Pros & cons

Pros

- Earn 1 point per $1 spent on all purchases.

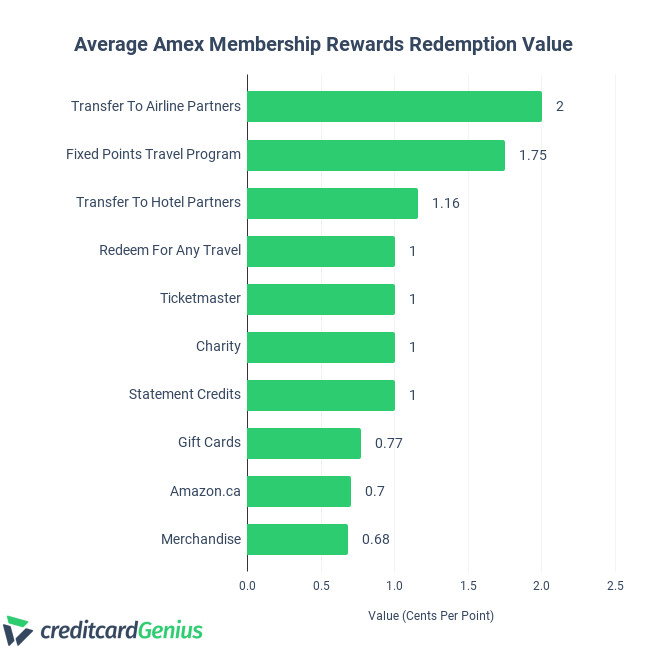

- Points worth up to 2 cents.

- 4 ways to redeem points for high value.

- No annual fee.

Cons

- Lower acceptance as an American Express.

- Minimum insurance included.

Your rewards

Getting your welcome bonus

Based on $3,000 in monthly spending, you can get up to 10,000 points which translates to an estimated $200.◊

For all welcome bonus details click here.

How you earn rewards

Each card earns rewards differently. Part of choosing your card is deciding what type of rewards you want to get. With American Express Green Card, here's how you earn rewards:

- 1 point per $1 spent on all purchases

For all reward details click here.

How much your rewards are worth

The dollar value of your rewards depends on the specific rewards program ‒ and what you choose to redeem your points for. For American Express Green Card in particular, if you spend $3,000 per month, here's our estimated annual rewards earned depending on which reward you choose:

| Transfer points to Aeroplan | $756 | |

| Fixed Points Travel Program | $662 | |

| Transfer points to Marriott Bonvoy | $438 | |

| Any travel | $378 | |

| Statement credits | $378 | |

| Charity donations | $378 | |

| Gift Cards | $291 | |

| Shopping at Amazon.ca | $265 | |

| Merchandise | $257 |

Calculating your annual rewards

$36,000 annual spending x 2.10% return on spending = $756 annual rewards

$756 annual rewards − $0.00 annual fee = $756 net annual rewards

Details and eligibility

- Estimated Credit Score

- 725 - 759

- Personal Income

- N/A

- Household Income

- N/A

- Annual Fee

- $0.00

- Extra Card Fee

- $0

- Card type

- Credit

- Purchase

- 21.99%

- Cash Advance

- 21.99%

- Balance Transfer

- N/A

Insurance coverage

- Extended Warranty

- 1 year

- Purchase Protection

- 90 days

Please review your insurance certificate for details, exclusions and limitations of your coverage, terms and conditions apply.

Learn more about the value of credit card insurance coverage.

Genius Rating

American Express Green Card's 3.9 Genius Rating is based on the weighted average of the following scores:

Methodology

All scores are produced by our math-based rating algorithm that takes into account over 126 credit card features.

Learn more about our rating methodology.

Awards

Each year for our annual credit card rankings our Genius Rating algorithm computes the best credit cards across 28 different categories. Here’s what this card has won this year:

Top cards from American Express

American Express Green Card Review

As one of Amex's most iconic cards, the American Express Green Card is so much more than just an icon – it's one of the best no annual fee credit cards around.

But what makes the Amex Green Card one of the best? Here are the details.

Earning rewards with the Amex Green Card

What makes the Amex Green Card so special? The rewards.

