Wondering what credit score you need to get approved for a credit card in Canada? In most cases, a score of 660 or higher gives you access to standard rewards cards – but if your score is lower, don’t worry: you still have options.

We’ll walk you through the kinds of credit cards you might qualify for based on your score and give you some strategic tips for raising your score. Once it’s as high as you like, you may consider applying for a better credit card that offers all the rewards and perks you’re looking for.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What credit score is needed for a credit card?

There is no simple answer or magic number for all credit cards, as each issuer has different credit score requirements. Their requirements can also vary depending on the type of credit card a borrower wants to obtain.

First, you’ve got to find out what your credit score is. Then, you can see where you fall in terms of credit score and the cards you might qualify for.

| Level of credit score | Minimum credit score | Example card |

|---|---|---|

| Poor credit | 300 | |

| Fair credit | 560 | |

| Good credit | 660 | |

| Very good credit | 725 | |

| Excellent credit | 760 |

300 to 559: Poor credit

If you’re a newcomer and haven’t established a credit history, or you have a low credit score, you might struggle to get a credit card. While you won’t qualify for a card with great rewards, low interest rates, or perks, that’s not to say you can’t find something.

Focus your search on secured credit cards, which work differently from unsecured cards. You’ll have to put down a deposit (which becomes your credit limit), but since the card issuer reports responsible use to the credit bureaus, you can slowly build your credit score.

560 to 659: Fair credit

You might have a few more options than someone with poor credit, but you’ll probably have to research credit cards for people with low credit. That said, you might be able to find a card that comes with some basic rewards, especially no-fee credit cards.

You can use one of these credit cards until your credit score improves. Then, apply for a card with better benefits.

660 to 724: Good credit

In Canada, 660 is considered a good score, so you’ll have more options for selecting a credit card that matches your spending and reward preferences. Note that while you have more choices (including cash back reward cards and some travel credit cards) than someone with a fair or poor score, you might not qualify for those premium credit cards that come with amazing bonuses.

725 to 759: Very good credit

Credit card issuers with stricter lending requirements may only approve people with credit scores of 725 or higher. This is more likely for premium credit cards that offer increased earn rates, lengthy insurance packages, or valuable benefits and rewards.

760+: Excellent credit

People with credit scores of 760 or higher can choose any credit card they like. Perks? Insurance? Discounts? Benefits? You got ‘em. Additionally, you can select any credit card that suits your preferences for earning rewards. For instance, if you’re an Aeroplan member, you could earn Aeroplan points and get Maple Leaf Lounge access with a top-of-the-line credit card.

What to do if you don’t meet credit score requirements

It might be time to look into secured credit cards if you don’t qualify for the unsecured cards you’ve been checking out. Secured credit cards typically offer near-guaranteed approval, as you provide a deposit that serves as your credit limit.

As you use the secured card to make purchases, your balance drops. To continue using the secured credit card, you simply deposit more money. If you maintain a good standing account, the card issuer will report responsible use to the credit bureaus, allowing your score to improve.

Once your score is higher, consider applying for a better unsecured credit card.

Build credit with a secured credit card

Secured cards build your credit history and prove to lenders that you can pay your bills on time.

The right secured card for you depends on your debt, spending habits, and goals. If you tend to carry a balance, consider a card with a low rate, like the Home Trust Secured Visa (Low Rate).

The downside of secured cards is that they don’t often come with typical credit card perks, rewards, and insurance. One outlier is Neo credit cards.

Providing a valuable alternative to secured cards that trade off benefits, Neo offers a secured version of each of its regular credit cards. This means you can take advantage of rewards and insurance even if you have poor credit.

Canada’s best secured credit cards:

Other ways to build your credit

If your credit score isn’t where you want it to be, the good news is that you can improve it — and often faster than you think. Here are a few proven ways to build stronger credit:

- Pay bills on time – even the minimum payment counts

- Avoid maxing out your credit cards – keep your balance below 30% of your limit

- Limit new credit applications – too many hard checks can hurt your score

- Pay down existing debt – especially high-interest balances

Another smart way to build your score is with a credit-building tool like KOHO Credit Building. Here's how it works:

- Open a free KOHO account (or upgrade for $7–22/month to add financial coaching and credit tracking)

- KOHO opens a small line of credit in your name

- They report your payments to the credit bureaus, and over time, your score can improve

KOHO Credit Building

Other factors that affect credit card approval

Your credit score is just one of several personal factors that credit card issuers consider when evaluating applications for approval or denial. They’ll also look at these factors:

- Your income: Card issuers often set a minimum personal or household requirement, although it is possible to find credit cards with no income requirement.

- Your age: You must be at least the age of majority in your province to be eligible for approval. Otherwise, a card issuer might require a cosigner.

- Your employment history: Some lenders require that you’ve been in the same job or with the same company for a specified period.

