Please note the Platinum Card has undergone substantial changes, which you can see here. As a result, the features described here are out of date but were accurate at the time of initial writing.

One of the most premium credit cards in Canada is the American Express Platinum Card. It offers outstanding value with an annual travel credit, unlimited lounge access at airports around the world, and much more.

I took the plunge on the Amex Platinum Card during the pandemic and decided it was so good, I kept it for another year.

Even though it has a sky-high $799 annual fee, I still felt it was 100% worth it to keep. Here's why.

Key Takeaways

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Pros and cons of the Amex Platinum card

We'll start with some pros and cons of the American Express Platinum Card so people who are unfamiliar with the card can get an idea of how good it really is.

Pros

First, there are plenty of benefits that come with the American Express Platinum Card.

- Most perks of any credit card – the list of perks is extensive. These include an annual $200 travel credit and $200 dining credit, unlimited airport lounge access, and automatic advanced status with a few hotel programs.

- Plenty of redemption choices – When you go to redeem your points, you can transfer them to various airline and hotel programs, take advantage of Amex’s fixed points travel chart, or simply redeem them towards any purchase.

- Top-notch insurance – The included insurance is quite good, with 11 types of insurance included.

- No income requirements – Unlike a comparable Visa or Mastercard, this card has no income requirements at all.

Cons

When it comes to cons, there’s 1 big one to be worried about, with 1 other thing to consider.

- High annual fee – The elephant in the room with the Platinum Card. It has a super high annual fee of $799.

- Not the best rewards – Surprisingly, other cards with lower fees offer much more in rewards than what the American Express Platinum Card has to offer.

Why I got the Amex Platinum Card in the first place

Like many others, I loved the perks that came with the card but did not want to pay a $799 annual fee. But because of the pandemic, Amex made some temporary changes that boosted the card's value.

At that time, you earned:

- 50,000 points after spending $3,000 in the first 3 months

- 10,000 points if you kept that card for 6 months

Redeemed for max value, that chunk of points was worth a total of $1,200.

But in April 2021, Amex made another temporary change to the cash value of all their Membership Rewards cards. And for the Platinum Card, they did these 2 things:

- Increased the cash value of one point from 0.7 cents to 2 cents

- Doubled the amount of points cardholders earned

It was a temporary offer that only lasted about 3 months. But suddenly, the first part of the welcome offer (50K points) was worth $1,000 in cash. And, when you combine earning double points AND the increased cash value, you were getting at least 4% cash back on all purchases (12% back on restaurants).

And that metal credit card? Not going to lie, it's a sweet feeling in your hands. Suffice it to say, Amex makes sure you know you're not holding an ordinary credit card.

Amex Platinum offers I received in my first year

Because no one was going to be using the travel incentives much, I was hit with some big Amex offers that were exclusive to the American Express Platinum Card.

For both of the offers I got, it was simply a matter of spending money on groceries. Spend X amount on groceries and get that much back.

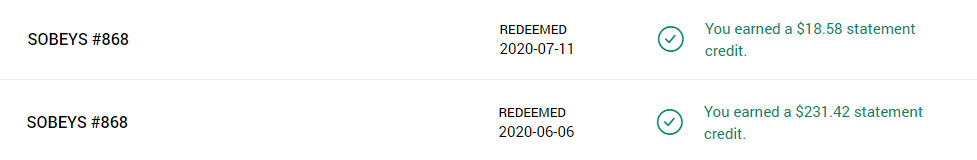

The first one was in June of 2020. Spend $250 on groceries, and get $250 back.

Here are the savings I saw.

A similar offer happened again in January of 2021. It was slightly less at $200, but that’s still $200 in free food.

Those were the major offers that I believe were specific to the Amex Platinum Card. There were others I used, but I think most Amex cards were able to access them.

So, combining these $450 in grocery savings, I got $1,450 in cash, for an annual fee of $699 – a total savings to me of $751. It’s one of the best offers I’ve ever got.

Why I decided to keep the Amex Platinum card for year 2

So what is making me keep it for year 2? There are a few reasons I’m going to hang on to this ultra-premium card for another year.

My large Amex Membership rewards bank

With the 10,000 points I got for keeping the card around, I had about 24,000 Membership Rewards points in the bank at the time I had to make the decision to keep it.

They certainly wouldn't have been lost. I could have:

- Transferred them to Aeroplan (my preferred choice for max value of $480)

- Taken the cash value for them

- Gotten immediate savings on my next trip with the Fixed Points Travel Program

- Earned a free night somewhere with a Marriott Bonvoy transfer

It kept my options open and gave me a lot of flexibility.