Thanks to the Amex Membership Rewards program, not only do you have plenty of ways to use your points, but they also come with some top level value as well.

Earning rewards with the Amex Green Card

So what do you earn for rewards? This card keeps it simple – you'll earn 1 point per $1 spent on every single purchase. You'll also get an additional point when you book your hotel or rental car with Amex Travel.

And while that may not seem like much, it's what your rewards are worth that matters. Let's take a closer look.

Amex Membership Rewards value

One of Canada's best rewards programs, Amex Membership Rewards gives you plenty of ways to use your points, including 4 different travel redemption options.

Here's a quick overview of all 4 options.

1. Transfer to Aeroplan and other airline partners

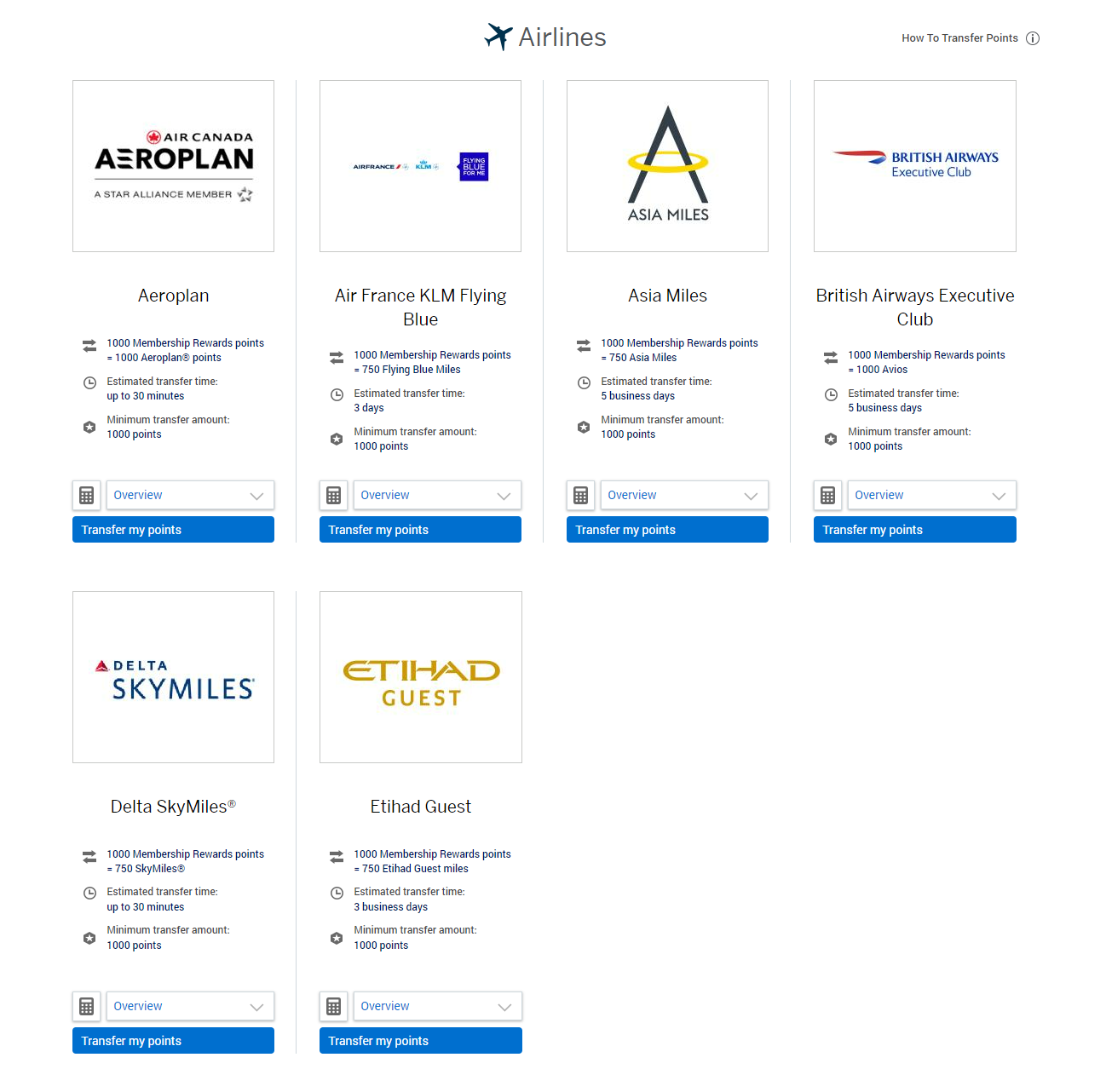

For the best value for your points, you'll want to transfer them to one of Amex's 6 airline partners.

Here are those partners, and the transfer ratio of your points.

We'll focus on Aeroplan, since it will be the most interesting option for most Canadians.

We value an Aeroplan point at 2 cents each, which then gives an Amex point the same value.

That means the Green Card has a return of up to 2% – an incredible number for a no annual fee card.

2. Amex Fixed Points Travel Program

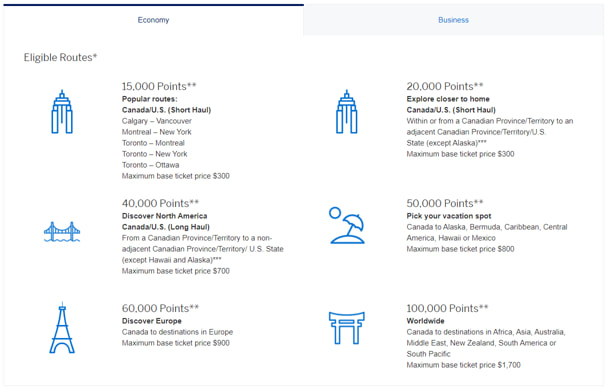

Prefer to not be tied down to only one airline (and its partners)? Then you can also turn to the Amex Fixed Points Travel Program for high value on any flight, from any airline.

For a set amount of points that covers the base airfare, you can fly to a set zone. All you have to do is pay the taxes and fees.

Here's what the chart looks like:

If you can maximize this chart you can get up to 2 cents each. However, since that redemption value is only available for a small number of short haul flights, a more reasonable value to expect is up to 1.75 cents each.

