotel credit.

Just note that Amex Travel does not price match.

Amex Hotel Collection list

So what hotels can you book with the Hotel Collection? Similar to the Visa Hotel Collection, there’s no full list of available of hotels.

The best way to find out is to make a test booking. Type in a city, and the hotels available in that city will appear.

American Express credit cards

So which American Express cards are eligible to use the Amex Hotel Collection?

Any Amex Membership Rewards card can book hotels through the hotel collection, including small business cards. As a bonus, you can also use your points to help pay for your booking as well.

Here’s an overview of the 3 personal cards available.

| Credit card | Welcome Bonus | Earn Rates | Annual Fee | Apply Now |

|---|---|---|---|---|

| American Express Cobalt | 15,000 points after spending $750 every month for the first year (terms) |

* 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

$191.88, charged as $15.99 per month | Apply Now |

| American Express Platinum Card | * 100,000 points after spending $10,000 in the first 3 months and making a purchase between months 15 to 17 (terms) | * 3 points per $1 spent on restaurants * 2 points per $1 spent on travel * 1 point per $1 spent on all other purchases |

$799 | Apply Now |

GC: $100

Our top-rated credit card period, the

Earn up to 5 points per $1 spent on your purchases. With a point worth up to 2 cents each when transferred to Aeroplan, that’s a return of up to 10% on your purchases.

With high earn rates and super flexible rewards, it’s no wonder why it’s our top credit card.

For the most perks of any Canadian credit card, the

There’s a long list of perks available, on top of being able to access the hotel collection:

- annual $200 travel credit,

- priority benefits at Toronto-Pearson airport,

- advanced status in 4 hotel programs, including Marriott Bonvoy, and

- unlimited access for you and a guest to Amex Centurion Lounge collection, which includes Priority Pass lounges.

And if you want more perks than the Hotel Collection provides, the Platinum Card gives you access to Fine Hotels & Resorts for increased perks.

Visa Infinite Luxury Hotel Collection

Visa offers a similar program – the Visa’s Luxury Hotel Collection.

Available to anyone with a Visa Infinite card, you’ll enjoy great benefits when you book through Visa’s hotel portal.

All you need to do to get your benefits is stay for 2 nights and pay using your Visa Infinite card (a few of these benefits are available if you only stay one night however).

There’s quite a few benefits you’ll receive:

- free room upgrade (if available),

- $25 USD food/beverage voucher,

- complimentary continental daily breakfast,

- VIP guest status,

- complimentary wi-fi,

- late check-out upon request (when available), and

- best available rate guarantee.

That’s quite the list of perks at your disposal.

Of particular note is the $25 USD food and beverage credit, not to mention the complimentary continental breakfast you’ll get every day, both of which help you save additional money while travelling.

And of course, a free room upgrade is always a nice treat, as is the VIP status, which can help bypass long check-in lines.

And to top it all off, if you find that the hotel is cheaper elsewhere, the Visa Hotel Collection will match the rate you found, with some conditions.

To see the full terms and conditions of all of these benefits, click here.

Visa Infinite Luxury Hotel Collection list

So what hotels are available to book through the collection? There are over 900 hotels available in this program.

But unfortunately, there’s no actual list of hotels available.

The best way to find out is to do some test bookings. Head to the Visa Hotel Collection site, type in your destination, and see what hotels are available.

Visa Infinite credit cards

As stated before, you can use the Visa Infinite Luxury Hotel Collection as long as you have any Visa Infinite card.

Here’s a summary of some of our favourites:

| Credit card | Welcome Bonus | Earn Rates | Annual Fee | Apply Now |

|---|---|---|---|---|

| Scotiabank Momentum Visa Infinite | * 10% cash back for the first 3 months, on the first $2,000 in spend (terms) | * 4% cash back on groceries and recurring bills * 2% on gas and daily transit * 1% on all other purchases |

$120, first year free | Apply Now |

| BMO eclipse Visa Infinite | * 80,000 points after spending $4,000 in the first 110 days, $7,000 in the first 6 months, and $12,000 in the first year (terms) | * 5 points per $1 spent on groceries, restaurants, gas, and transit * 1 point per $1 spent on all other purchases |

$120, first year free | Apply Now |

| Scotiabank Passport Visa Infinite | * 50,000 points after spending $2,000 in the first 3 months and $10,000 in the first 6 months (terms) | * 2 points per $1 spent on groceries, restaurants, entertainment, and daily transit * 1 point per $1 spent on all other purchases |

$150 | Apply Now |

* Note: All cards have typical Visa Infinite income requirements of either $60,000 personal or $100,000 household.

