Aeroplan is a terrific rewards program in Canada. You can use Aeroplan points to fly anywhere Air Canada and their Star Alliance partners can take you.

Aeroplan also offers a wide selection of top-notch credit cards to earn you points everywhere you shop and get benefits while flying with Air Canada.

But Aeroplan isn’t for everyone. Perhaps you don’t plan on flying with Air Canada. And while you can use Aeroplan points for hotels and car rentals, they lose a substantial amount of their value.

And there’s no cash option either, so if you want to turn your points into something quick and easy you can use, there’s no option for that either.

Luckily, there are plenty of other travel rewards programs out there for you to look at. Here’s an overview of 7 options.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

1. American Express Fixed Points Travel Program

One program that could be a great replacement is the American Express Fixed Points Travel Program which is part of American Express Membership Rewards.

Some rewards programs are pretty complicated… but things don’t get much easier than this fixed points program. Cardholders are given the ability to book flights any day, to any destination, and with nearly any airline they like.

Plus, the Amex Fixed Points Travel Program allows you to use your points to pay for the taxes, fees, and surcharges that flying leads to – that isn’t something that all rewards programs do. Your points won’t go quite as far on taxes and fees though, so you may just want to pay them out of pocket instead and save your points for your next flight.

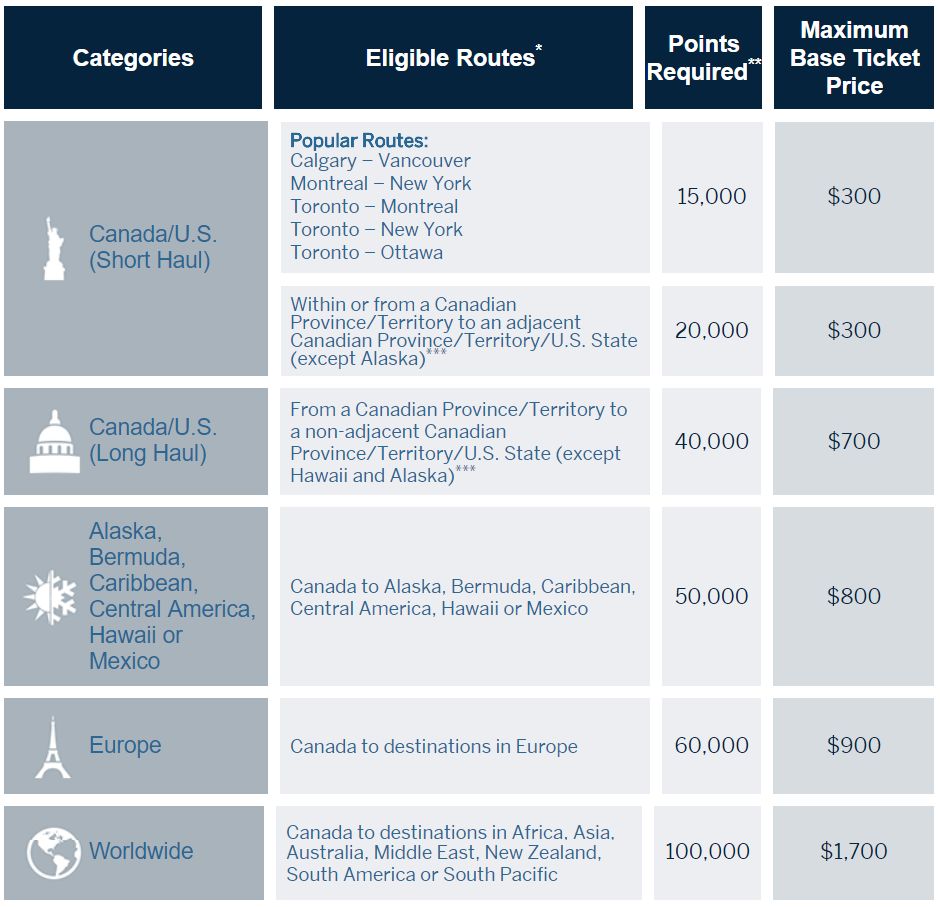

Cardholders simply need to match their intended destination to the chart below to find out how many points are required for a free flight (as long as the flight they are booking is under the max amount).

Points, which are also referred to as Membership Rewards Points, can be used for a number of different things and can be earned simply by using select American Express Credit Cards.

One credit card that gives cardholders these valuable rewards is the

- The Best Overall Credit Card

- The Best Restaurant Credit Card

- The Best Travel Credit Card

- The Best Rewards Credit Card

- The Best Grocery Credit Card

- The Best American Express Credit Card

The lucrative rewards program and bonus earn rate go a long way to boost its Genius Rating but it has a lot of other benefits as well:

- a high sign up bonus,

- a solid insurance package,

- premium American Express exclusive perks, and…

- a monthly fee of only $15.99.