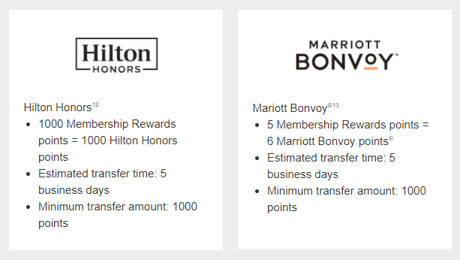

3. Transfer to hotel partners

Amex also has 2 hotel partners you can transfer points to.

Here are those options, and the transfer ratio.

Marriott Bonvoy is by far the better choice. Not only are their points worth more, but the transfer ratio is better.

We value a Marriott point at 0.97 cents when redeemed for a free night, and a Hilton Honors point at 0.64 cents.

For the Hilton transfer, that's only an Amex point value of 0.64 cents. But for Marriott, when you consider the 5:6 transfer ratio, each Amex point is worth 1.16 cents each – almost double Hilton's value.

And, that's still an excellent return on the Green Card of 1.16%.

4. Redeem for any purchase

Finally, there's the easy to use option where you can redeem for any purchase made to the card (including travel).

Apply your points to any purchase you make, and each point is worth 1 cent. This way, you can find the best travel deal out there, and simply use your points to pay for it.

Want more? There are other ways to redeem your points. Here's a summary of your other options, and what each point is worth.

4 benefits of the Amex Green Card

On top of the rewards, here are 4 other reasons to like it.

1. High value rewards

We've already gone over this in detail, but it's worth saying again – these are some incredibly valuable rewards.

Each point is worth up to 2 cents, giving a return of 2% on all your spending – something no other no fee credit card can say.

2. No income requirements

While many no fee cards have income requirements, there are none to worry about here.

In fact, all Amex credit cards have no income requirements. It's one less requirement you have to worry about with American Express.

