This post was sponsored by Amex Bank of Canada. The views and opinions expressed in this blog, however, are purely our own. If you apply and get approved for an American Express Card, we may receive compensation from American Express, which can be in the form of monetary payment.

Many credit card issuers now offer installment plans – also known as buy now, pay later (BNPL) – where you can turn larger purchases like vacations, appliances, and renovation projects into smaller monthly payments of varying lengths.

These plans are typically easy to get approved for and generally don’t charge interest for their duration (but instead they charge a fee approximating the interest that you would’ve otherwise paid).

Plan It® – the American Express® installment program – allows you to turn eligible purchases of at least $100 into monthly payment plans of 3, 6, or 12 months. You can also use those payments to pay down a portion of your most recent monthly statement.

Let’s break down everything you need to know about Plan It, how it works, and when you can use it.

Key Takeaways

- Amex Plan It is a credit card installment program.

- With Plan It, you can pay for larger purchases over a period of 3, 6, or 12 months.

- There is a fee to use Plan It – typically 0.94% per month of the total amount, which is equal to the product's annual interest rate.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Amex Plan It eligibility

Amex Plan It isn’t available in every province or with every American Express card. Let’s look at three main criteria for eligibility.

1. Available in 7 provinces and 2 territories

The Amex Plan It program is available to the majority of Canadians – here's the list of provinces & territories where cardmembers can use it:

- Ontario

- British Columbia

- Alberta

- Saskatchewan

- Manitoba

- Newfoundland

- New Brunswick

- Yukon

- Northwest Territories

2. Available on select American Express cards

To be eligible for Plan It, your card must be issued by American Express – you cannot access Plan It with Scotiabank Amex cards.

Your card must also be a personal credit card, not an Amex charge card. Here’s the full list of cards that can access Plan It installment plans:

- American Express Cobalt® Card

- American Express® Green Card

- American Express® Gold Rewards Card

- SimplyCash® Preferred Card from American Express

- Marriott Bonvoy® American Express®* Card

- SimplyCash® Card from American Express

- American Express Essential™ Credit Card

- American Express® Aeroplan®* Reserve Card

Amex Plan It is also available on the following small business cards.

- Marriott Bonvoy® Business American Express® Card

- American Express® Aeroplan®* Business Reserve Card

3. Available for new purchases of $100 or more

You can only plan purchases of at least $100 after it is posted. Alternatively, you can also wait for your statement and then plan a portion of the balance in a lump sum. You cannot pay off balance transfers or cash advances using Amex Plan It.

The bottom line: Installment plans like this are good for any larger purchase where you may want to spread out your payments.

Note: You can create Plan It plans for purchases made in a foreign currency but your plan will be based on the final conversion amount in Canadian dollars.

What does Plan It cost?