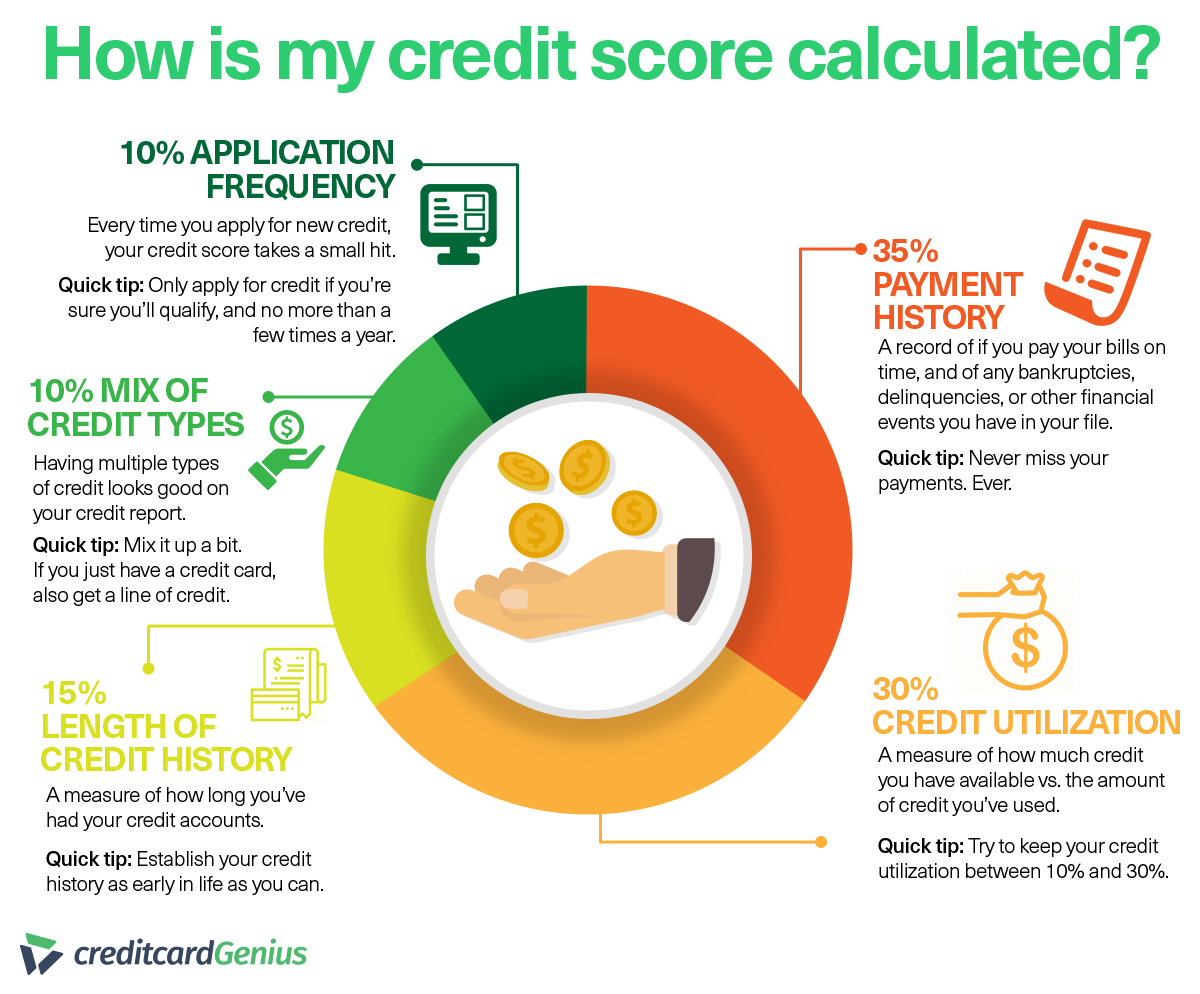

Remember, your credit score is a huge factor. Still, it’s composed of several components: paying your bills on time, the frequency of credit applications, the percentage of available credit you’re using, the duration of your accounts, and the variety of credit you have.

FAQ

Can I get a credit card with a 600 score?

Yes, you can obtain a credit card with a lower credit score, but it will likely be a fairly basic option or may have a lower credit limit. If you’re struggling to get approval, consider shopping around for a secured credit card.

What is Canada's average credit score?

The average Canadian credit score is between 650 and 700, but if your score is below this, don’t worry. It is possible to build your score over time.

What's the easiest credit card to get?

If your credit score is very low, you will likely be limited to secured credit cards, few of which offer much in the way of rewards or perks. The best credit card for those with a low credit score is the Neo Secured Card, which has no income requirements or annual fees, yet still offers rewards on purchases —a rarity for a secured credit card.

How do I improve my credit score fast?

Focus on paying down your debt and prioritize making your payments on time. Since these are some of the largest factors in determining your score, addressing and improving these factors can significantly boost your score. You can also check your credit score and dispute any inaccuracies that may be affecting your score.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×1 Award winner

×1 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.