Understanding credit scores, credit score ranges, and where your own score falls is important for many reasons. Especially if you're in the market for a new credit card, understanding where your score lies on the credit spectrum can help you choose the right products.

Here, we explain how to find your score (and what range your score places you in. You'll also find an overview of some of the best credit cards available to you.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

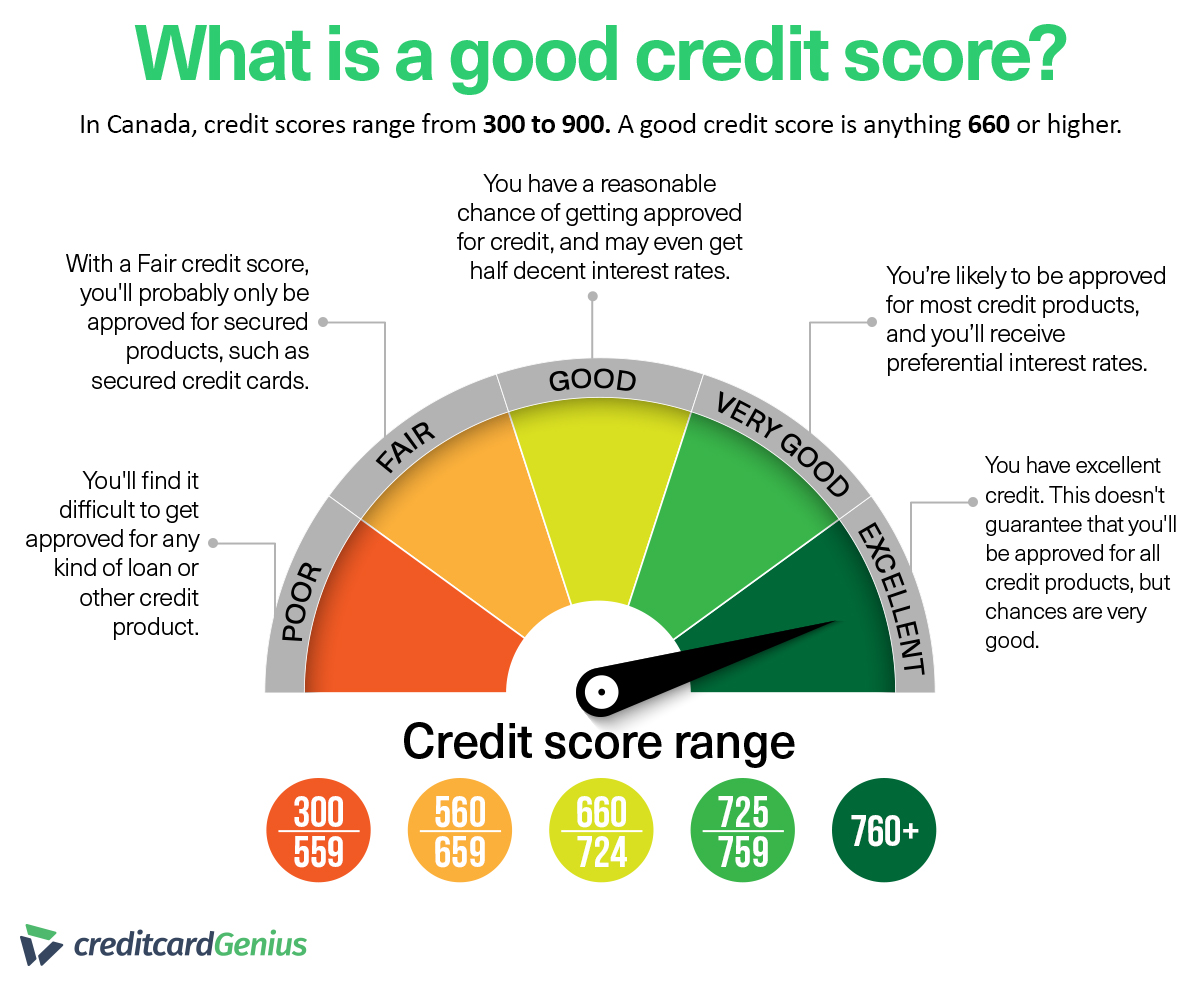

What are the credit score ranges?