Future Amex offers

Finally, more terrific offers could come down the pipe, like the grocery ones. This is a bit of a gamble because no one can predict what offers could come.

But in any case, I felt confident that more top-notch offers were coming for Platinum Cardholders.

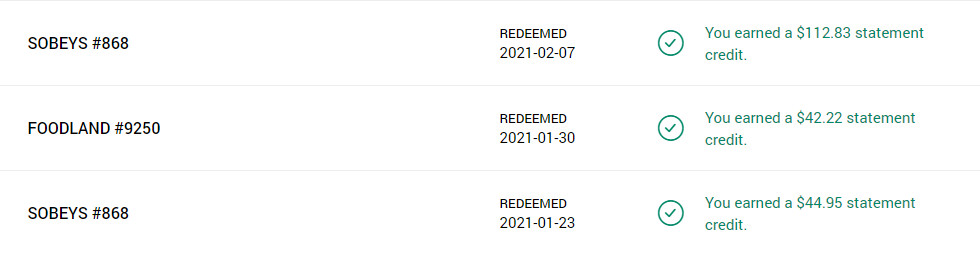

And my faith wasn't misplaced – Amex ended up dropping a terrific offer (that's understating it) for existing Platinum Cardmembers.

Keep in mind that this is on top of the card's regular earn rate.

To get the full amount, I needed to spend $5,000 on those categories in 3 months.

I used a couple of tricks to help get the most from this bonus. I bought gift cards at other merchants I shopped at and shifted more of my grocery spending to Sobeys.

I didn't get the full amount of points – probably only around 34,000. Regardless, it was still a nice boost to my earnings.

Amex Platinum Canada Card details

Here are the full details on this super premium credit card.

Earning Amex Membership rewards

Let’s start with how you’ll earn points.

First, there’s a superb welcome bonus that can provide more value than I got. You can get 100,000 points after spending $10,000 in the first 3 months and making a purchase between months 15 to 17.

What are those points worth? Here’s our estimated value for the welcome bonus.

| Redemption Option | Point Value | Welcome Bonus Value |

|---|---|---|

| Transfer To Aeroplan | 2 cents | $2,000 |

| Fixed Points Travel Program | 1.75 cents | $1,750 |

| Transfer To Marriott Bonvoy | 1.164 cents | $1,160 |

| Redeem For Any Purchase | 1 cent | $1,000 |

There’s a lot of value here, and will more than offset the annual fee for at least one year.

And on your everyday purchases, you’ll get:

- 2 points per $1 spent on restaurants and travel

- 1 point per $1 spent on all other purchases

That’s a return of up to 6 cents on your purchases. Based on our typical $2,000 monthly spend, you can expect an average return of 2.45%.

Amex Membership Rewards value

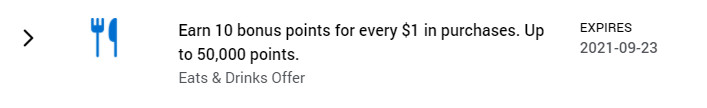

You've got a lot of ways you can redeem your points, and there are several options for travel where you can maximize your value

First, there are 6 airline partners you can transfer points to. For most Canadians, Aeroplan will be the best option. You can transfer points at a 1:1 ratio, and each Aeroplan point is worth 2 cents each.

Here are all of Amex’s travel partners and their conversion rates.