GC: $20

Our top-rated cash back card is the

Earn 4% cash back on groceries and recurring bill payments – the highest earn rates of any cash back card in Canada. Plus, earn 2% cash back on gas and daily transit, as well as 1% on all other purchases.

GC: $150

One of the best flexible rewards Visa credit cards is the

You’ll earn 5 BMO Rewards points per $1 spent on groceries, restaurants, gas, and transit, while earning 1 point per $1 spent on all other purchases.

GC: $80

If flexible travel rewards are more your thing, then consider the

Earn 2 Scene+ points per $1 spent on groceries, restaurants, entertainment, and daily transit. Earn 1 point on all other purchases.

But what really separates this card is it charges no foreign transaction fees – the only Visa Infinite card to do so. Save yourself an additional 2.5% on foreign transactions when you use this card.

Booking comparison between programs

Now that we have the details on both programs, how do the prices stack up side by side?

Here are a few pricing comparisons between the 2 programs, while also comparing the price found on hotels.ca. We then subtracted the voucher to get the net cost for your stay. For the Visa prices, we allowed for $40 USD for the daily breakfast for 2. Both the voucher and daily breakfast were converted to Canadian dollars.

One point to note – these programs don’t always offer the same hotels. In fact, in many of the searches we performed, we couldn’t find the same hotel in both programs.

We were, however, able to find a few for direct comparisons, with screenshots included for each price we found.