Generally, your credit score falls into 1 of 5 ranges, but it can vary depending on which credit monitoring bureau’s score you’re looking at.

| TransUnion | Equifax | |

|---|---|---|

| Poor | 300 - 692 | 300 - 559 |

| Fair | 693 - 742 | 560 - 659 |

| Good | 743 - 789 | 660 - 724 |

| Very Good | 790 - 832 | 725 - 759 |

| Excellent | 833+ | 760+ |

Although your exact score is important, the range you fall in is what lenders look at. Therefore, someone with a 760 Equifax credit score will receive the same rates as someone with a perfect 900 score, as both fall within the "Excellent" range.

If your score is a little lower than you’d like, consider the factors that make up your score so you can figure out ways to improve it.

These are just some of the factors that go into your credit score:

- Length of credit history

- Credit card balance

- On-time payment history

- Overall debt and credit availability

- Number of recent credit applications

- Types of credit products

- History of bankruptcy or insolvency

Each credit monitoring bureau weighs these factors differently, which is why your score can vary even if your credit file remains the same.

How to check your credit score

There are several ways to check your credit score for free:

- Visit the credit bureau websites directly. Equifax offers free access to your credit score and report. Your score is updated monthly, so register and log in regularly to see how your score is doing. You can also access your score through TransUnion, but you’ll have to pay for their credit monitoring service to get it. TransUnion only provides free access to your credit report, not your credit score.

- Use third-party credit reporting sites: Sites like Borrowell and Credit Karma offer this service for free, but they make their money through affiliate marketing, so you’ll be bombarded with ads and emails trying to sell financial products.

- Check with your bank: Most big banks offer free access to your credit score and report as a benefit. For instance, Scotiabank users can see their credit scores and reports as a perk of having a Scotia account. Just log in to access your information.

Best credit cards for your credit score range

You don’t want to waste time and effort – or have your credit score take a hit – by applying for credit cards that you probably won’t qualify for. If you’re in the market for a new card, take a moment to see the best options based on your credit score.

Best credit cards for poor credit

Although your options are limited if your credit score is in the poor range, secured cards are a great option. Secured guards offer almost guaranteed approval because you put down a deposit (that becomes the card’s credit limit).

Here are the best secured credit cards in Canada:

| Credit card | Annual fee | Pros | Cons | Learn more |

|---|---|---|---|---|

| Home Trust Secured Visa Card | * $0 | * No annual fee * Issued by a major bank | * No welcome bonus or rewards * $500 minimum deposit | Apply Now |

| Neo Secured Mastercard | * $95.88 | * Earn an average of 5% cash back with Neo retail partners * Only requires a $50 minimum security deposit | * Limited rewards outside of Neo partners * No insurance included | Apply Now |

| Secured Tims® Mastercard | * $0 | * Earn points at Tim Hortons and elsewhere * No annual fee | * Points have low value * Limited insurance | Apply Now |

Best credit cards for fair credit

With a fair credit range, your options are still very limited. It's not until the next range that more credit cards become available.

But there are still a few cards worth mentioning – here are 3 options:

| Credit card | Annual fee | Pros | Cons | Learn more |

|---|---|---|---|---|

| Tangerine Money-Back Credit Card | * $0 | * 2% cash back on up to 3 categories of your choice * 1.95% on balance transfers for 6 months | * Only earns 0.5% cash back on non-category purchases * Limited insurance included | Apply Now |

| Neo Mastercard® | * $0 | * No income requirements * Earn an average of 5% cash back with Neo retail partners | * Doesn't earn rewards everywhere * No insurance included | Apply Now |

| Home Trust Preferred Visa | * $0 | * No income requirements * 1% cash back on all purchases | * No welcome bonus * Limited insurance | Apply Now |

Best credit cards for good credit

People with good credit start having more credit options, although you will have to pay attention to income requirements.

