For the best set of travel perks you can find on a credit card, you really can't beat what American Express Platinum Cards provide. Available in both personal and business versions, you'll get unparalleled perks when you're travelling.

There are some major changes coming to both the American Express Platinum Card and The Business Platinum Card from American Express, from higher annual fees, new credits, and a change in how rewards are earned.

Here are the details for both cards – these changes take effect on September 26, 2023.

Key Takeaways

- Both American Express Platinum credit cards are getting some major changes.

- Changes include higher annual fees, updates to earn rates, and new credits.

- The changes take effect on September 26, 2023.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Changes to the American Express Platinum Card

We'll start with the personal card in the American Express Platinum Card. Here is what is changing. It's definitely a good news/bad news situation.

New annual fees

We are going to start with the bad news first and get it out of the way. The annual fee is going to be increasing by $100, from $699 to $799.

The fee for additional Platinum Cards will also be going up – from $175 to $250.

The one silver lining here is the fee if you add Gold Cards to your account. They currently cost $50, however the first 2 you add to your account won't cost you anything.

New earn rates

The earn rates are also changing, and sadly, not for the better. Here are the current earn rates for the card:

- 3 points per $1 spent on restaurants

- 2 points per $1 spent on travel

- 1 point per $1 spent on all other purchases

The bonus earn rate on restaurants is being downgraded, from 3 to 2 points per $1 spent. If you're an existing card member prior to August 15, this change won't take effect until October 26, 2023.

It certainly isn't pleasant to see rewards drop. But we will say you won't have this card purely for the rewards either. Both the American Express Cobalt Card and the American Express Gold Rewards Card vastly out earn what this card provides.

If rewards have always been your top priority the Platinum Card may not be for you.

A new dining credit

Here's the good news – a new credit is coming to the Platinum Card.

Every year, you'll get access to a $200 dining credit. This benefit will get reset every year on January 1st.

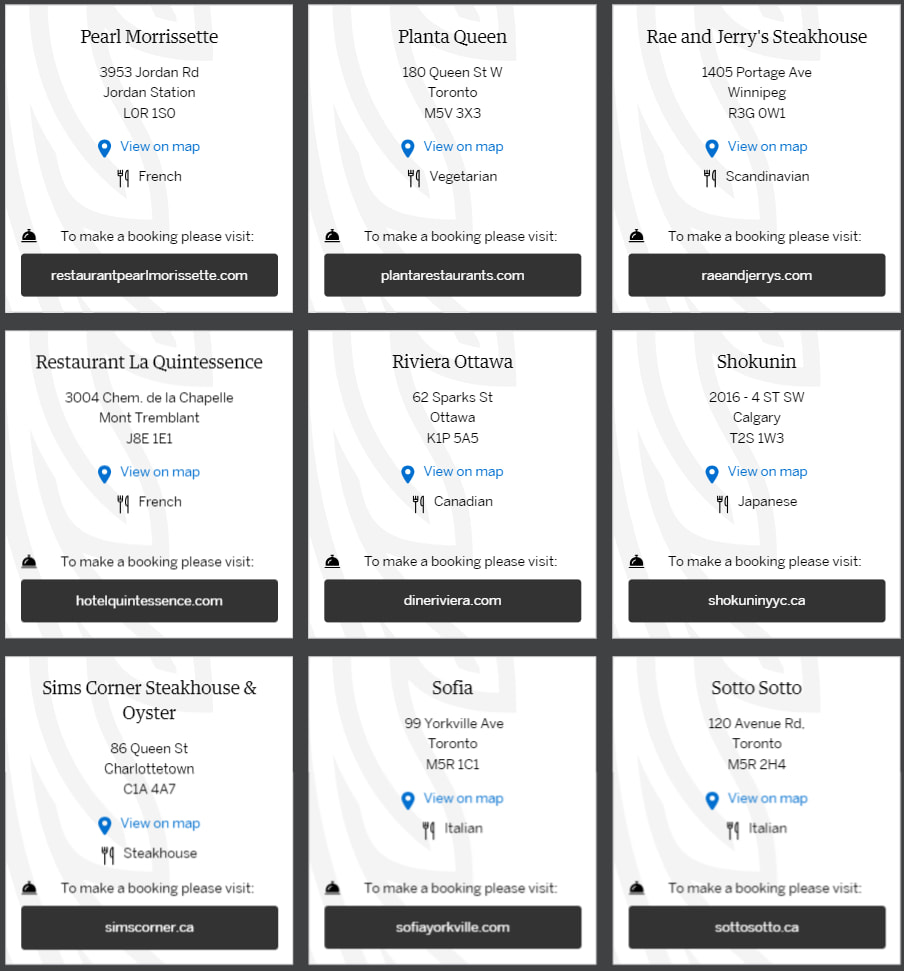

It's not all restaurants where this applies. Its select restaurants American Express has partnered with. Sadly, the Canadian landing page doesn't work, but you can view the list if you head to the UK version then switch your country to Canada in the dropdown (we asked Amex about this and they state the Canadian landing page will be up when these changes are in effect.)