Read our detailed review here:

GC: $100

2. Air Miles

The most widely known rewards program in Canada is, without a doubt, the Air Miles program.

As of January 25, 2026, Cash Miles and Dream Miles have been merged into a single balance.

In summer 2026, Air Miles will rebrand as Blue Rewards.

Air Miles credit cards are no longer available to new cardholders. For alternatives, explore Canada’s best BMO credit cards

Air Miles is a loyalty program that was founded in 1992, and awards cardholders with “miles” for purchases they make at participating locations.

The miles earned can be used as either Cash Rewards or Dream Rewards, and in turn can be used for a number of different things – flights, hotels, merchandise, gift cards, and even to make purchases at different participating stores.

It’s the flexibility of this program that makes it a favorite among Canadians, but it does have its downsides.

If you’ve collected Air Miles in the past, or know much about the program, you will know that miles are not given at every store, so, unless you shop exclusively at Air Miles partner locations, it could take a very long time to earn enough rewards to actually go somewhere.

3. Avios

Live in (or near) Montreal, Ottawa, Toronto, Calgary, or Vancouver? The Avios program, which is part of the oneworld alliance, can take you almost anywhere in the world.

Wondering which oneworld alliance airlines fly out of Canada?

- American Airlines

- British Airways

- Cathay Pacific

- Qantas

- Japan Airlines

- Qatar Airways

- Royal Jordanian

Similar to Alaska Airlines, you won’t be able to use Avios to fly within Canada. This is for those of you who want to explore the rest of the world. A great option for earning Avios is the

- 1 point per dollar spent,

- 2 points per dollar spent on British Airways

…and all for an annual fee of $165.

The card benefits don’t stop there, however.

If you spend more than $30,000 per year, you earn a companion award eVoucher. Book an award ticket on British Airways, and you’ll be able to bring someone else with you – you just have to pay the taxes, fees, and carrier charges. Or if you're flying solo, you can use it to pay 50% fewer Avios on your flight.

Finally, this card will give you access to 9 different types of insurance.

4. Alaska Airlines

One nice thing about the Alaska Airline rewards program is that the miles that you earn can be redeemed on both oneworld airlines as well as a number of exclusive partner airlines.

Here are a few airlines you’ll be able to use Alaska Airlines miles with:

- American Airlines,

- British Airways,

- Cathay Pacific,

- Icelandair, and

- Qantas.

Because of these added options, if you live in any major Canadian cities that have these airlines, you should be able to get anywhere you want to go.

However, it is important to note that these are all foreign airlines, meaning they are unable to takeoff and land within Canada during the same flight. So, if you’re looking for travel rewards that can get you from province to province, this wouldn’t be the best rewards program for you.

5. Marriott Bonvoy Rewards

With all this talk about travel rewards programs, you’re probably pretty surprised to see a hotel loyalty program on the list, but there’s a surprising reason why the Marriott Bonvoy Rewards Program is mentioned here.

What is this new program so great?

For starters, not only does it allow you the option to book travel (and cover taxes and fees) with no blackout dates, but it will also allow you to transfer your Bonvoy points to over 40 different airline programs – and often at a 3:1 ratio.

As an added bonus, if you transfer your points in 60,000 increments, you will be given a 25% bonus, turning your 60,000 points to 25,000 miles.

6. Travel programs with guaranteed returns

If you want to start earning points that are flexible and easy to use with the same guaranteed return everytime you redeem, many of the big banks offer first-class travel programs and credit cards.

Simply pay for a travel purchase, either by using the company’s own travel website, or book any travel you like from any provider (if this option is offered) and get the same value for your points every time.

Our favourite programs for this category are BMO Rewards, Scene+, TD Rewards, and American Express Membership Rewards.

For BMO Rewards, use your points to pay for any travel purchased through BMO Rewards. Each point is worth 0.67 cents when redeemed for travel. The best card to earn BMO Rewards points is the

The Scene+ program not only lets you redeem your points with their own travel service, but also with any provider you wish with no loss of value. The only catch with redeeming points for any travel is you need to redeem at least 5,000 points. Each point is worth 1 cent when redeemed this way.

Our favourite Scene+ credit card is the

For a few extra perks, you can also look at the

Finally, American Express Membership Rewards, in addition to the Fixed Points chart, allows you to redeem your points for any travel from any provider. Redeem any amount you like – each point is worth 1 cent.