3. Valuable welcome bonus

Finally, there's a valuable welcome bonus included. You can earn 10,000 points after spending $1,000 in the first 3 months.

Those points can be worth up to $200, which is an incredible welcome bonus for a no annual fee credit card.

4. No annual fee

Did we mention this card has no annual fee? We did?

Well, it's worth saying again. This credit card can provide more rewards than many premium credit cards out there – all while not costing you anything to keep in your wallet.

2 things to think about with the Amex Green Card

All that said, the Amex Green Card isn't perfect. There are 2 things you'll want to keep in mind.

1. Lacklustre insurance

First, the insurance. You'll only get basic extended warranty and purchase protection insurance.

While that's par for the course with most no annual fee cards, there are some no fee credit cards that offer some surprisingly valuable insurance packages. If that's something you're interested in, you won't find it here.

2. Amex acceptance

And of course, there's the little issue concerning Amex acceptance. For some, it can be a deal breaker.

But it might not be as bad as you think it is. Most major retailers take Amex cards, save for Loblaws and Costco. And more and more small businesses are starting to take them now too.

But don't take it from us – check out this map Amex has made. You can see for yourself just how many places will accept your card.

Comparison to the Amex SimplyCash Card

Amex has a terrific credit card lineup, including another no fee credit card you can think about – the

Since this is also a no fee cash back credit card, let's see how the 2 cards compare.

| Amex Green | Amex SimplyCash | |

|---|---|---|

| Earn Rate |

* 1 point per $1 spent on all purchases |

* 2% cash back on gas * 2% cash back on groceries (up to $300 cash back annually) * 1.25% cash back on all other purchases |

| Welcome Bonus | 10,000 points (terms) | 5% cash back for the first 3 months, up to $2,000 in spend (terms) |

| Maximum Return | 2% | 1.25% |

| Insurance coverages | 2 types | 3 types |

| Apply Now | Apply Now | Apply Now |

The only real difference in these cards is with the rewards (and whether or not you want a Centurion on your card).

And at first glance, it may seem like the Green Card is the better option, as you can earn up to 2% back on your purchases.

But, there are 2 keywords to remember – "up to." That means it's not guaranteed.

If all you plan to do is redeem points for any purchase, you're better off with the SimplyCash card. Why? You'll earn 1.25% cash back on all your purchases, a 0.25% increase in your rewards.

But, if there's any chance you'll be able to get more from the other travel options, then you'll be better off with the Amex Green Card for the higher potential rewards.

Summary

There's plenty to love with the American Express Green Card – from having no fee to having high value rewards.

Have (or had) the Green Card? Leave us a user review below, so others can see what you think of it.

FAQ

What does the Amex Green Card offer for rewards?

The Amex Green Card offers 1 point per $1 spent on all purchases. And with each Amex point worth up to 2 cents each, the card can offer a return of up to 2% on spending.

Is the Amex Green Card a charge card?

No, the Amex Green Card is not a charge card, just a regular credit card.

Does the Amex Green Card have an annual fee or income requirements?

The Amex Green card has no annual fee and has no income requirements to meet.

Key benefits

User reviews

Reviewed by 4 Canadians

Thank you for your review!

Hang tight while we verify and approve it.

If you want to see your review right away...

Create an account:

I got approved for this card with a transunion score of 682. I’ve had this card for about two weeks and it’s amazing! I love the reward system and I’ve already gotten my bf to sign up using my link, which quadrupled my membership rewards. It’s an amazing card to introduce someone into the seemingly mysterious world of American Express. I love the fact that this card has no annual fees but still reaps the same benefit as the other more premium cards with annual fees that American Express offers. Long story short, it’s an amazing card and a great starter card for people who want to use AMEX for the first time.

Great card, as a student as well. Tricky application for me personally. Great credit limit to utilize lower credit utilization. Use a referral link!!!! got bonus points because of that! Customer service was great, maximum wait time for me was less than 2 minutes.

It's a great card. It's the best no annual fee card I have. Will be keeping it.

Easy bonus and strong earn rate for a free Amex card, solid keeper card to build credit and just store, pretty good basic insurance and good card to start off with amex!

×1 Award winner

×1 Award winner

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*