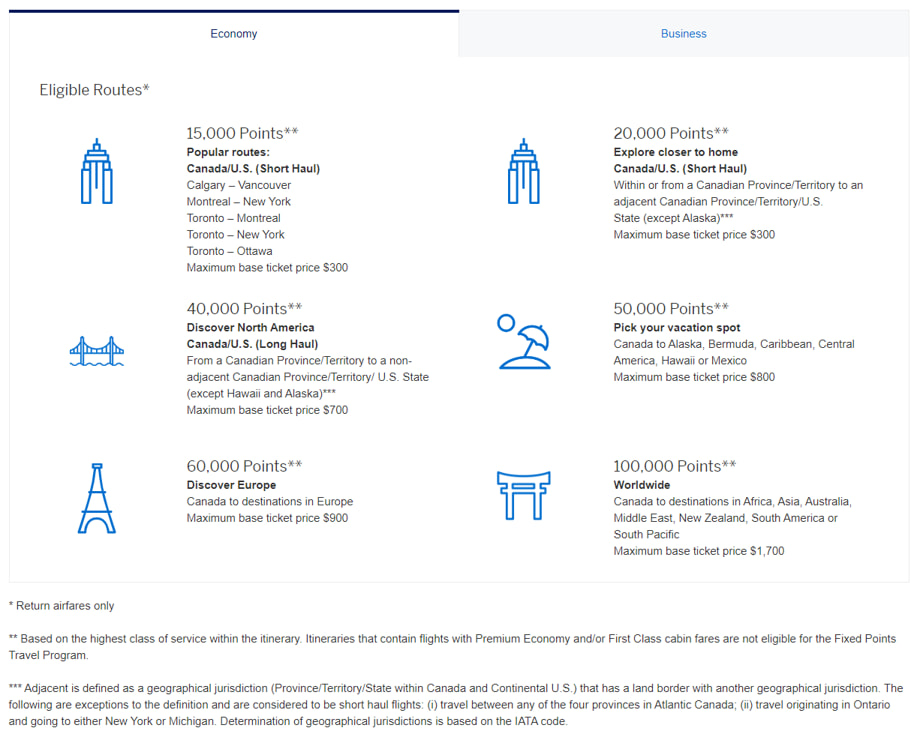

Next is with the Amex Fixed Points Travel program. For a set amount of points, you can fly to a set zone for just the taxes and fees. Redeemed this way, each point is worth up to 1.75 cents each.

Here’s what the economy chart looks like (there’s a business version too) – how many points you need and the max airfare covered.

You can also transfer points to Marriott Bonvoy and Hilton Honors. Transferring to Marriott is the best option. Points transfer at a 5:6 ratio, and with each Marriott point worth 0.97 cents each, that gives an Amex point a value of 1.16 cents.

And finally, you can redeem points towards any purchase made to the card. When you do so, each point is worth 1 cent. Many programs have differing rates for booking any travel or getting statement credits. For Membership Rewards, it’s the same value.

All told, you’ve got plenty of ways to use your points for high value.

Amex Platinum Canada Card perks

The real reason to get this card is the perks. Here's a quick rundown on them.

Amex Platinum Card annual travel and dining credits

First, there's the aforementioned $200 annual travel credit, where you can make any travel booking through American Express. If you spend more than $200, then the credit can be applied.

The same goes for the dining credit. If you dine at one of the curated restaurants on Amex's list, you can also take advantage of $200 in dining credits.

Airport lounge access

The $799 unlocks unlimited access to over 1,300 lounges worldwide for not just the cardholder, but also a guest.

Just keep in mind that for some, you'll have to register for Priority Pass first and show that card to gain entry.

Advanced hotel status

When you have the Amex Platinum, you get automatic advanced status in several hotel programs:

- Marriott Bonvoy – Gold Elite

- Hilton Honors – Gold

- Radisson Rewards – Gold

When you stay at these properties, you’ll get extras like free room upgrades, bonus points, and late check out/early check-in.

The status stays with you as long as you have the card, but you do have to register first – the details are in the welcome kit.

Amex Fine Hotels + Resorts

The last major benefits we’ll highlight are Fine Hotels + Resorts. When booking hotels through Fine Hotels and Resorts, you get extra benefits at one of their over 2,200 hotels which include:

- Daily breakfast for 2

- $100 experience credit for things like spa services, complimentary airport transfers, and more

- Free room upgrade when available

- Guaranteed late check-out and early check-in

Comparing Amex Platinum to BMO eclipse Visa Infinite Privilege card

The American Express Platinum Card isn't the only game in town when it comes to premium credit cards.

Here’s a comparison to one of its competitors – the

| American Express Platinum Card | BMO eclipse Visa Infinite Privilege Card | |

|---|---|---|

| Welcome bonus | Up to 100,000 bonus points (terms) | Up to 200,000 bonus points (terms) |

| Earn rates |

* 2 points per $1 spent on restaurants and travel * 1 point per $1 spent on all other purchases |

* 5x BMO Rewards points for every $1 spent on travel, dining, gas, groceries, and drugstores * 1 point per $1 spent on all other purchases |

| Major perks | * Annual $200 travel credit * Annual $200 dining credit * Unlimited lounge access to 1,200+ lounges * Advanced status with select hotel chains * Access to Fine Hotels + Resorts |

* $200 annual lifestyle credit * 25% bonus points when you add an authorized user * Visa Infinite Privilege benefits * Priority Pass Membership with 6 free passes |

| Insurance coverage | 11 types | 12 types |

| Annual fee | $799 | $599 |

| Income requirements | None | * $150,000 personal * $200,000 household |

| Apply now | Apply now | Apply now |

Here’s the breakdown in a few key areas.