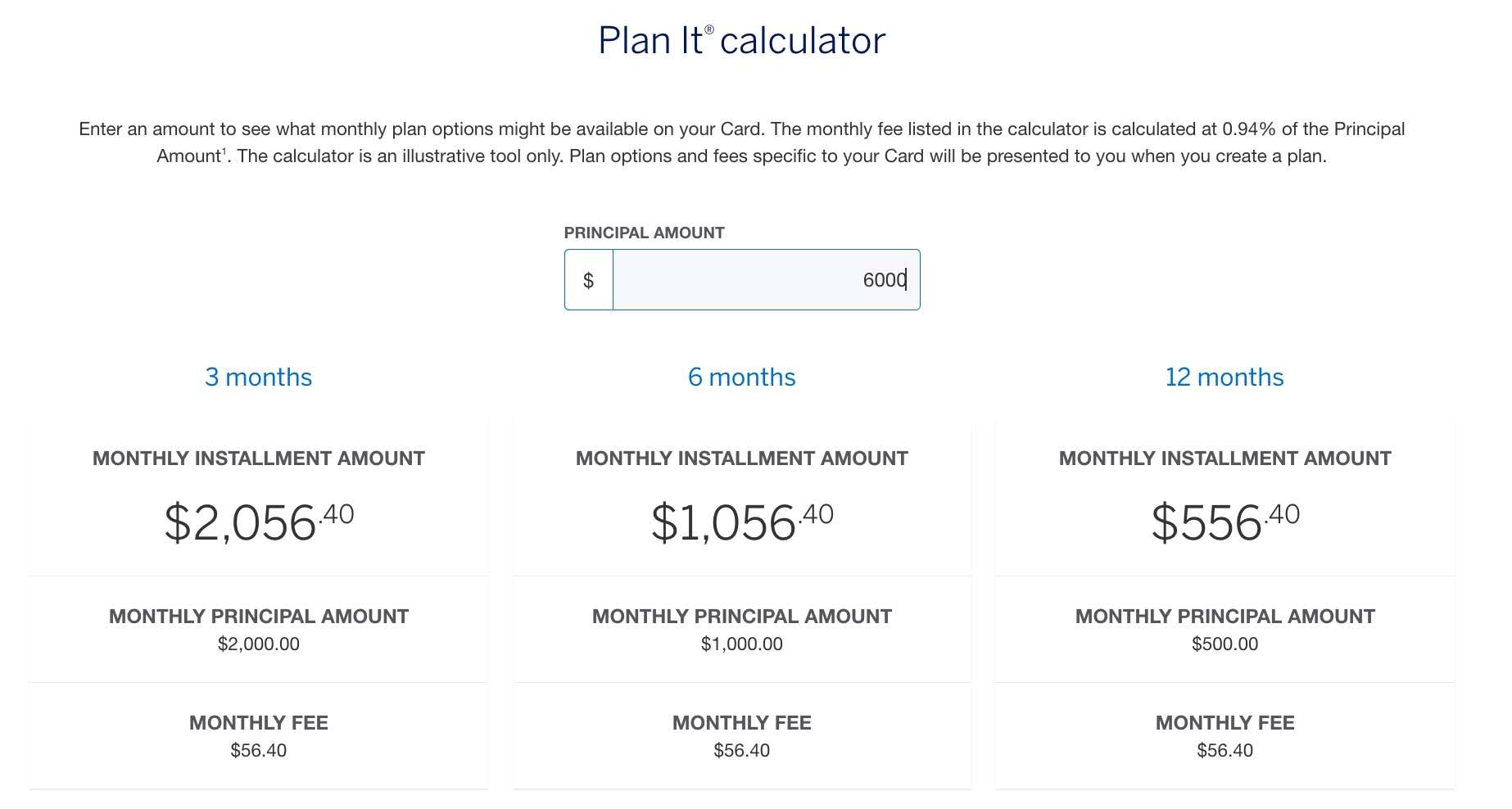

The cost of using Plan It depends on the size of your purchase. You can easily use the Plan It calculator to estimate your monthly payments.

- Take the total amount you want to convert into an installment plan and multiply it by the fee percentage – this gives you the monthly fee

- Take the total amount you want to convert into installments and divide it by the installment plan length – this is your monthly installment payment

- Add the monthly installment plan amount to the monthly fee for your total monthly payment

The exact fee will vary and is based on the annual interest rate of the card product.

Let’s look at a quick example: Say Mark needed $6,000 for his school tuition. He put the tuition payment on his card and then used Plan It to split the transaction into 12 monthly installments. Mark paid off his plan in equal installments of $556.40 (0.94% monthly fee calculation).

Note that the monthly fee never changes, regardless of how long your plan is. The longer your plan is, the more you’ll pay in total fees.

How to set up an Amex installment plan

If you’re ready to try setting up your own Amex Plan It installments, Amex has created a handy video for you to follow.

Here’s how to use Plan It on your mobile device:

If you prefer to use a computer, follow along with the video on the Plan It landing page to set up your installment plan.

Best American Express cards

So, what do the best American Express cards have to offer? Here are the quick details on our top cards that can access Plan It.

And remember: New Amex card members can use Plan It right away on eligible cards. Once you’re approved, you’re free to start making purchases and putting them on payment plans.

| Amex credit card | Welcome bonus | Earn rates | Annual fee | Annual interest rates | Learn more |

|---|---|---|---|---|---|

| American Express Cobalt® Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) | * 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases | $191.88 | * Subject to approval. The preferred rate for purchases is 21.99% and funds advances is 21.99%. If you have Missed Payments, the applicable rates for your account will be 25.99% and/or 28.99%. See the information box included with the application for the definition of Missed Payment and which rates apply to charges on your account and other details. | Learn more |

| SimplyCash® Card from American Express |  $50 GeniusCash + 5% cash back for the first 3 months (terms) $50 GeniusCash + 5% cash back for the first 3 months (terms) | * 2% cash back on gas * 2% cash back on groceries (up to $300 cash back annually) * 1.25% cash back on all other purchases | $0 | Same as above. | Learn more |

| Marriott Bonvoy® American Express®* Card | 110,000 bonus points (terms) | * 5 points per $1 spent at Marriott properties * 2 points per $1 spent on all other purchases | $120 | Same as above. | Learn more |

| American Express® Gold Rewards Card | Up to 60,000 bonus points (terms) | * 2 points for every $1 spent on gas, groceries, drugstores, and travel * 1 point for every $1 spent on all other purchases | $250 | Same as above. | Learn more |

Let’s dig a little deeper into the best credit card in Canada – the American Express Cobalt® Card.

This card tops our list of the best credit cards thanks to its rewards. You'll earn Amex Membership Rewards at these rates:

- 5 points per $1 spent on eligible groceries and restaurants

- 3 points per $1 spent on eligible streaming services

- 2 points per $1 spent on eligible gas, transit, and ride share purchases

- 1 point per $1 spent on all other purchases

And redeeming these points offers a lot of flexibility. Here are just a few of the most popular redemption options:

- Use points for purchase (1,000 points = $10)

- Flexible points travel (1,000 points = $10)

- Merchandise and gift cards

Terms and conditions apply.

This whole package has an annual fee of $191.88, which is charged as $15.99 per month.

Have you used Amex Plan It?

If you’ve created an installment plan with your Amex card, tell us about it!

Leave a comment below to share your experience with others.

FAQ

What is Amex Plan It?

Amex Plan It allows you to pay for purchases over $100 in installments for up to 12 months.

What does Amex Plan It cost?

The cost to set up an Amex installment plan will vary depending on your purchase amount but typically rests around 0.94% per month of the amount you're converting to the installment plan and is based on the annual interest rate of your card product.

What term lengths are available with Amex Plan It?

Amex Plan It is available in three durations: 3, 6, and 12-month installment plans.

Is Amex Plan It available to all Amex cardmembers?

There are a few eligibility requirements for Amex cardmembers to be able to use Amex Plan It. You must have an Amex credit card (not a charge card), have a purchase over $100, and not be located in Quebec, Nova Scotia, PEI, or Nunavut.

What is the best American Express credit card?

The best American Express card is the American Express Cobalt® Card, which offers up to 5 points per $1 spent on purchases. You can use these points in a variety of ways with Amex Membership Rewards.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×9 Award winner

×9 Award winner

GC:

GC:

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 1 comments