Borrowell and Credit Karma are very similar credit reporting services that allow you to check your score for free. Borrowell has a slight edge over its competitor with a higher level of encryption. It also offers more services than Credit Karma, aside from the usual credit score and/or reports.

We combed through each company’s site for information about the credit monitoring service they use and the financial products they offer. Here, you'll find a thorough comparison of what Borewell and Credit Karma have to offer.

Key Takeaways

- Borrowell works with Equifax to provide your free credit score, plus it provides recommendations for other financial products and services.

- Credit Karma shows you your credit file and score from TransUnion, plus it offers suggestions for other financial products and services.

- If you get a different score from both sites, this is likely because they pull their information from different credit bureaus.

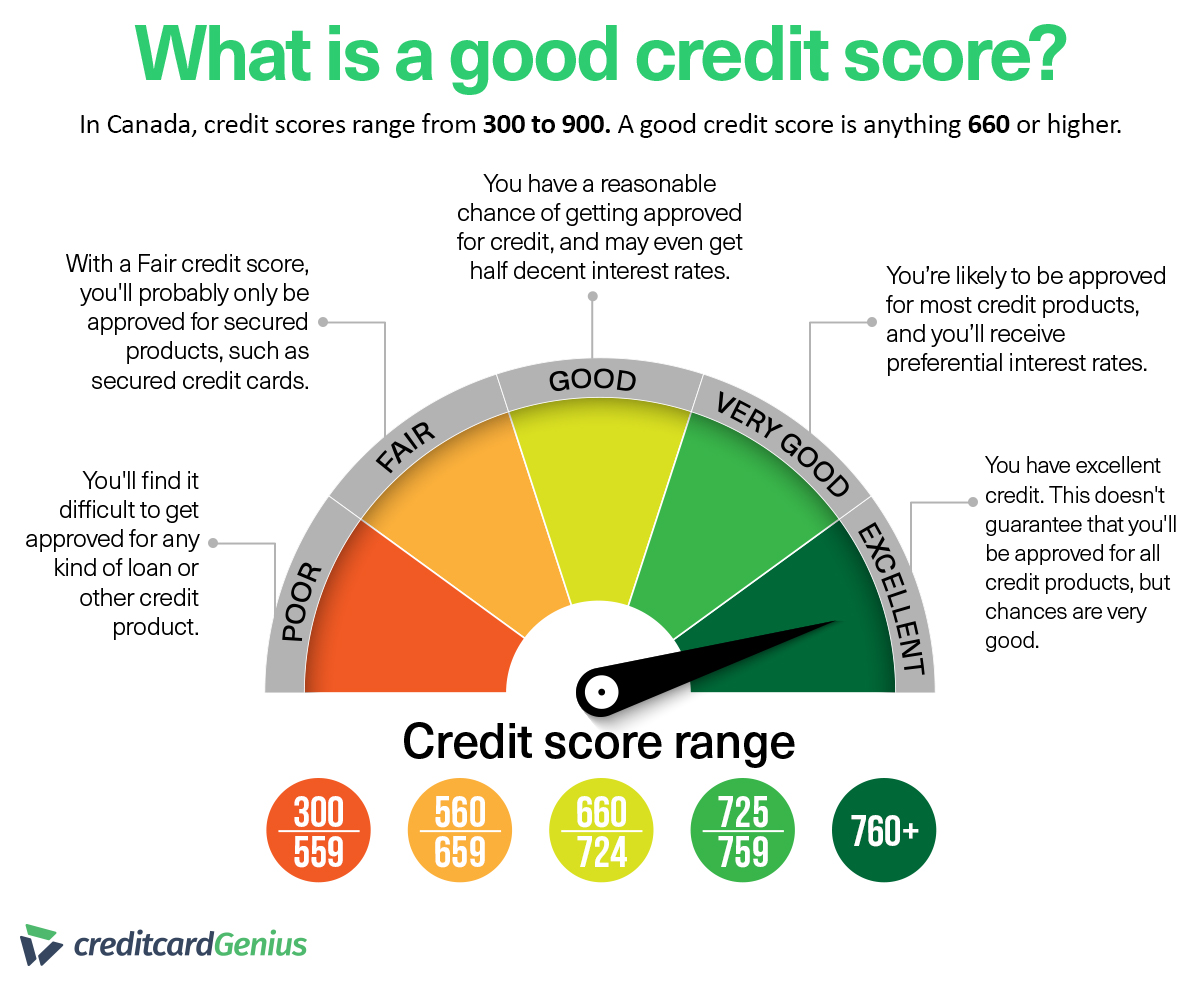

- A good credit score is usually 660 or above.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

What is Borrowell?

Borrowell is a Canadian fintech company that draws your score from Equifax and provides you with your free credit report. The company can do this free of charge because it makes money by affiliate marketing – they promote products they think you may use, and if you sign up, Borrowell receives a kickback.