And of course the best card is still the

GC: $100

7. RBC Avion Rewards

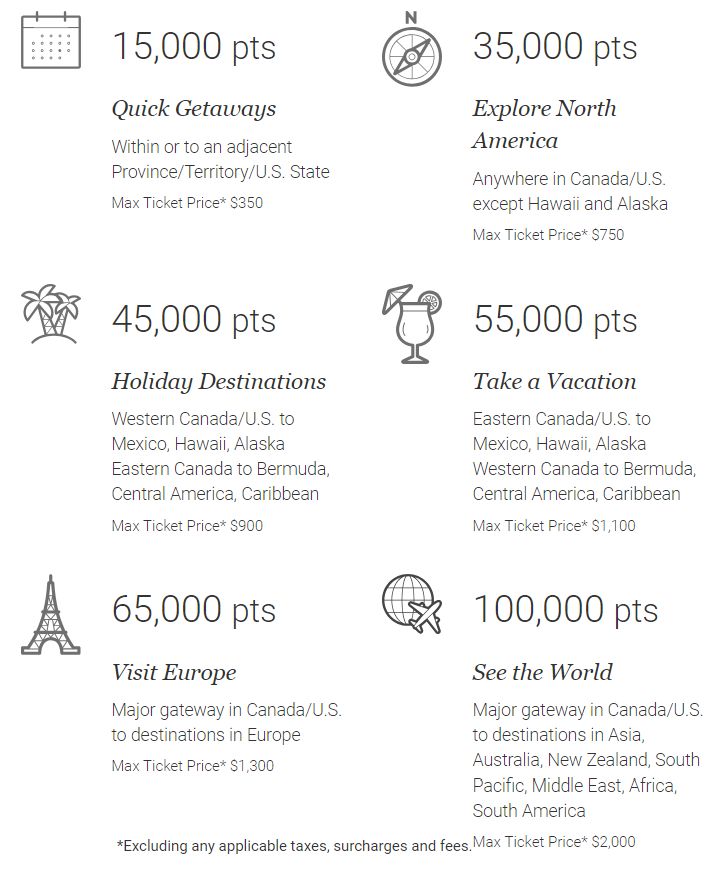

RBC Avion points allow cardholders to redeem for any flight…any time.

You just need to decide where you want to go. Check out the chart below to find out how many Avion points you need to find yourself at your dream destination.

One of the top Avion credit cards, the

- WestJet Rewards,

- British Airways Avios,

- American Airlines AAdvantage, and

- Cathay Pacific Asia Miles

Another RBC credit card that could be an option for our readers is the

Unlike all the other cards on our list so far, this card rewards cardholders with a percentage of cash back instead of points or miles – up to 2% back. This cash can be used towards WestJet flights or vacations with no blackouts and no restrictions. This card comes with:

- a comprehensive insurance package,

- 24/7 Concierge Service,

- an annual round trip discounted companion voucher to anywhere that WestJet flies (a favourite feature among its users), and…

- the ability to get your first checked bag free on all WestJet flights – a big money saver if you travel on WestJet flights often.

Aeroplan credit cards

We love the Aeroplan program. You’ve got plenty of places you can use your points, and you can book any available seat on Air Canada with your points.

One big plus to the program that offers more benefits is having an Aeroplan branded credit card. They come with a standard set of benefits.

Looking for a suggestion? Here’s a rewarding Aeroplan credit card that we recommend.

The

You’ll earn plenty of Aeroplan points, get a generous welcome bonus, and get some Air Canada benefits on the side.

To start, get up to 40,000 Aeroplan points after spending $3,000 in the first 3 months and spending $1,000 in month 13.

On all your purchases, here’s what you’ll earn:

- 2 points per $1 spent on Air Canada

- 1.5 points per $1 spent on restaurants

- 1 point per $1 spent on all other purchases

On top of all those points, here are the Air Canada benefits you’ll get to enjoy:

- free first checked bag,

- preferred pricing on reward flights, and

- earn 1,000 Elite Qualifying miles for every $10,000 spent annually.

These are all outstanding perks to make a free rewards flight even better. Not to mention this card comes with a comprehensive insurance package that covers you on Aeroplan flight rewards.

We would love to hear what you think

Do you have a favourite travel rewards program?

Are you optimistic about the changes that are coming for the Aeroplan program?

Or are you getting ready to jump ship?

Let us know in the comments below!

FAQ

What is the Aeroplan program?

The Aeroplan program is the loyalty program for Air Canada. You can use Aeroplan points to fly anywhere Air Canada and their Star Alliance partners fly to.

What are some alternatives to the Aeroplan program?

There are plenty of travel programs if flying with Air Canada is not in your plans. There are other airline programs you can look at, Air Miles, or one of the many flexible rewards programs that exist.

What is the best Aeroplan credit card?

The best Aeroplan credit card is the Amex Cobalt Card. Even though it doesn’t earn Aeroplan points directly, the Membership Rewards accumulated can be transferred at a 1:1 ratio to Aeroplan. You’ll earn up to 5 points per $1 spent on all purchases, the most of any Aeroplan credit card.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner  $100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

$100 GeniusCash + Earn up to 15,000 Welcome Bonus Membership Rewards® Points.*

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 7 comments