Although it doesn’t earn as many points as the

Key Takeaways

- The American Express Gold Rewards card is best suited to Canadians who spend at least $25,000 per year on gas, groceries, drugstores, and travel combined.

- The Amex Gold has no income requirements but requires an estimated credit score of 660 – 724 and a $250 annual fee.

- Using the Amex Gold, you can collect unlimited points on travel purchases and enjoy an estimated $1,800+ worth of benefits, including travel insurance.

- American Express Membership Rewards points can be transferred to Aeroplan or redeemed on travel for an average value of 1.5 cents CAD per point.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

American Express Gold Rewards Card overview

The American Express Gold Rewards Card is a premium credit card issued by the bank and payment network American Express.

For Canadians who travel frequently (but not lavishly), it strikes the sweet spot between the high earning rates of the Amex Cobalt and the premium perks package of the Amex Platinum. In exchange for a $250 annual fee, cardholders can collect unlimited points on travel purchases and enjoy nearly $2,000 worth of perks and benefits.

The Amex Gold has no pre-set spending limit but should be paid in full each and every month. For a small fee, cardholders can use "Amex Plan It" to finance purchases over $100 CAD – the only other option is to pay a whopping 21.99% in credit card interest if you carry a balance.

If you occasionally carry a balance, this isn’t the card for you – might we suggest a low interest credit card instead?

Pros:

- 11 types of insurance

- 5 ways to earn rewards

- 6 ways to redeem rewards

- 5 travel perks, including airport lounge access

- Points worth up to 2 cents CAD each

- No income requirements

- No limits on travel rewards

Cons:

- 21.99% interest on purchases

- Points worth as little as 0.3 cents CAD each

- Limited acceptance for American Express

- Not as many rewards as other premium cards

| Are you eligible for the American Express Gold Rewards Card? | |

|---|---|

| Personal annual income requirements | None |

| Household annual income requirements | None |

| Estimated credit score required | 660 – 724 |

| Annual fee | $250 |

| Extra card fee | $0 |

American Express Gold Rewards Card rewards

After signing up for the Amex Gold, your first taste of rewards will be a 60,000-point welcome bonus after spending $1,000 every month for the first year.

After that, you’ll collect points in 5 spending categories:

- 2 points for every $1 spent on gas, groceries, drugstores, and travel

- 1 point for every $1 spent on all other purchases

Plus, you’ll get 1 extra point for every $1 you spend on Amex Travel Online, making travel the most rewarding spending category. There are no limits on how many points you can collect, and since the Amex Cobalt now earns fewer points on travel purchases, the Amex Gold is a better choice for frequent travellers.

For example, to earn $500 in rewards, an Amex Cobalt cardholder would have to spend $25,000 on travel per year. With the Amex Gold, you only have to spend about $12,500 – or $8,333, if you use Amex Travel Online.

However, if you only spent about $2,000 per month on the essentials, you’d earn about $660 in rewards after one year with the Amex Gold. With the Cobalt, you’d collect a staggering $1,080 in rewards.

It all comes down to your spending habits: If you spend more on travel than essentials, take the Amex Gold. If all you want is points on everyday spending, take the Cobalt.

Learn more about the Amex Cobalt vs. Amex Gold debate: which one is better?

American Express Membership Rewards

The Amex Gold uses American Express Membership Rewards, a flexible rewards program with 6 redemption options. The best ones are to convert your points to Aeroplan points at a 1:1 ratio or trade them for fixed travel credits for an average value of 1.5 cents CAD per point.

If you opt to treat the Amex Gold like a cash back credit card, statement credits yield just under 1 cent CAD per point. It probably doesn'tmake much sense to redeem trade points for merchandise or gift cards, some of which are valued as little as 0.3 cents CAD per point.

Learn more about how to maximize the American Express Membership Rewards program

American Express Gold Rewards Card perks and benefits

The American Express Gold Rewards card provides an estimated $1,800 in credit card benefits, including insurance. We’ll start with the standard Amex benefits package, which includes:

- A $100 USD credit and a one-category room upgrade when you stay 2 or more consecutive nights in a property in The Hotel Collection

- Access to early tickets and reserved seats through Front of the Line Amex Presale and Reserved Tickets

- Exclusive deals, discounts, and offers through Amex Offers

- On-site benefits and special experiences through Amex Experiences

As you can see, you’ll need to stay at fancy hotels, attend hot concerts, and spend money with partners to make use of these perks. It’s less like getting a free ice cream and more like buying an ice cream and getting free sprinkles and a cherry on top.

On top of these benefits, the Amex Gold adds 5 travel-themed credit card perks:

- A $100 annual travel credit toward a single booking on Amex Travel Online

- A $50 NEXUS credit every 4 years

- 4 complimentary visits to Plaza Premium Lounges in Canada per year

- A complimentary Priority Pass membership, enabling you to access 1,200+ airport lounges worldwide for $35 USD per visit

- Hertz Car Rental Benefits, including a one-class upgrade (on rentals of 5 days or more) plus one free additional driver

Getting airport lounge access with your credit card sounds glamorous but often depends on timing and admission policy. During high-traffic periods, you could wait in line for an hour only to find a shortage of seats in the lounge and crumbs at the buffet. Even Amex’s official fine print admits, "some lounges do not admit guests."