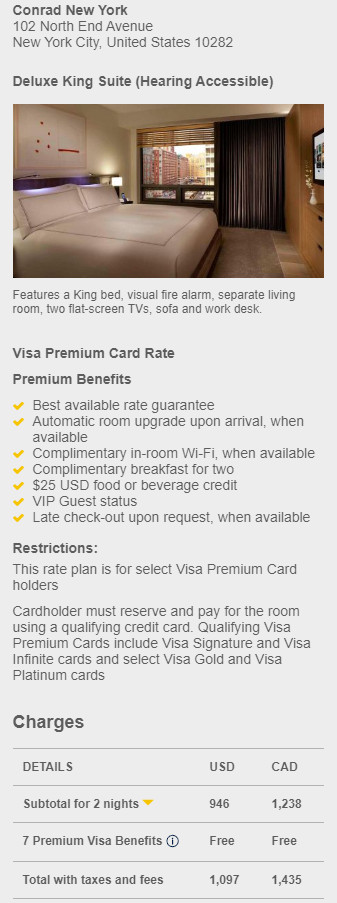

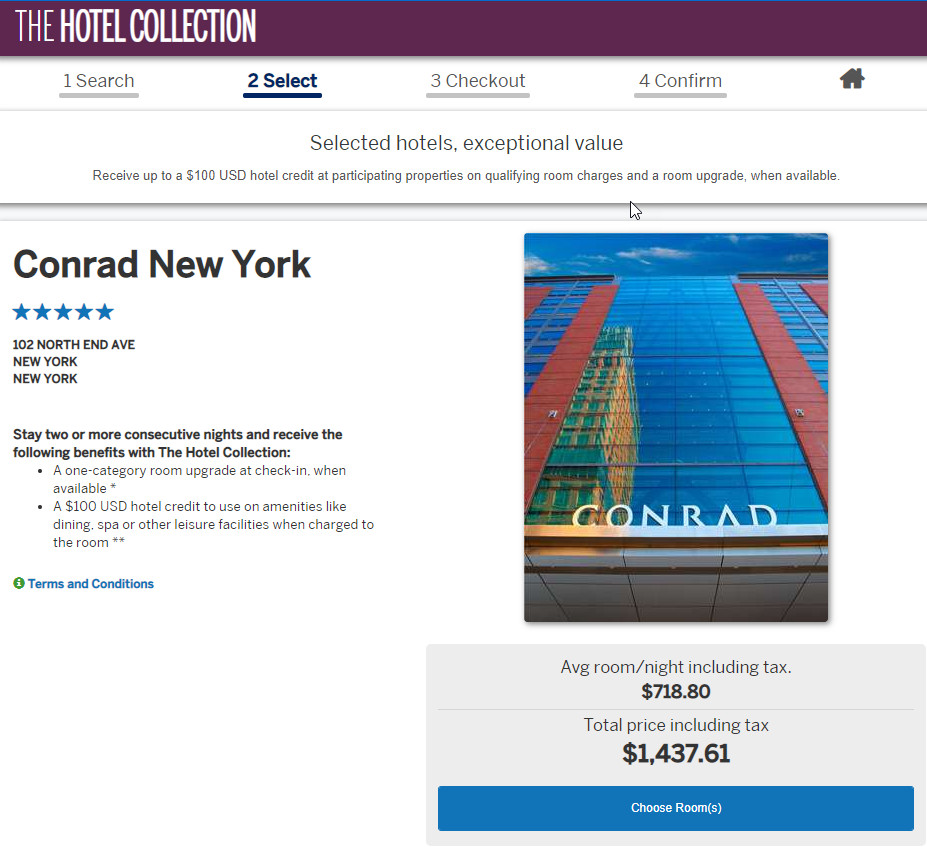

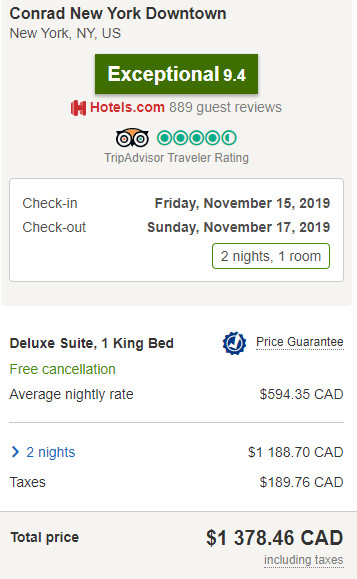

Conrad New York

First up is the Conrad Hotel in New York. The date for the reservation is from November 15 – 17, 2019.

| Visa Luxury Hotel Collection | Amex Hotel Collection | Price as found on Hotels.ca | |

