A favourite travel rewards program of many, Aeroplan offers easy-to-use points for travel on Air Canada and the Star Alliance network.

An easy way to collect points is with an Aeroplan credit card. And their sign-up bonuses can be particularly lucrative.

But, there’s a new term with the Aeroplan program you’ll want to be aware of.

Never miss an amazing deal again + get our bonus 250+ page eBook for FREE. Join 50,000 other Canadians who receive our weekly newsletter – learn more.

Aeroplan to start limiting Aeroplan credit card sign-up bonus points

There's a new term that deals with Aeroplan credit card welcome bonus points. On December 19, 2022, Aeroplan started limiting the amount of points people can earn through sign-up bonuses.

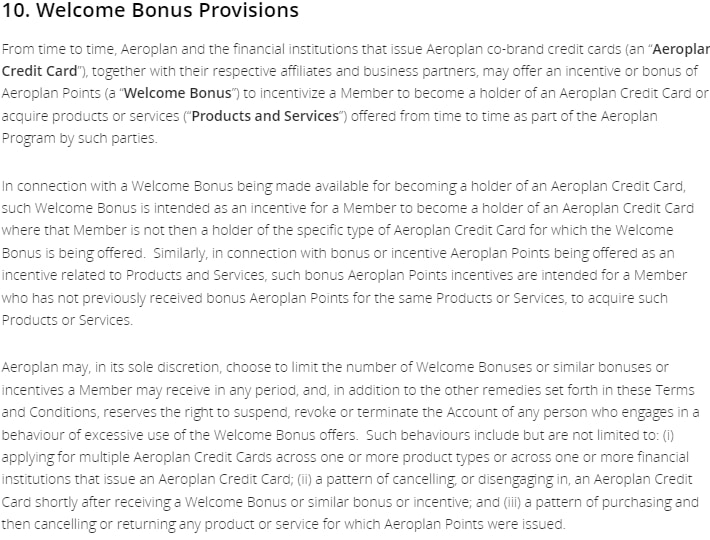

Here was the term at the time:

A little vague. Sure they'll limit you, but never really said much else.

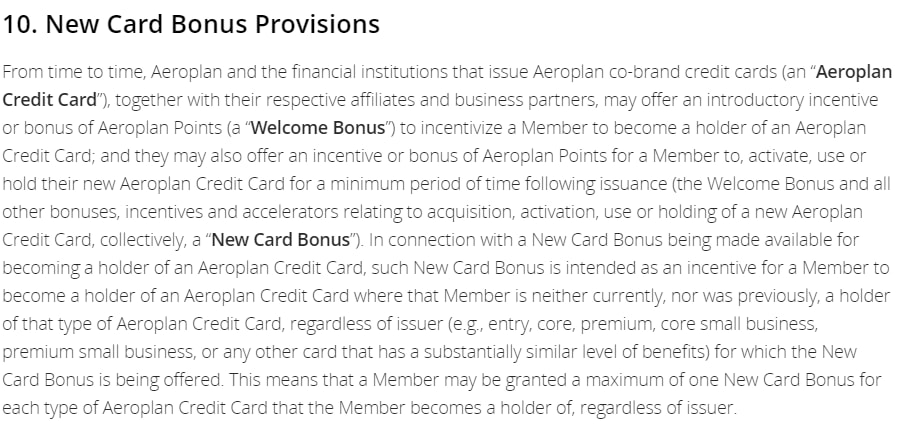

But starting February 5, 2024, members will only be able to receive 1 welcome bonus from a credit card per account.

The full terms are here if you would like to view them. Basically, the program won't deposit any welcome bonus points to your account if you already received one in the past.

What the issuers are stating

Now you may be wondering, are the banks saying the same thing? They aren't.

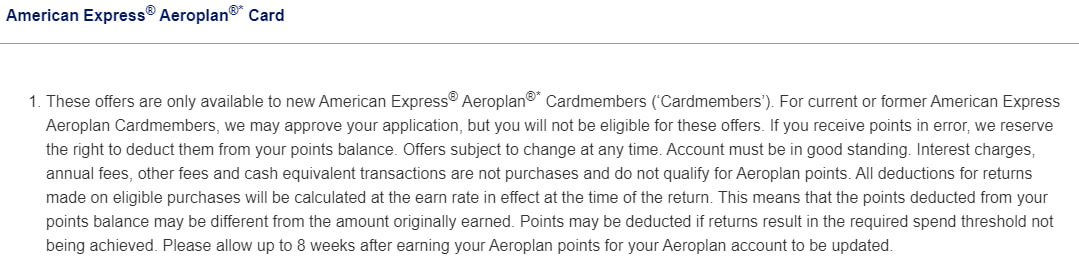

First, here’s the welcome bonus terms for the American Express Aeroplan Card.

No mention of having any Aeroplan credit card before, just that you couldn’t have had this card in the past.

As for CIBC, the terms for CIBC Aeroplan Visa Infinite Card don’t state much other than it’s only for newly approved accounts AND that the offer may be revoked if it appears you are manipulating or abusing it.

