Pros & cons

Pros

- Up to 10,000 bonus points.

- Up to 2 points per $1 spent on purchases.

- 10% bonus points every year on your birthday.

- No annual fee.

Cons

- Annual caps on bonus categories.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 12,700 points which translates to an estimated $127.◊

For all welcome bonus details click here.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With MBNA Rewards Platinum Plus Mastercard, here's how you earn rewards:

- 2 points for every $1 spent on restaurants , groceries , and select recurring bills (up to $10,000 spent annually per category)

- 1 point per $1 spent on all other purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For MBNA Rewards Platinum Plus Mastercard in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Any travel | $554 | |

| e-Gift Cards | $549 | |

| Gift Cards | $510 | |

| Merchandise | $477 | |

| Statement Credit/Direct Deposit (World Elite) | $460 | |

| Statement Credit/Direct Deposit (Platinum Plus) | $277 |

Calculating your annual rewards

$36,000 annual spending x 1.54% return on spending = $554 annual rewards

$554 annual rewards − $0.00 annual fee = $554 net annual rewards

Details and eligibility

- Estimated Credit Score

- 660 - 724

- Personal Income

- N/A

- Household Income

- N/A

- Annual Fee

- $0.00

- Extra Card Fee

- $0

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance

- 22.99%

- Balance Transfer

- 22.99%

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

- Mobile Device

- $1,000

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

MBNA Rewards Platinum Plus Mastercard's 4.2 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from MBNA

Our review

To earn flexible travel rewards with no annual fee, the MBNA Rewards Platinum Plus Mastercard is one of our top no annual fee credit cards.

Here's what makes this card special.

Earning MBNA Rewards

With this credit card, you'll be earning MBNA Rewards points on all your purchases.

To get you started on the right foot, you'll earn 10,000 bonus points when you complete these 2 activities:

- 5,000 points when you spend $500 in the first 90 days, and

- 5,000 points when you sign up for paperless e-statements within the first 90 days.

As for your regular earn rates, you'll get:

- 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category)

- 1 point per $1 spent on all other purchases

In the first 90 days, your earn rate is doubled on restaurants, groceries, and bill payments.

Using your MBNA Rewards

So what can you use your MBNA Rewards for?

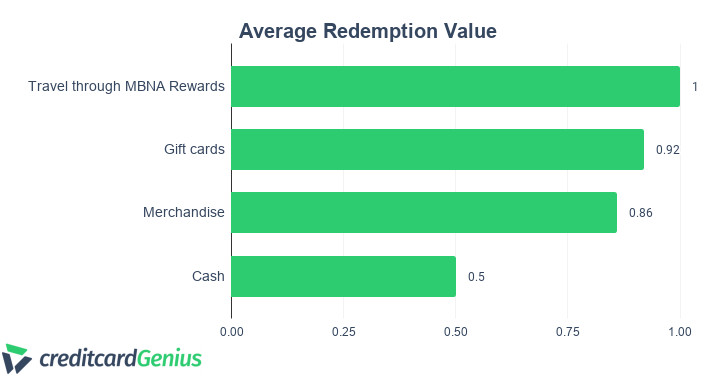

You've got a wide variety of choices in how to redeem your rewards. Here's the summary of what each option is worth:

| MBNA Rewards Redemption Option | Value Of One Point |

|---|---|

| Travel through MBNA Rewards | 1 cent |

| Gift Cards | 0.92 cents |

| Merchandise | 0.86 cents |

| Cash | 0.50 cents |

Most programs have a wide range of point values, but here they're all quite close. So in case travel isn't in your cards, you've got other ways to get good value for your points.

4 benefits to the MBNA Rewards Platinum Plus Mastercard

So what are the benefits to this credit card? Here are 4 reasons why we like it.

1. High average earn rate

Among no annual fee credit cards, this card offers some of the best earn rates.

Based on our typical $2,000 monthly spend, you would get an average rate of return of 1.35%. And that doesn't max out the annual caps on any of the 3 categories it earns bonus rewards.

2. 3 types of travel and purchase insurance

Even though it's a no annual fee credit card, you've still got 3 types of purchase and travel insurance at your disposal, which includes all 3 types of rental car insurance.

In total, we've estimated the insurance package is worth $303 per year.