|---|---|---|---|

| Total Price | $1,435 CAD | $1,438 CAD | $1,378 |

| Property Credit | $25 USD ($33 CAD) | $100 USD ($132 CAD) | N/A |

| Daily Breakfast | $40 USD ($53 CAD) | N/A | N/A |

| Net Price | $1,349 | $1,306 | $1,378 |

Visa Infinite Hotel Collection

Amex Hotel Collection

Hotels.ca

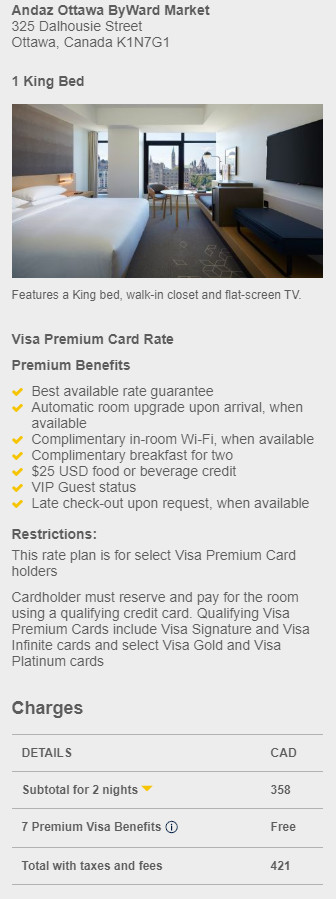

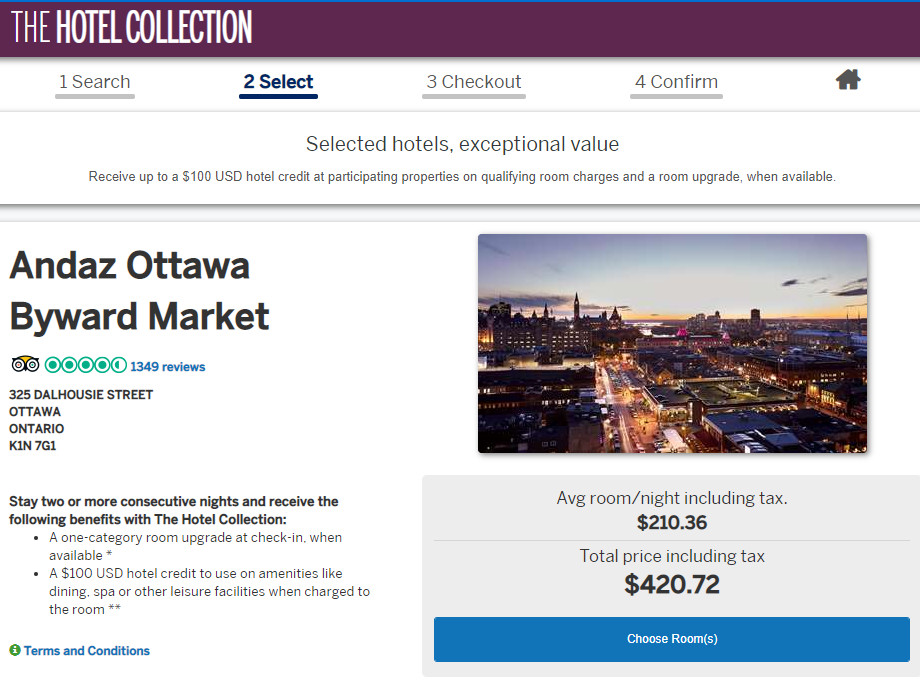

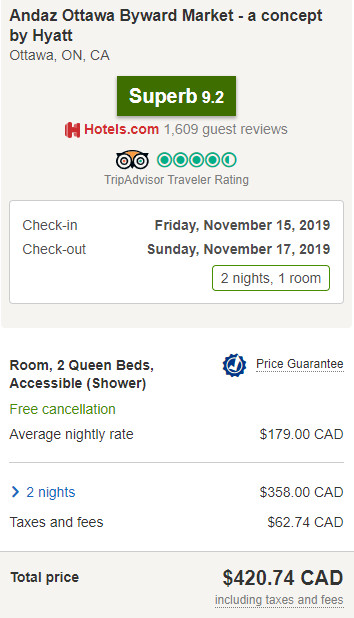

Andaz Ottawa Byward Market

The other one we’ll look at is the Andaz Ottawa Byward Market hotel, with the same booking dates.

| Visa Luxury Hotel Collection | Amex Hotel Collection | Price as found on Hotels.ca | |

|---|---|---|---|

| Total Price | $421 CAD | $421 CAD | $421 CAD |

| Property Credit | $25 USD ($33 CAD) | $100 USD ($132 CAD) | N/A |

| Daily Breakfast | $40 USD ($53 CAD) | N/A | N/A |

| Net Price | $335 | $289 | $421 |

Visa Infinite Hotel Collection

Amex Hotel Collection

Hotels.com

As shown, it was hit or miss whether prices were the same. But factoring the property credits, the Amex Hotel Collection came ahead in both scenarios.

But if you could price match the Visa hotel in New York, it would come out ahead – you don’t have this option with Amex.

The verdict

So which one is better?

If you just want the most savings and are making a short stay, the Amex Hotel Collection is better, as the on-property credit is larger. But, if you just want more perks or are making a longer stay, then the Visa Infinite Hotel Collection is better.

Why is Visa better for longer stays? The free daily breakfast savings will really start to add up, and will quickly overtake Amex’s larger credit.

Of course, it also depends on the hotel you want to stay at as well. They both have very different sets of hotels you can book, and your choice can come down to where you like to stay.

If you can’t decide between the 2, you could just have both an Amex Membership Rewards and Visa Infinite card as well. The only downside is paying a 2nd annual fee.

Your thoughts

What are your thoughts on these programs?

Do they seem interesting and worth your while?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 4 comments