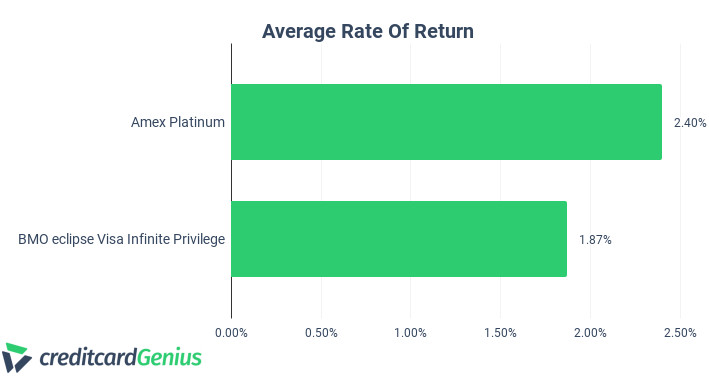

Earn rates

We'll start off with the earn rates on everyday purchases.

It’s not much of a contest here – thanks to their partnership with Aeroplan, your Amex Membership Rewards points are worth up to 2 cents each, and gives an overall return of 2.45% based on a typical monthly spending of $2,000.

Benefits

The perks and benefits are 2 big reasons to look at either card. Here's the estimated value they provide.

Again, it’s not much of a contest. But the Amex Platinum Card is far superior to every credit card in this regard, and why it wins best credit card for perks every year.

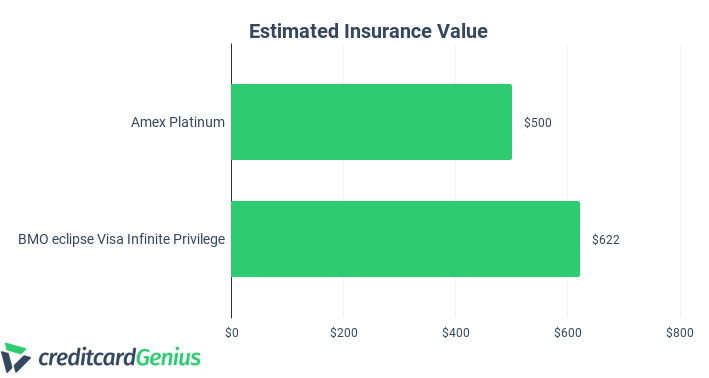

Insurance

These are premium travel credit cards, and as such, you’re likely going to travel and may need to call upon the insurance these cards include.

The BMO eclipse card wins here, with an insurance package that’s worth more than $600.

Welcome bonus

Finally – the welcome bonuses. We all want to be rewarded when getting a new credit card.

The Amex Platinum blows this card (and just about any other card) out of the water.

So, it wasn’t much of a contest – other than insurance, the Amex Platinum Card wins handily.

And best of all – there are no high income requirements to meet for the Platinum Card. Your income won’t hold you back from being approved.

Will you take the plunge on the Platinum Card?

It can take a leap to apply for the Amex Platinum in Canada.

But hopefully, I've shown you what it can offer to offset its high annual fee.

Will you take the plunge on the Amex Platinum Card? Let us know in the comments below.

FAQ

What does the Amex Platinum card earn for rewards?

The Platinum Card earns Amex Membership Rewards on purchases at these rates:

- 2 points per $1 spent on restaurants and travel

- 1 point per $1 spent on all other purchases

It also has a fantastic welcome bonus of 100,000 points, which can be worth up to $2,000.

What are some of the benefits provided by the Amex Platinum Card?

The Amex Platinum Card offers the most benefits of any credit card in Canada. Some of the major benefits include:

- $200 annually in both travel and dining credits

- Unlimited airport lounge access for the cardholder and a guest

- Advanced status with Marriott Bonvoy and Hilton Honors

- Access to Amex Fine Hotels + Resorts

What is the annual fee of the Amex Platinum Card?

The Amex Platinum Card has an annual fee of $799. However, this card also has no minimum income requirements to meet, making it more accessible.

Is the Amex Platinum Card annual fee worth it?

It all depends on whether or not you can take advantage of the benefits and special offers Amex provides. If you can use this card to its full potential, then it can be worth it.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

×2 Award winner

×2 Award winner

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 11 comments