Credit Karma Canada is one of the most popular services for free credit score checks. It's always helpful to know your credit score, especially if you're planning to make a big purchase or refinance a loan, and Credit Karma provides a fast, budget-friendly way to access this information.

Of course, it's not a perfect service, and there are other options to consider. Below, we’ll explain how Credit Karma works, what it offers, and how it measures up against competitors.

Key Takeaways

- Credit Karma offers Canadians a way to access their credit score for free.

- Credit Karma will show you your credit file and score from TransUnion.

- There are other ways to check it, from Borrowell and having a certain bank account.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is Credit Karma?

Credit Karma is a third-party service that allows users to check their credit scores for free on a weekly basis. The company was founded in 2007 with the idea that people should have easy, free access to their credit scores and financial data. It launched during the financial crisis and quickly grew within the U.S. before expanding to Canada in 2016.

How does Credit Karma offer free credit reports? It makes money through affiliate marketing, which means that when you sign up and agree to the terms, Credit Karma displays credit cards and other financial products that may interest you. And if you apply through one of their links, they earn a commission from the company offering the product.

Although they don't sell your personal information, you’ll probably find that you’re bombarded with marketing emails from Credit Karma.

Is Credit Karma Canada legit?

Credit Karma Canada is a legitimate business, not a scam. The company has an impressive 4.6 Trustpilot rating and is transparent about its business funding.

If you’re still unsure, consider the fact that over 140 million people have used Credit Karma to monitor their credit and financial accounts.

The company also publishes its security standards. Credit Karma:

- Doesn't sell your personal information or share it with third parties

- Uses 128-bit encryption for site security

- Has a dedicated security team to instantly respond to security incidents

- Works with third-party security companies to audit and assess site security

Credit Karma Canada services

Checking your credit score might be the main draw that gets you to the Credit Karma site, but it’s not the only service the company provides.

Here is every service you can access through Credit Karma:

- Credit score: Credit Karma pulls your score and file from TransUnion. The score updates every week, so you can log in regularly to check your progress.

- Financial service offers: Credit Karma offers recommendations through affiliates for credit cards, personal loans, mortgages, and chequing accounts.

- Financial education articles: Access an archive of 85+ valuable articles that explain your credit score, budgeting, student loans, debt management, and much more.

Be aware that Credit Karma Canada doesn’t offer the same services as the U.S. version does. For instance, you won’t get identity monitoring, TurboTax, or Credit Karma Money Spend.

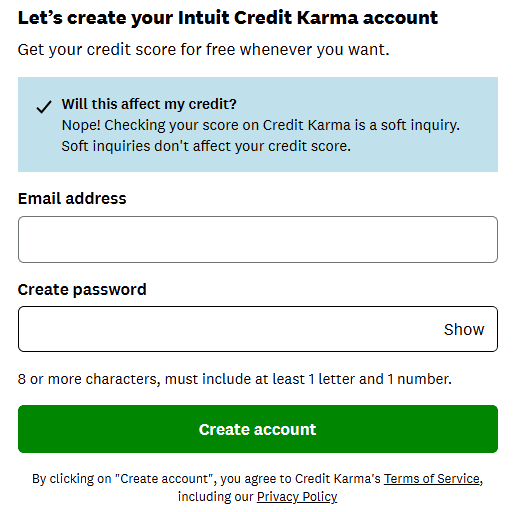

How to get your free credit score

It’s fairly simple to get your free credit score through Credit Karma (and Borrowell has similar steps).

First, you’ll need to create an account.

From there, you’ll need to provide details about yourself so that Credit Karma can pull your TransUnion report. Here’s the info you need to give:

- Your name

- Date of birth

- Social Insurance Number (optional)

- Address

- Income

Agree to the terms and conditions, and you’re all set! Credit Karma will display your credit score on the following page.

If you choose not to use Credit Karma, you can still access your free report by requesting it from your Big 5 bank. Log in to your bank’s website or mobile app to access CreditView, and you'll see your score displayed, all at no cost.

Of course, you can also contact Equifax or TransUnion directly to get your credit report. Both offer credit monitoring services, too.

Credit Karma vs. other companies

Credit Karma isn’t the only option for accessing your credit score for free. Similar third-party services, like Borrowell, offer this for free, or you can go through your bank. Most banks (especially the Big 5) provide clients with access to their Equifax or TransUnion report free of charge.

Take a look at the following table to see how Credit Karma stacks up:

| Credit Karma | Borrowell | TransUnion Credit Monitoring | BMO | |

|---|---|---|---|---|

| Company type | Third-party service | Third-party service | Credit bureau | Big bank |

| Cost | $0 | $0 and up | $24.95 per month | $0 (for banking clients) |

| Services offered | * Credit score * Credit reports * Credit monitoring * Financial service offers * Financial education and resources | * Credit score * Credit reports * Credit monitoring * Financial service offers * Credit building assistance | * Credit score * Credit reports * Credit monitoring * Consumer disclosure * Credit and debt analysis | * Credit score * Credit report |

| Pulls from which bureau? | Transunion | Equifax | TransUnion | TransUnion |

| Notes | * Receive notifications of notable changes to your credit report * Helpful educational resources available | * Bank-level security for your personal information * Offers personalized credit education | * Get ID Restoration Services with up to $1,000,000 * Unlimited access to your file, and unlimited updates | * Credit scores are updated monthly

* Easy access to credit cards and other high-quality products |

Is Credit Karma good?

Whether Credit Karma is a useful financial tool is somewhat subjective, so we turned to Reddit to see what users had to say.

Many pointed out that Credit Karma pulls your score from TransUnion or Equifax before processing it through their algorithm to generate a new number. Some argue that this is done to boost the score and then offer you credit card offers and loan products.

Another common complaint is that the interface is clunky and hard to use. Here’s what one American Redditor said about using Credit Karma:

If you’re willing to navigate to your score and don’t mind promotional emails, you probably won't mind using Credit Karma. That said, be aware that you may see a higher score with Credit Karma than you would from other third-party services or the credit bureaus themselves.

FAQ

How accurate is Credit Karma in Canada?

Credit Karma scores are accurate, but can differ somewhat from what lenders see because each bureau calculates scores differently. If you're applying for a loan, ask the lender which score they use, then check your score with that provider.

Is there a risk to using Credit Karma?

Credit Karma won’t affect your credit score, as it only performs soft credit checks. If you’re concerned about site security, rest assured that it's been in operation since 2007 and uses 128-bit encryption to protect user data.

What is the average credit score in Canada?

According to a 2024 report from the Fair Issac Corporation (FICO), the average Canadian credit score is around 760. This is significantly higher than the 650 score that Borrowell found to be the Canadian average in 2022.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 7 comments