You’ll find 4 credit card options from PC Financial, including a premium World Elite Mastercard that earns you lots of rewards and comes with some solid benefits.

If you’re a loyal President’s Choice (or Loblaws, Esso, or Shoppers Drug Mart) customer, at some point you’ve probably been asked if you’ll be paying with your PC card. Shopping with a PC Financial Mastercard earns you PC Optimum points, which you can redeem for cash back, car washes, gas discounts, fee discounts, and charitable donations.

Key Takeaways

- There are 4 tiers of PC Mastercard – the basic Mastercard, a World Mastercard, and 2 World Elite Mastercards.

- With each higher tier comes better benefits but higher income requirements.

- PC Mastercards earn PC Optimum points, which you can redeem towards purchases at participating stores or free car washes at Esso.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

PC Financial Mastercards compared

There are 4 President's Choice Mastercards available, each with its own bonuses and quirks.

| PC Mastercard | PC World Mastercard | PC No Fee World Elite Mastercard | PC Insiders World Elite Mastercard | |

|---|---|---|---|---|

| Annual fee | $0 | $0 | $0 | $120 |

| Earn rates | * At least 30 points per litre at Esso * 25 points per $1 spent at Shoppers Drug Mart * 10 points per $1 spent on all other purchases | * At least 30 points per litre at Esso * 35 points per $1 spent at Shoppers Drug Mart * 20 points per $1 spent at participating grocery stores * 10 points per $1 spent on all other purchases | * Up to 30 points per litre at Esso * 45 points per $1 spent at Shoppers Drug Mark * 30 points per $1 spent at participating grocery stores * 10 points per $1 spent on all other purchases | * Up to 70 points per litre at Esso * 50 points per $1 spent at Shoppers Drug Mart * 40 points per $1 spent at participating grocery stores * 10 points per $1 spent on all other purchases |

| Interest rates | * Purchase: 21.99% * Cash advance: 22.97% * Balance transfers: 22.97% | * Purchase: 21.99% * Cash advance: 22.97% * Balance transfers: 22.97% | * Purchase: 21.99% * Cash advance: 22.97% * Balance transfers: 22.97% | * Purchase: 21.99% * Cash advance: 22.97% * Balance transfers: 22.97% |

| Income requirements | Subject to credit approval and other criteria | $50,000 personal or $80,000 household | $80,000 personal or $150,000 household | $80,000 personal or $150,000 household |

| Foreign transaction fee | 2.5% | 2.5% | 2.5% | 2.5% |

| Insurance coverage types | 2 | 2 | 4 | 5 |

The better the earn rate, the higher the income requirements you need to meet. In fact, the card you get all depends on the income you report – you fill out one application form and PC Financial decides which PC Mastercard you get.

Pros and cons of PC Financial Mastercards

Still on the fence about getting one of these cards? We break down both the good and the bad so you can make an informed decision without being pressured by a customer service agent the next time you shop.

- PC Optimum Rewards: Earn points to redeem with partners and at Esso gas stations. In addition to discounts, your points earn you a 3% reward value.

- PC Financial app: The app allows you to conveniently check your balance, transactions, and statements. It also provides easy access to customer service.

- No annual fee options: There are 3 PC Mastercards with no annual fee – including a World Elite Mastercard – so rewards are simply money in your pocket.

- No charge for additional cardholders: PC Financial lets you add 4 authorized cardholders to your account for no extra fee. This gives you 4 times the earning potential!

- PC Optimum points can only be redeemed at participating stores: Only retail partners and Esso gas stations accept PC points, so the rewards aren’t as flexible as, say, the Scene+ program.

- High income requirements for premium cards: While the lowest-tier PC Mastercard has no income requirements, the PC World Mastercard and the PC World Elite Mastercards have higher requirements of $50,000 personal/$80,000 household or $80,000 personal/$150,000 household, respectively.

- Interest rates go up if you miss payments: PC Mastercards have fairly standard interest rates – but if you get behind on payments for 2 consecutive months, your interest rates may jump an additional 4% to 5%.