There are more Canadian cities with restaurants than you think – it's not just limited to major cities like Toronto. I was pleasantly surprised at the list of cities with at least one participating restaurant.

As of this time, there are 109 restaurants listed out. And you can also use your credit at any of the restaurants listed in other countries too – you're not just limited to Canada.

If you can make use of the full credit, that more than offsets the $100 increase in annual fee.

To use the credit, you'll have to enable it through your Amex Offers.

Here's a small sampling of Canadian restaurants where you can use this credit.

Member extras

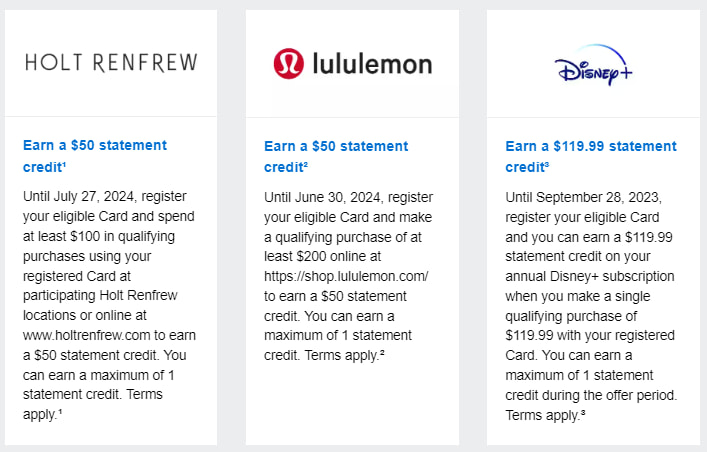

Member extras are somewhat new to Amex cards. These are long running credits you can get from major retailers, and will change from time to time.

You can view these offers for any Amex card in your Amex Offers. Here are the current ones for the Platinum Card.

If you can use all of them, that's almost $220 in savings.

The Business Platinum Card from American Express changes

As to the The Business Platinum Card from American Express, it's getting plenty of new credits, along with some annual fee changes.

New annual fees

The annual fee is going up, and we mean up – from $499 to $799. So that's a lot more to pay.

Additional card fees are also changing. For additional Platinum Cards, you'll pay $250 for them now, up from $199. But if you add Gold Cards, they're now free, instead of paying $50 for them.

New credits coming

The good news – there are plenty of new credit card benefits coming that will more than offset the $300 annual fee.

$200 annual travel credit

The Business Platinum Card from American Express will now include the same travel credit as the American Express Platinum Card. Make a travel booking greater than $200 through Amex Travel, and you'll get $200 off your booking.

$100 Nexus credit

Every 4th year, you can save on a NEXUS application. Charge the cost of a NEXUS membership to your card, and you can get up to $100 back.

$120 wireless credit

Charge your wireless bill to your Business Platinum Card, and you can get back $10 per month, up to $120 per year. Easy savings on a basic expense.

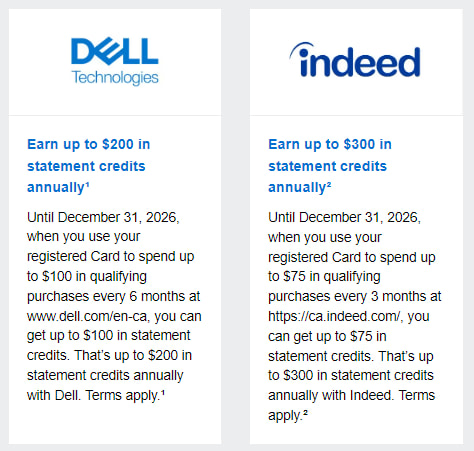

High value Member extras

These are going to vary, but the Member extras Amex is providing for this card right now are worth $500.

Here are the 2 major offers for this card.

Your thoughts on Amex's card changes

There's definitely some good and some bad when it comes to these changes. Higher annual fees, but also more credits to be found.

What are your thoughts on these changes? Let us know below and share your opinion with everyone.

FAQ

What American Express credit cards are getting changes?

Both American Express Platinum Cards are getting updates. The American Express Platinum Card is getting a new annual fee, earn rates, and credits. The Business Platinum Card from American Express is getting a new annual fee and more credits.

What changes are coming to the American Express Platinum Card?

The American Express Platinum Card is getting the following changes:

- higher annual fee of $799,

- updated earn rate on dining of 2 points per $1 spent, and

- new $200 dining credit.

What changes are coming to the American Express Business Platinum Card?

For The Business Platinum Card from American Express, these are the major changes:

- higher annual fee of $799,

- new $200 travel credit, and

- new $120 wireless credit.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 5 comments