Since cards in the good range can vary a lot (even by the same card issuer), we’ve listed your best options:

| Credit card | Annual fee | Pros | Cons | Learn more |

|---|---|---|---|---|

| American Express Cobalt® Card | * $191.88 | * No income requirements * 10 types of insurance included | * Lower acceptance as an American Express * Annual/monthly fee | Apply Now |

| RBC Avion Visa Infinite | * $120 | * High point value of up to 2.33 cents * Includes 12 types of insurance | * Income requirements of $60K personal/$100K household * Poor rewards if not redeemed through the Air Travel Redemption chart | Apply Now |

| BMO CashBack® World Elite®* Mastercard®* | * $120 | * Up to 3% cash back on purchases * 13 types of insurance included | * Income requirements of $80K personal/$150K household * Low monthly spend caps on bonus categories | Apply Now |

Best credit cards for very good credit

This score range is where you'll find the biggest selection of credit cards available. Sure, there are some holdouts for the excellent range, but overall, you shouldn't have an issue getting accepted if you have a very good credit score.

Here are the best credit cards in this range:

| Credit card | Annual fee | Pros | Cons | Learn more |

|---|---|---|---|---|

| American Express® Gold Rewards Card | * $250 | * $100 annual travel credit * 4 free passes to Plaza Premium lounges in Canada | * Lower acceptance as an American Express * High annual fee of $250 | Apply Now |

| Scotiabank Gold American Express® Card | * $120 | * Up to 45,000 bonus points, first year free (terms) * 4 ways to redeem points for high value | * Lower acceptance as an American Express * High annual fee of $120 | Apply Now |

| TD First Class Travel® Visa Infinite* Card | * $139 | * Visa Airport Companion membership with 4 free passes * Annual $100 travel credit | * Income requirements of either $60,000 personal or $100,000 household * Points only worth 0.5 cents each | Apply Now |

Best credit cards for excellent credit

With the best credit score, you can choose just about any credit card and be guaranteed approval (as long as you meet income requirements). We’ve narrowed down your best options and recommend the following cards:

| Credit card | Annual fee | Pros | Cons | Learn more |

|---|---|---|---|---|

| MBNA Rewards World Elite® Mastercard® | * $120 | * Up to 5 points per $1 spent on purchases * 10% bonus points every year on your birthday | * Income requirements of $80K personal/$150K household * No trip cancellation and interruption insurance | Apply Now |

| National Bank World Elite Mastercard | * $150 | * Up to 5 points per $1 spent on purchases * Includes 10 types of insurance | * Income requirements of $80K personal/$150K household * No welcome bonus | Apply Now |

| SimplyCash® Card from American Express | * $0 | *  $50 GeniusCash + 5% cash back for the first 3 months (terms) $50 GeniusCash + 5% cash back for the first 3 months (terms)* No income requirements | * Lower acceptance as an American Express * Limited insurance included | Apply Now |

FAQ

What's a good credit score in Canada?

According to Equifax, a credit score between 660 and 724 is considered to be a good score. TransUnion considers anything between 743 and 789 to be a good score. In general, anything between 660 and 724 is good.

Can you have a 900 credit score?

In theory, it’s possible to get a 900 credit score, but it’s incredibly rare. Remember, those with 900 scores get the same interest rates as those with scores around 760+ (for Equifax) or 833+ (for TransUnion).

Is 650 a bad credit score in Canada?

No, this isn't necessarily a bad score. 650 is considered a fair credit score. If you put in some work and financial planning, you can bring your score up to 660, which is considered good.

How long does it take to go from a 650 credit score to 700?

This depends on your personal situation. Paying off debt, increasing your income to improve your debt-to-income ratio, and having a good mix of credit accounts open for extended periods can all help, but these all take time.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.