- Minimal insurance package is included: Unlike the best credit cards for insurance, these PC cards leave a lot to be desired. The premium card only comes with 4 types of insurance (compared to a card like the Scotiabank Gold Amex, which comes with over a dozen types of coverage).

- PC Financial Mastercards have no other perks: These cards don’t include extras like lounge access, flight perks, or roadside assistance.

How many PC Optimum points can you earn?

One reason people choose President's Choice Mastercards is for the sweet boost to their PC Optimum reward points The table below shows what you can expect to earn back with each PC Financial Mastercard.

| PC Financial Mastercard | PC World Mastercard | PC No Fee World Elite Mastercard | PC Insiders World Elite Mastercard | |

|---|---|---|---|---|

| Points per $1 spent at PC grocery stores | 10 | 20 | 30 | 40 |

| Points per $1 spent at Shoppers Drug Mart * | 25 | 35 | 45 | 50 |

| Points on Esso fuel purchases (per litre) | 30 | 30 | 30 | Up to 70 |

| Points on all other purchases | 10 | 10 | 10 | 10 |

You'll want to note that the earn rates for Esso are the minimum you'll receive – you'll receive more points for purchasing premium gasoline.

Keep in mind: PC Financial Mastercards include what would normally come with the free (non-financial) PC Optimum account, so you'll need to subtract these from the earn rates on the table to know how much more your credit card will earn.

Are PC Financial Mastercards worth it?

The main benefits of PC Mastercards include the reward points, the convenient mobile app, the ability to add up to 4 additional cardholders to your account at no extra cost.

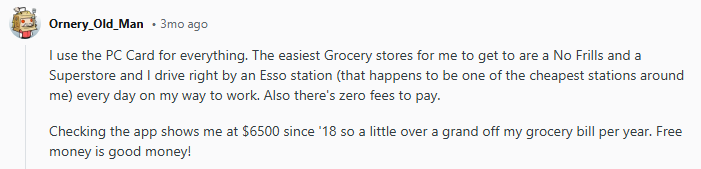

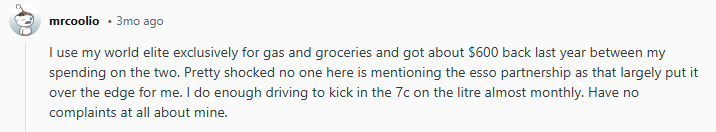

Although PC Financial Mastercards aren’t as popular as some credit cards, we were curious to see what real cardholders thought of them. When we turned to Reddit, here’s what we found:

Other Redditors chimed in to say similarly positive things:

If you do the majority of your shopping at Loblaws or with PC partners, it might make sense to use a PC card for your purchases. That said, if you aren’t a dedicated PC customer, you’ll probably want to shop around for a card with more flexible reward options.

Alternatives to the PC Financial Mastercards

| Credit card | Welcome bonus | Annual fee | Rewards | Apply | |

|---|---|---|---|---|---|

| Best flexible rewards | MBNA Rewards World Elite Mastercard |  $20 GeniusCash + 30,000 bonus points (terms) $20 GeniusCash + 30,000 bonus points (terms) | $120 | * 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases | Apply now |

| Best cash back by categories | Tangerine Money-Back Credit Card |  $140 GC Boost + 10% extra cash back for the first 2 months (terms) $140 GC Boost + 10% extra cash back for the first 2 months (terms) | $0 | * 2% cash back on purchases in up to 3 Money-Back Categories * 0.5% cash back on all other purchases | Apply now |

| Best insurance coverage | Scotia Momentum Visa Infinite Card |  $20 GeniusCash + 10% cash back for the first 3 months, first year free (terms) $20 GeniusCash + 10% cash back for the first 3 months, first year free (terms) | $120 | * 4% cash back on groceries and recurring bill payments * 2% cash back on gas and transit * 1% cash back on all other purchases | Apply now |

| Best cash back with roadside assistance | BMO CashBack World Elite Mastercard |  $125 GeniusCash + Up to $480 cash back in the first year, first year free (terms) $125 GeniusCash + Up to $480 cash back in the first year, first year free (terms) | $120 | * 5% cash back on groceries, up to $500 in monthly spend * 4% cash back on transit, up to $300 in monthly spend * 3% cash back on gas, up to $300 in monthly spend * 2% cash back on recurring bills, up to $500 in monthly spend * 1% cash back on all other purchases | Apply now |

You'll note that we didn’t include any American Express credit cards since they're not accepted at Loblaws stores.