But Borrowell doesn’t just provide free credit reports. If you head to its website, you’ll see a handful of helpful financial products and services like:

- Banking recommendations: If you’re shopping around for a new bank or you’re new to banking in Canada, Borrowell’s banking recommendations can save you a few headaches. You’ll get detailed information from the six major banks that Borrowell partners with.

- Personal loan recommendations: Borrowell makes it easy to search for the right personal loan for you, whether you’re buying a car, renovating your home, consolidating debt, or more.

- Credit card recommendations: The Borrowell site helps you compare 60+ credit cards – but we have to say we’re partial to our three-minute credit card quiz that helps you find the best credit card from over 260 options.

- Mortgage recommendations: Shopping for a mortgage can take a considerable amount of time, but Borrowell’s mortgage coach searches over 50 lenders to give you some of the best options.

- Insurance recommendations: Borrowell partners with well-known insurance providers to offer personalized insurance suggestions. You can also compare current insurance rates.

- Credit-building tools: If your credit score needs some work, sign up for Rent Advantage or Credit Builder. You’ll make small monthly payments, and Borrowell will report your responsible payments to Equifax, which can improve your score over time.

Remember, Borrowell earns money if you purchase products through its recommendations.

| Pros | Cons |

|---|---|

| Free and easy to use | You’ll get product marketing |

| Access to its financial education blog | You don’t see your TransUnion score |

| Bank-level security with 256-bit encryption | The credit-building tools cost money |

| Recommendations are personalized to you |

What is Credit Karma?

Credit Karma was founded in 2007 and operates similarly to Borrowell, offering a free credit score based on information received from TransUnion. In addition to getting your credit score, it also has partnerships to recommend personal loans and mortgages.

Credit Karma receives money from its affiliate partners (just like Borrowell) in order to offer credit reporting for free.

While Credit Karma doesn’t offer as many financial recommendations, it does provide:

- Banking recommendations: Get personalized chequing and savings offers through some of the biggest banks in Canada. You may even get limited-time bonuses for signing up.

- Personal loan recommendations: Credit Karma works with 30 lenders to help you access loans of up to $60,000 through LoanConnect.

- Mortgage recommendations: Credit Karma partners with Homewise so you can compare mortgage rates, get pre-approved, or refinance your mortgage.

- Credit card recommendations: The site has a credit card recommendation page, but it's not as comprehensive as the credit card recommendations on creditcardGenius. We counted roughly 90 cards on Credit Karma, whereas creditcardGenius boasts

228 .

| Pros | Cons |

|---|---|

| Free and easy to use | You’ll get product marketing |

| Access to its personal finance articles | You don’t see your Equifax score |

| Bank-level security with 128-bit encryption | Doesn't offer credit-building tools or as many financial recommendations |

| Recommendations are personalized to you |

Verdict: Which is better?

It's tough to choose a winner, as both are free, convenient, and comprehensive – but when you get right down to it, Borrowell has the edge. It offers a higher level of encryption, which can keep your financial information safe. Plus, it provides more services than Credit Karma.

We also love the fact that Borrowell has credit-building programs (even if they do cost a little). These are similar to the KOHO Credit Building, which lets you pay a small monthly fee for the same thing. The difference with KOHO, however, is that it reports to both credit bureaus, whereas Borrowell only reports to Equifax.

What is a good credit score?

Generally speaking, a good credit score is anything 660 or higher. The individual credit bureaus may differ slightly in their definitions of a "good" score, but the differences aren't significant.

Why you may get different scores from different sites

You may find that Credit Karma says you have a different credit score than what Borrowell shows. The biggest reason for this is that Credit Karma pulls your information from Equifax and TransUnion, while Borrowell only uses Equifax.

Since each of these credit monitoring bureaus uses different scoring models, your credit score might be slightly different.

If you’re making a large purchase in the near future, you may want to request scores from both sites so you have the best idea of your credit score (and borrowing capability).

FAQ

Is Borrowell or Credit Karma accurate?

One site isn’t consistently more accurate than the other, especially since each credit reporting service draws information from a different credit bureau. If you’re looking for accuracy, consider using both sites to find your score.

Why are my Borrowell and Credit Karma scores different?

Scores can vary since both services pull from different credit bureaus – Borrowell uses both TransUnion and Equifax, while Credit Karma just uses TransUnion. Plus, the credit bureaus may adjust your score at various times, so your information can look different.

Is Borrowell a legit credit score?

Borrowell is a legitimate credit reporting service that pulls credit information from Equifax, so the score it presents to you should also be legitimate. It also uses bank-level security with 256-bit encryption to keep your information safe.

What is a good credit score in Canada?

Generally, a score between 660 – 724 is considered good in Canada, but if yours is lower, don’t worry. There are steps you can take to improve your score over time, like making timely bill payments and lowering your debt.

Where can I check my credit score for free?

Both Borrowell and Credit Karma provide your credit score for free, but you may also be able to check your score for free through your bank or credit union. Some credit cards also offer free credit score access.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.