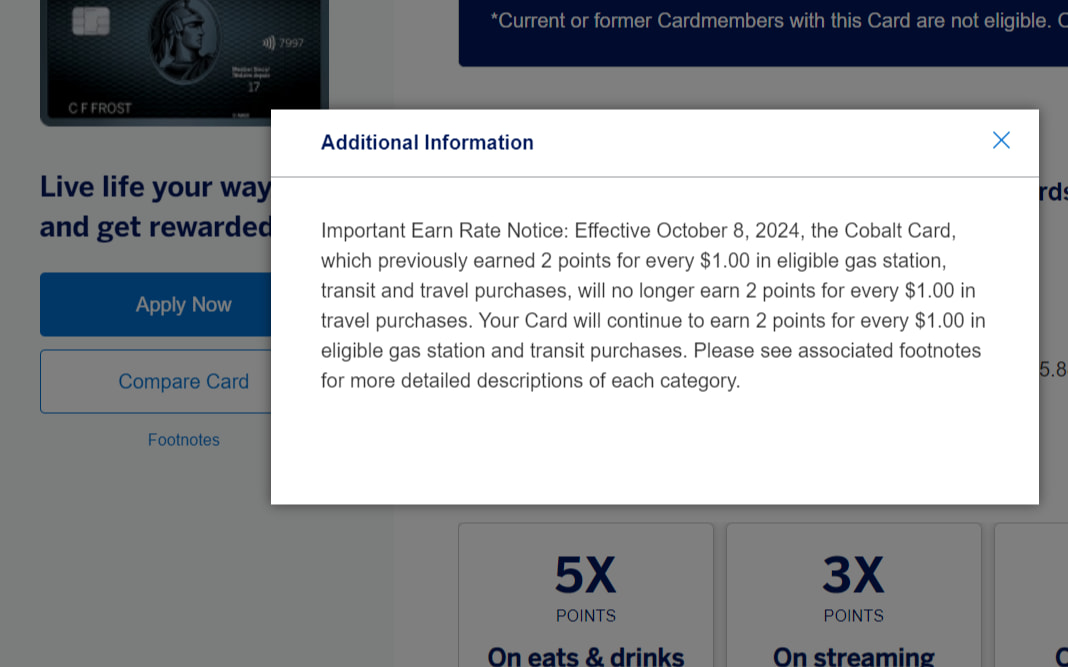

One of the most popular credit cards in Canada – the American Express Cobalt Card – is getting a new earn rate on travel purchases. Starting October 8, 2024, this card will earn 1 point per $1 spent on travel instead of 2 points per $1 spent.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

New travel earn rate for the American Express Cobalt Card

The American Express Cobalt Card has a variety of earn rates and you can currently earn 2 points per $1 spent on the following:

- Gas

- Transit

- Travel

But as of October 8, 2024, travel will fall under the "all other purchases" category and earn you just 1 point per $1 spent.

Here are the details from the Amex website:

Sure, it’s not great news – but this card will likely stay atop our rankings for best credit card in Canada. Even with the reduced travel earn rate, you'll still be able to earn plenty of rewards on purchases.

Based on our $2,000 monthly spend breakdown, the card’s existing earn rate gives users 54,000 points per year. The change decreases the return to 52,800 – a loss of 1,200 points.

Alternative Amex cards

If you use the American Express Cobalt Card primarily for travel purchases, Amex has two other cards ready to fill the void: both the American Express Gold Rewards Card and American Express Platinum Card offer 2 points per $1 spent on travel purchases.

The cards have higher annual fees – $250 and $799, respectively. But in exchange, you’ll get better insurance coverage (up from the 10 types offered by Cobalt) and more travel perks.

Here’s a rundown of what the American Express Gold Rewards Card offers:

- $100 annual travel credit (which essentially wipes away the annual fee difference)

- 4 free lounge passes to Plaza Premium lounges in Canada

- 11 types of insurance

The American Express Platinum Card kicks things up a notch:

- $200 annual travel credit

- $200 annual restaurant credit

- Unlimited airport lounge access for the cardholder and a guest

- Access to the International Airline Program

- Automatic Marriott and Hilton gold status

- 11 types of insurance with increased coverage amounts

What are your thoughts on the Amex changes?

If you’re a Cobalt cardholder, what do you think about this change? Do you have plans to switch to another product?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×3 Award winner

×3 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.