Let’s take a closer look at what these alternatives have to offer.

Best for flexible rewards

The MBNA Rewards World Elite Mastercard is a standout card for earning flexible rewards on your groceries (along with restaurants and bills).

We love that you get high-value redemption options like travel through MBNA Rewards or e-gift cards from retailers like Amazon and Walmart. Plus, every year on your birthday, MBNA will give you a bonus of 10% of the points you've earned in the last 12 months, to a maximum bonus of 15,000 points. It essentially raises your return to up to 5.5% on purchases.

Pros:

- Up to 30,000 welcome bonus points

- 6 redemption options for high value

- 12 types of insurance included

Cons:

- Income requirements of either $80,000 personal or $150,000 household

Best for cash back by categories

The Tangerine Money-Back Credit Card is a hyper-flexible card that allows you to choose from a list of 10 categories and earn a boosted 2% cash back. If you get your rewards applied as a monthly statement credit, you can choose 2 of the following categories. If you get them deposited into a free Tangerine Savings account, you get to choose 3. You'll earn 0.5% cash back on all other purchases.

Pros:

- No annual fee

- 1.95% on balance transfers for 6 months

- Only $12,000 personal income per year

Cons:

- Only earns 0.5% cash back on non-category purchases

- Limited insurance included

If you meet the World Mastercard income requirements of $60,000 personal or $100,000 household, you can opt for the Tangerine Money-Back World Mastercard. It has the same rewards, no annual fee, and includes extra perks like a Mastercard Travel Pass membership and extra insurance.

Best insurance coverage

The Scotia Momentum Visa Infinite Card has the highest combined spending bonus for both groceries and recurring bills of any cash back credit card in Canada – and the most comprehensive insurance package. You’ll get almost a dozen types of coverage, including purchase protection and mobile device coverage.

Pros:

- 10% cash back for the first 3 months, up to $2,000 in spend

- Annual fee of $120 waived for the first year

Cons:

- Income requirements of $60,000 personal or $100,000 household

- Rewards paid out once per year as a statement credit

Best cash back with roadside assistance

The BMO CashBack World Elite Mastercard offers solid earn rates on many basic categories – and while the potential to earn hefty rewards makes this card valuable, it comes with the bonus of free roadside assistance. Plus, you'll get 13 types of insurance.

Pros:

- up to $480 cash back in the first 12 months

- Redeem cash back on demand

- Up to 7 cents per litre off at Shell

- Annual fee of $120 waived for the first year

Cons:

- Low monthly spend caps on bonus categories

- Income requirements of $80,000 personal or $150,000 household

FAQ

Do PC Financial Mastercards have an annual fee?

The PC Insiders World Elite Mastercard has an annual fee of $120, but neither the basic nor World Mastercards have an annual fee.

What are the major drawbacks of PC Mastercards?

The biggest drawbacks of PC Mastercards include the fact that you can only redeem your PC Optimum points at participating stores, and that 2 of the 4 cards have fairly high income requirements.

How many PC Financial credit cards are there?

PC Financial offers 4 credit cards – a basic Mastercard, World, and two different World Elite cards (one has no fee). Which one you get approved for depends on your income requirements.

What are the best cash back credit cards for grocery shopping?

There are plenty of terrific options when it comes to earning rewards on groceries. We think the best choices are the Scotiabank Momentum Visa Infinite, which earns 4% cash back on groceries and recurring bills, or the BMO CashBack World Elite Mastercard, which earns 5% cash back on the first $500 in monthly spend on groceries.

What stores earn bonus PC Optimum rewards?

You can earn PC Optimum rewards at President's Choice branded stores, including Superstore, No Frills, Dominion, Shoppers Drug Mart, Wholesale Club, and Independent Grocers. You can also earn bonus PC Optimum points at The Mobile Shop, Esso, and PC Express.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×7 Award winner

×7 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 48 comments