3. Plenty of high value redemption options

Most flexible reward programs only provide good value when redeeming for travel. But not here. MBNA Rewards provide only a slight loss of value when redeeming for gift cards or merchandise – easy ways to use points you've accumulated.

4. No annual fee

Did we mention that this card has no annual fee? It's the icing on the cake when it comes to this credit card.

2 drawbacks to the MBNA Rewards Platinum Plus Mastercard

Are there a couple of drawbacks? There are. Here are 2 things to keep in mind.

1. Annual caps on categories

It's not great having the annual caps on the categories, as it limits your earning potential.

With that said, if you are spending more than that per month, there are other credit cards out there with an annual fee that would provide more rewards, and more than offset their annual fee.

2. Poor cash redemption value

While there are multiple high value redemption options available, getting cash back is not one of them. Its value is half that of redeeming for travel, so if you're looking for cash back from a credit card, you may want to look elsewhere.

Comparison to the MBNA Rewards World Elite Mastercard

There's one other credit card that offers MBNA Rewards – the

Here's how these 2 credit cards compare.

| MBNA Rewards Platinum Plus | MBNA Rewards World Elite Mastercard | |

|---|---|---|

| Welcome bonus | Up to 10,000 points, plus double points on gas, groceries and restaurants for 3 months (terms) | Up to 30,000 points (terms) |

| Annual fee | $0 | $120 |

| Rewards | * 2 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $10,000 spent annually per category) * 1 point per $1 spent on all other purchases |

* 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases |

| Insurance Coverage | 3 types | 12 types |

| Income Requirements | None | * Personal: $80,000 * Household: $150,000 |

Between these credit cards, the annual rewards are the major difference.

The World Elite card offers 2 points per $1 spent on every purchase, not just a few capped categories.

For this privilege, you're paying an annual fee of $120, so whether or not it's worth it depends on your spending habits.

Based on our $2,000 annual spend, the Platinum Plus Mastercard earns $336 in rewards, while the World Elite Mastercard earns $624.

The World Elite card earns more than enough rewards to offset the higher annual fee.

The only other major difference is in insurance. The World Elite only offers one more type, but it's a rare coverage – price protection. If something you purchased goes on sale for less than what you paid for it (within 60 days), you can get refunded the difference.

There is one other minor difference to be aware of. When it comes to redeeming your points for cash, the World Elite card has a much better value of 0.83 cents per point (compared to the 0.5 CPP value of the Platinum Plus card).

Bottom line

At the end of the day the MBNA Rewards Platinum Plus Mastercard is a top, all-round no annual fee credit card.

What are your thoughts if you have the card?

Let us know in the comments below.

FAQ

What does the MBNA Rewards Platinum Plus Mastercard offer for rewards?

The MBNA Rewards Platinum Plus Mastercard offers 2 points per $1 spent on bills, groceries, and restaurants (up to $10,000 per year per category), and 1 point per $1 spent on all other purchases.

What can MBNA Rewards points be used for?

Here are the 4 main ways MBNA Rewards points can be used, and what each point is worth.

- Redeem for travel through MBNA Rewards – 1 cent

- Gift cards – 0.92 cents

- Merchandise – 0.86 cents

- Cash – 0.5 cents

Does the MBNA Rewards Platinum Plus Mastercard include insurance coverage?

Yes! Despite the fact it has no annual fee, you'll get 3 types of insurance coverage.

Key benefits

‡, ††, ✪, ***, Terms and Conditions apply.

The Toronto-Dominion Bank is the issuer of this credit card. MBNA is a division of The Toronto-Dominion Bank. ®MBNA and other-trademarks are the property of The Toronto-Dominion Bank.

User reviews

Reviewed by 11 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

Now that it has removed all the travel insurance and rental insurance it is no longer the value card it once was. Will be looking for another primary card.

I love it , best bang for the back no annual fee card I have used so far

Was great, but with the change in cash back, I'm dumping this card!

like many other cards they charge a 2.5% fee on the top of the mastercard/visa exchange rate. I want a no-free card with NO FX FEE as well. Why does credit card genius make it impossible to search on that criteria ?

IT IS GREAT MASTERD CARD

×1 Award winner

×1 Award winner