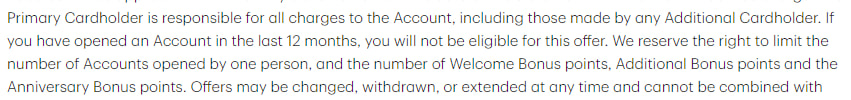

Finally, here’s what TD has to say for the TD Aeroplan Visa Infinite Card:

For TD, you just can’t have had this card within the last 12 months, although they do mention limiting the number of points they award to anyone.

For all of them, they have their own limitations, but none of them have anything to say about having an Aeroplan credit card in the past.

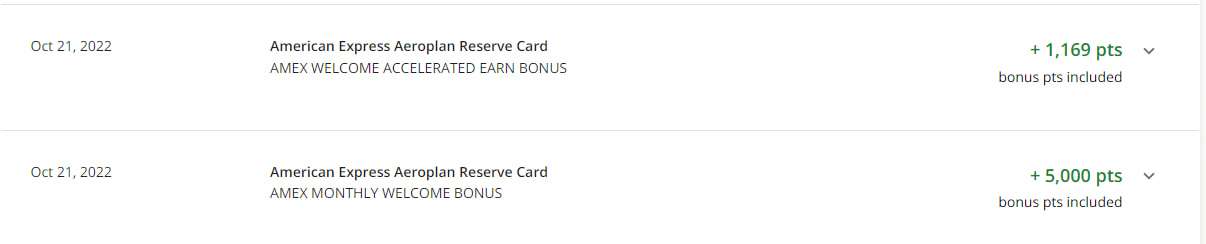

Our tip if you don’t get your points? First, make sure you didn’t get your bonus points in your Aeroplan account. I got the American Express Aeroplan Reserve Card this year – here’s what it looks like when welcome bonus points hit your Aeroplan account.

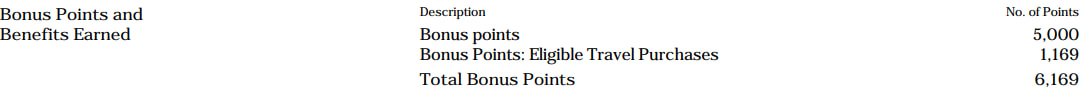

Very clear what is a welcome bonus. If that’s not there, turn to your credit card statement – they should list out what you earned for points (at least Amex does).

Pretty clear on what was earned for bonus points.

So, if you’re missing points and it’s not in Aeroplan but on your bank statement, contact Aeroplan. If they’re missing from your statement, call your bank.

Why is Aeroplan limiting its welcome bonus?

A big question to ask is why is Aeroplan putting limits on the amount of welcome bonus points you can earn.

Nothing has been said, but our guess is Air Canada is trying to improve flight availability for their members. By limiting the number of big bonuses that churners are getting, they’re hoping to make the program more attractive to everyone.

If everyone has an easier time getting the flight they want, they’ll get higher satisfaction among their members.

Everything is done for a reason, and this is our guess why. And hopefully it does actually lead to improvement in getting flight rewards for lower prices.

Aeroplan welcome bonus limit workaround – Amex Membership Rewards

So, if you've already taken advantage of an Aeroplan credit card offer in the past and want more bonus points, what can you do?

There’s a workaround – with Amex Membership Rewards cards. You can transfer any points you earn with these cards at a 1:1 ratio to Aeroplan, including juicy welcome bonuses.

So here’s a way to still pad your bank. Amex’s only rule is that you haven’t had the card before, and even then, they may still give it to you if it’s been quite some time.

Here are the personal credit cards you can do this with.

| Credit Card | Welcome Bonus | Earn Rates | Annual Fee | Learn More |

|---|---|---|---|---|

| American Express Cobalt Card |  $100 GeniusCash + Up to 15,000 bonus points (terms) $100 GeniusCash + Up to 15,000 bonus points (terms) |

* 5 points per $1 spent on eligible groceries and restaurants (up to $2,500 spent per month) * 3 points per $1 spent on eligible streaming services * 2 points per $1 spent on eligible gas, transit, and ride share purchases * 1 point per $1 spent on foreign currency purchases * 1 point per $1 spent on all other purchases |

$191.88 | Learn More |

| American Express Gold Rewards Card | Up to 60,000 bonus points (terms) | * 2 points for every $1 spent on gas, groceries, drugstores, and travel * 1 point for every $1 spent on all other purchases |

$250 | Learn More |

| American Express Green Card | 10,000 bonus points (terms) | * 1 point per $1 spent on all purchases |

$0 | Learn More |

| American Express Platinum Card | Up to 100,000 bonus points (terms) | * 2 points per $1 spent on restaurants and travel * 1 point per $1 spent on all other purchases |

$799 | Learn More |

What are your thoughts on Aeroplan’s new terms?

These are simply our thoughts. Sure, it doesn’t look good on Aeroplan, but when you think about what they might be trying to accomplish, it’s not hard to see why they’re doing this.

What are your thoughts on Aeroplan’s new term?

Let us know in the comments below.

creditcardGenius is the only tool that compares 126+ features of 228 Canadian credit cards using math-based ratings and rankings that respond to your needs, instantly. Take our quiz and see which of Canada's 228 cards is for you.

Comments

Leave a comment

Required fields are marked with *. Your email address will not be published.

Showing 10 comments