We recommend treating this perk as a bonus – nice to have, but not guaranteed.

American Express Gold Rewards Card insurance coverage

The Amex Gold includes 11 types of insurance totalling $500,000+ of coverage and an estimated $431 of value. Amex cards have less coverage than their competitors (such as the TD Aeroplan Visa Infinite Card), but still provide a respectable package of travel and shopping insurance.

For example, a purchase protection plan can replace your newest purchase if it’s lost, damaged, or stolen within the first 90 days of ownership.

American Express® Gold Rewards Card

| Extended Warranty | 1 year |

| Purchase Protection | 90 days |

| Travel Accident | $500,000 |

| Emergency Medical Term | 15 days |

| Emergency Medical Maximum Coverage | $5,000,000 |

| Trip Cancellation | $1,500 |

| Trip Interruption | $1,500 |

| Flight Delay | $500 |

| Baggage Delay | $500 |

| Lost or Stolen Baggage | $500 |

| Hotel Burglary | $500 |

| Rental Car Theft & Damage | Yes |

Please review your insurance certificate for details, exclusions and limitations of your coverage.

Is the American Express Gold Rewards Card worth it?

The American Express Gold Rewards Card tries to strike a balance between points and perks, and we’d say it succeeds – but only if you travel frequently.

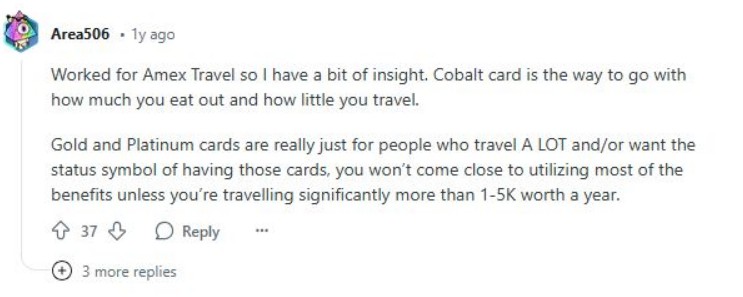

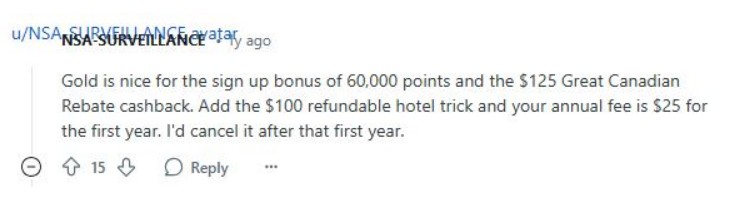

As an (alleged) former Amex employee explained on Reddit, Gold cards are for people who spend more than $5,000 per year on travel and desire a status symbol. Other users agreed, praising its generous welcome bonus, but ultimately advising you should keep it for a year and then move on.

Alternatives to the Amex Gold

The Amex Gold isn’t the only travel credit card for Canadians craving points with a small side of travel perks. There are 3 top competitors:

| American Express Cobalt Card | MBNA Rewards World Elite Mastercard | American Express Platinum Card | |

|---|---|---|---|

| Annual fee | $191.88 | $120 | $799 |

| Welcome bonus | $ $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) | $30,000 bonus points (terms) | $Up to 100,000 bonus points (terms) |

| Rewards | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | * 5 points for every $1 spent on restaurants, groceries, and select recurring bills (up to $50,000 spent annually per category) * 1 point per $1 spent on all other purchases | * 2 points per $1 spent on restaurants and travel * 1 point per $1 spent on all other purchases |

| Income requirements | * None | * $80,000 personal or $150,000 household | * None |

| Types of insurance | 10 | 12 | 11 |

| Pros | * 8 spending categories * Amex benefits | * 10% annual bonus points * Complimentary Dragonpass membership * World Elite Mastercard benefits * Worldwide acceptance | * $200 annual dining credit * $200 annual travel credit * $600+ worth of benefits at Fine Resorts + Hotels * Amex benefits * Complimentary concierge service * Priority services at Pearson airport * Unlimited airport lounge access * and more… |

| Cons | * Lower acceptance for Amex * No airport lounge access * No travel credits | * Limited airport lounge access * No travel credits * Only 4 spending categories | * Lower acceptance for Amex * Not as much insurance as other ultra-premium cards * Only 3 spending categories |

| Best choice for… | More rewards | More acceptance | More perks |

FAQ

Is Amex Gold worth it in Canada?

Because it’s not accepted everywhere in Canada and doesn’t earn as many points as the Amex Cobalt, the Amex Gold is only worth it for Canadians who spend over $5,000 on travel per year.

Is Amex Gold a hard card to get?

Because it lacks hard income requirements, it’s easier to qualify for the American Express Gold Rewards Card than other premium cards – but you still need a good credit score.

Does Amex Gold get lounge access?

The American Express Gold Rewards Card includes 4 complimentary visits to Plaza Premium Lounges, plus a complimentary Priority Pass membership to 1,200+ airport lounges worldwide for $35 USD per visit.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×3 Award winner

×3 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.